Get the free Tax Organizer

Get, Create, Make and Sign tax organizer

How to edit tax organizer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax organizer

How to fill out tax organizer

Who needs tax organizer?

Understanding the Tax Organizer Form for Effective Tax Preparation

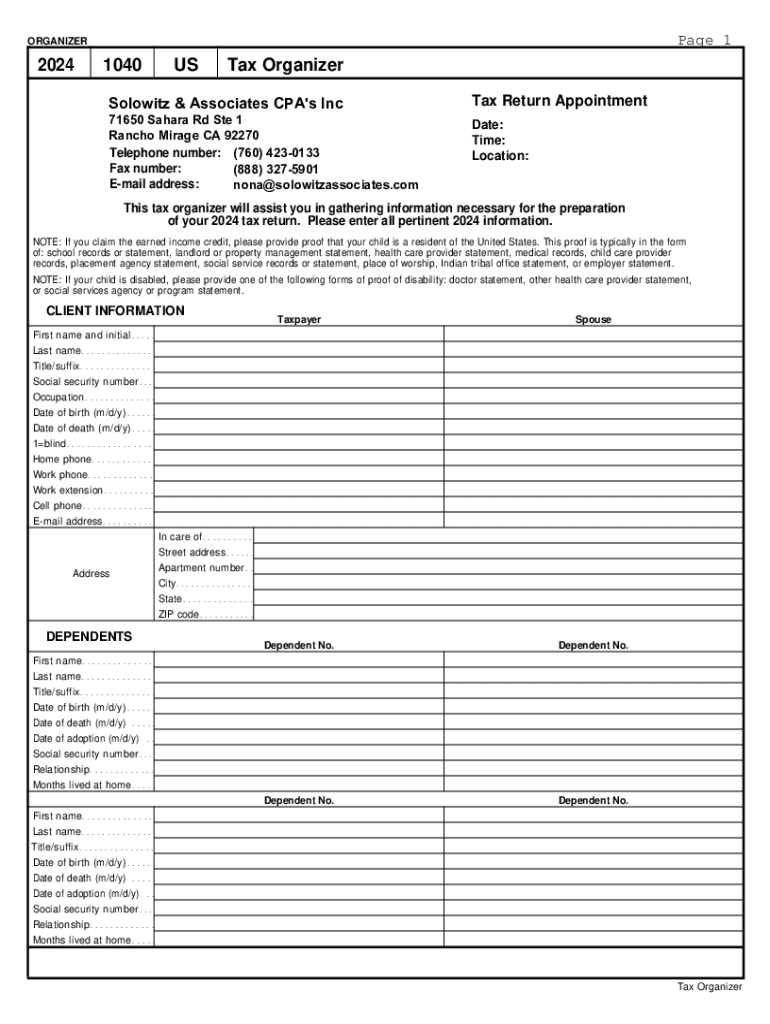

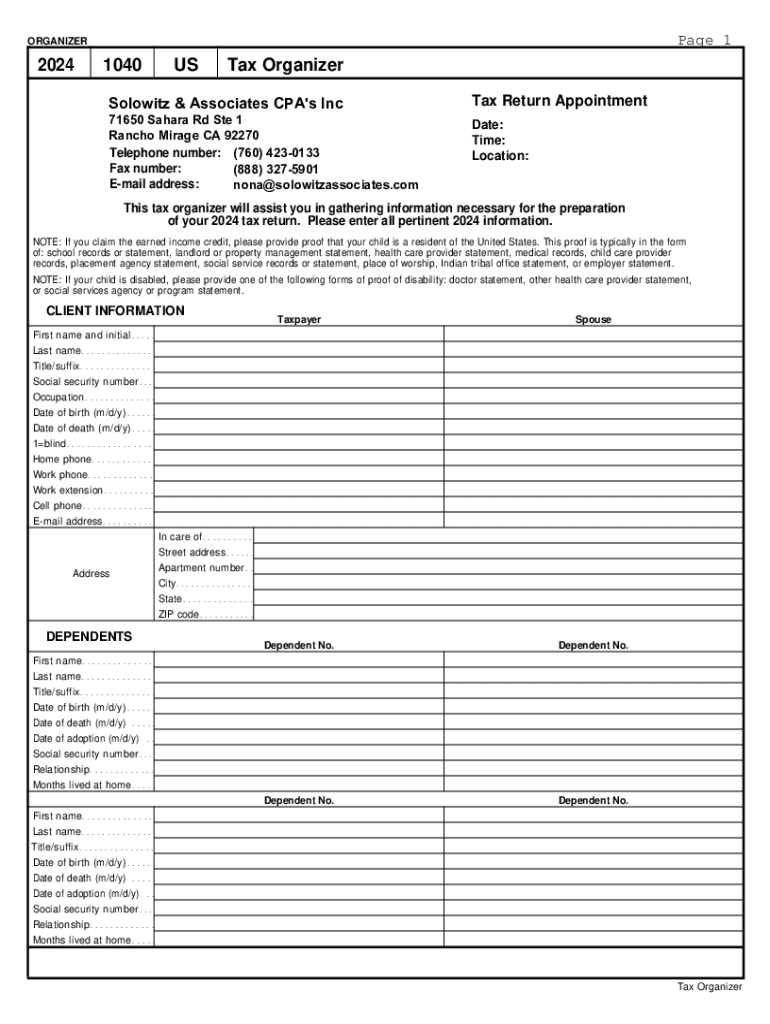

Overview of the tax organizer form

A tax organizer form is a detailed document designed to help individuals and businesses systematically collect and organize the information necessary for tax preparation. Its primary purpose is to streamline the tax filing process by providing a structured way to gather financial data, minimizing the risk of missing crucial information that could lead to errors or missed deductions.

