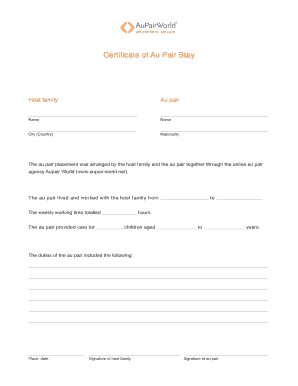

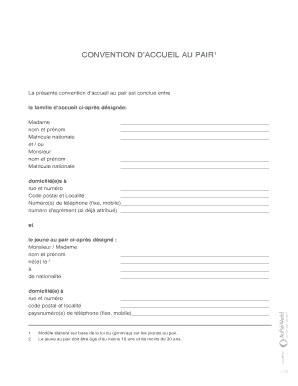

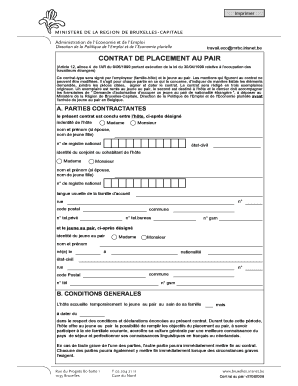

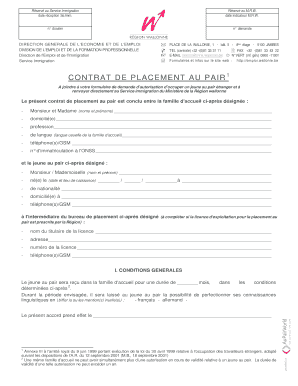

Get the free Tax Statement

Get, Create, Make and Sign tax statement

How to edit tax statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax statement

How to fill out tax statement

Who needs tax statement?

Understanding Tax Statement Forms: A Comprehensive Guide

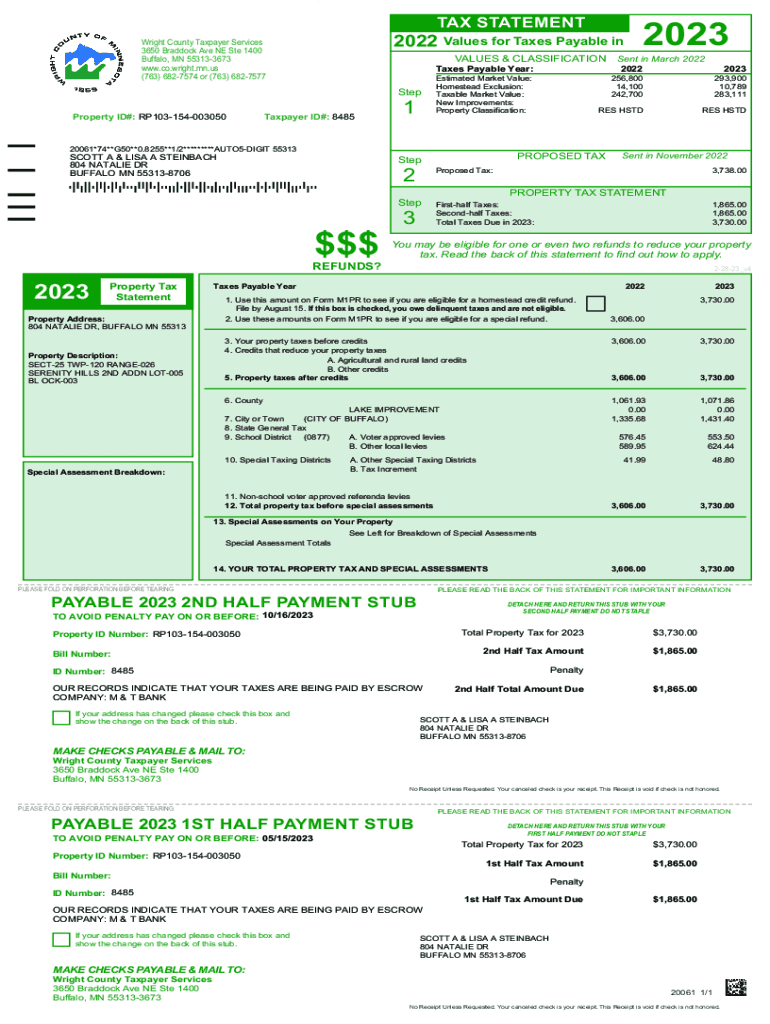

Understanding tax statement forms

A tax statement form is a document provided by employers, banks, and other entities to report various income types received by an individual during the fiscal year. These forms are vital for accurately filing taxes, as they summarize income earned, taxes withheld, and other crucial information that taxpayers must include in their tax returns. Understanding these forms is essential for anyone who wants to file their taxes correctly and avoid potential legal issues.

The importance of tax statement forms cannot be overstated. When it comes time to file taxes, these forms serve as the basis for reporting income and calculating tax obligations. Missing or incorrectly filled out forms can lead to discrepancies that could trigger audits or penalties. Relying on accurate data from tax statement forms helps ensure that tax filings are legitimate and reflect true earnings.

Types of tax statement forms

Several common tax statement forms are widely used, each serving a specific purpose. The W-2 form reports wages paid by employers and the taxes withheld from those earnings. If you are self-employed or have received payment without traditional employment, you might encounter 1099 forms, which are used to report various types of income received. For individual taxpayers, Form 1040 serves as the primary tax form for reporting income to the IRS.

