Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out texas tax exempt form

Who needs texas tax exempt form?

Understanding the Texas Tax Exempt Form: A Comprehensive Guide

Overview of Texas tax exemption

Tax exemption in Texas refers to a legal status granted to individuals and organizations that allows them to avoid certain taxes, commonly sales and use taxes. Understanding tax exemption is crucial, as it can result in significant savings and benefits for eligible parties. This is especially relevant for non-profits, educational institutions, and religious organizations, which often rely heavily on contributions and funding. Key types of tax exemptions in Texas include those for non-profit organizations, sales tax exemptions for purchases of equipment, and specific allowances for healthcare and educational services.

Who qualifies for tax exemption in Texas?

Eligibility for tax exemption in Texas varies significantly based on the type of entity applying. Individuals may qualify if they can demonstrate that their purchases are directly related to their significant health needs or if they meet certain income thresholds within specific programs. For organizations, non-profits and charities typically qualify for sales tax exemptions, while educational institutions and religious organizations are often granted more expansive exemptions based on their non-profit status. Additionally, governmental entities usually enjoy automatic exemptions from various taxes.

Understanding the Texas tax exempt form

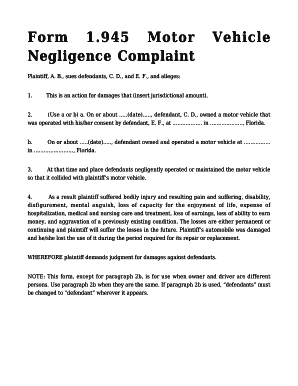

The Texas tax exempt form, officially known as Form 50-775, is an Optional Sales and Use Tax Exemption Form. Its primary purpose is to facilitate the process through which eligible individuals and organizations can secure tax exemptions. Completing this form accurately is crucial since it serves as the official documentation required by vendors to exempt qualifying purchases from sales tax. The form includes key components such as personal information, organization details, and the reason for exemption which must be clearly outlined to avoid any issues during submission.

Steps to complete the Texas tax exempt form

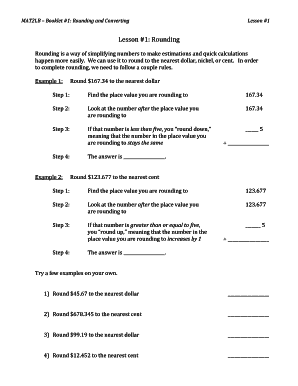

Filling out the Texas tax exempt form involves a systematic approach to ensure accuracy and compliance. The first step is to gather the necessary documentation that proves eligibility, such as proof of non-profit status or other relevant documentation. Once documented, filling out the form involves providing personal or organizational information, including tax identification numbers and the precise reason for seeking an exemption. Accuracy is critical; therefore, careful review and editing of the form are advised before submitting it through the appropriate channels. Submission methods include online options, mailing the form, or delivering it in person to relevant tax authorities.

Utilizing pdfFiller for Texas tax exempt form

pdfFiller provides powerful tools that simplify the completion of the Texas tax exempt form process. Users can leverage interactive tools for a streamlined experience, making it easier to edit, sign, and collaborate on documents. The cloud-based platform means your forms are accessible from anywhere, which is particularly beneficial for teams and individuals on the move. The ability to electronically sign documents speeds up the process significantly, allowing submissions to be completed without delay. Furthermore, managing forms on a secure platform minimizes the risk of losing important documents, ensuring compliance and easy retrieval of tax-related paperwork.

Common mistakes to avoid when completing the tax exempt form

Filling out the Texas tax exempt form may seem straightforward, but various common errors can lead to significant delays. One frequent mistake is omitting crucial personal or organizational information. It's imperative to check that all required fields are accurately filled out, including the tax ID number and description of the exemption. Using outdated forms or failing to provide the necessary supporting documents can also result in rejections. New applicants should carefully read the instructions provided with the form and consider using digital tools like pdfFiller to minimize human error during the process.

Frequently asked questions (FAQs) about Texas tax exemption

Many individuals and organizations have questions regarding the Texas tax exemption process. Common inquiries include the types of organizations that can apply for tax exemption—typically non-profits, charities, and educational institutions. Processing times for tax exempt forms can vary, but understanding that it may take several weeks is essential for planning. Additionally, applicants often wonder if they can amend a submitted form; generally, amendments are allowed but require adherence to prescribed procedures. In cases of denial, knowing the appeal process and steps to reapply is crucial for further pursuing tax exemption.

Additional considerations for Texas tax exemptions

It's important to stay informed about the expiration and renewal processes related to tax exemptions in Texas. Most exemptions are not permanent; therefore, organizations should maintain careful records of their status and ensure compliance with any necessary renewals. Tax laws and regulations can change, impacting eligibility or the exemption process itself, making it vital for applicants to regularly review available resources and updates from the Texas state tax authority.

Resources for further assistance

For additional support, applicants are encouraged to explore official Texas tax resources, including the Texas Comptroller’s website, which offers guidance documents and detailed instructions on tax exemptions. Direct contact with state tax offices can also provide clarity. Joining community resources or local tax support groups greatly assists individuals and organizations in navigating the complexities of tax exemptions in Texas, making it easier to stay compliant and informed.

Conclusion

Understanding the Texas tax exempt form is a vital step for eligible individuals and organizations aiming to navigate the complexities of tax exemptions efficiently. Utilizing the capabilities that pdfFiller provides not only simplifies the process but also enhances accuracy, promoting timely submissions. By leveraging these resources and following the outlined steps, applicants can maximize their benefits from available tax exemptions, ultimately supporting their missions and operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete pdffiller form online?

How do I edit pdffiller form on an iOS device?

How do I complete pdffiller form on an iOS device?

What is texas tax exempt form?

Who is required to file texas tax exempt form?

How to fill out texas tax exempt form?

What is the purpose of texas tax exempt form?

What information must be reported on texas tax exempt form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.