Get the free New York State Surplus Property Web User Registration and Agreement (cs-217.1) - ogs ny

Get, Create, Make and Sign new york state surplus

How to edit new york state surplus online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new york state surplus

How to fill out new york state surplus

Who needs new york state surplus?

New York State Surplus Form: A Comprehensive How-to Guide

Overview of New York State surplus forms

New York State surplus forms are official documents used to report and manage excess properties owned by state agencies. The primary purpose is to ensure that these assets are properly accounted for, utilized, or disposed of in accordance with state regulations. Not only do these forms help maintain transparency and accountability, but they also facilitate the efficient redistribution of resources within government entities.

For individuals and teams involved in state and local government operations, understanding and accurately completing surplus forms is essential. Mismanagement or lack of knowledge about the surplus process can lead to inefficient asset management, potential legal consequences, and financial losses. By adhering to compliance requirements and best practices associated with these forms, agencies can ensure they are operating smoothly and effectively.

Types of surplus forms in New York State

In New York State, surplus forms are categorized based on the type of asset being reported or disposed of. Understanding these categories can greatly assist individuals and teams in navigating the surplus process successfully.

Each type of surplus form comes with specific guidelines that must be followed. Common pitfalls in filling these out include underreporting assets or failing to provide adequate documentation, both of which can lead to compliance issues. To avoid these mistakes, it is critical to familiarize oneself with the individual requirements for each category.

