Get the free Municipal Claim and Tax Lien Law - PA General Assembly

Get, Create, Make and Sign municipal claim and tax

Editing municipal claim and tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out municipal claim and tax

How to fill out municipal claim and tax

Who needs municipal claim and tax?

Municipal Claim and Tax Form How-to Guide

Understanding municipal claims and tax forms

Municipal claims refer to legal claims made by local government entities against properties to collect owed taxes or fees. These claims help municipalities maintain essential services, such as public education, infrastructure, and emergency services. Each type of tax or claim requires appropriate filings, typically done using specific tax forms that detail the necessary information for submission.

Tax forms related to municipal claims encompass various documentation that individuals and businesses must complete to report their taxable income, property ownership, and other financial details to the local tax authority. Accurate filing of these forms is crucial, as inaccuracies may lead to penalties, delays, or even legal action. Conversely, submitting forms on time can ensure continued eligibility for tax benefits and prevent the accruing of additional fees.

Types of municipal claims

Municipal claims can arise from various sources, including unpaid taxes and licensing violations. Understanding these claims is essential for compliance and financial management. Here are the main types of municipal claims you should be aware of:

Tax form overview

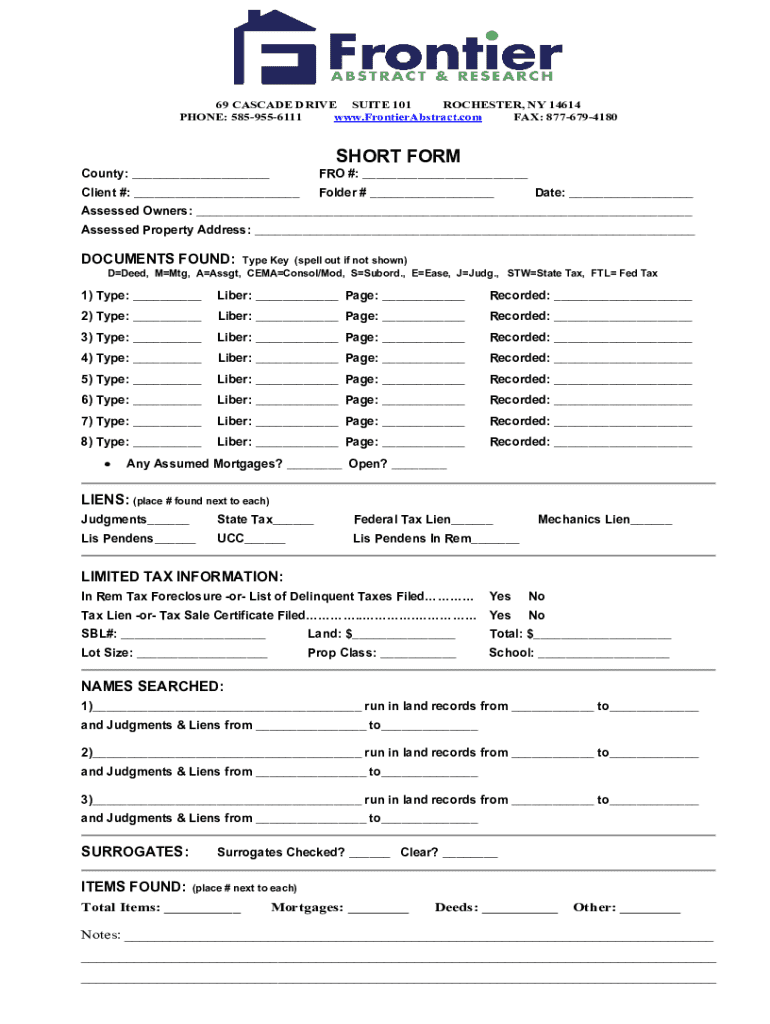

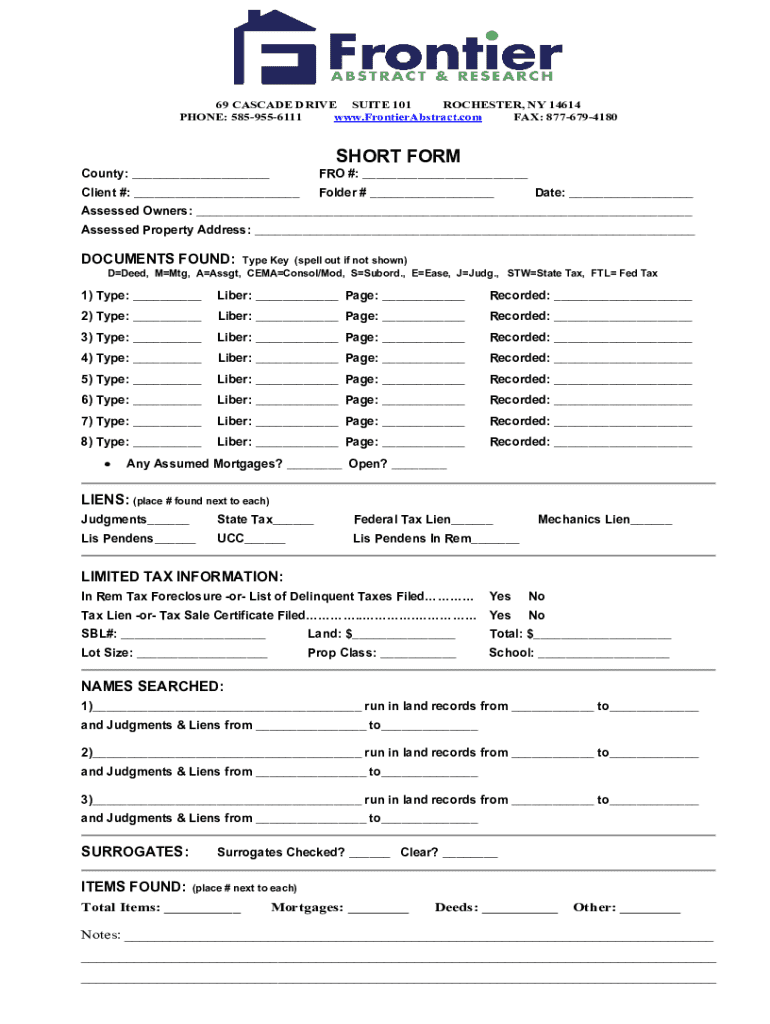

Municipal tax forms are vital for documenting tax liabilities and payments. Each form has distinct components and sections that gather essential information required by the municipality.

Key components typically include personal and property information, such as name, address, property identification number, and financial documentation that supports the tax claim or payment. Understanding these forms will enable you to complete them accurately and efficiently.

Step-by-step guide to completing municipal tax forms

Completing municipal tax forms accurately is a crucial step in ensuring compliance with local regulations. Here’s how to approach it:

First, gather necessary personal information, including your full name, address, and Social Security number. Next, collect all property details such as lot numbers, legal descriptions, and any ownership documents. Finally, prepare financial documentation that may include income statements or tax returns if required by the municipality.

When filling out the form, follow each section detail-by-detail, using sharp, clear information. Review instructions for specific wording or numerical formats required by your local tax authority. It's also prudent to check for common pitfalls, such as transposition of numbers or forgetting to sign the document.

Signing and submitting your municipal claim and tax form

Once your form is complete, it must be signed to be valid. In today’s digital age, electronic signatures (eSignatures) are widely accepted, streamline the process, and save time. With pdfFiller, eSigning is straightforward. Simply follow the prompts to add your electronic signature.

After signing, you need to decide how to submit the form. Online submissions are typically faster and can provide immediate confirmation of receipt, while mailing a form may delay the process but could be necessary in some cases. Ensure you follow specific submission guidelines based on your municipality's requirements, and keep extra copies for your records.

