Get the free Financial Disclosure

Get, Create, Make and Sign financial disclosure

Editing financial disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure

How to fill out financial disclosure

Who needs financial disclosure?

Financial disclosure form: A comprehensive how-to guide

Understanding financial disclosure forms

A financial disclosure form is an official document that outlines an individual's or organization's financial activities, assets, and liabilities. These forms are crucial for maintaining transparency and accountability, particularly in public service and corporate governance. By demanding such disclosures, entities aim to ensure that stakeholders, including the public, investors, and employees, are informed about potential conflicts of interest or financial misconduct.

The importance of financial disclosure lies in its ability to promote trust within various sectors. Whether discussing a public office or a corporate boardroom, stakeholders need to understand the financial standing and potential biases of the individuals making critical decisions affecting their lives and investments.

Who needs to file?

Financial disclosure forms are typically required for several categories of individuals and organizations, including:

Types of financial disclosure forms

Financial disclosures come in various forms tailored to specific needs, including:

The importance of financial transparency

Financial transparency is a critical component of ethical business and governance practices. The ethical considerations for financial disclosures focus on establishing and maintaining public trust. When stakeholders, including consumers and investors, understand the financial operation of a business or government agency, it fosters a culture of accountability.

Legal requirements also play a significant role in financial disclosures. Various regulations govern the accuracy and timeliness of these filings, ensuring that all entities operate within the boundaries of the law. Non-compliance with these regulations can lead to serious repercussions, including legal action, financial penalties, and damage to reputations.

Consequences of non-compliance

Failing to comply with financial disclosure regulations can lead to disastrous consequences for both individuals and organizations. Depending on the severity of the violation, consequences can vary from minor fines and penalties to severe legal consequences, including imprisonment for fraudulent activity.

Businesses may also face reputational damage, losing consumer trust and confidence, which can directly affect their bottom line. For public officials, the loss of credibility can result in political backlash and diminished public support.

Key components of a financial disclosure form

When preparing a financial disclosure form, several essential components must be included to ensure accuracy and compliance. These components include:

How to fill out a financial disclosure form

Filling out a financial disclosure form can initially seem daunting, but a step-by-step approach can simplify the process. Here’s a detailed guide to help you prepare your form effectively:

Accuracy is vital while filling out your financial disclosure form. Double-checking figures and documentations before submission minimizes the risk of errors.

If you're uncertain about any section, consider reaching out to financial professionals who can offer guidance and expertise on the matter.

Common mistakes to avoid

Certain pitfalls can derail your financial disclosure efforts. Here are common mistakes to watch out for:

Editing and managing your financial disclosure form

Even after preparing your financial disclosure form, there may be a need for editing or revisions as circumstances change. Utilizing tools such as pdfFiller allows for seamless PDF editing, ensuring you can make updates as necessary without starting from scratch.

Maintaining version control is also critical. Developing a strategy for saving and organizing each form revision will be helpful for future reference, especially for individuals required to submit multiple disclosures over time.

Managing multiple disclosures

If you find yourself in a situation where multiple financial disclosures are needed, consider robust organization methods. Categorizing documents according to submission timelines or types can help streamline the process.

Using cloud-based solutions ensures that you can access your documents from anywhere, allowing for collaborative efforts when sharing information with advisors or legal consultants.

Interactive tools and resources for financial disclosure

A variety of interactive tools can enhance the process of preparing a financial disclosure form. A financial disclosure calculator, for example, can help individuals and organizations estimate their obligations based on the nature of their finances.

Checklists are also invaluable; they provide a step-by-step guide to ensure all necessary components are included in your filing. These resources can streamline the preparation process, reducing the likelihood of oversight.

A template library, such as that offered by pdfFiller, allows users to access pre-formatted financial disclosure forms tailored to their specific needs, enhancing convenience and accuracy in submission.

Submitting your financial disclosure form

Submission of financial disclosure forms can vary considerably by entity and jurisdiction. Generally, there are two methods: electronic submissions and paper submissions.

Understanding the review process following your submission is also key. Usually, the respective authority will evaluate your disclosure for accuracy and completeness, which could involve further clarification if needed.

Keeping track of submission deadlines

Being proactive about submission deadlines is essential. Creating a calendar with key dates can help you stay organized, ensuring you submit all required financial disclosures timely.

Setting reminders weeks in advance can also reduce the stress of approaching deadlines, providing you with ample time to prepare thoroughly.

Frequently asked questions (FAQs)

What if make a mistake on my form?

If you discover an error after submission, contact the appropriate governing body immediately to discuss correction procedures. Open communication is critical in addressing issues promptly.

How often do financial disclosures need to be updated?

The frequency of updates typically depends on specific regulations but is commonly annual or biannual. Always be aware of the requirements applicable to your situation.

What are the privacy implications?

Transparency comes with privacy concerns, especially regarding personal financial information. Understand what information is required by law to disclose and be aware of any potential risks associated with sharing sensitive financial data.

