Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

Editing financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

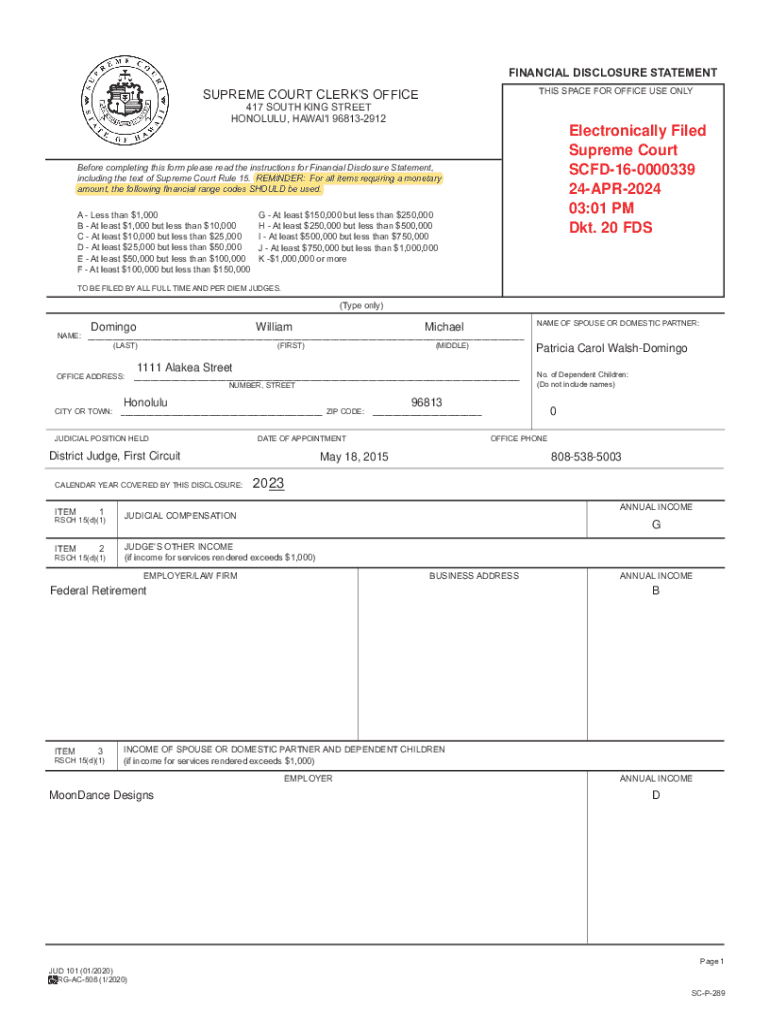

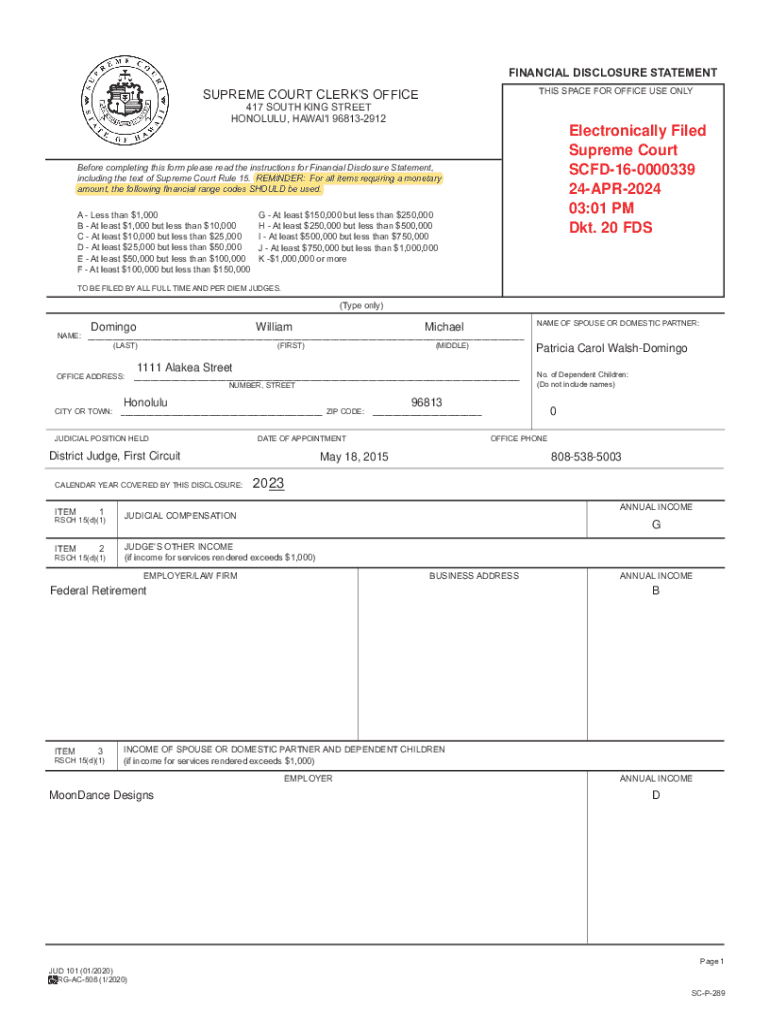

Understanding the Financial Disclosure Statement Form

Understanding the financial disclosure statement form

A financial disclosure statement form is a vital document that provides an overview of an individual's or organization's financial dealings. It serves to promote transparency and accountability, especially in sectors where public trust is paramount.

