Get the free 990-ez

Get, Create, Make and Sign 990-ez

How to edit 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990-ez

How to fill out 990-ez

Who needs 990-ez?

990-EZ Form: A Comprehensive How-to Guide

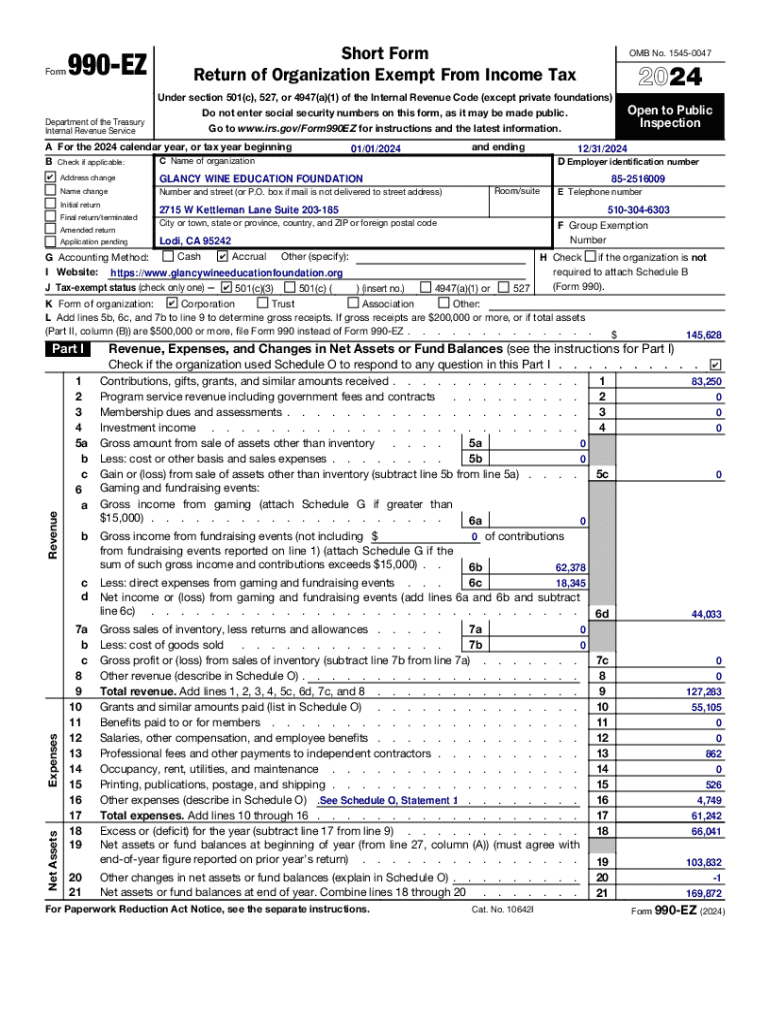

Understanding Form 990-EZ

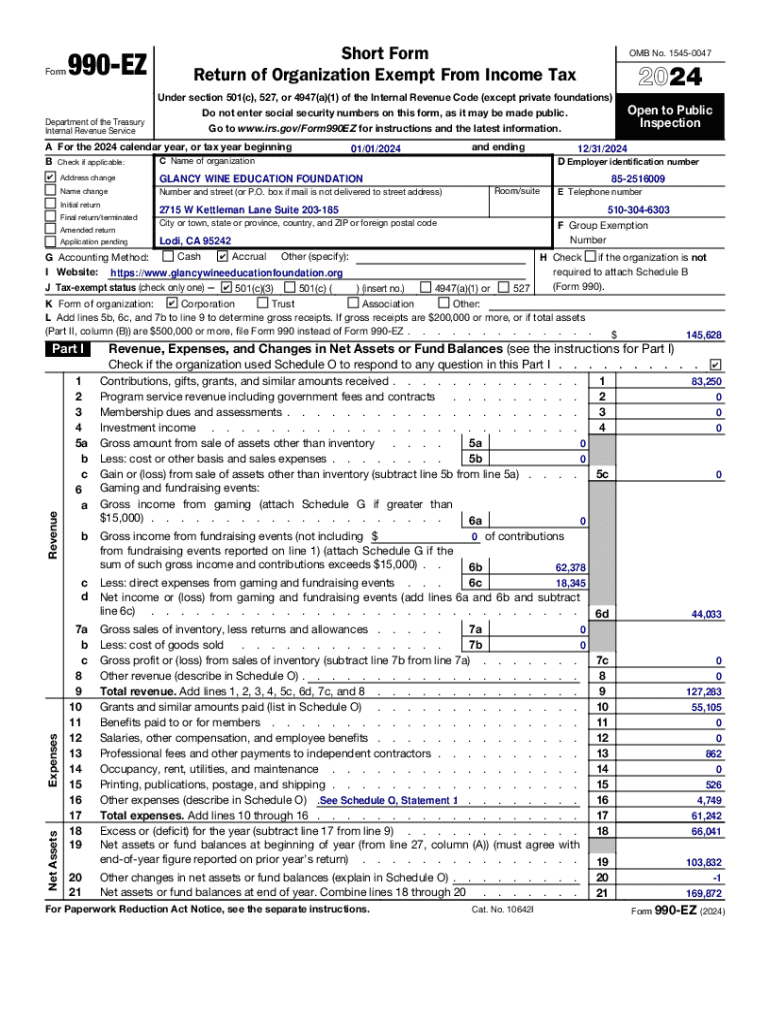

Form 990-EZ is a streamlined version of the more detailed Form 990, specifically designed for small tax-exempt organizations to provide essential financial information to the IRS. This form is vital for transparency and accountability in the nonprofit sector, as it allows organizations to report their financial activities, governance, and compliance with tax laws.

The importance of Form 990-EZ cannot be understated; it plays a critical role in ensuring that tax-exempt organizations maintain their nonprofit status. Furthermore, it serves public interests by offering insights into how these organizations utilize their funds. Understanding the differences between Form 990 and Form 990-EZ is crucial, with the latter being shorter and suited for organizations with gross receipts under $200,000 and total assets under $500,000.

Who needs to file Form 990-EZ?

Organizations eligible to file Form 990-EZ include those that are recognized as 501(c)(3) charitable organizations and other small nonprofits meeting the receipt and asset thresholds. This simplifies the filing process for smaller entities that do not have complex financial operations.

Exceptions to these requirements exist, such as certain religious organizations that are exempt from filing altogether, irrespective of their size. Additionally, organizations that operate under a group exemption must verify if they can file Form 990-EZ or if their parent organization’s filings suffice. It is essential for nonprofits to understand their specific filing requirements, as these may vary depending on their type, size, and operational complexity.

What you’ need to successfully file Form 990-EZ

