Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-to Guide

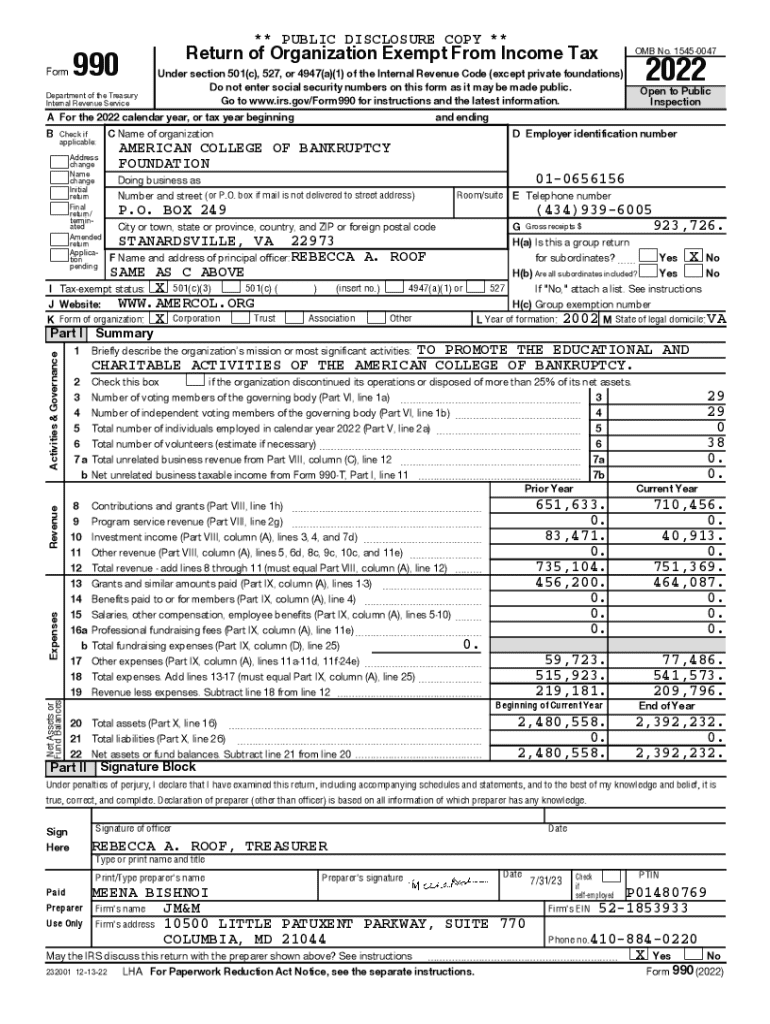

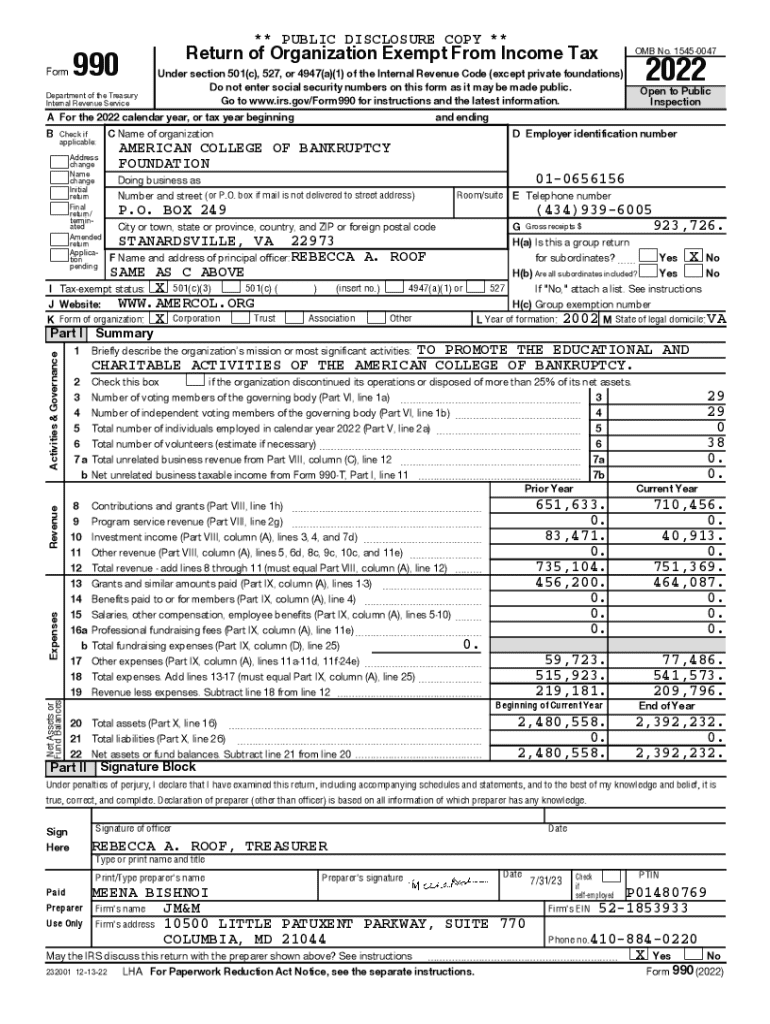

Understanding Form 990

Form 990 is a crucial document for nonprofit organizations in the United States as it serves a fundamental purpose: ensuring transparency and accountability in the nonprofit sector. This form collects essential information about an organization’s financial performance, governance, and programmatic activities, which is vital for the IRS, donors, and the general public to assess the operational health and integrity of a nonprofit.

Nonprofits must report on their revenues, expenditures, and overall financial health, as well as governance policies that guide their operations. By providing such disclosures, Form 990 plays an important role in enhancing public trust in the nonprofit sector.

Who must file?

Not every nonprofit is required to file Form 990. Entities that typically must file include tax-exempt organizations with gross receipts over $200,000 or total assets exceeding $500,000, and all public charities with gross receipts above $100,000. Smaller organizations may file Form 990-N, also known as the e-postcard.

Certain organizations, such as churches, governmental units, and some small nonprofits, may be exempt from filing. Knowing the specifics of who needs to submit Form 990 is essential to avoid penalties.

Anatomy of Form 990

Form 990 is divided into multiple sections that provide a structured approach for reporting. Let's explore the main sections to understand what each part entails.

Additional sections delve into functional expenses, balance sheets, and governance practices, ensuring comprehensive reporting.

Filling out the Form 990

Filling out Form 990 requires careful attention to detail and a clear understanding of the information needed in each section. Here’s a handy step-by-step guide to help organizations navigate the process.

To avoid common errors, organizations should conduct a thorough review, utilize software tools designed for nonprofit reporting, and consult experienced accountants or auditors when necessary.

Filing requirements and deadlines

Form 990 must be filed annually, and the deadline typically falls on the 15th day of the fifth month following the organization's fiscal year end. For many organizations, this means May 15 for a fiscal year ending December 31.

If an organization cannot meet the deadline, it can apply for a six-month extension by submitting Form 8868. However, late filing can incur penalties, including a $20-per-day fine up to a maximum of $10,000.

Understanding the impact of Form 990

Form 990 is not just a filing requirement; it serves as a key tool in nonprofit accountability. Public inspection regulations require organizations to make their Form 990 available for public scrutiny, further enhancing transparency.

