Get the free Nonprofit Loan Application

Get, Create, Make and Sign nonprofit loan application

How to edit nonprofit loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonprofit loan application

How to fill out nonprofit loan application

Who needs nonprofit loan application?

Nonprofit Loan Application Form: A Comprehensive Guide

Understanding nonprofit loans

Nonprofit loans are financial instruments specifically tailored to help nonprofit organizations fund their missions. Unlike traditional loans, which are focused on profit generation, these loans support activities and projects that serve public benefits, such as community service, education, and social welfare. Nonprofits often face unique financial constraints, making access to loans a crucial component for sustaining operations and funding initiatives.

The importance of loans for nonprofit organizations cannot be overstated. They provide essential capital for operational needs, enable nonprofits to expand their reach, and support projects that require upfront investment. In a sector that frequently operates on tight budgets, loans can offer the financial flexibility needed to navigate cash flow challenges, allowing nonprofits to fulfill their commitments and expand their services.

Types of nonprofit loans

There are several types of nonprofit loans available, each designed to meet different financial needs. Understanding the various loan options is essential for making informed decisions that align with your organization’s goals.

Choosing the right type of loan is critical for your organization. Assess your specific needs, the time frame for the funds, and the amount of capital required to ensure you select the most appropriate loan type.

Evaluating your financial needs

Before applying for a loan, it's essential to evaluate your nonprofit's financial needs thoroughly. Understanding both your current financial position and projections for the future can guide you in determining how much funding you require.

You should also familiarize yourself with key financial health indicators, such as your organization’s debt-to-equity ratio and operating reserves. Lenders often consider these metrics when reviewing loan applications.

