Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

Editing financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

A Comprehensive Guide to Financial Disclosure Statement Forms

Understanding financial disclosure statements

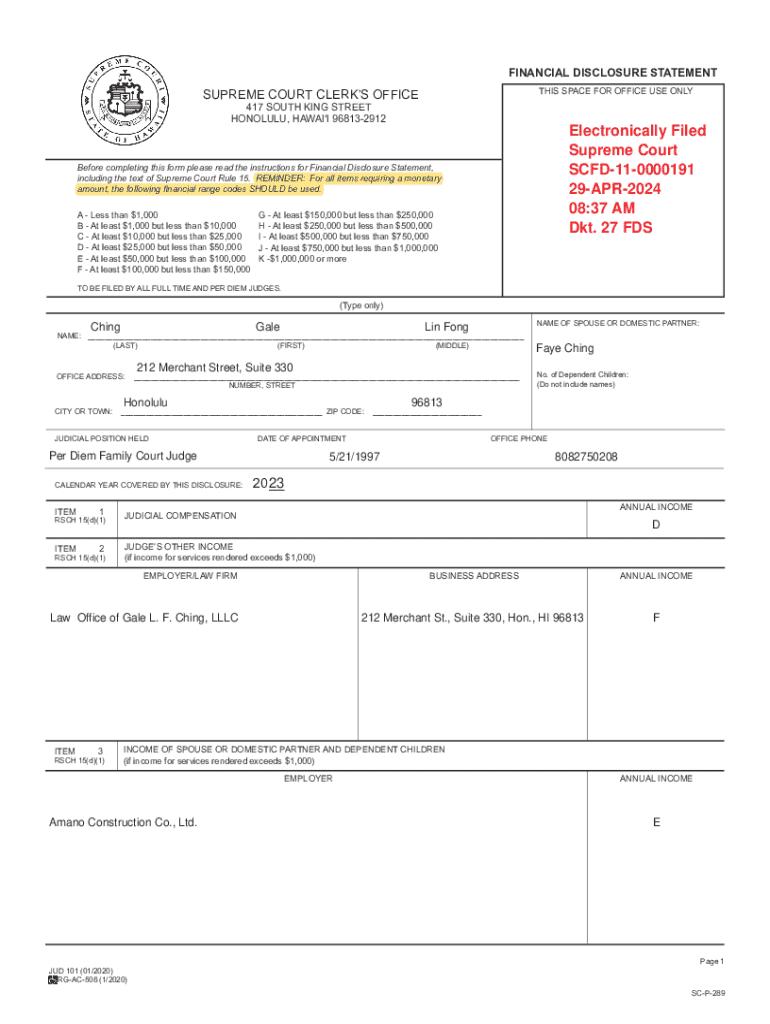

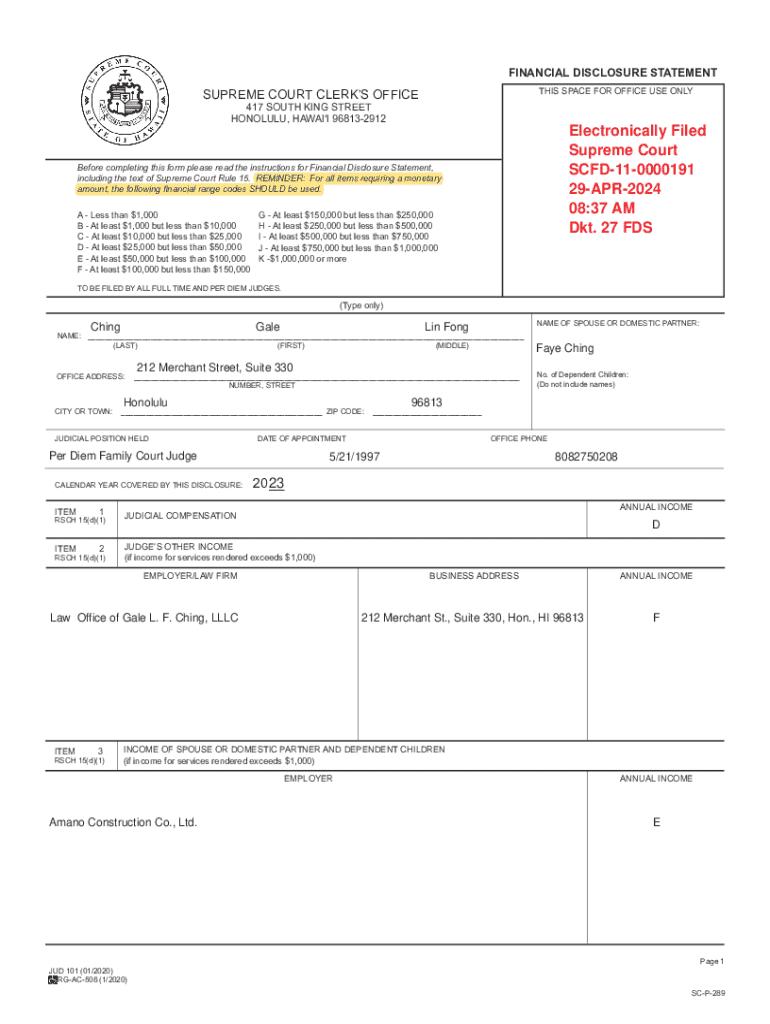

A financial disclosure statement form is a critical document that provides transparency regarding an individual’s or organization’s financial interests. This form serves multiple purposes, such as preventing conflicts of interest and ensuring public trust in governmental and private institutions. By disclosing financial information, parties involved can maintain accountability and integrity in their roles.

These statements are particularly important for public officials and candidates, as they often encounter situations that require unbiased decision-making. Organizations, including nonprofits and business entities, also need to complete financial disclosure statements to illustrate their financial dealings and foster trust among stakeholders.

Who needs to submit?

Individuals, particularly those in public office or seeking election, are typically required to submit financial disclosure statements. This often includes elected officials, candidates for public office, and certain government employees. Organizations, including corporations and nonprofits, may also be required to disclose financial information depending on jurisdiction and regulatory requirements.

Legal requirements

Legal obligations associated with financial disclosure vary by location and sector. In many jurisdictions, laws mandate specific individuals and organizations to submit these statements to oversight agencies. Failure to comply can lead to penalties, including fines and loss of public office. It’s crucial to familiarize yourself with local laws to ensure compliance.

Types of financial disclosure statements

Financial disclosure statements may come in various formats depending on local laws and organizational needs. Common types include standard forms for public officials, specific disclosures for real estate transactions, and conflict-of-interest disclosures. Each form serves a unique purpose but shares the common goal of promoting transparency and accountability.

Variations may arise based on jurisdiction. For instance, certain states may require additional detail in disclosures while others may provide more streamlined forms. Therefore, understanding the specific formatting and content required in your area is essential.