Anyone interested can obtain copies of Form 990 from the IRS website or third-party platforms that aggregate nonprofit data. This accessibility allows donors, analysts, and other stakeholders to evaluate an organization’s financial health and effectiveness.

Resources for completing Form 990

Navigating the complexities of Form 990 can be challenging, but numerous resources can greatly enhance the process. Many software programs are specifically designed for Form 990 completion, automating figures and ensuring accuracy.

For organizations requiring additional help, pro bono services offered by accounting firms and nonprofit associations can provide valuable support.

Staying informed: The history and evolution of Form 990

Form 990 has undergone significant changes since its inception, reflecting evolving needs for accountability and transparency in the nonprofit sector. The IRS continuously revises the form to improve data collection and reduce reporting burdens, leading to important updates that nonprofits must monitor.

Future trends suggest that digital advancements will further shape how Form 990 is completed and submitted, enabling even greater efficiencies.

Advanced topics related to Form 990

The responsibilities surrounding Form 990 extend beyond just filing. Board members and financial officers have fiduciary duties to ensure compliance and accurate reporting. Engaging in best practices, such as regular financial reviews and incorporating independent audits, is essential for maintaining organizational integrity.

Research shows that clear communication around financial practice enhances trust with donors and the public, possibly translating into increased donations and community support.

Additional links and tools

Organizations can now leverage interactive tools and resources for calculating potential penalties and understanding filing timelines in a more intuitive manner. Utilizing these digital aids from providers like pdfFiller can streamline the process of Form 990 management.

Finding more information

To simplify the process of gaining insights and specific information regarding Form 990, interactive search functionalities can provide quick access to various topics within this guide. The ability to navigate complex regulations and compliance measures continues to improve, thanks to digital solutions.

For a broader view of nonprofit operations and transparency improvements, numerous articles and research papers are available to provide further reading on best practices and trends in the nonprofit sector, fostering a deeper understanding of effective operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 990 directly from Gmail?

Can I sign the form 990 electronically in Chrome?

How do I edit form 990 straight from my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.