Get the free Form 990 - as sdsu

Get, Create, Make and Sign form 990 - as

Editing form 990 - as online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990 - as

How to fill out form 990

Who needs form 990?

How to Fill Out Form 990: A Comprehensive Guide

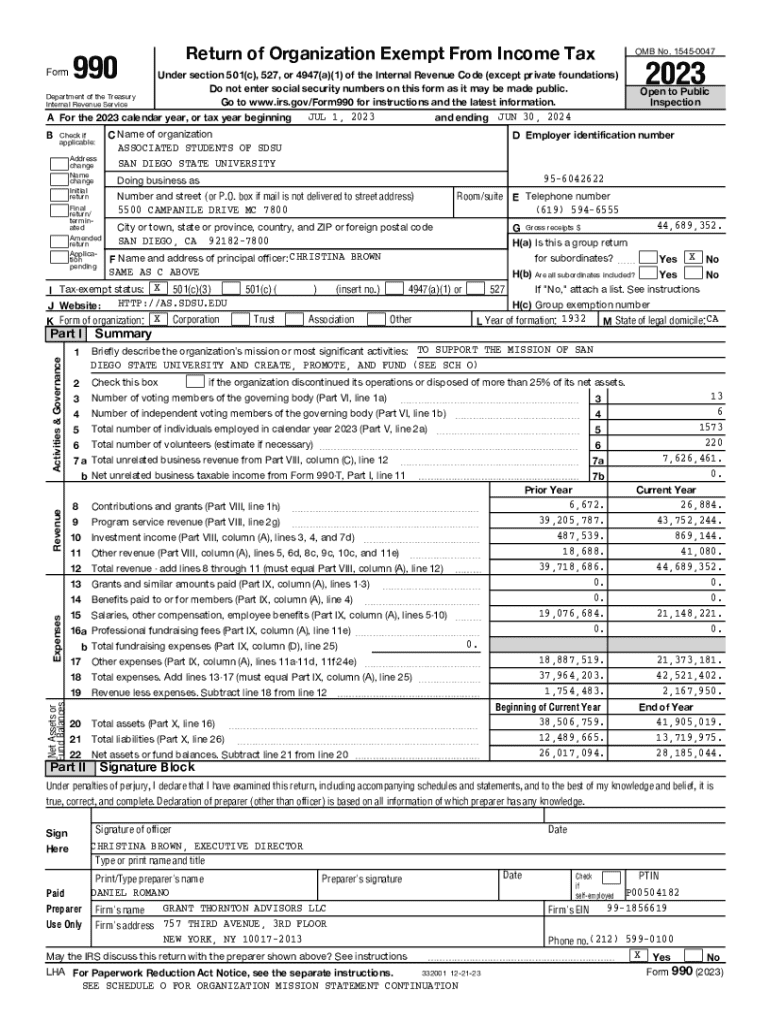

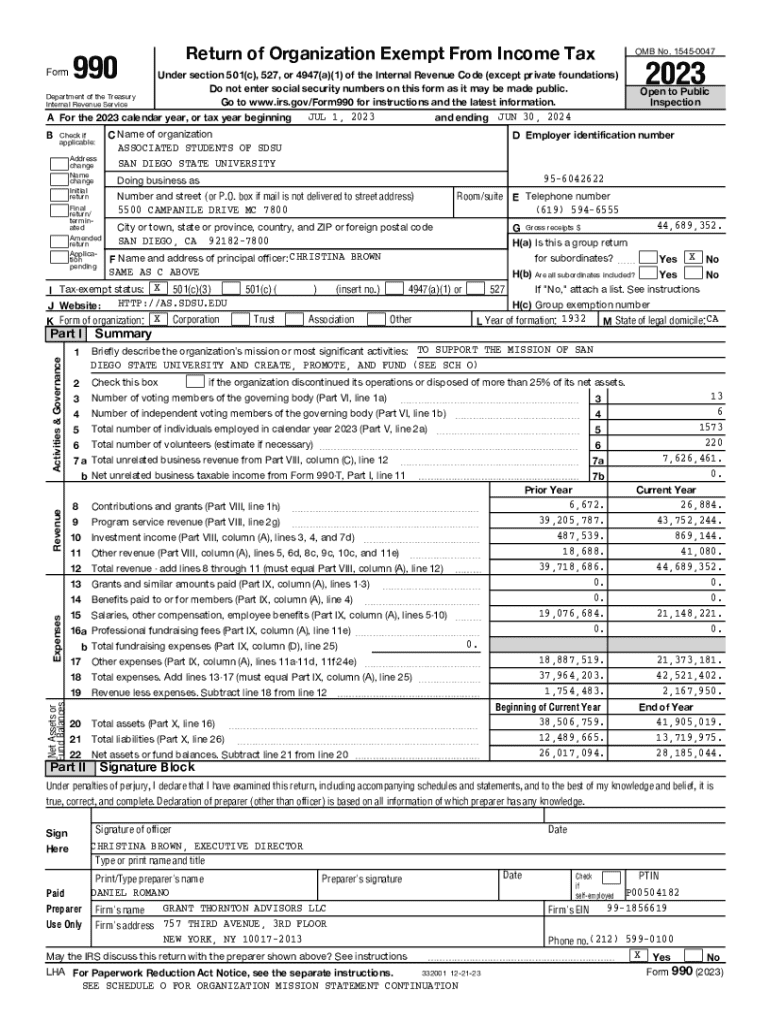

Overview of form 990

Form 990 is a crucial document that non-profit organizations in the United States must file annually with the IRS. It provides detailed financial information about the organization, including income, expenses, and operational activities. The primary purpose of this form is to promote transparency and accountability within the non-profit sector, allowing stakeholders, including donors, to assess an organization's financial health and governance.

Filing Form 990 is not just a regulatory requirement; it serves as a vital tool for non-profits to maintain public trust. By sharing their financial data and operational practices, organizations can build credibility and attract potential supporters. Key benefits of filing Form 990 include enhanced visibility, potential tax exemptions, and the ability to receive public and private funding.

Who needs to file form 990?

Not every non-profit is required to file Form 990. Eligibility criteria generally depend on the type of organization, its income, and its activities. Organizations classified as 501(c)(3) typically need to file the form unless they fall under specific exemptions. For example, churches, certain governmental entities, and small non-profits with gross receipts of $50,000 or less generally do not need to file.

It's essential to remember that some organizations may still be required to file if they receive specific types of funding or if they engage in certain activities. Understanding the income thresholds also plays a vital role—those with gross receipts under $200,000 may need to file Form 990-EZ, while larger organizations generally must file the full Form 990.

