Get the free ISA Transfer Form | EQ Investors - eqinvestors co

Get, Create, Make and Sign isa transfer form eq

How to edit isa transfer form eq online

Uncompromising security for your PDF editing and eSignature needs

How to fill out isa transfer form eq

How to fill out isa transfer form eq

Who needs isa transfer form eq?

Your Complete Guide to the ISA Transfer Form EQ Form

Understanding the ISA Transfer Form EQ Form

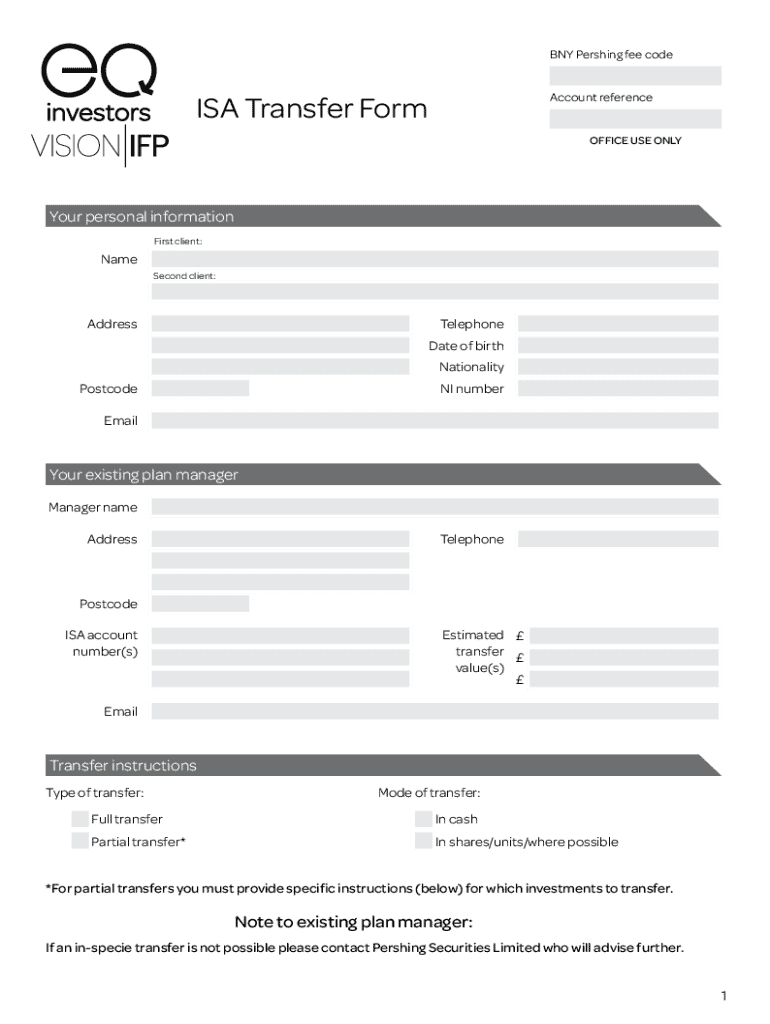

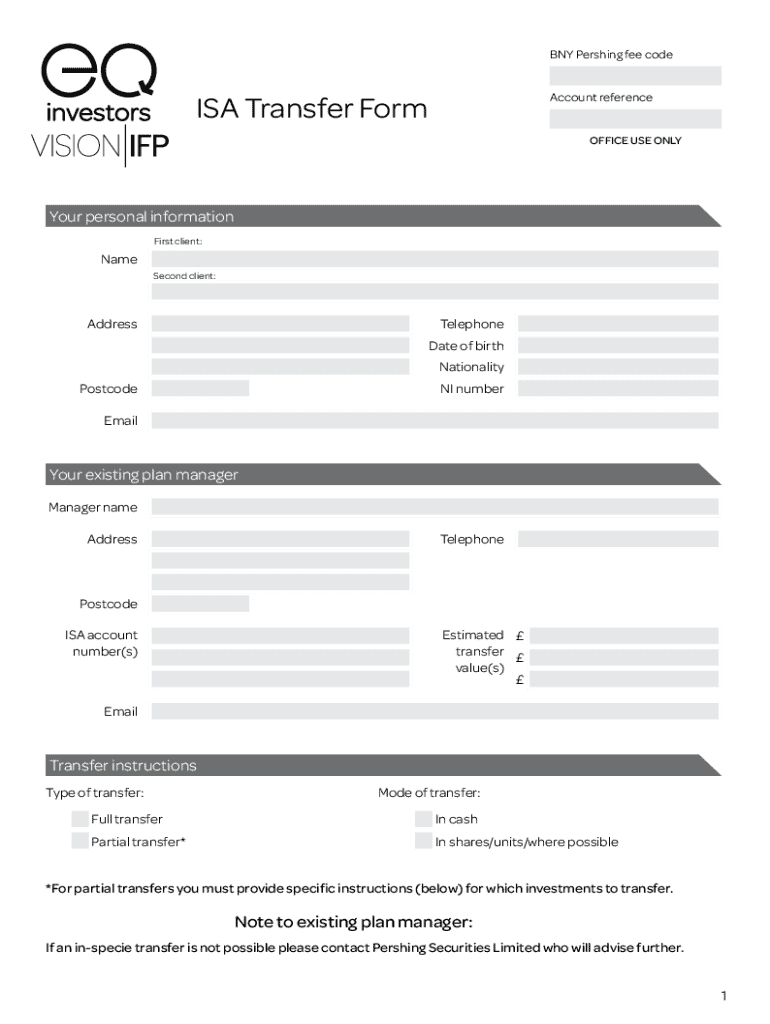

The ISA Transfer Form EQ Form is essential for individuals looking to transfer their Individual Savings Accounts (ISAs) from one provider to another. This form serves as a formal request to facilitate the movement of funds between ISAs without losing tax advantages. Using the EQ form ensures that the transfer process follows the necessary regulations and that funds retain their tax-free status.

The EQ Form is particularly important as it streamlines the transfer process by providing a structured and legally recognized template. It's crucial for individuals who want to ensure their savings remain intact and compliant with HMRC regulations. The form should be utilized whenever an individual decides to change ISA providers, whether due to better interest rates, improved service quality, or a change in financial goals.

Key features of the ISA Transfer Form EQ Form

The ISA Transfer Form EQ Form encompasses several key features that make it user-friendly and efficient. It provides comprehensive fields for essential details, including personal identification, current ISA provider information, and specifics on the transfer amounts.

Preparing to fill out the ISA Transfer Form EQ Form

Before diving into the completion of the ISA Transfer Form EQ Form, you must gather the necessary information and documentation. This preparation is critical for smooth processing and helps eradicate common pitfalls that can delay the transfer.

Understanding common terminology used in the EQ Form can help prevent confusion while filling it out. Familiarize yourself with concepts such as 'transfer value,' 'current provider,' and 'new provider,' which are integral to the transfer process.

Step-by-step guide to completing the ISA Transfer Form EQ Form