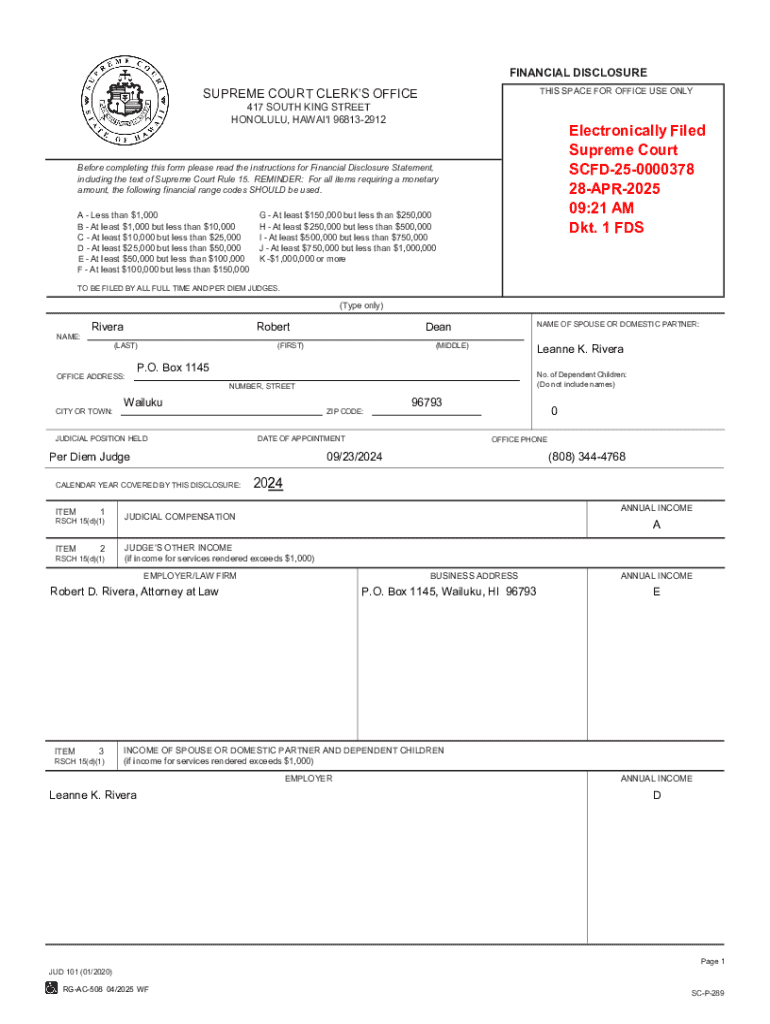

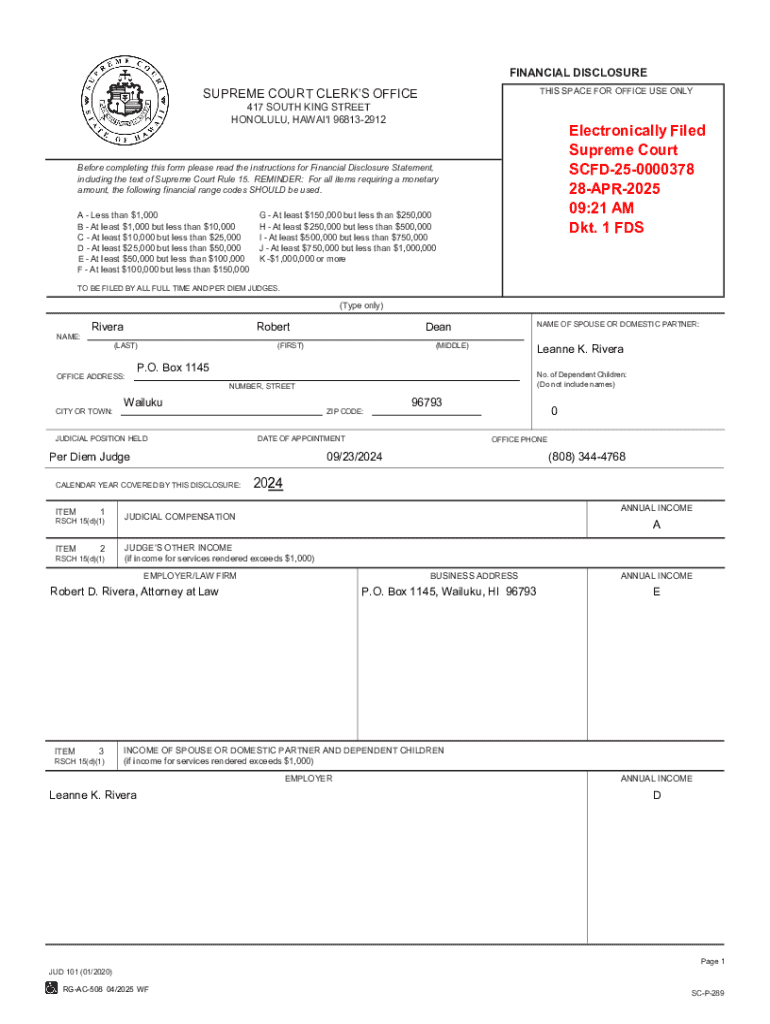

Real-world examples of financial disclosure forms

Examining real-world financial disclosures can enhance understanding of what effectively complete and detailed forms entail. Case studies can illustrate how high-profile figures approached their financial disclosures, dissecting both successful and problematic forms.

Analyzing these examples can provide insights on formatting, level of detail expected, and common pitfalls encountered by others, guiding you toward more effective preparation.

Legal and ethical resources

The legal framework surrounding financial disclosures is extensive, encompassing various regulations and laws designed to promote transparency and accountability. Understanding these guidelines is fundamental to ensuring compliance.

Ethical guidelines provide a framework for interpreting these laws responsibly. Seek out professional guidance if you find the legalese overwhelming; consultants and legal advisors can simplify the process.

Connect with financial disclosure experts

Finding the right consultants or advisors can significantly ease the process of preparing and submitting your financial disclosure form. Look for resources online that connect individuals with qualified experts in financial reporting and disclosures.

Platforms focused on community support can also offer valuable insights and shared experiences, creating a valuable network of support for individuals navigating financial disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the financial disclosure in Chrome?

How can I fill out financial disclosure on an iOS device?

How do I complete financial disclosure on an Android device?

What is financial disclosure?

Who is required to file financial disclosure?

How to fill out financial disclosure?

What is the purpose of financial disclosure?

What information must be reported on financial disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.