The purpose of this form is to ensure that parties with financial authority disclose all relevant financial details, which helps mitigate potential conflicts of interest and fosters ethical practices. As a legal requirement in many jurisdictions, failing to fill out this form accurately can result in penalties or legal ramifications.

Who needs to file?

Filing a financial disclosure statement is often required of individuals in public office, corporate executives, and certain organizations that may influence public policies or practices. This also includes non-profit organizations and charities that must prove their financial integrity and accountability.

Common scenarios necessitating a financial disclosure include public servant appointments, board memberships in corporations, and fundraising efforts by non-profits. Failure to comply could hinder professional advancement or lead to disqualification from holding certain positions.

Key components of the financial disclosure statement

Each financial disclosure statement consists of several key components that must be filled out accurately. The personal information section collects basic identification details such as name, address, and contact information. This foundational data serves as the framework of your financial profile.

The financial information section is where individuals list various assets, such as real estate and investments, and must also disclose any liabilities and debts. In addition, recipients of gifts and sources of income need to be reported accordingly. Identifying potential conflicts of interest is equally crucial; outlining relationships or holdings that could impede impartial decision-making is imperative.

Step-by-step guide to filling out the form

Filling out a financial disclosure statement requires careful preparation. Start by gathering all necessary financial documents, including bank statements, investment reports, and tax returns. This ensures that you have accurate and comprehensive information at hand.

Next, adhere strictly to the provided guidelines when completing each section. When detailing personal information, ensure every entry is precise to avoid confusion. Reporting assets and liabilities accurately is equally important; any discrepancies can lead to legal issues. Pay special attention to gifts and income from other sources, ensuring all are appropriately logged, while conflicts of interest need to be flagged and described clearly.

Lastly, stay wary of common mistakes such as misreporting values or omitting assets. If errors occur, follow the specific procedures to amend the document and resubmit. Highlighting transparency is critical, and most organizations appreciate it when corrections are made proactively.

Additional tools for managing your financial disclosure

Utilizing interactive worksheets can greatly simplify the process of completing your financial disclosure statement form. These digital tools often come equipped with prompts and guidelines, allowing users to track their submission step-by-step. Establishing a checklist can also serve as a practical way to ensure all components have been addressed.

Collaboration features in these templates can enhance the process significantly. Allow team members or advisors to review your submissions, fostering better communication regarding any overlooked details or necessary adjustments. Engaging in effective collaboration can streamline the completion process.

Editing and signing your financial disclosure statement

Editing PDF forms, including the financial disclosure statement, has been made simpler with tools like pdfFiller. Users can effectively add, delete, or modify sections of the statement, ensuring that all information is up to date and accurate before it is submitted.

Moreover, utilizing e-signatures is an essential part of the submission process. Electronic signatures validate the document and can expedite the review process. pdfFiller provides a step-by-step guide for users to securely sign their documents, ensuring a hassle-free experience.

Best practices for submitting your financial disclosure

Understanding submission protocols is crucial for timely compliance. It is important to be aware of the submission methods available, whether online or via paper forms, and the deadlines associated with each. Always check specific requirements, as they may vary between organizations.

Once submitted, confirming the receipt of your financial disclosure statement is a key step. Following up helps ensure that your document has been processed without issues. If any complications arise, knowing the correct process for addressing them is essential.

Resources for ongoing support and information

Accessing customer support through services like pdfFiller can be invaluable when navigating the financial disclosure statement form. For any questions or troubleshooting, such platforms often provide dedicated resources to assist users efficiently.

Moreover, staying informed about legislative changes related to financial disclosure is important. Regularly review policies through credible news sources or legal updates to ensure that your disclosures adhere to current laws and regulations.

Frequently asked questions (FAQs)

As you prepare to fill out your financial disclosure statement, you might encounter several common roadblocks. Frequently asked questions revolve around specific disclosure items, confusion about valuations, and details on whom to contact for support.

Clarifications on specific requirements can help ease concerns over compliance and accuracy. For additional guidance, organizations often provide handy resources for step-by-step assistance in completing the financial disclosure statement form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial disclosure statement for eSignature?

How do I execute financial disclosure statement online?

How do I complete financial disclosure statement on an iOS device?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.