Get the free Official Form 201

Get, Create, Make and Sign official form 201

Editing official form 201 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official form 201

How to fill out official form 201

Who needs official form 201?

A Comprehensive Guide to Official Form 201 Form

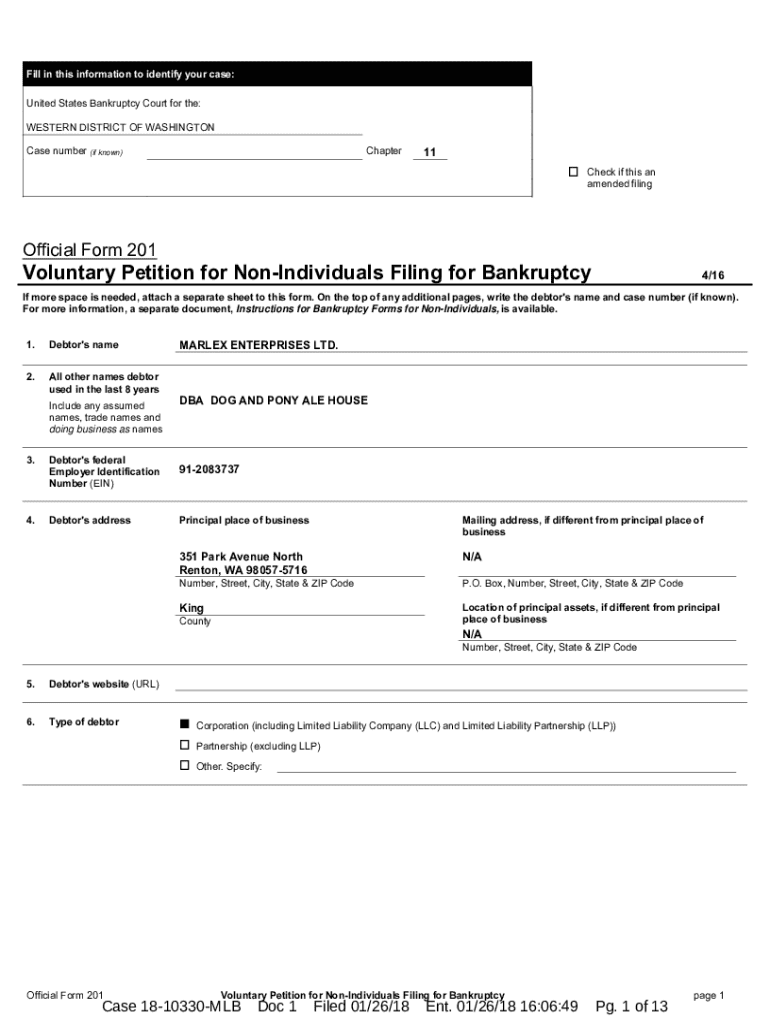

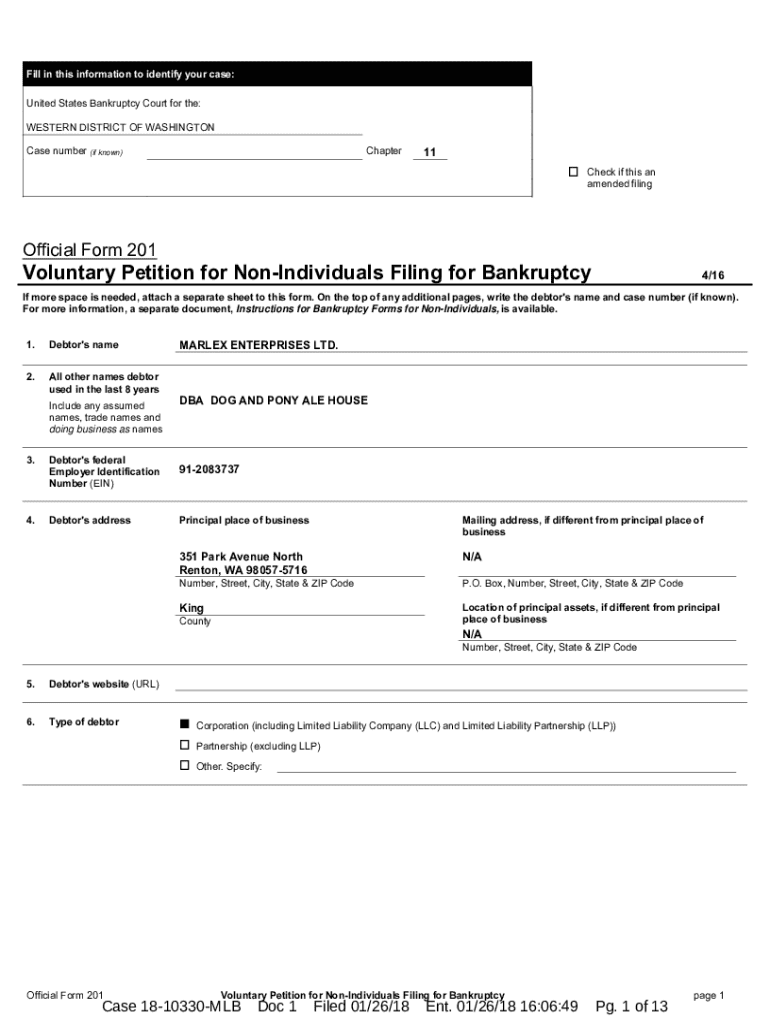

Understanding the Official Form 201

The Official Form 201 is a critical document, especially within the legal and financial arenas, serving specific functions based on its context. It's primarily used for asset disclosure and can be instrumental in a variety of proceedings such as bankruptcy filings, loan applications, and financial assessments. Understanding its purpose enhances one's ability to prepare and submit necessary documents accurately.