Detailed instructions for completing form 990

Completing Form 990 involves providing comprehensive details about the organization. The IRS requires specific information in various sections, and each must be filled with precision. Here’s a step-by-step guide to essential parts of Form 990:

1. **Organizational Information**: This section requires the organization’s name, address, and Employer Identification Number (EIN). Make sure this information is up-to-date and matches IRS records.

2. **Mission and Activities**: Here, organizations should succinctly describe their mission statements and report on major program activities. Clear insights into how the organization fulfills its mission enhance transparency.

3. **Financial Information**: A breakdown of income, expenses, assets, and liabilities is crucial. Prioritize accuracy in reporting numbers to reflect the organization’s financial health accurately.

4. **Governance**: This section covers board structure, policies, and compensation practices. Organizations should illustrate how their governance ensures accountability and ethical practices.

Common challenges and solutions

Organizations often encounter challenges while preparing their Form 990, especially navigating complex tax information. One common issue involves ensuring the accuracy of data reported. To avoid discrepancies, organizations are encouraged to implement a systematic review process before final submission.

Compliance is another significant challenge, especially with frequent updates to tax regulations. Keeping abreast of changes can involve meticulous attention to detail. One effective solution includes using resources such as accounting software or consulting with tax professionals who specialize in non-profit organizations.

