A comprehensive guide to the North Carolina independent contractor form

Understanding independent contractors in North Carolina

An independent contractor in North Carolina is defined as a self-employed individual who provides specific services to clients under a contract. Unlike employees, they maintain control over how they perform their work, allowing for greater flexibility. This distinction carries implications for taxation, liability, and duties.

Key differences between independent contractors and employees can significantly impact how both parties navigate their contractual relationships. Independent contractors do not have the same benefits as employees, such as health insurance or retirement plans, and are responsible for their own taxes. Understanding these differences is crucial for both the contractor and the client.

In North Carolina, the legal framework surrounding independent contractors revolves around various laws, including the Internal Revenue Code and the North Carolina Employment Security Law. Recognizing the classification of workers is essential for compliance with labor laws and tax regulations.

Importance of the North Carolina independent contractor form

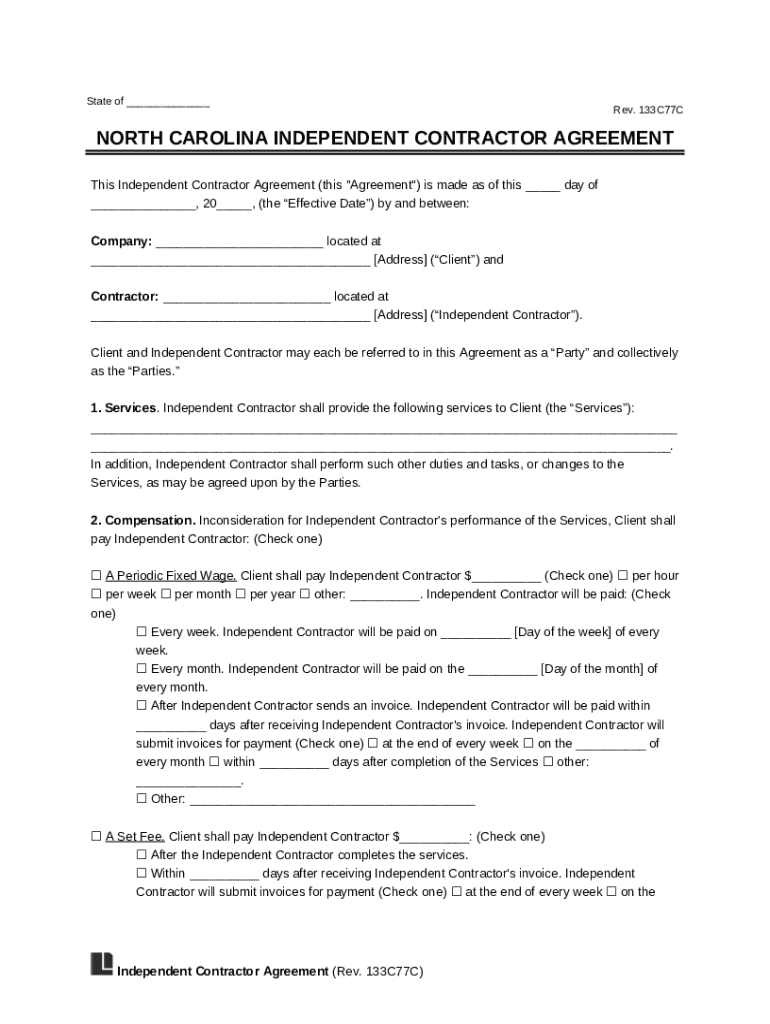

The North Carolina independent contractor form serves a critical purpose in formalizing the business relationship between a contractor and a client. This form outlines the terms of engagement and provides clarity on the expectations from both parties.

Legal implications of using the form are significant; it helps protect all parties involved by minimizing misunderstandings and ensuring compliance with state and federal regulations. The form serves as evidence of the nature of the working relationship, which becomes vital should any disputes arise.

Clarifies the scope of services provided.

Establishes mutual obligations and responsibilities.

Common situations requiring the North Carolina independent contractor form include freelance work, consultancy services, or any scenario where specialized skills are utilized without a traditional employment setup. Ensuring proper documentation is beneficial for future reference.

