Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

Editing financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Financial Disclosure Statement Form: A Comprehensive How-to Guide

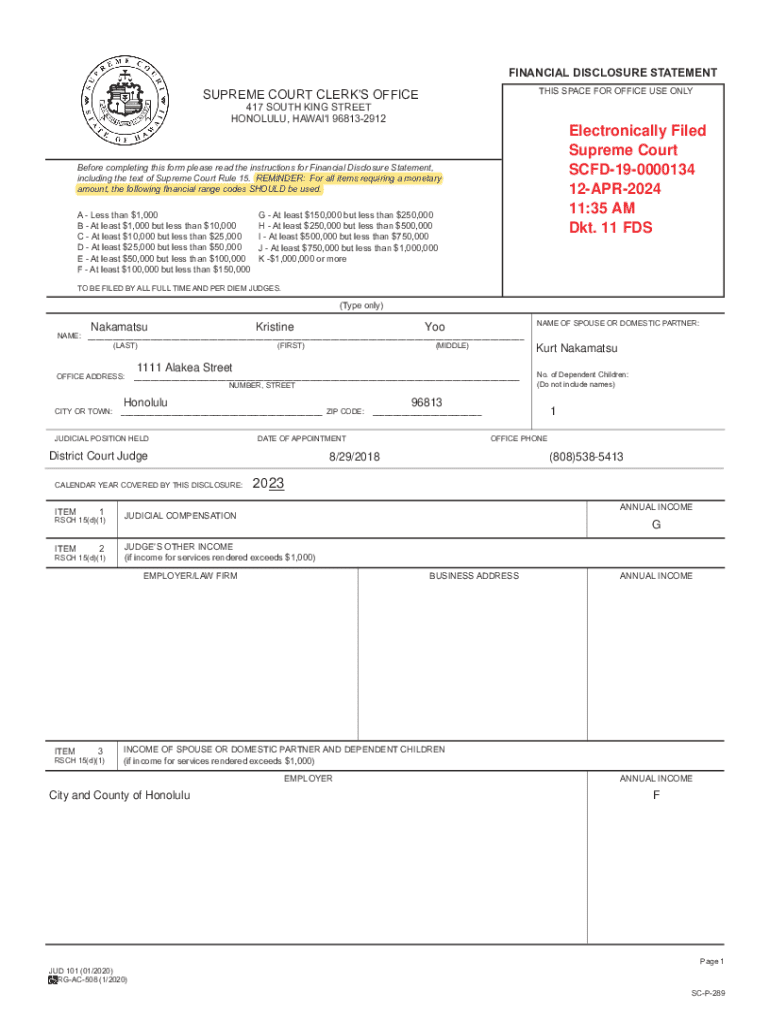

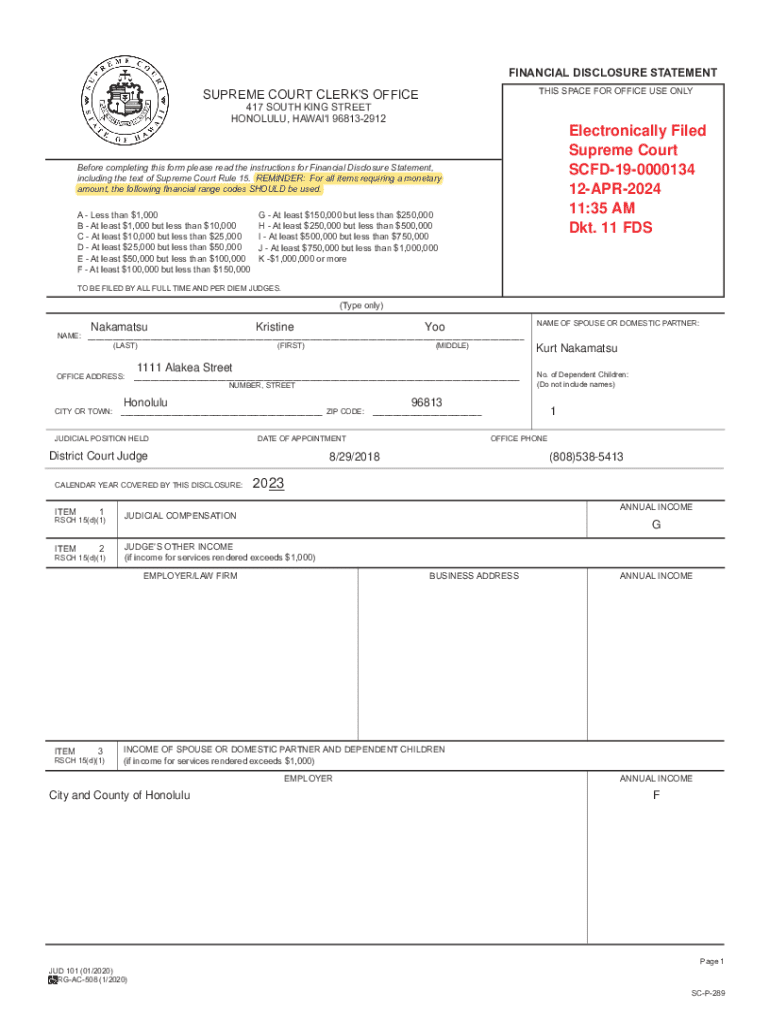

Understanding the financial disclosure statement form

A financial disclosure statement form serves as a detailed account of an individual's or organization’s financial activities, assets, and liabilities. It is designed to provide clarity and transparency into the financial standings of parties involved, be they public officials, nonprofit organizations, or corporate entities. The primary purpose of this form is to ensure responsible financial practices, allowing stakeholders to understand where funds derive and how they are utilized.

