Get the free F4

Get, Create, Make and Sign f4

Editing f4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out f4

How to fill out f4

Who needs f4?

Understanding the F-4 Form in Mergers and Acquisitions

Understanding the F-4 form

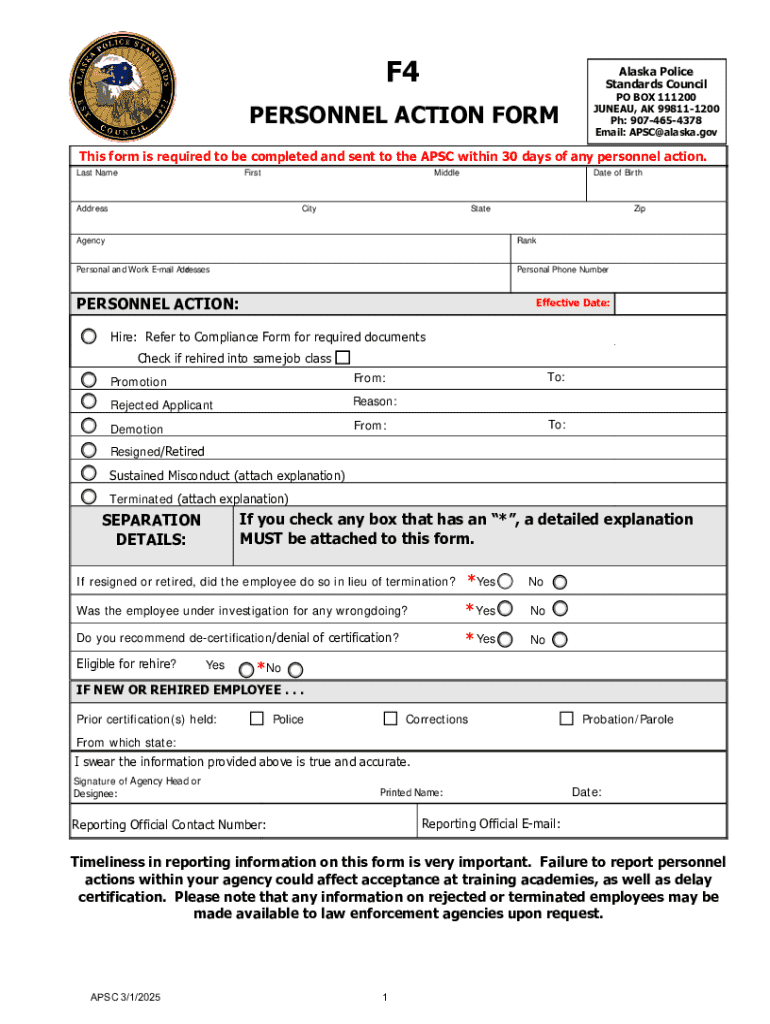

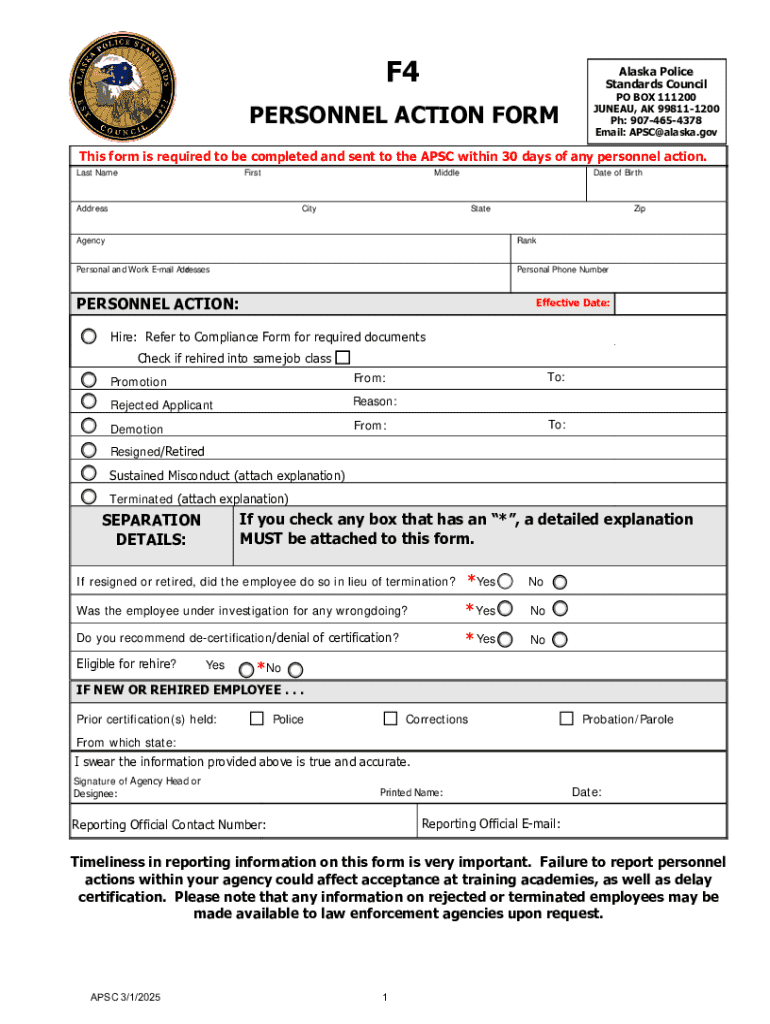

The F-4 Form is a key document utilized in the context of mergers and acquisitions, primarily in the United States. This form plays an essential role in reporting various types of transactions, especially those involving the exchange of securities. In essence, the F-4 is a registration statement that provides crucial information about the securities being offered in connection with a business combination. Understanding its intricacies is vital for corporations aiming for a successful transition during mergers and acquisitions.

