Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out declaration of homestead

Who needs declaration of homestead?

A Comprehensive Guide to the Declaration of Homestead Form

Understanding the declaration of homestead

The Declaration of Homestead is a legal document that homeowners may file to protect a portion of their property's value from creditors. This can be particularly vital for those who wish to ensure that their home remains secure, even in the face of financial difficulties. Filing this declaration not only affords specific legal protections but also can provide significant psychological reassurance to homeowners, knowing their most valuable asset is safeguarded.

The importance of filing a declaration is underscored by its potential to provide a safety net. Many states allow homeowners to exempt a certain amount of equity in their homes from bankruptcy proceedings or judgments. Moreover, it often garners benefits in terms of property tax relief, contributing further to a homeowner's financial stability. With legal implications that can have lasting impact on one's financial health, understanding these fundamentals is crucial.

Benefits of filing a declaration of homestead

Filing a Declaration of Homestead comes with numerous advantages, making it an attractive option for homeowners. One primary benefit is protection from creditors; should a homeowner face bankruptcy or other financial challenges, the declared homestead protects a portion of the home’s equity, limiting the creditors' ability to seize the property. This peace of mind can be invaluable, especially for families seeking financial security.

Additionally, many states offer property tax exemptions as part of their homestead policies, which can significantly reduce an individual’s tax burden. This could result in substantial savings, contributing to a homeowner's financial independence over time. Another vital aspect is the safeguarding of family home equity, ensuring that the family home remains in the family even through potential hardships.

Types of homestead exemptions

Understanding the types of homestead exemptions available is crucial for homeowners looking to maximize their benefits. Generally, there are three main types: standard exemptions, senior citizen exemptions, and disability exemptions. Each type has distinct eligibility requirements and advantages, catering to different demographic groups and providing varying levels of protection.

Eligibility criteria for each exemption type vary widely by state and can include age, disability status, or even income limits. Therefore, it’s essential for prospective filers to check their specific state’s requirements.