The role of board members in form 990

Board members play a pivotal role in overseeing the compliance process for Form 990. Best practices dictate that board members are involved in the preparation and review of the form. Engaging the board not only enhances accountability but also ensures diverse perspectives contribute to the final submission.

Involvement in the preparation process should include board members understanding the financial data and mission as reported in the form. Establishing a checklist for board members can be extremely helpful in keeping them informed and engaged. Such a checklist may include reviewing program expenses, compensation practices, and ensuring compliant governance structures.

FAQs related to form 990

Filing Form 990 may generate questions among non-profit leaders. Here are answers to some frequently asked questions:

Filing modalities

Non-profits have multiple options for filing Form 990, including electronic filing or paper submission. The IRS encourages electronic filing for organizations with gross receipts of $100,000 or more due to the enhanced tracking capabilities.

E-filing platforms offer various features that simplify the process, including step-by-step guidance, data validation checks, and automatic calculations that reduce the likelihood of errors. By utilizing tools available on the pdfFiller platform, non-profits can streamline their filing process considerably.

Assessing public and governmental scrutiny

Non-profits have a public obligation to ensure transparency in their financial practices, which Form 990 helps facilitate. The form is publicly accessible, allowing stakeholders to examine an organization’s finances and governance structures. This transparency can lead to both increased public trust and scrutiny.

Understanding the implications of publicly available data is vital for non-profits as it impacts their ability to attract funders and maintain donor relations. Proper management of public perception is essential, and this often includes proactive communication regarding financial health and impact, backed by solid data reported in Form 990.

Utilizing form 990 data for organizational improvement

Form 990 can serve as a powerful analytical tool for non-profits aiming to enhance their operational effectiveness. By analyzing financial trends and organizational data reflected in the form, organizations can evaluate their financial health, identify growth opportunities, and address funding challenges.

Data derived from Form 990 can also inform strategic planning. Organizations can leverage insights to cultivate relationships with potential funders by tailoring their funding strategies and demonstrating impact and accountability through evidence-based narratives.

Best practices and additional resources for filing form 990

To ensure successful completion of Form 990, organizations should adopt best practices that promote thoroughness and compliance. Setting up a timeline and establishing regular reminders can keep filing on track yearly.

Creating an internal review checklist can also streamline the process, ensuring all necessary documents are prepared and reviewed before submission. Utilizing online tools available through pdfFiller can further simplify document management and enhance collaboration within teams.

Supporting your team through the filing process

Effective collaboration and support for teams engaged in filing Form 990 can lead to smoother processes and fewer mistakes. Teams can utilize collaborative tools for document preparation, ensuring all members contribute efficiently and transparently to the filing process.

Document management solutions available through pdfFiller can enhance efficiency, providing users with easy access to templates and enabling smooth edits. The platform also supports e-signatures, facilitating quick approvals on necessary documents.

Next steps after filing

Once Form 990 is submitted, organizations should prepare for follow-up questions or inquiries from the IRS. This may involve maintaining documentation and ensuring records are organized. Setting reminders for next year's filing should also be a priority since timely submissions are essential to avoid penalties.

Engaging stakeholders with the filed information can further enhance transparency. Sharing highlights and insights derived from the submitted Form 990 with donors and stakeholders can bolster relationships and foster trust.

Final notes

As a non-profit organization, the commitment to transparency and compliance is essential for success and sustainability. pdfFiller is dedicated to supporting non-profits throughout the filing process, assisting in simplifying the burdens of Form 990 filing through a user-friendly platform.

By leveraging pdfFiller’s features—such as e-signatures, collaboration tools, and comprehensive document management—non-profits can enhance their filing experience. This ensures not just compliance but also fosters a culture of transparency and accountability within the organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 990 - as without leaving Google Drive?

How do I make changes in form 990 - as?

How do I fill out form 990 - as on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.