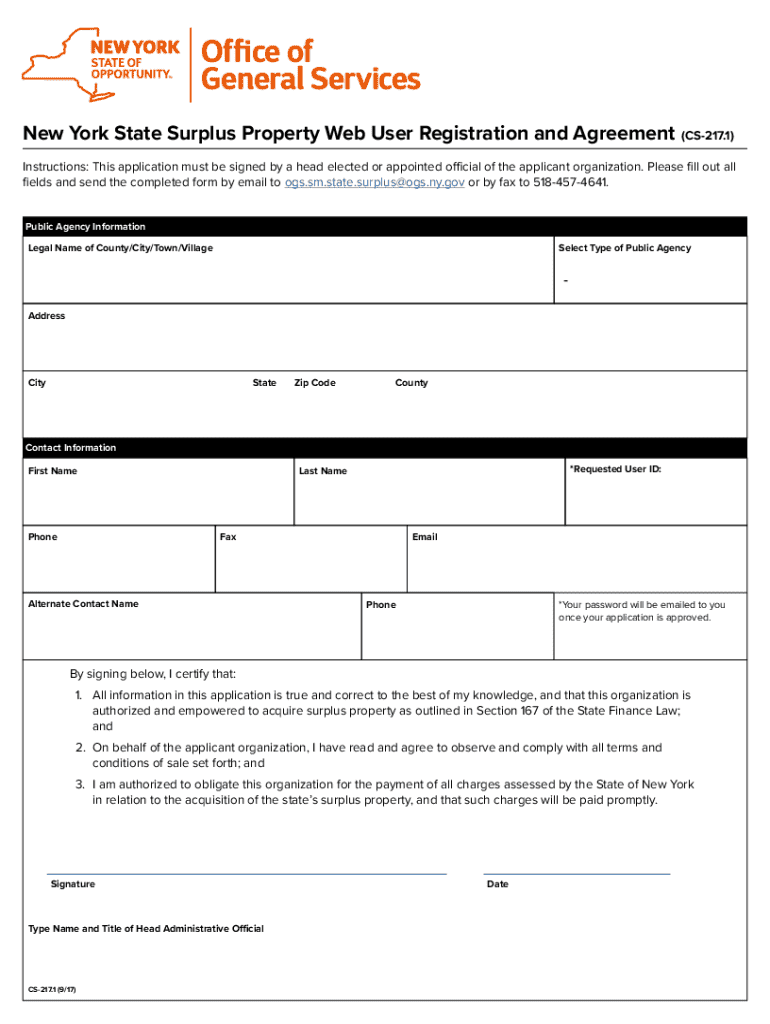

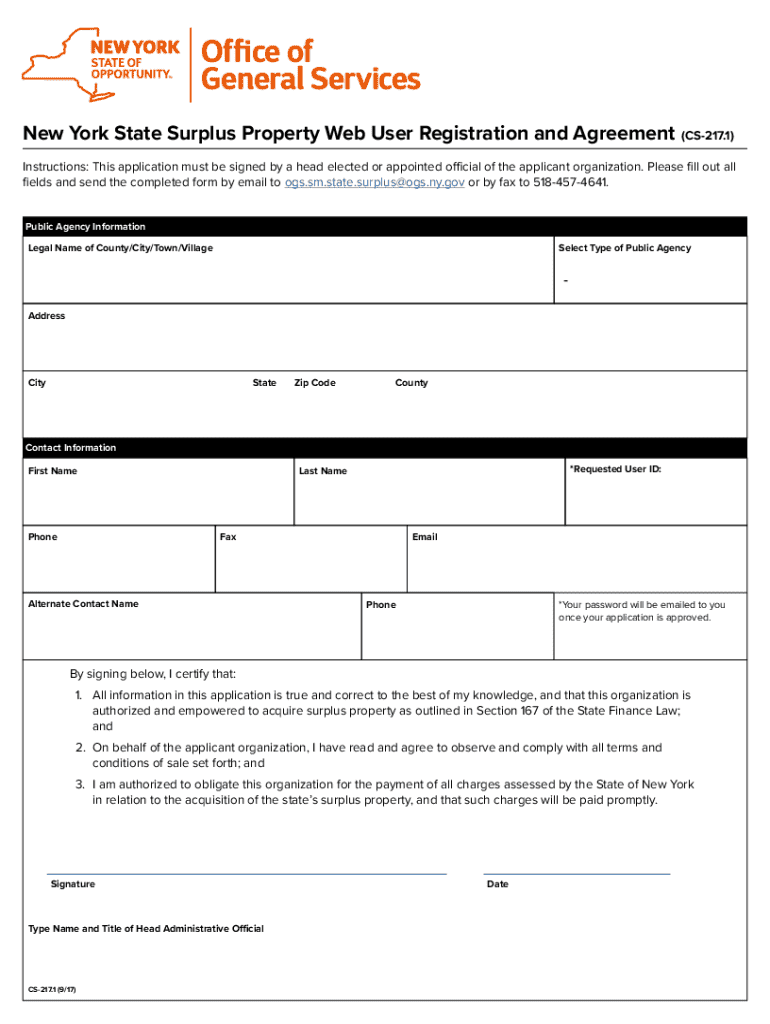

Step-by-step instructions for filling out New York State surplus forms

Successful completion of New York State surplus forms requires careful attention to detail and organization. Here’s a step-by-step guide to ensure a smooth process.

Each of these steps is crucial in ensuring that the surplus form is accepted and that all assets are accounted for without issue. Thorough preparation and careful submission can streamline the surplus process and enhance compliance with state regulations.

Tools for managing your surplus forms

Utilizing the right tools can simplify the process of managing surplus forms. pdfFiller offers several interactive features that enhance the ease of form management.

These tools not only streamline the form management process but also provide secure storage and easy retrieval, ensuring that all documentation is kept organized and readily accessible.

Troubleshooting common issues with surplus forms

Despite careful preparation, issues can arise when submitting surplus forms. Common problems include submission rejections due to incomplete or incorrect information.

Being proactive in understanding potential issues can save time and reduce frustration during the surplus management process.

FAQs about New York State surplus forms

Having clarity on the surplus forms process can alleviate many concerns individuals and teams face.

Understanding these frequently asked questions provides essential clarity and can help ensure smoother experiences with surplus forms.

Best practices for managing surplus property

Managing surplus property effectively requires diligence and constant improvements in processes. Regular audits can prevent unnecessary accumulation of excess assets, ensuring that all items are accounted for accurately.

Incorporating these best practices into day-to-day operations can enhance overall surplus property management and compliance within organizations.

Case studies of successful surplus property management

Real-world examples illustrate the significant benefits of effective surplus property management. Local government agencies that implement structured surplus processes often report increased efficiency and cost savings.

These case studies underscore the importance of adopting best practices to enhance the management of surplus assets effectively.

Insights on future developments in surplus property management

Looking ahead, several trends and potential changes in the landscape of surplus property management in New York cannot be overlooked. Regulations may continue to evolve, emphasizing transparency and quick asset turnover.

Understanding these developments helps agencies adapt to the changing landscape while maintaining compliance and efficiency in managing surplus property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify new york state surplus without leaving Google Drive?

How can I send new york state surplus to be eSigned by others?

Can I create an eSignature for the new york state surplus in Gmail?

What is New York State surplus?

Who is required to file New York State surplus?

How to fill out New York State surplus?

What is the purpose of New York State surplus?

What information must be reported on New York State surplus?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.