Utilizing a tax organizer is essential for efficient tax preparation as it ensures all relevant documents are reviewed and organized before the actual filing. This not only saves time but also allows for better accuracy in reporting income and expenses. It is particularly beneficial in complex tax situations, such as those involving multiple income sources or significant deductions.

Types of tax organizer forms

Tax organizers can be categorized into two main types: individual tax organizers and business tax organizers. Each serves specific purposes and contains distinct sections tailored to the user's financial situation.

Individual tax organizers

Individual tax organizers include sections that require information about personal details, income sources, and potential deductions. Common inclusions are W-2 forms from employers, 1099 forms for freelance or contractor income, and documentation for charitable contributions.

Business tax organizers

Business tax organizers cater to self-employed individuals and small businesses, focusing on income and expenses tracking. They commonly include sections for receipts related to operational costs, profit and loss statements, and details regarding employee or contractor payments. Proper documentation of these aspects is crucial for maximizing deductions and minimizing tax liabilities.

Moreover, individuals should consider whether to use free or paid tax organizer forms. While free forms can be a cost-saving option for straightforward tax situations, paid versions often offer more robust features, support, and better integrations with tax filing software.

How to fill out a tax organizer form

Completing a tax organizer form can seem overwhelming, but breaking it down into manageable steps can simplify the process significantly. Here’s a step-by-step guide to help you through:

While filling out the form, some common mistakes to avoid include inputting incorrect Social Security numbers, overlooking income sources, or failing to update changes in personal status that might affect your tax situation.

Editing and customizing your tax organizer form

Editing your tax organizer form can enhance its effectiveness and ensure that it meets your specific needs. With tools like pdfFiller, users can easily modify existing templates or create custom forms tailored to individual financial situations. This customization might include structuring sections differently or adding new fields that reflect unique tax circumstances.

Utilizing templates specifically designed for various tax situations can help you save time and ensure all necessary information is included. Furthermore, the ability to add comments and annotations enables collaboration with tax professionals or team members involved in the tax preparation process.

Signing and sharing your tax organizer form

Once your tax organizer form is complete, you might need to share it with a tax professional or discuss it with collaborators. pdfFiller simplifies this process with eSigning options, enabling you to sign your document digitally. This feature not only speeds up the sharing process but also enhances security.

When sharing, pdfFiller provides various options such as sending links or directly sharing through email, ensuring your tax organizer form reaches the right parties efficiently. Collaboration tools also allow real-time discussions and updates, making tax preparation a more streamlined process.

Managing your tax organizer form with cloud-based solutions

Managing tax documents through cloud-based platforms offers significant advantages, especially in terms of flexibility and security. With pdfFiller, you can access your tax organizer forms from anywhere, at any time, ensuring you have your information on hand when needed.

Additionally, cloud-based solutions provide secure storage options, keeping your sensitive information safe while allowing easy retrieval. Regular backups and a user-friendly interface can simplify the organization and maintenance of all tax-related documents.

Additional features of pdfFiller relevant to tax organizers

pdfFiller offers a range of user-centric features designed to enhance your experience with tax organizers. Interactive tools for tracking expenses and income can be invaluable for both individuals and small business owners, enabling better financial management throughout the year.

Moreover, the platform’s integration with accounting software ensures seamless synchronization of your financial data, further simplifying the tax preparation process. User testimonials often highlight the efficiency and ease of use that pdfFiller brings to tax organization, proving its worth in helping users manage their tax responsibilities.

Common questions and troubleshooting

As users dive into the tax organizer process, they often encounter common questions. What should I include on my tax organizer form? How often should I update my information? What if I lose my form? Addressing these inquiries can ease anxiety and clarify expectations.

Many users may also face issues while using tax organizer forms, such as formatting problems or difficulties accessing their files. Fortunately, pdfFiller offers a dedicated support system to assist with troubleshooting, ensuring you can focus on what matters most — preparing your taxes accurately.

Summary of best practices for using tax organizer forms

Understanding how to optimize the use of a tax organizer form can significantly impact the ease and efficiency of your tax preparation. Regular updates and audits of your tax information are paramount to ensure nothing is overlooked as financial situations evolve.

Keeping your tax organizer form organized, accessible, and up-to-date allows you to handle your tax obligations with confidence. With tools like pdfFiller at your disposal, the process becomes not only manageable but also streamlined, helping you focus on maximizing deductions and minimizing liabilities.

Related content and tools

To further complement your journey in tax organization, pdfFiller offers a range of related forms and templates that work seamlessly with your tax organizer. Additional resources, including blogs, webinars, and guides, are available to assist users in mastering tax documentation and preparation.

These resources provide valuable insights into maximizing the use of tax organizer forms, ensuring you stay well-informed throughout the tax season. With comprehensive support from pdfFiller, individuals and teams can tackle tax preparation with ease and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax organizer from Google Drive?

How do I make changes in tax organizer?

How do I make edits in tax organizer without leaving Chrome?

What is tax organizer?

Who is required to file tax organizer?

How to fill out tax organizer?

What is the purpose of tax organizer?

What information must be reported on tax organizer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.