Get the free Suitability Assessment Form

Get, Create, Make and Sign suitability assessment form

How to edit suitability assessment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out suitability assessment form

How to fill out suitability assessment form

Who needs suitability assessment form?

Suitability Assessment Form: A Comprehensive How-to Guide

Understanding the suitability assessment form

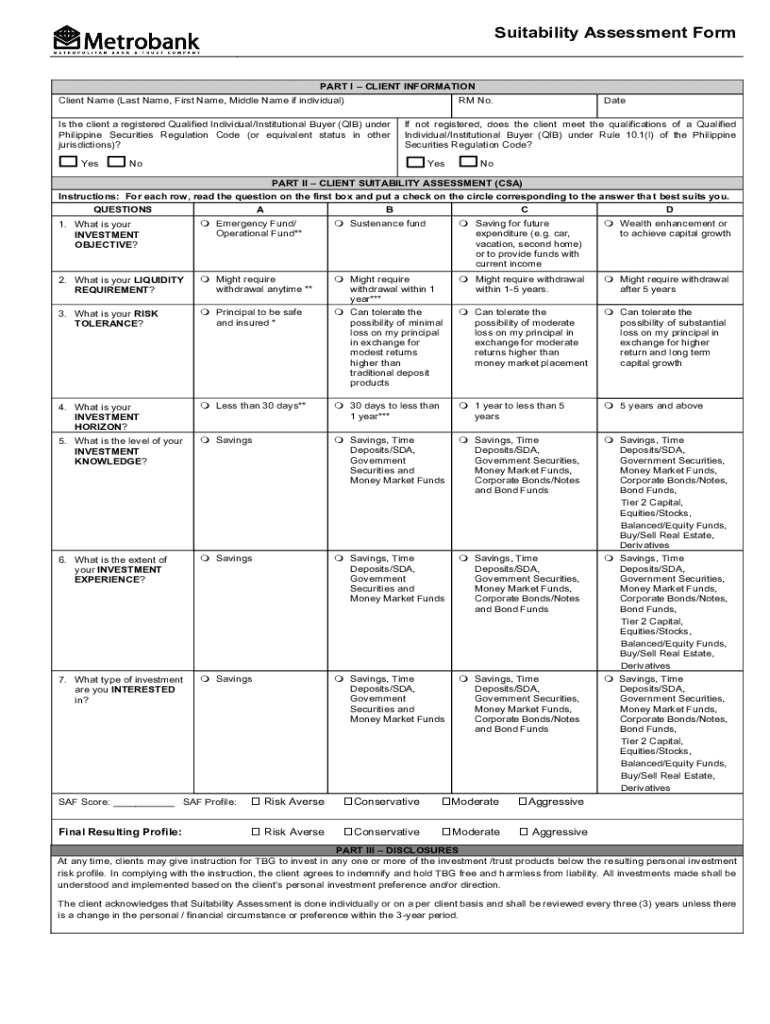

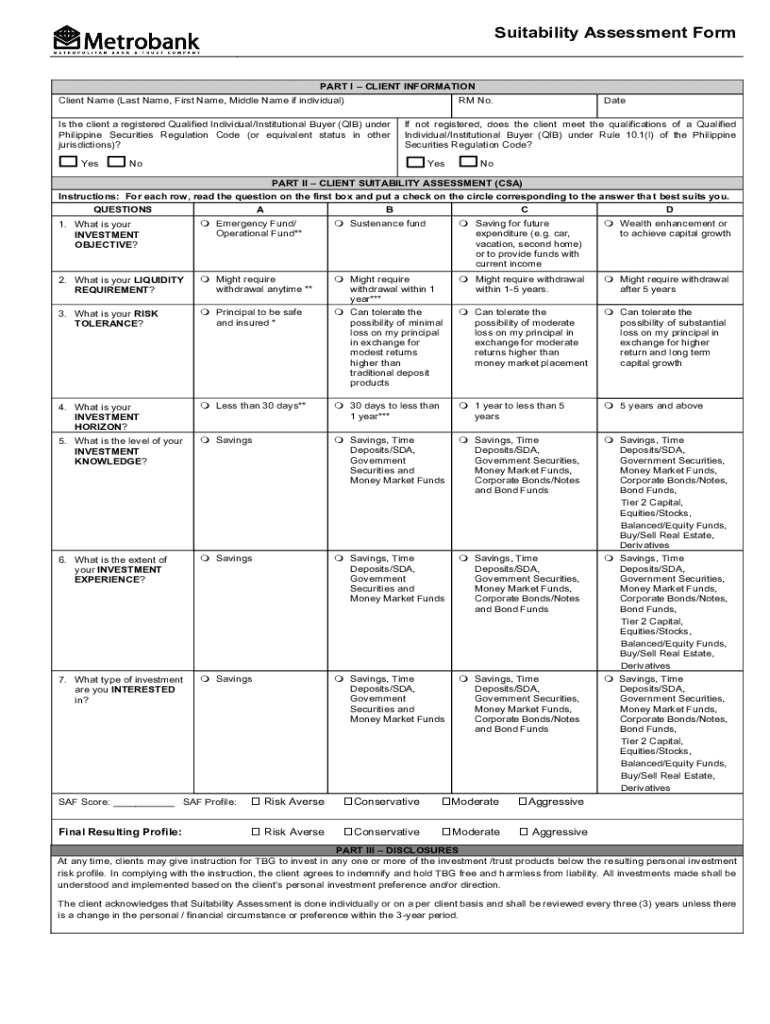

A suitability assessment form is a vital document that financial institutions utilize to evaluate an individual's qualifications as an appropriate candidate for specific investment opportunities. This form functions not only as a guideline for asset management but also ensures adherence to regulatory demands by capturing essential user data.

