Get the free Business Contribution Form

Get, Create, Make and Sign business contribution form

Editing business contribution form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business contribution form

How to fill out business contribution form

Who needs business contribution form?

Business Contribution Form: Complete Guide to Document Management and Collaboration

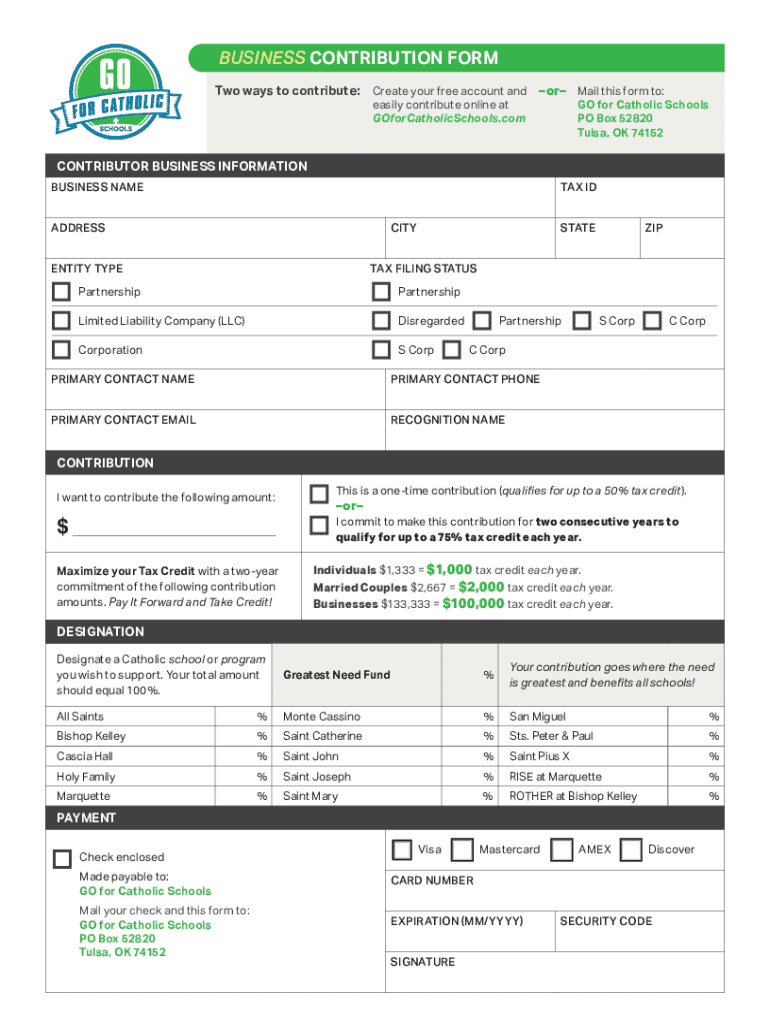

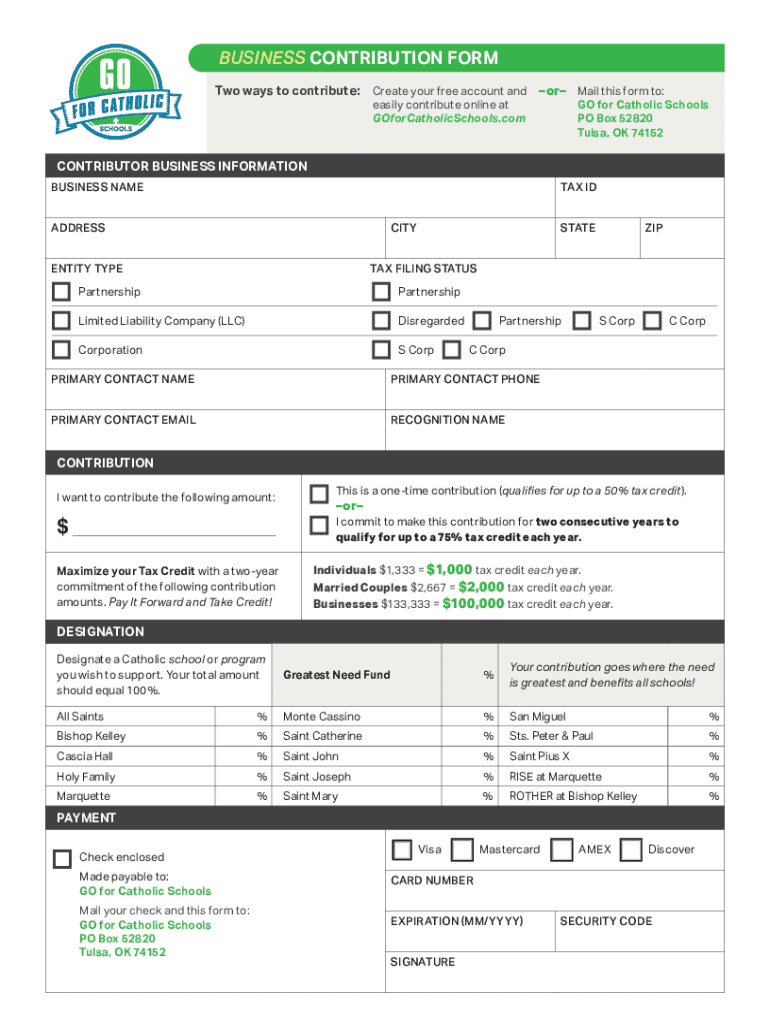

Understanding the business contribution form

A business contribution form is a crucial document that outlines the contributions made by individuals or entities to a business entity. It serves a dual purpose: recognizing contributions and establishing ownership stakes. Businesses of all types—be it LLCs, corporations, or partnerships—utilize this form to ensure clarity in stakeholder commitments and maintain proper records.

In many cases, there are legal and regulatory requirements surrounding contributions, thus making the form integral to business operations. It includes essential details such as contributor identity, contribution type, and the value assigned to each contribution, providing a formal acknowledgment of commitment and investment.

Purpose and benefits of using a business contribution form

Using a business contribution form provides significant advantages to organizations. Primarily, it adds clarity in ownership and investment, which is vital for establishing roles among partners and stakeholders. It records contributions, enabling transparency in business dealings, which is essential for trust within any team or partnership.

Furthermore, many jurisdictions require documentation of business transactions for regulatory compliance. This aspect cannot be overlooked, as failing to maintain proper records may lead to legal complications down the road. Moreover, managing contributions electronically through platforms like pdfFiller transforms collaboration, offering instant document access and streamlining feedback among team members.

Preparing to fill out your business contribution form

Before diving into filling out the business contribution form, it is crucial to gather all necessary information. This includes accurate details regarding all contributors and their respective contributions. Preparing a checklist of information can aid significantly in ensuring that nothing is overlooked, which could later complicate the form's accuracy.

The critical information to collect includes personal identification details, the nature of each contribution, and any corresponding valuation. Having this data readily available not only simplifies the process but also significantly boosts compliance with legal requirements. When selecting a platform for document creation, pdfFiller is an advantageous choice due to its user-friendly interface and robust features geared toward enhancing document accuracy and security.

Step-by-step instructions for completing the business contribution form

Filling out the business contribution form can be straightforward if executed systematically. The form generally begins with entering comprehensive business information, which typically includes the business's name, legal structure, and address. This contextual backdrop is essential as it identifies the entity receiving the contributions.

Next comes the contributor information section. Here, you will detail personal information such as names, roles, and contact information of those making contributions. After that, the contribution details section requires thorough attention, as it involves documenting what type of contributions are being made—monetarily or non-monetarily, such as equipment, real estate, or services.