To successfully complete Form 990-EZ, organizations must gather all required information and documentation in advance. Key components include detailed financial statements, such as the statement of revenue and expenses. Organizations need to ensure that their records are up-to-date and reflect accurate financial data for the tax year.

Step-by-step guide to completing Form 990-EZ

1. Add organization details

Start by entering basic organization details, including the name, Employer Identification Number (EIN), and mailing address. This foundational information is critical for the IRS to identify your organization.

2. Select tax year and form type

Choose the correct tax year that the form applies to and ensure you're selecting Form 990-EZ. This helps the IRS process your filings accurately.

3. Enter financial data

Financial data entry comprises two major sections: income and expenditures. You’ll need to report all sources of income, including donations and investment income, alongside all expenses incurred during the year.

4. Complete additional schedules

Depending on your organization's activities, fill out the necessary schedules such as Schedule A for public charity status or Schedule B for Schedule of Contributors. These supplements provide additional context and information regarding your organization’s operations.

5. Review your form summary

Before submitting, thoroughly review your entries for accuracy. Double-check all financial figures and organizational information to prevent unnecessary delays or penalties.

How to file Form 990-EZ electronically

E-filing offers numerous advantages over paper filing, such as faster processing times and automatic acknowledgment of receipt from the IRS. This method also reduces the chance of errors that can arise from manual entry.

Using platforms like pdfFiller simplifies the e-filing process through an intuitive interface that guides users in filling out the forms correctly. After completing the form, you can directly submit your 990-EZ electronically through the platform.