Specific situations requiring disclosure

Real estate transactions often necessitate detailed financial disclosures to prevent any potential conflict between personal interests and professional responsibilities. Similarly, individuals or entities must disclose potential conflicts of interest in dealings or decisions where financial interests are involved, ensuring that all parties operate without bias.

Key components of a financial disclosure statement

A well-executed financial disclosure statement requires comprehensive personal information. This usually includes full name, address, and the nature of your role within an organization. Clear identification of relationships to various business entities is essential for maintaining transparency.

Moreover, reporting financial interests is a crucial segment. This involves disclosing types of assets, income, debts, and liabilities. Accurate reporting promotes compliance and helps prevent any future legal complications.

Signature and certification

At the end of the form, signatures serve as a vital component to confirm the accuracy of the information presented. Certifying the truthfulness reinforces the importance of accurate reporting for maintaining integrity in the disclosure process.

Step-by-step process for filling out the form

Filling out a financial disclosure statement can be straightforward if approached methodically. Begin by preparing the necessary documents which include tax returns, personal financial statements, and any pertinent documents related to your financial interests.

Preparing to fill out the form

Before diving into the details, gather all relevant information. This may include transaction records, bank statements, and contracts that directly impact your financial status. Properly organizing the information assists in comprehensive completion without missing critical details.

Step-by-step guide to completion

Commence with personal information before outlining all financial interests. Ensure every section is filled precisely, using appropriate figures and honest representations. Utilize online platforms like pdfFiller to simplify the process with templates that guide you through each section.

Common mistakes to avoid

Frequent errors include omitting important information and inaccuracies in reporting financial amounts. Take time to double-check figures and ensure that no sections have been left blank. This attention to detail minimizes the risk of rejection and fosters a reputation of trustworthiness.