Step-by-step guide to completing the North Carolina independent contractor form

To effectively complete the North Carolina independent contractor form, start by gathering the necessary information. This includes personal details such as your full name, address, Social Security number, and relevant business information if applicable.

Personal Information - name, contact details.

Business Information - if operating under a business entity.

Details of services provided - clear description of work.

Next, filling out the form involves carefully following each section. The contractor information section should detail your personal and business information accurately. The payment terms must clarify how you will be compensated, including payment frequency and method, while the duration of the agreement outlines how long the contract will be effective.

Be mindful of common mistakes, such as failing to include specific terms or providing inaccurate information. After completing the form, thoroughly review it for accuracy to prevent any issues down the line.

Editing and customizing the form using pdfFiller

pdfFiller offers a streamlined process for editing and customizing your North Carolina independent contractor form. Begin by uploading the document to the pdfFiller platform, which is user-friendly and accessible from any device.

Utilizing the editing tools, users can customize the document to suit their specific needs. This includes adding or removing sections to reflect unique agreements and inserting digital signatures to formalize the agreement with ease.

Upload your form to pdfFiller.

Use editing tools for customization.

Save and share your final document.

The advantages of using pdfFiller extend beyond mere editing; it provides a collaborative environment where you can manage your documents efficiently, share them with collaborators, and ensure everything is tracked.

Signing the North Carolina independent contractor form

Once the form is complete, signing it is the next critical step. There are two main options for signing: an electronic signature or a handwritten one. Digital signatures are becoming increasingly accepted and can expedite the signing process.

Using pdfFiller’s eSign features allows for quick and secure signing, making it easier for both parties to finalize the agreement without the need for physical documents. The legal validity of electronic signatures in North Carolina is established, ensuring that contracts signed digitally hold the same weight as those signed by hand.

Managing your independent contractor agreement

Proper document management is essential in maintaining a successful independent contractor relationship. Version control becomes vital, as keeping track of any amendments or updates ensures that everyone operates on the latest agreement.

Collaboration between parties can be enhanced using platforms like pdfFiller, allowing simultaneous access and edits. Tracking changes is crucial for accountability, giving a clear record of agreements, discussions, and documentation.

Implement version control for easy tracking.

Collaborate with other parties directly on the platform.

Maintain comprehensive records of all agreements.

Frequently asked questions (FAQs)

Determining whether to use an independent contractor form often hinges on the nature of your work arrangement. If you are providing specialized services and do not receive employee benefits, using the form is advisable.

Failing to utilize the form could lead to serious legal consequences. Without clear terms established, disputes regarding payments, responsibilities, or deadlines can arise, resulting in potential financial or legal repercussions.

Evaluate your work arrangement to determine necessity.

Recognize the risks of operating without a formal agreement.

Consult legal counsel if uncertain about modifications.

Related forms and documentation

When working as an independent contractor, it is crucial to differentiate between various types of agreements. For instance, employee agreement forms are designed for traditional employment situations, while non-disclosure agreements protect confidential information shared between parties.

Familiarizing yourself with other templates available on pdfFiller can further streamline your document management. The North Carolina employment contract and the IRS W-9 form for contractors are two essential documents that complement the independent contractor form.

Employee Agreement Forms - for traditional employment.

Non-Disclosure Agreements - for protecting confidential information.

IRS W-9 Form - for tax reporting purposes.

Rights and responsibilities of North Carolina independent contractors

Independent contractors in North Carolina enjoy specific rights, including timely payment for services rendered and safe working conditions. Understanding these rights is essential for effective self-advocacy in the business landscape.

Equally important are the responsibilities that lie with independent contractors. Delivering work on time and maintaining clear communication with clients are vital to building trust and ensuring successful business relationships.

Right to fair payment for services provided.

Right to a safe working environment.

Responsibility to communicate effectively with clients.

Conclusion

Understanding the implications of the North Carolina independent contractor form is vital in today's diversified workforce. Using this form not only clarifies the relationship between independent contractors and clients but also ensures legal protection for both parties.

pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform, making the process of handling independent contractor agreements straightforward and efficient.