The necessity for a financial disclosure statement cannot be overstated. In light of growing concerns over transparency and accountability in both public and private sectors, these forms help maintain trust. They serve critical legal requirements, often mandated by regulations at local, state, or federal levels, thus protecting against potential conflicts of interest and fostering ethical governance.

Types of financial disclosure statements

Different entities utilize financial disclosure statements tailored to their specific needs. Public officials often submit disclosures to comply with ethics laws, detailing sources of income, property holdings, and potential conflicts of interest. Nonprofit organizations are required to maintain transparency concerning their funding sources, expenditures, and impact. This documentation is crucial for maintaining donor trust and securing future funding.

Corporate entities typically use financial disclosure statements in the context of investor relations or regulatory compliance. These forms shed light on financial health, ensuring shareholders and potential investors are aware of associated risks. It's important to note that the specific regulatory requirements for these statements can vary widely depending on jurisdiction. Local, state, and federal laws will dictate the level of detail required, making it crucial for all parties to stay informed.

Preparing to fill out your financial disclosure statement

Before embarking on the completion of your financial disclosure statement form, it’s vital to gather all necessary documents that accurately represent your current financial situation. Start by compiling records of income sources, including pay stubs, investment earnings, and any rental income. Further, collect documentation that details assets—such as property deeds, bank statements, and stock ownership.

Having a thorough understanding of debts and liabilities is equally important. List mortgages, loans, and credit card debts that you are currently responsible for. It's advisable to also categorize these assets and liabilities to enhance clarity when filling out the form. Being aware of what constitutes confidential information can significantly ease the preparation process. Understand that while certain financial information must be disclosed, other sensitive data, such as specific bank account numbers and personal identification details, should remain private.

Step-by-step guide to completing the financial disclosure statement form

To begin the completion of your financial disclosure statement form, first access an official version of the document through platforms like pdfFiller. This resource offers an easily navigable interface for filling out forms. Start by entering your personal details, ensuring accuracy by double-checking all entries to avoid common errors.

Next, carefully detail your financial situation. Break down income sources in their respective sections, making sure to be as specific as possible. While listing assets and liabilities, clarity is key. Use clear headings and subheadings to divide each section logically. Once you've filled in all necessary information, review your disclosures meticulously to ensure everything is accurate. A thorough review can help you prevent any oversights that could lead to complications during the submission process.

Editing and customizing your financial disclosure statement

After completing the form, it might be necessary to make edits or customizations. Utilizing pdfFiller’s editing tools can significantly enhance your document. You can modify the text, insert annotations, or add comments that clarify any of your disclosures. Clear explanations of complex financial situations can foster understanding and ensure there's no ambiguity about your financial status.

When customizing your document, prioritize clarity and professionalism in formatting. Adhere to consistent font sizes and styles for better readability. Avoid cluttered layouts, and be mindful of spacing. Common errors to seek out include typos, incorrect figures, and misclassifications of income or assets. A clean, professionally prepared document speaks volumes about your attention to detail.

Signing and submitting your financial disclosure statement

An essential part of the financial disclosure process involves signing the document. With pdfFiller, signing electronically is straightforward. The platform allows users to utilize eSignatures, which are legally accepted in many jurisdictions, streamlining the submission process. Make sure that when signing, the signature matches the identity of the individual filling out the form.

Once you’ve signed your form, familiarize yourself with the different submission processes available. You can often submit your completed financial disclosure statement online through designated portals or send it via traditional mail. Keeping records of your submission is critical; save copies of both the form and submission confirmation, if applicable, for your records.

Managing and storing your financial disclosure statement

Post-submission, managing your financial disclosure statement becomes essential. Using pdfFiller, you can organize and store your documents effectively. Their features allow easy access to all your stored documents, ensuring that you can retrieve your financial disclosures whenever necessary. Regularly organizing documents helps prevent misplacement and confusion.

Furthermore, it’s crucial to keep track of updates to your financial situation. Many situations—such as buying a new property or changing jobs—can affect your financial standing. Updating your disclosures promptly ensures compliance with regulations and enhances transparency. Schedule regular intervals to review and revise your financial information, maintaining accurate records.

Common questions and troubleshooting

As you navigate the financial disclosure statement process, you may encounter various questions or concerns. Common FAQs often revolve around specific requirements for different types of entities or what happens if errors are found post-submission. Many individuals are unsure of how to correct disclosures once submitted, prompting the need for a resource that addresses these common issues explicitly.

If issues arise during the completion or submission of the form, ensure you know your channels for support. Many financial advisors or legal experts can provide guidance tailored to your specific situation. Establish a network of contacts familiar with the financial disclosure process, so you always have resources available.

Best practices for future financial disclosure statements

To maintain accountability and transparency, it is vital to maintain accurate records year-round. Keeping detailed and accurate financial records ensures that when the time comes to fill out your financial disclosure statement, the process is significantly smoother. Consider implementing a regular schedule for updating your financial records that align with key financial periods, such as tax season or when major financial decisions are made.

Additionally, stay informed about any regulatory changes that might affect your obligations regarding disclosures. These changes can be vital in ensuring that your financial disclosures remain compliant and up-to-date. By fostering a culture of transparency within your organization or personal finance practices, you encourage accountability and build trust among stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial disclosure statement for eSignature?

Where do I find financial disclosure statement?

How do I complete financial disclosure statement online?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.