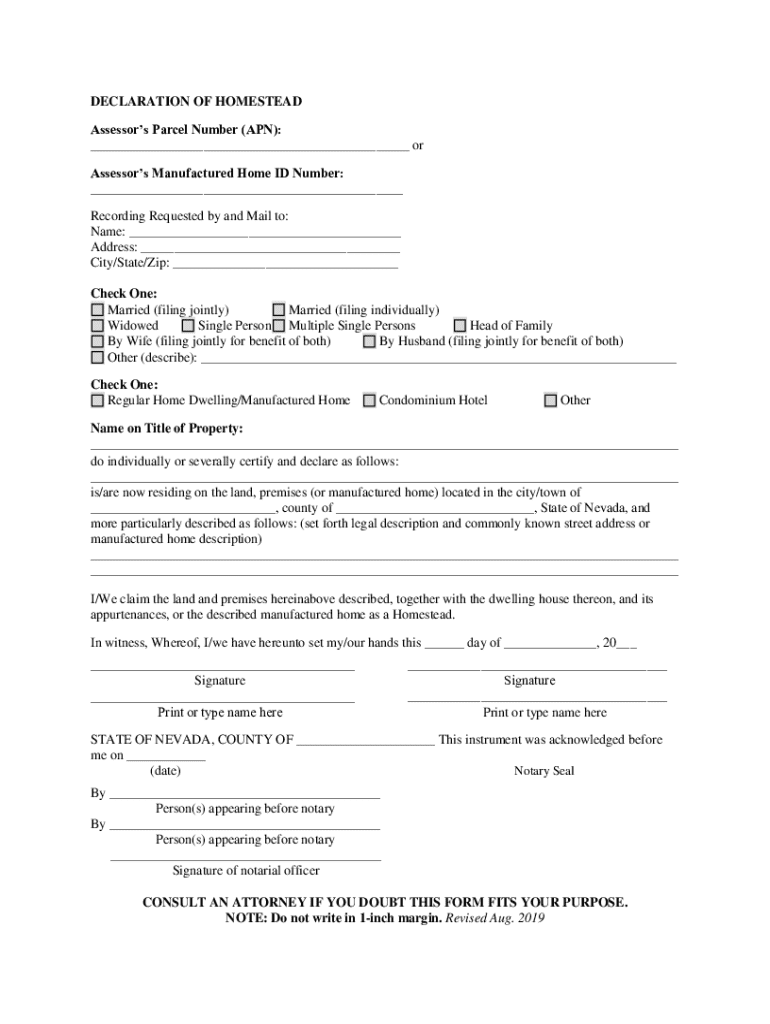

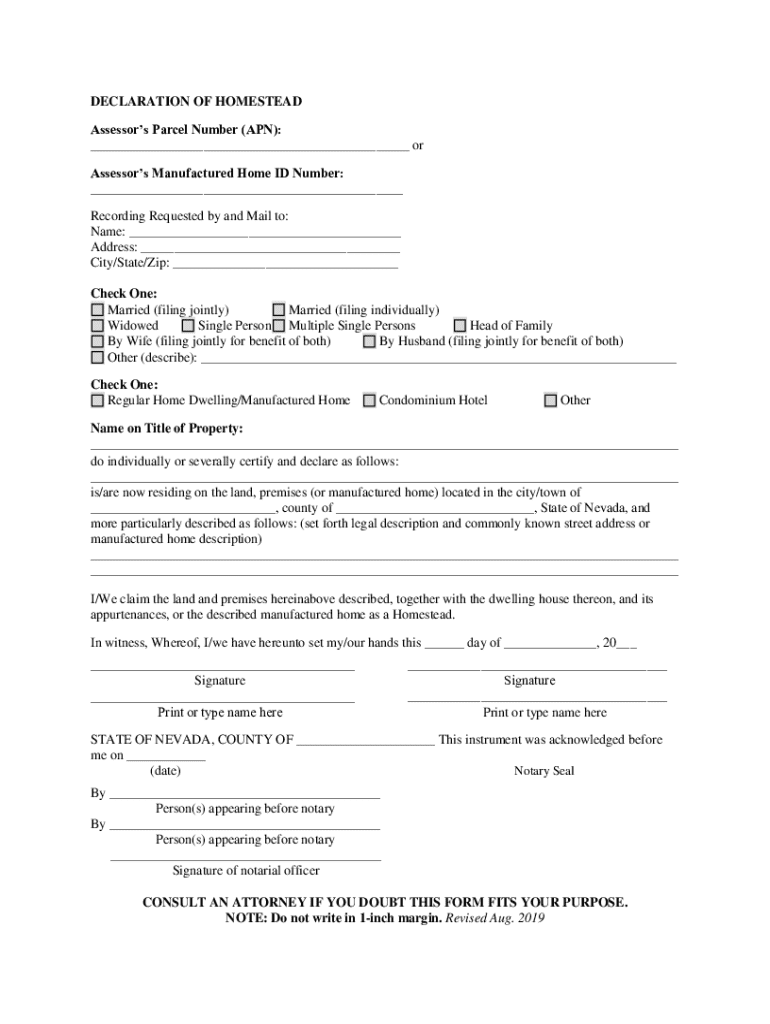

Preparing to complete the declaration of homestead form

Before diving into the filing process, it's necessary to gather the required documentation and information. This preparation stage is crucial to ensure the declaration form is filled out correctly and promptly. Key documents typically needed include proof of ownership (like a deed), a clear description of the property being claimed, as well as personal identification documents such as a driver’s license or passport.

Each state has specific requirements regarding documentation and the information contained within the Declaration of Homestead form. Therefore, reviewing the state-specific guidelines can save time and prevent potential rejections, ensuring a smooth filing process.

Step-by-step guide to completing the declaration of homestead form

Completing the Declaration of Homestead Form can seem daunting, but breaking it down into manageable steps can greatly simplify the process.

Common mistakes to avoid when filing a declaration of homestead

Filing the Declaration of Homestead can be straightforward, but there are common pitfalls that filers should be aware of to avoid complications. Incomplete information, such as missing signatures or incorrect property details, can result in delays or denials of the application. Ensure all required fields are thoroughly filled out, and double-check facts for accuracy.

Another common mistake is missing deadlines. Many states have specific deadlines for filing homestead declarations, particularly linked to property tax cycles. Mark your calendar to avoid unnecessary interruptions in the process. Lastly, forgetting to notarize the form is a frequent error; make sure this crucial step is not overlooked.

Other related forms and declarations

In addition to the declaration of homestead, there are related forms that homeowners should be aware of. A Declaration of Abandonment of Homestead is essential when a homeowner chooses to relinquish the homestead protection on a property, often due to a sale or move. Understanding when and how to use these related documents is vital for maintaining proper legal standing regarding property ownership.

Comparing these documents will help in deciding which form is appropriate for your current situation, especially during significant life changes.

Resources for further assistance

When navigating the Declaration of Homestead process, having a reliable set of resources can make all the difference. State and local government resources often provide essential information regarding eligibility, application timelines, and the specific benefits associated with filing. Consider reaching out to local legal aid organizations for personalized assistance, especially if you encounter complexities that could affect your filing.

For specific questions regarding your unique situation, having contact information for local authorities responsible for property records on hand can be very beneficial.

Frequently asked questions (FAQs)

As homeowners contemplate filing a Declaration of Homestead, several questions commonly arise. Understanding qualifications for homestead exemptions is crucial. Many homeowners wonder about their eligibility based on ownership status and property use. An essential aspect is whether a revocation of the Declaration of Homestead is possible; homeowners may seek to do this due to selling their property or changing financial circumstances.

Additionally, it's necessary to comprehend the implications of changes in circumstances after filing. For example, if a homeowner's financial situation improves significantly, the process for adjusting or revoking benefits may differ.

Utilizing pdfFiller for a seamless experience

Navigating the Declaration of Homestead process can be greatly simplified by utilizing pdfFiller’s extensive platform. With editing features that allow users to modify PDFs seamlessly, individuals can adapt their forms easily without the need for additional software. The eSigning options further enhance convenience; documents can be electronically signed, ensuring you meet notarial and filing requirements quickly.

Collaborative tools available on pdfFiller are especially beneficial for teams managing documents across offices or areas. Sharing and managing forms through a single, cloud-based platform can save both time and effort, making the homestead filing experience as straightforward as possible.

Conclusion

Filing a Declaration of Homestead is a valuable step for homeowners aiming to protect their property and financial future. By following the guidelines outlined in this guide, individuals can navigate the complexities of the process with confidence. The advantages of shielding one’s home from creditors, achieving tax exemptions, and the peace of mind that comes from safeguarding family assets cannot be understated. Utilizing pdfFiller not only streamlines the process but also empowers users to manage their documents effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit pdffiller form from Google Drive?

How do I complete pdffiller form online?

How do I fill out the pdffiller form form on my smartphone?

What is declaration of homestead?

Who is required to file declaration of homestead?

How to fill out declaration of homestead?

What is the purpose of declaration of homestead?

What information must be reported on declaration of homestead?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.