Filling out the ISA Transfer Form EQ Form requires attention to detail. Here’s a straightforward guide to help you navigate this process step-by-step.

Managing your ISA transfer with pdfFiller

pdfFiller offers an array of interactive tools that can significantly enhance your experience when completing the ISA Transfer Form EQ Form. With cloud-based document management, users can access their forms from anywhere, making the transfer process convenient.

Common mistakes to avoid when filling out the ISA Transfer Form

When completing the ISA Transfer Form EQ Form, several common errors can occur, leading to delays or complications in your transfer. To ensure a seamless process, be mindful of these pitfalls.

Special considerations for different types of ISAs

Transfers involving different types of ISAs can carry distinct rules and implications. Understanding these nuances is essential to ensure compliance and optimal account management.

Frequently asked questions (FAQs) about ISA Transfer Form EQ Form

Several common questions arise when people consider submitting the ISA Transfer Form EQ Form. Here are some answers to the most frequently asked queries.

Expert insights and tips for a successful ISA transfer

Financial advisors often have valuable insights into optimizing your ISA transfer process. Their advice can provide guidance on completing the ISA Transfer Form EQ Form efficiently.

Getting support for your ISA transfer process

Navigating the ISA transfer process can sometimes be complicated. It’s reassuring to know that pdfFiller offers extensive customer support to assist you along the way.

Ensuring compliance and security in your ISA transfers

Compliance and security are paramount when dealing with financial documents like the ISA Transfer Form EQ Form. Understanding the necessary regulatory requirements is essential for a hassle-free transfer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify isa transfer form eq without leaving Google Drive?

How do I edit isa transfer form eq straight from my smartphone?

Can I edit isa transfer form eq on an Android device?

What is isa transfer form eq?

Who is required to file isa transfer form eq?

How to fill out isa transfer form eq?

What is the purpose of isa transfer form eq?

What information must be reported on isa transfer form eq?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.