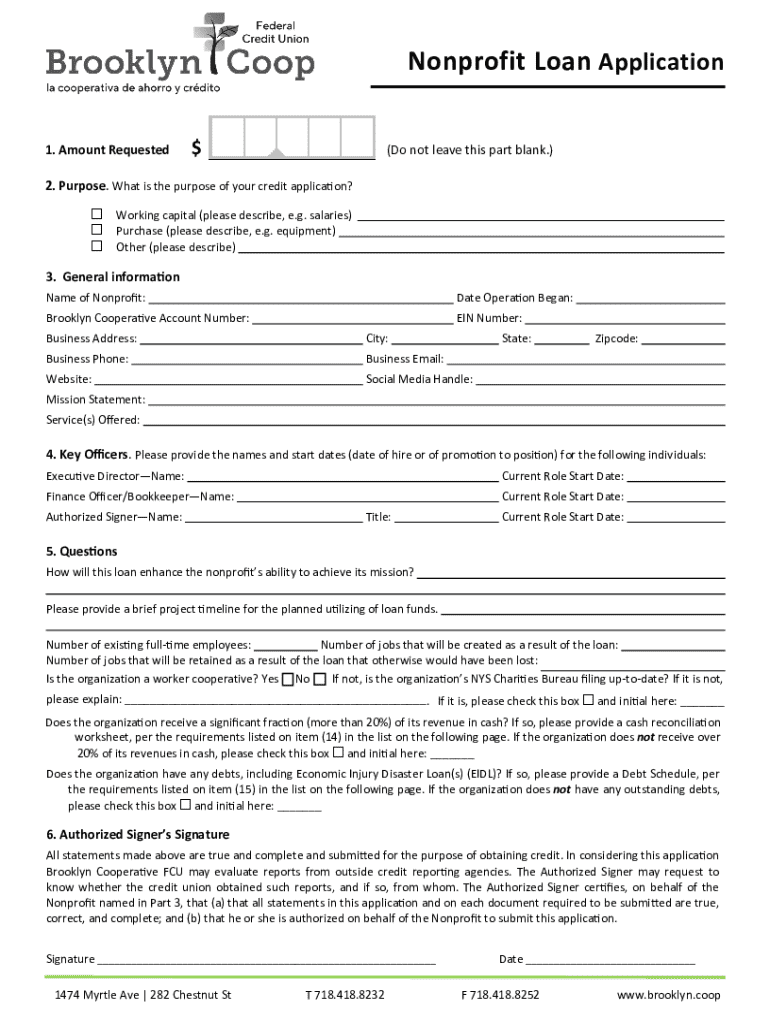

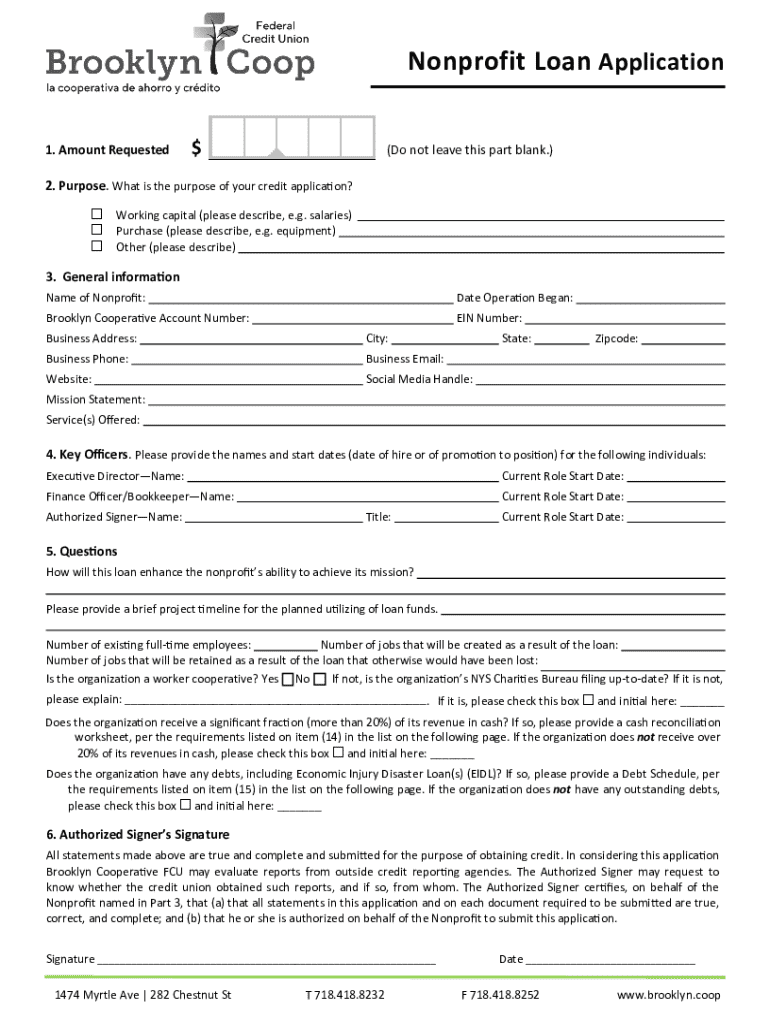

The nonprofit loan application process

Navigating the nonprofit loan application process can be daunting, but breaking it down into manageable steps can facilitate the experience. Here's a step-by-step guide to help you efficiently complete your application.

Following these steps can streamline the process, reducing bottlenecks and enhancing the potential for successful loan approval.

Managing your loan

Receiving loan approval is just the beginning. Effectively managing your loan post-approval is critical to ensure your nonprofit's sustained success. Here are essential steps to consider.

It's also crucial to establish a robust reporting and accountability structure. Create metrics for measuring your nonprofit's impact and adopt rigorous financial reporting standards to maintain transparency and stakeholder trust.

Common questions about nonprofit loans

Many organizations have questions as they navigate the nonprofit loan landscape. Here are some frequently asked questions that can offer insight and clarity.

Factors that influence loan approval

Understanding what influences a lender’s decision on a loan application can empower nonprofits to improve their chances of approval. Here are some critical factors lenders consider.

Best practices for a successful loan application

To enhance the likelihood of a successful loan application, nonprofits should adopt several best practices during the preparation phase. Attention to detail and clarity can make a significant difference.

Additional tools and resources

As you navigate the nonprofit loan application landscape, various tools and resources can facilitate preparation and enhance understanding.

Keeping in touch and future opportunities

Engaging with the nonprofit community and staying informed about funding opportunities is vital for long-term success. Subscribing to newsletters and connecting with industry peers can provide valuable insights.

Contact information

For individuals and teams seeking guidance in completing their nonprofit loan application, reaching out to experts can be invaluable. Utilize available support channels to get your questions answered.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in nonprofit loan application?

How do I edit nonprofit loan application on an iOS device?

How can I fill out nonprofit loan application on an iOS device?

What is nonprofit loan application?

Who is required to file nonprofit loan application?

How to fill out nonprofit loan application?

What is the purpose of nonprofit loan application?

What information must be reported on nonprofit loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.