Editing and customizing your financial disclosure statement

Once you have filled out the financial disclosure statement form, you may find it beneficial to edit or customize it for clarity and conciseness. Utilizing pdfFiller, users can easily manage the document to reflect any changes or updates needed.

Utilizing pdfFiller for document management

With pdfFiller's user-friendly interface, you can upload your completed document, edit text, and include additional notes for further clarity. This flexibility ensures that your financial statement remains relevant and up to date, meeting any updated legal obligations or personal modifications.

Adding additional information and notes

If specific sections require more information than the form allows, pdfFiller enables the addition of supplementary details without compromising the integrity of the original document. This capability allows users to provide a full picture while adhering to legal requirements.

Signing and submitting your form

Understanding the submission process is critical for ensuring your financial disclosure statement is accepted. Depending on your jurisdiction, submission guidelines dictate where and how to present your form — either electronically or physically.

Understanding eSignature options

With advancements in digital technology, eSigning has become a widely accepted practice. Be cautious to use recognized eSignature solutions that comply with legal standards to avoid any complications regarding the legitimacy of your submission.

Submission guidelines

Each jurisdiction has associated deadlines for submission. Familiarizing yourself with these guidelines is essential to prevent late submissions, which might incur penalties. Ensure to keep copies of your form for your records, demonstrating compliance.

Managing your financial disclosure statements

Managing your financial disclosure statements requires effective document organization and record-keeping practices. Adopting digital solutions like pdfFiller ensures that you store your documents securely while remaining easily accessible for updates or reviews.

Storing and organizing your documents

Establishing a systematic storage approach helps manage your documentation effectively. Utilizing folders or online document management systems can streamline retrieval when drafting future forms or responding to inquiries.

Tracking updates and revisions

Continuous monitoring of your financial situation is crucial, particularly if there are significant changes in asset values or income streams. Regularly updating your financial disclosure statement ensures compliance with legal requirements and provides accurate reflections of your financial interests.

Common post-submission issues

What happens if your form gets rejected? Understanding this process is vital; frequently, rejections stem from clerical errors or omissions. Prepare to revise and resubmit promptly, addressing all feedback provided to enhance the chances of acceptance.

Resources for assistance

Should you require assistance when filling out or submitting your financial disclosure statement, numerous resources are available to provide guidance. Legal resources, tutorials, and support documents can be found through trusted platforms like pdfFiller.

Legal resources and advice

If you face complexities with your financial disclosure statements or need in-depth legal interpretations, professional assistance from lawyers specializing in compliance and disclosure can guide you through your obligations.

Additional tools and templates

Online platforms, particularly pdfFiller, offer multiple templates and forms associated with financial disclosures. Utilizing these resources streamlines your documentation, ensuring that you uphold meticulous standards.

Frequently asked questions

Addressing common queries about financial disclosures can minimize confusion, particularly regarding regulatory requirements. Seeking out FAQ sections on documentation websites can clarify misconceptions and provide definitive answers.

The benefits of using pdfFiller for financial disclosure statements

Opting to use pdfFiller for your financial disclosure statement provides numerous advantages, primarily focusing on accessibility and ease of use. Being cloud-based allows you to access your documents from anywhere at any time, thereby fostering a more streamlined workflow.

Collaboration features

pdfFiller enhances teamwork through its collaboration features. You can share documents with team members for feedback or contributions, promoting a collective effort in compiling accurate financial statements.

Enhanced security and compliance

Security is paramount when handling sensitive financial information. pdfFiller ensures documents remain secure and compliant with legal standards, giving peace of mind during the financial disclosure process.

Contacting support for further help

Navigating the financial disclosure statement process can be challenging, but pdfFiller offers dedicated support to guide users. Whether for technical assistance or inquiries regarding the forms, do not hesitate to reach out to the pdfFiller support team.

How to reach the pdfFiller support team

Contact methods include email, phone, and live chat options. The support team is well-equipped to assist with any issues regarding financial disclosure statements and will typically be available during business hours.

Using help resources effectively

pdfFiller’s website includes a comprehensive help section filled with tutorials, FAQs, and guides. Utilizing these resources efficiently can enhance your overall experience and ensure that you successfully navigate the intricacies of the financial disclosure statement process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit financial disclosure statement from Google Drive?

How do I fill out the financial disclosure statement form on my smartphone?

How can I fill out financial disclosure statement on an iOS device?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.