Get the free Official Form 201

Get, Create, Make and Sign official form 201

How to edit official form 201 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official form 201

How to fill out official form 201

Who needs official form 201?

Your Complete Guide to Official Form 201

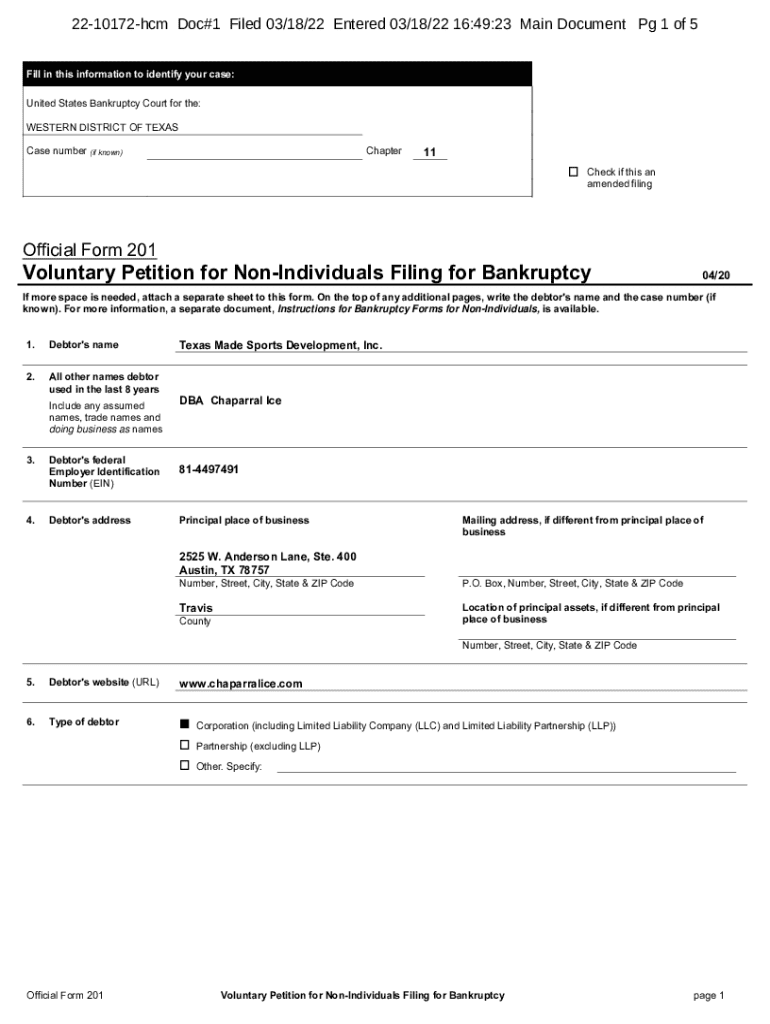

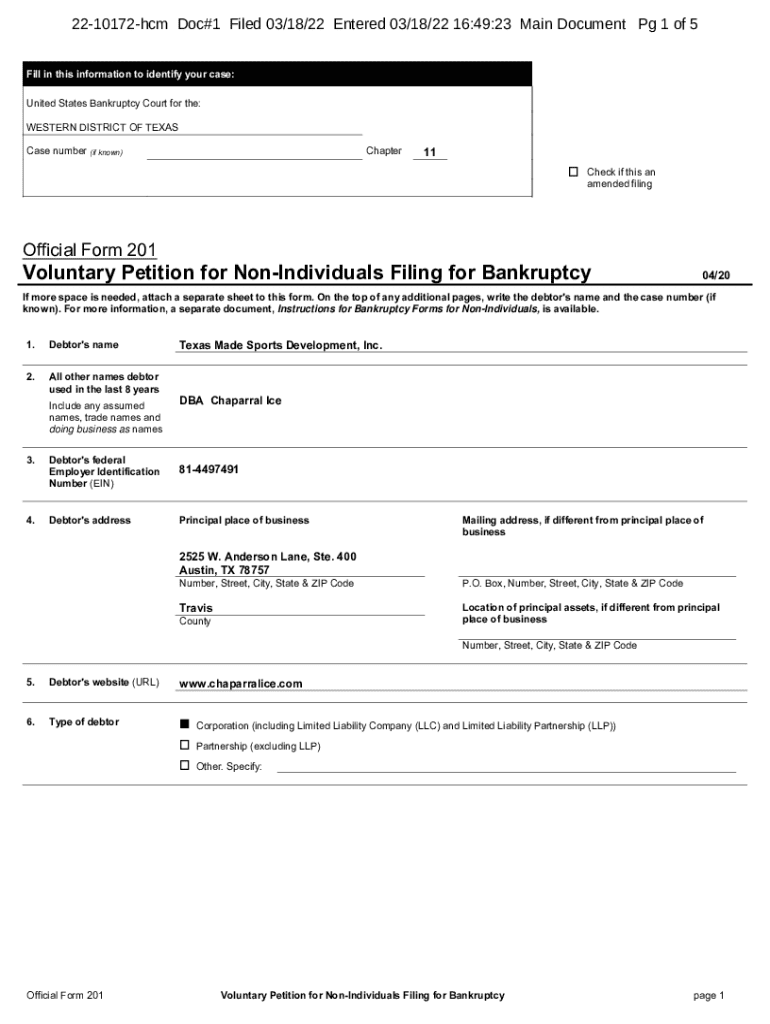

Understanding the Official Form 201

Official Form 201 is a vital document required for various legal and administrative processes. This form is primarily used in the context of bankruptcy proceedings and ensures that all pertinent information is disclosed accurately. It plays a crucial role in helping debtors communicate their financial situation to the relevant authorities. The proper use of Form 201 can significantly impact the success of a bankruptcy case or any related proceedings.