Common challenges and solutions

Filing municipal claims can present several challenges. One common issue involves errors during the application process, such as submitting incorrect or incomplete information. To avoid this, always cross-check your information against official documents and ensure clarity in your entries.

If your submission gets rejected or requires further information, promptly address any communications from the municipality. Keep all correspondence and respond as needed to expedite the resolution. Technical issues may also arise during online submissions; ensure you are familiar with the platform before submitting your forms and retain backup copies.

Managing municipal claims post-submission

After submission, understanding the review process is crucial. Each municipality has its timeline for processing claims, check your local authority’s website or contact them for specific expectations. If you don’t hear back within the expected timeframe, follow up to confirm your application’s status.

Keeping accurate records of your submissions is essential. Using a digital storage solution like pdfFiller can help in organizing documents and ensuring quick access when needed. Stay proactive in your record management to assist in future claims or penalty disputes.

Interactive tools available on pdfFiller

pdfFiller provides a variety of interactive tools that enhance your municipal claim and tax form experience. Document automation features allow you to create and populate forms quickly, ensuring efficiency and accuracy. Additionally, collaborative tools enable teams to work together seamlessly on tax submissions or claims.

Furthermore, accessing pre-filled municipal forms through pdfFiller can save time and reduce errors. The process of editing forms is simplified, making it easier to update information as needed.

Legal and compliance considerations

Municipal claims and tax forms are governed by a framework of local laws that vary by jurisdiction. It is essential to stay informed about relevant regulations to ensure compliance when filing your claims.

Keeping up with changes in tax legislation can be daunting, so consider subscribing to legal resources or consulting with experts in municipal law. Having access to reliable resources can guide you through complex interactions with the legal framework surrounding municipal claims.

Frequently asked questions

When it comes to municipal claim and tax form submissions, users often have several questions. Here are some common inquiries and answers:

Conclusion of services provided by pdfFiller

pdfFiller offers a comprehensive suite of services geared towards managing municipal claims and tax forms efficiently. From automated form filling to eSigning and collaboration tools, pdfFiller empowers users to streamline the document management process.

Explore more document solutions that can simplify your life and enhance your efficiency when dealing with municipal claims and tax forms. Efficient document management is paramount for success in tax filing, and pdfFiller is here to help ensure that task is as smooth as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send municipal claim and tax for eSignature?

How can I get municipal claim and tax?

Can I create an electronic signature for signing my municipal claim and tax in Gmail?

What is municipal claim and tax?

Who is required to file municipal claim and tax?

How to fill out municipal claim and tax?

What is the purpose of municipal claim and tax?

What information must be reported on municipal claim and tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.