Editing and customizing the business contribution form

Once the initial information is entered into your business contribution form, the next step is to customize it to suit your business's specific needs. With pdfFiller, users have the flexibility to edit the form easily. You can add branding, logos, and modify sections that may not pertain to your business type.

Moreover, incorporating interactive tools like checkboxes and dropdown menus into the form can significantly enhance usability. These features make the completed form more visually appealing and easier to navigate, allowing contributors to understand their roles and responsibilities at a glance.

Signing your business contribution form

Once the business contribution form is filled out and customized to meet your company's requirements, the next essential step is signing the document. Electronic signatures (eSignatures) have gained immense popularity due to their legal validity and security. Utilizing electronic signatures provided by platforms like pdfFiller not only expedites the signing process but also ensures compliance with digital signature laws.

To add your eSignature in pdfFiller, simply follow a straightforward step-by-step process, ensuring that your signatures are secure and verifiable. Following best practices for maintaining document security during the signing process is crucial. This includes ensuring that all parties have access to the document and implementing safeguards for sensitive information.

Managing and storing your completed business contribution form

After signing the business contribution form, effective document management becomes paramount. Saving and organizing completed forms within a reliable document management system such as pdfFiller prevents losses or misfiling of essential records. Choosing the right file format can also be pivotal; pdf is often preferred for its universal acceptance and security.

Leveraging cloud storage options to store and manage your documents allows access from virtually anywhere. This capability not only aids in organization but also in collaboration, as teams can share documents easily for feedback and approvals, enhancing team synergy and project progression.

Troubleshooting common issues with business contribution forms

Despite the straightforward nature of business contribution forms, issues may arise during completion and submission. Being aware of common mistakes, such as incomplete forms or inaccuracies in contributor details, can save significant time in rectification efforts. Timely identification of errors allows for immediate correction, culminating in a smoother approval process.

Furthermore, navigating the approval process can sometimes lead to confusion. Creating a structured feedback system can streamline this process, ensuring each team member knows their responsibilities and deadlines. In case you encounter challenges, pdfFiller offers dedicated support to assist with any issues pertaining to your business contribution forms or other document management needs.

Real-world applications of business contribution forms

Businesses across diverse sectors have successfully implemented business contribution forms to formalize investment and ownership structures. Case studies reveal how effective use of these forms has resulted in enhanced transparency and operational efficiency. For instance, an LLC in the technology sector noted that using contribution forms streamlined the onboarding process for new members by clearly defining investment expectations.

Insights from industry experts underline the importance of having a standardized method for documenting contributions. Best practices often emphasize regular updates and reviews to ensure forms reflect current business structures and contributions accurately. These practices not only facilitate better organization but also enhance trust amongst collaborators.

Future of document management and contribution forms

As we look ahead, the landscape of digital document creation and management increasingly leans towards automation and integration. Emerging trends suggest that businesses will favor platforms that unify various document-related tasks, from creation to storage. This shift points towards a future where managing documents becomes more intuitive and less cumbersome.

New regulations and practices may also influence how contribution forms are approached, prompting businesses to adapt swiftly to comply with evolving standards. Keeping abreast of these changes will be essential for maintaining compliance and ensuring that document management processes align with industry best practices.

Engaging with pdfFiller’s resources and support

pdfFiller offers a wealth of resources designed to empower users in document management. Comprehensive user guides and tutorials provide detailed instructions, ensuring you get the most out of your business contribution form and other document functionalities. Engaging with community forums allows users to share experiences and discover novel solutions to common issues.

To stay informed about the latest features and updates, ongoing education in document management innovations via pdfFiller's resources is advisable. Updates and enhancements to the platform continually aim to improve user experience and usability, positioning users for success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get business contribution form?

How can I fill out business contribution form on an iOS device?

Can I edit business contribution form on an Android device?

What is business contribution form?

Who is required to file business contribution form?

How to fill out business contribution form?

What is the purpose of business contribution form?

What information must be reported on business contribution form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.