The purpose of Form 201 extends beyond bankruptcy filings. It serves to collect personal, financial, and other foundational information that institutions or creditors require to make informed decisions. Failure to complete this form accurately can lead to delays or complications in the process.

Key features of Official Form 201 include sections dedicated to personal information, financial disclosures, and supporting documentation requirements. Each of these components plays a critical role in providing context and clarity to the information submitted.

Who needs to use Form 201?

Determining eligibility for using Official Form 201 is essential, as it is primarily designed for individuals and entities undergoing bankruptcy proceedings. Common scenarios that require this form include individuals facing financial distress, small businesses looking to restructure their debts, and teams seeking to manage financial information regarding bankruptcy filings.

Individuals in dire financial circumstances often find themselves needing to use Form 201. This scenario can include those struggling with medical debts, unexpected job losses, or other hardships. On the business side, small business owners may opt for bankruptcy as a means to restructure debts, maintain the business, and provide a fresh financial start.

Step-by-step instructions for filling out Form 201

To effectively fill out Official Form 201, preparation is key. Start by gathering all necessary documentation, including personal identification, detailed financial records, and information regarding creditors. Setting up your workspace to minimize distractions will allow you to focus on accurately completing this essential form.

A detailed breakdown of each section of Form 201 is crucial for accurate completion. The personal information section requires your name, address, and contact information. Next, the financial information section involves a thorough disclosure of income, expenses, assets, and debts, impacting how the bankruptcy process functions.

Avoiding common mistakes while filling out Form 201 is essential. One common pitfall includes omitting details or providing incomplete information. Always double-check entries for accuracy. Best practices involve reviewing the document thoroughly and seeking advice or assistance if you are unsure how to fill out specific fields.

Editing and managing Form 201

Edit Official Form 201 using the powerful tools available through pdfFiller. With its intuitive interface, you can edit text and fields seamlessly, ensuring that your form is accurately tailored to your needs. Utilizing features like adding digital signatures allows you to maintain professionalism while ensuring the form is compliant with current legal standards.

Efficient management of your completed forms is crucial. Once filled out, save your completed forms securely within pdfFiller's cloud-based storage system. This way, you'll have access to your documents from any location. You can also share forms with collaborators directly for any necessary reviews or approvals, ensuring everyone involved knows the status of the submission.

eSigning and submission

Understanding the eSignature process is critical when submitting Official Form 201. Legally recognized in many jurisdictions, eSignatures streamline the submission process. This modern approach ensures that your documents are signed securely and efficiently. Follow the step-by-step guide provided by pdfFiller to ensure that you correctly apply your electronic signature.

There are several options for submitting Form 201 once completed. The electronic submission process is simpler and can save you time. However, if preferred, mailing a hard copy is still an option. Ensure that you follow all provided guidelines to avoid critical delays in the processing of your form.

Troubleshooting common issues

Navigating the complexities of Official Form 201 can raise questions. Common FAQs include what to do if you make a mistake while filling out the form. If errors occur, it is vital to address them promptly. Many individuals recommend contacting support directly to resolve issues efficiently.

Furthermore, if there are errors after submission, having a plan in place for correction is critical. Knowing how to rectify mistakes can alleviate stress during the filing process. pdfFiller customer support is readily available to assist you if difficulties arise while completing or submitting the form.

Additional tools and resources

pdfFiller offers various features tailored specifically for managing Official Form 201. For teams, collaborative tools enhance document sharing and editing experiences, allowing collective input on forms. These features ensure that all team members can participate efficiently while meeting deadlines.

Legal compliance is of utmost importance when dealing with forms like Official Form 201. pdfFiller ensures that every document you handle through their platform meets established compliance standards, providing peace of mind. Being aware of these considerations can save you from potential legal complications.

Case studies and user experiences

User experiences can often provide insight into how effectively Official Form 201 can be applied in various scenarios. Many individuals have shared success stories about how they utilized the form to overcome financial hurdles. Cases involving small business owners illustrate how careful management of Form 201 led to successful restructuring and the revitalization of their business operations.

These real-world scenarios show how effective document management can transform financial stress into renewed opportunities. Teams that utilized pdfFiller for handling Form 201 often report increased efficiency, improved collaboration, and minimized errors in submission.

Staying updated

Keeping track of changes to Official Form 201 is crucial for ensuring that you are using the most current version. Regulatory updates can alter requirements, impacting how you fill out the form. Subscribing to updates from the official sources results in receiving the latest information, limiting potential problems during the submission process.

Using the latest version of any form is essential for compliance and proper processing. Regularly verify that you possess the newest iteration of Form 201. This approach mitigates risks associated with outdated documentation.

Conclusion of Form 201 understanding

Efficient management of Official Form 201 is integral to navigating your financial disclosures effectively and successfully. Leveraging pdfFiller's comprehensive editing, signing, and collaboration tools enables you to handle this process seamlessly.

Investing the time and effort, alongside utilizing the available tools, reaps significant benefits during complex financial transitions. Embrace the technology of tools like pdfFiller to ensure a smooth document handling experience today.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit official form 201 in Chrome?

Can I create an eSignature for the official form 201 in Gmail?

How do I fill out the official form 201 form on my smartphone?

What is official form 201?

Who is required to file official form 201?

How to fill out official form 201?

What is the purpose of official form 201?

What information must be reported on official form 201?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.