When e-filing, organizations should be mindful of common pitfalls, such as failing to provide the necessary documentation or submitting incomplete information. Utilizing interactive tools from pdfFiller can greatly minimize these risks.

Key filing deadlines

The deadline for filing Form 990-EZ is the 15th day of the fifth month following the end of your organization’s tax year. For example, if your tax year ends on December 31, the due date would be May 15 of the following year.

Extensions may be available, allowing organizations to file up to six months later. However, it is important to formally request this extension. Missing these deadlines can carry substantial penalties, including financial fines and potential loss of tax-exempt status.

Penalties for late or incorrect filing

Late or incorrect filings of Form 990-EZ can lead to hefty penalties ranging from $20 per day up to a maximum of $10,000 for large organizations. For smaller nonprofits, the penalties can be lower but can still accumulate quickly.

To mitigate these risks, organizations should ensure accurate record-keeping throughout the year, utilize pdfFiller's automated features to reduce errors, and submit their forms well in advance of deadlines.

Amendments and corrections to Form 990-EZ

If an organization discovers an error after filing, they can amend their Form 990-EZ by submitting Form 990-EZ with the correct information along with 'Amended' written at the top of the form. It's important to address inaccuracies promptly to avoid penalties.

Organizations should be aware that not all information can be amended. Corrections primarily relate to financial figures and organizational details. The process is straightforward, but attention to detail is crucial to prevent further errors.

Best practices for preparing Form 990-EZ

Adopting best practices in preparation can significantly ease the process of completing Form 990-EZ. Utilizing templates, especially those offered by pdfFiller, can provide guidance and help ensure that no necessary components are overlooked.

Keeping financial records organized throughout the year eases the burden during tax season. Leveraging pdfFiller's collaboration features allows team members to work together efficiently, ensuring all aspects of the form are tackled collectively.

Frequently asked questions (FAQs)

Many organizations inquire about specific details regarding their filings. One common question involves the Group Exemption Number (GEN); this number is used for organizations operating under a larger umbrella group that holds tax-exempt status. It's essential to use this number correctly to indicate your group affiliation.

Another frequent inquiry is whether Form 990-EZ should be filed electronically. Electronic filing is encouraged and often results in more efficient processing.

Organizations also wonder if they can leverage last year’s data for the current year's filing. While past data can inform entries, it's essential to update all figures to reflect the most current financial status.

Lastly, information on Form 990-T — which pertains to unrelated business income tax — is vital for organizations involved in activities that generate income outside of their core mission. Understanding this relationship ensures that organizations comply with IRS regulations.

Resources and tools for nonprofits

To navigate the complexities of nonprofit tax compliance, organizations can access pdfFiller's Knowledge Base, which provides an array of helpful resources and tools. From comprehensive articles to interactive videos and webinars, these resources empower organizations to better understand the filing process and stay compliant.

Additional articles and blog posts on nonprofit tax compliance further lend a helping hand, ensuring that organizations can find valuable insights to bolster their understanding.

Maximizing efficiency with pdfFiller

pdfFiller is designed to streamline the document management process, making it easier for organizations to prepare and file Form 990-EZ. The platform allows users to edit PDFs, eSign documents, and collaborate effectively, all from a single, accessible cloud-based solution.

Smart AI assistance further augments the filing experience, guiding users to ensure they fill out their forms correctly. With robust customer support options, users can easily troubleshoot any issues that arise during the filing process.

User experiences and testimonials

Organizations have shared positive experiences about how pdfFiller has simplified their filing of Form 990-EZ. Many users report that the straightforward functionality of the platform reduces anxiety around tax season, particularly for those without dedicated financial teams.

Feedback highlights the platform's ease of use, especially among tax professionals who appreciate the interactive tools designed to aid in accurate filings and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 990-ez without leaving Google Drive?

How do I make edits in 990-ez without leaving Chrome?

How do I edit 990-ez on an Android device?

What is 990-ez?

Who is required to file 990-ez?

How to fill out 990-ez?

What is the purpose of 990-ez?

What information must be reported on 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.