Each of these forms has distinct uses and requirements, which can often confuse individuals who are new to filing taxes. Understanding the differences is vital for ensuring that you report your income correctly and take advantage of any applicable deductions or credits. For instance, while W-2 forms are issued by employers, the 1099 series includes several variations such as 1099-MISC and 1099-NEC, each tailored to different types of income, including freelance work or rental income.

How to obtain your tax statement form

Obtaining your tax statement form is straightforward, but it requires diligence. The official IRS website is an excellent place to start, as many employers and financial institutions report earnings and withholdings directly to the IRS, which can also be accessed through your online account. Additionally, your employer or bank usually provides W-2s and 1099s by January 31st of each tax year, leaving enough time for you to incorporate them into your tax filings.

If you find that you are missing a tax statement form, you can request a copy from your employer or financial institution. They are legally required to provide you with duplicates if you request them. Alternatively, pdfFiller provides a user-friendly way to download, print, and organize necessary forms, ensuring you have them ready for filing.

Filling out your tax statement form

Properly completing your tax statement form is essential for accurate tax filing. Start by gathering all necessary information such as your Social Security number, total earnings, any deductions you plan to claim, and credits you wish to apply. Having this data at hand simplifies the process and ensures that you don't miss any critical details.

As you begin filling out the form, take time to thoroughly understand the boxes and sections. For instance, what income categories appear on the W-2? These may include regular wages, tips, and certain deductions. Watch for common pitfalls such as transposing numbers or misreporting income types. Ensure accuracy by double-checking all data before submission.

To further assist with the filling process, consider utilizing pdfFiller’s tools, which streamline the completion of the form and provide easy access to error-checking features. By leveraging technology, you reduce the likelihood of mistakes and enhance the accuracy of your tax submissions.

Editing your tax statement form

If you discover an error on your tax statement form after it has been submitted, do not panic. You have options for editing your tax statement form efficiently. Utilize pdfFiller’s comprehensive editing features to quickly make necessary adjustments. Whether it is correcting income figures, updating your SSN, or changing details regarding deductions, pdfFiller allows for seamless editing to ensure your information is up-to-date.

You can easily add or correct information as needed, and the platform’s annotation and commenting tools can help keep track of changes made. These features not only aid in maintaining organization but also enhance overall clarity and communication throughout the editing process.

Signing your tax statement form

Signing your tax statement form ensures that your personal information is verified and protects you legally. eSignatures have become a standard practice and are legally binding, making eSigning via pdfFiller a convenient solution. By including an eSignature, you are not only affirming the accuracy of the information provided but also streamlining the filing process, allowing for quicker processing.

To eSign via pdfFiller, simply navigate to the signing options available within the platform. The process is straightforward: review your document, add your signature, and finalize the process. Security measures in place ensure your signature and document are safeguarded, complying with legal standards.

Submitting your tax statement form

Once your tax statement form is complete and signed, the next step is submission. You typically have two options: e-filing or paper filing. E-filing is increasingly popular due to its convenience and speed. Simply upload your completed forms to the IRS via authorized software or services like pdfFiller, making it easier to track your submission and receive updates.

On the other hand, if you choose paper filing, ensure to send your forms via certified mail to confirm delivery. Knowing the deadlines associated with both e-filing and paper filing is essential. Missed deadlines can lead to penalties, so staying organized and adhering to submission timelines helps you avoid financial repercussions.

Frequently asked questions

It’s common to have questions while navigating tax statement forms. Understanding IRS communication, for example, is vital insomuch as receiving a notice requires careful attention. Make sure to read any correspondence from the IRS thoroughly, as it typically outlines what actions you need to take. Don't hesitate to reach out directly to the IRS or consult trusted tax professionals if unsure about the next steps.

Getting help with your tax statement forms

If you find yourself in need of assistance while completing your tax statement forms, numerous resources are available. You can turn to professional tax preparation services for personalized help in navigating complex forms and identifying potential deductions. Alternatively, online support communities, including forums and social media groups, may provide valuable peer guidance.

pdfFiller offers dedicated customer support, equipped to guide you through issues relating to tax statement forms. From technical questions about using the platform to inquiries about how to properly fill out tax documents, accessing professional support can make the tax filing process much smoother.

Staying informed on tax topics

Keeping up-to-date with tax regulations is essential for all taxpayers. Changes in tax laws and guidelines can occur frequently, affecting how you report income and claim deductions. Following the IRS website or reputable financial news outlets helps stay in the loop about new policies that could impact your filings.

Additionally, pdfFiller updates its blog with useful articles and insights on the latest tax topics, along with new features available on their platform. Accessing these resources can equip you with knowledge that empowers you to navigate your tax obligations confidently.

Language assistance

Many taxpayers require language assistance when navigating tax statement forms. Ensuring that forms are accessible in multiple languages is essential for inclusivity and understanding. The IRS provides a variety of resources aimed at assisting non-English speakers, including translated tax forms and instructions for filing.

In addition, resources like pdfFiller are dedicated to ensuring that users can access translated versions of tax statement forms. This helps manage the process smoothly, minimizing the confusion that can accompany paperwork in a non-native language.

Connect with us

For continuous support and guidance in managing your tax statement forms, engage with pdfFiller. The platform is designed to simplify the process of handling your document needs while providing a wealth of resources and knowledge to help you succeed. Your feedback is valuable, and we encourage users to share their experiences to enhance the platform further.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax statement from Google Drive?

How can I get tax statement?

How do I edit tax statement in Chrome?

What is tax statement?

Who is required to file tax statement?

How to fill out tax statement?

What is the purpose of tax statement?

What information must be reported on tax statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.