The significance of the suitability assessment in document management is immense; it allows financial advisors to create tailored investment strategies that align with the risk tolerance and financial goals of their clients. For individuals, this form can clarify their investment readiness and provide a structured approach to addressing financial planning. Anyone engaged in investing, whether as an individual investor or part of a financial institution, benefits from utilizing this document.

Key components of the suitability assessment form

The structure of a suitability assessment form typically encompasses several critical components designed to gather comprehensive information. These sections are thoughtfully categorized to facilitate clarity and accuracy throughout the assessment process.

Section A: User information

The initial part focuses on user information, requiring personal details such as name, address, and contact information. Accurate data collection is essential, as it forms the foundation for all subsequent assessments and is pivotal for regulatory compliance.

Section B: Financial profile

The financial profile section aims to capture the user's investment goals and assess risk tolerance. It includes questions on financial objectives, investment experience, and likely portfolio preferences. For high net worth investors, a dedicated statement declaring net worth is often necessary.

Section : Certified investor statements

This section elaborates on investor status, distinguishing between certified sophisticated investors and self-certified. Understanding these categories aids firms in determining the suitability of specific investment products to qualified individuals.

Section : Declarations and agreements

The final section covers legal implications of the financial agreements and the necessity of declaring one's financial intentions. It's crucial as it protects both the investor's and the institution's interests, ensuring transparent communication.

Step-by-step guide to filling out the suitability assessment form

Completing the suitability assessment form may seem daunting, but following a structured approach can streamline the process. Here's a detailed guide on navigating each step.

Step 1: Prepare your personal and financial information

Before diving into the form, start by gathering necessary documents such as tax returns, financial statements, and any relevant identification. Having this information at your fingertips smooths the process and reduces errors.

Step 2: Online access and interaction with the form

If you're using pdfFiller, begin by logging in to your account. Once you're in, navigate to the suitability assessment form through the dashboard. The interactive tools provided by pdfFiller allow for a user-friendly experience, making it easy to complete the document.

Step 3: Complete each section thoughtfully

Approaching each section requires careful consideration. When filling out personal details, ensure that every entry is accurate and complete. For the financial assessments, take your time to evaluate your risk tolerance and investment goals honestly.

Step 4: Review and edit your responses

Once the sections are completed, utilize pdfFiller’s editing features to review your responses. Check for any errors, clarifying any ambiguities before moving to the next step. This thorough review process will help avoid future complications.

Step 5: Obtain required signatures and submit

The final step involves gathering necessary signatures. Utilize the eSignature functionality within pdfFiller to sign electronically. After it's signed, submit it through the designated platform and keep track of your submission for follow-up.

Managing your suitability assessment form within pdfFiller

Effective management of the suitability assessment form is crucial for ongoing compliance and document integrity. Here’s how pdfFiller enhances your management capabilities.

Saving your work for later completion

If you’re unable to finish the form in one sitting, pdfFiller allows you to save your work without losing any input. This functionality enables you to pick up right where you left off without frustration.

Accessing previous versions of your form

Editing documents can sometimes lead to unintentional changes. Using pdfFiller, you can access previous versions of your form, allowing alternatives and rollback capabilities if necessary.

Collaborating with others on the form

Working with a team on a single form can be efficient. pdfFiller lets you invite team members to review the document, enabling comments and suggestions directly on the form. This collaborative aspect enhances accuracy and shared understanding.

Common issues and troubleshooting tips

Despite user-friendly platforms, challenges may arise when filling out the suitability assessment form. Here are some common issues and practical solutions.

Frequently asked questions regarding the suitability assessment form

Users often have questions about the suitability assessment form, particularly about its contents and the implications of the data provided. Clarifying these concerns early in the process can mitigate confusion and facilitate smoother submissions.

Technical problems and solutions users might face

Additional considerations

When completing a suitability assessment form, keeping legal compliance and best practices top of mind is essential. This document not only serves an immediate purpose but also functions as a tool for ongoing financial alignment.

Reviewing your suitability assessment regularly

It is advisable to review and update your suitability assessment periodically. As your financial situation evolves or market conditions change, ensuring your form reflects current status can enhance investment strategies.

Recognizing when to update the form is pivotal; major financial events such as career changes, inheritance, or market fluctuations should trigger a review. Keeping financial information current ensures relevance and accuracy in your investment decisions.

Benefits of using pdfFiller for your suitability assessment needs

Leveraging pdfFiller for your suitability assessment form brings numerous benefits beyond mere document completion. The platform is designed to provide a seamless experience tailored to user needs.

Conclusion and next steps

Engaging in a suitability assessment is a fundamental step in successful financial planning. By utilizing the insights from this guide, users can effectively leverage the suitability assessment form to align their investments with financial aspirations.

Embracing tools like pdfFiller not only streamlines the process of document creation and management, but it also ensures that your financial documentation remains secure, collaborative, and compliant with ever-evolving regulations. In turn, this fortifies your financial strategy and empowers achieving investment goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete suitability assessment form online?

How do I make edits in suitability assessment form without leaving Chrome?

How do I edit suitability assessment form on an iOS device?

What is suitability assessment form?

Who is required to file suitability assessment form?

How to fill out suitability assessment form?

What is the purpose of suitability assessment form?

What information must be reported on suitability assessment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.