This form carries significant weight in ensuring compliance with financial transparency and legal obligations. Whether you're an individual seeking to manage your financial portfolio or part of a team engaged in more complex transactions, knowing how to navigate the Official Form 201 is crucial.

Who needs to use the Official Form 201?

Individuals in various situations often find the Official Form 201 necessary. For instance, someone pursuing a bankruptcy case must fully disclose their assets and liabilities using this form. Additionally, teams involved in corporate finance or legal matters may use this form collectively to ensure that all pertinent financial information is available and accounted for.

Key features of the Official Form 201

The structure of the Official Form 201 consists of several essential sections designed to capture vital information. Notably, users must provide comprehensive details about their income, debts, and asset locations. This thoroughness is imperative to ensure that the form meets legal scrutiny and fulfills the necessary requirements of financial institutions or courts.

Additionally, variations of the Official Form 201 may exist tailored to specific jurisdictions or particular purposes, emphasizing that one must be aware of the context in which they are operating. Always check whether a state-specific form is required to avoid unnecessary delays.

Step-by-step guide to filling out the Official Form 201

Filling out the Official Form 201 requires careful preparation and attention to detail. Individuals should gather necessary documents like bank statements, tax returns, and details about debts before starting. This preparation helps ensure a smoother experience when completing the form.

Here's a breakdown of how to effectively fill out each section:

Double-checking each entry against your supporting documents is crucial to prevent common errors, such as mismatched figures or missing data.

Common mistakes to avoid

Many users encounter pitfalls when filling out the Official Form 201, which can lead to delays or complications. It's essential to recognize these common mistakes. Omitting required details, miscalculating debts, or failing to sign the form can create significant setbacks in processing.

Utilizing pdfFiller for the Official Form 201

Using pdfFiller enhances the experience of managing the Official Form 201. It allows users to edit, sign, and share forms effortlessly from a cloud-based platform. Not only does the platform provide a user-friendly interface, but it also integrates advanced features that make the entire process seamless.

Several tools available on pdfFiller can significantly enhance your form completion experience:

Submitting the Official Form 201

Once the Official Form 201 is filled out, understanding the submission requirements is essential to ensure it reaches the right destination promptly. Depending on its purpose, the form can be submitted to a court, financial institution, or regulator.

Be aware of deadlines as they can be critical in legal and financial processes. Factors influencing these deadlines can include filing dates or specific timelines linked to court schedules.

Tracking your submission

After submission, it's crucial to track the form to confirm receipt. Keeping records of submitted documents or using tracking numbers provided by the submission platform helps ensure that the form was processed accordingly.

Frequently asked questions (FAQs)

Users often have various queries about the Official Form 201, particularly regarding its legal implications and submission processes. A clear understanding of common issues can significantly enhance one's confidence in using the form.

Troubleshooting submission errors

If issues arise during the submission process, knowing the steps to troubleshoot can mitigate frustration. Common problems include technical issues with submission platforms or disputes regarding completed forms.

Best practices for document management

Proper document management is key once you've obtained or submitted the Official Form 201. Ensuring secure, reliable archiving means that you can reference previous submissions if required. Digital storage solutions are advisable to streamline processes while keeping them secure.

Editing and updating your form in the future

As situations change, you might need to edit or update the Official Form 201. pdfFiller has features that allow revisions to be made quickly, ensuring your documents always reflect the latest information.

Case studies and real-life examples

Examining success stories involving the Official Form 201 reveals how effective document management can lead to successful outcomes. Customers have shared experiences of receiving loans or finalizing financial transactions quickly because of their thoroughness in completing this form.

Conversely, lessons gleaned from experiences where users failed to submit complete forms often illustrate the importance of accuracy.

Connecting through community support

Leveraging community support channels can provide valuable assistance to users struggling with the Official Form 201. Engaging in forums or support groups fosters a sharing of tips and collective problem-solving.

Interactive features of pdfFiller for enhanced learning

pdfFiller offers various interactive features to educate users about the form. Tutorials and webinars provide in-depth guidance and showcase best practices for utilizing the platform effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete official form 201 online?

Can I edit official form 201 on an Android device?

How do I fill out official form 201 on an Android device?

What is official form 201?

Who is required to file official form 201?

How to fill out official form 201?

What is the purpose of official form 201?

What information must be reported on official form 201?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.