The importance of the F-4 Form cannot be overstated. It serves as a comprehensive disclosure document that allows investors to make informed decisions. It ensures transparency by detailing the terms of the transaction, the risks involved, and the financial standing of the companies involved. Typically, investment banks, legal advisors, and corporate finance teams are the primary users of the F-4 Form, as they prepare the necessary documentation for filing and help navigate the process.

Navigating the F-4 filing process

Filing the F-4 Form involves a series of essential steps to ensure compliance and accuracy. First and foremost, it's critical to understand the filing requirements dictated by the Securities and Exchange Commission (SEC). Every detail in the F-4 must be correct and complete; otherwise, the filing might be delayed or rejected.

To complete the F-4 Form successfully, you can follow a step-by-step approach:

The timeline for filing the F-4 Form can vary, but once submitted, the review process typically requires at least 30 days. Prompt action and attention to detail can lead to smoother approvals and quicker transaction kick-offs.

Common mistakes to avoid when filing the F-4 form

Filing the F-4 Form can be daunting, and many first-time filers might stumble upon common pitfalls that could lead to filing errors. One of the most frequent mistakes is submitting incomplete documentation. Lacking large chunks of required information can lead to significant delays, or worse, a rejected submission.

Additionally, double-checking the accuracy of the filed information is critical. Incorrect numbers, miscategorized data, or wrong legal terms can have severe implications, including legal consequences and loss of investor confidence. Missed deadlines are another area to be careful with; failing to meet critical submission dates can derail a merger or acquisition process.

Leveraging technology for F-4 form completion

In today's digital age, utilizing cloud-based tools such as pdfFiller can streamline the completion of the F-4 Form. These tools offer numerous advantages over traditional methods, including seamless PDF editing, eSigning capabilities, and collaborative features that allow teams to work together from different locations.

Here's a step-by-step tutorial on how to use pdfFiller for F-4 Form management:

Understanding regulatory compliance and F-4 filings

Regulatory compliance is paramount when dealing with F-4 filings. Corporate governance plays a critical role in ensuring that all necessary requirements are faithfully met in submissions. Potential regulatory questions can arise at any stage of the process; thus, being prepared with accurate and complete documentation is vital.

Furthermore, retaining compliance throughout the filing process involves establishing a protocol for ongoing reviews and updates before submission. Engaging accountants, legal advisors, and compliance officers early on can prevent complications downstream, ensuring that your company is not only filing on time but also upholding the highest standards of transparency and governance.

Frequently asked questions (FAQs) about the F-4 form

Understanding the nuances of the F-4 Form can be challenging. Here are some frequently asked questions that address common concerns:

Case studies: Successful F-4 form utilization

Examining successful scenarios can provide insight into effective utilization of the F-4 Form in real-world situations. For instance, a notable case involved a tech startup acquiring a smaller competitor to expand its market share. The meticulous preparation of the F-4 Form facilitated a smooth transition, which was positively received by stakeholders and ultimately led to increased investor confidence.

Another example came from a pharmaceutical company that needed to comply with strict regulations while also securing FDA approvals. Their strategic use of the F-4 Form not only met SEC requirements but also kept all regulatory bodies adequately informed, helping maintain their reputation in a complex landscape.

Additional services and solutions for F-4 compliance

In addition to pdfFiller's capabilities, various enhanced offerings help teams manage multiple filings. These solutions can include advanced document tracking, real-time collaboration tools, and pre-designed templates for various types of transactional filings, making compliance more efficient.

By leveraging pdfFiller, teams can ensure that their form management processes are not only streamlined but also comprehensive, allowing for greater focus on strategy and execution rather than administrative hurdles.

Contact an expert for personalized guidance

Sometimes navigating the complexities of the F-4 Form can feel overwhelming. Engaging experts can provide you with personalized guidance tailored to the specifics of your transaction. Before reaching out, prepare a list of questions regarding your circumstances, including specifics about your transaction type, relevant deadlines, and any initial concerns you might have.

Accessing the right professional assistance can make a substantial difference in the outcome of your filing. Experts can offer strategic insights that not only expedite the process but also facilitate compliance with all regulatory bodies.

Resources for staying updated on F-4 developments

Staying informed about the latest updates in F-4 regulations is indispensable for teams involved in M&A. There are various reliable sources, including the SEC’s official website and industry newsletters, that provide timely information and analysis on changes impacting F-4 Filings.

Networking opportunities at industry events and conferences can also enhance your perspective, allowing professionals to share insights and updates with each other. Engaging in communities focused on corporate governance and compliance can further bolster your strategies for staying ahead in the M&A space.

Conclusion

The F-4 Form is a crucial component of the mergers and acquisitions process, providing the necessary framework for reporting relevant securities transactions. A successful filing requires meticulous attention to detail and a comprehensive understanding of the associated requirements. Leveraging modern tools like pdfFiller not only simplifies the process but also enhances collaboration and compliance among teams. By understanding the complexities of the F-4 Form and utilizing the right resources, businesses can navigate the M&A landscape with greater confidence and success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify f4 without leaving Google Drive?

Can I sign the f4 electronically in Chrome?

How do I complete f4 on an Android device?

What is f4?

Who is required to file f4?

How to fill out f4?

What is the purpose of f4?

What information must be reported on f4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.