Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out church exemption claim form

Who needs church exemption claim form?

Church exemption claim form: A comprehensive how-to guide

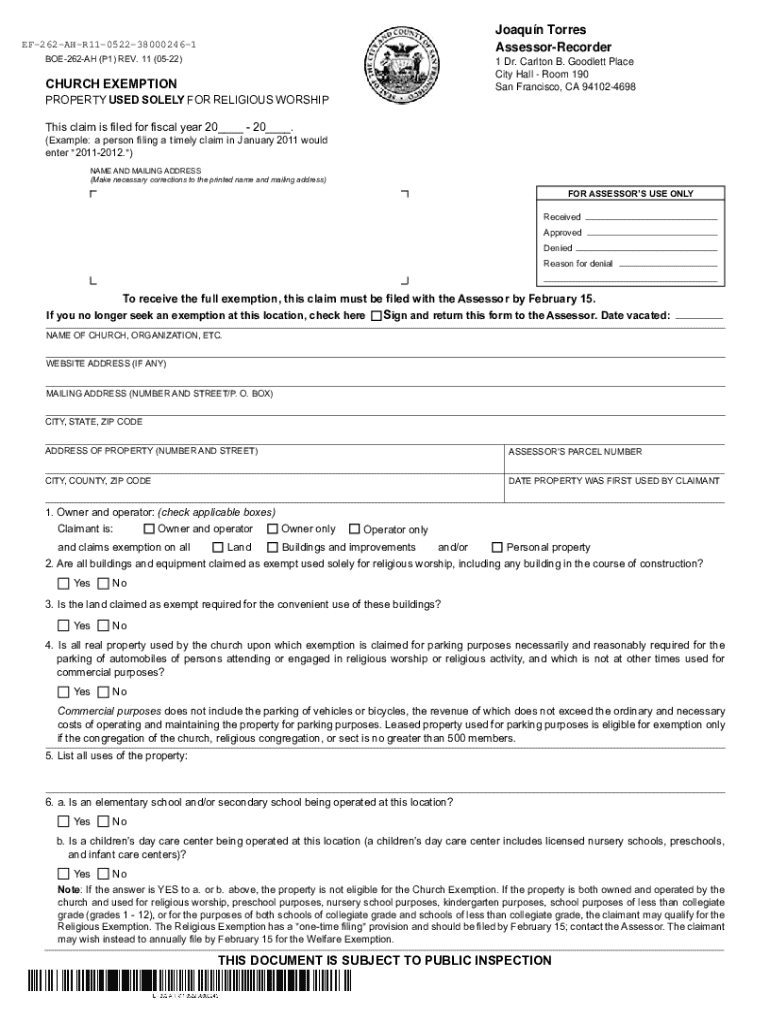

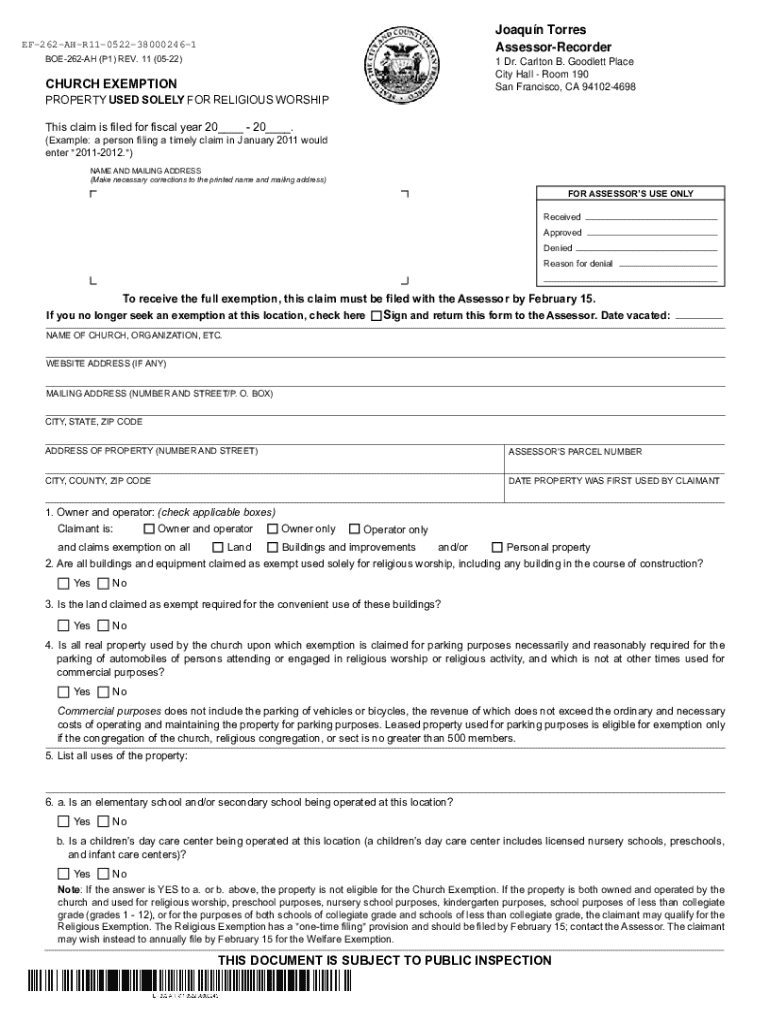

Understanding church exemption claims

Church exemption claims refer to the process through which religious organizations apply to receive tax exemptions on properties they own or use for religious purposes. This exemption is crucial because it allows churches to allocate more resources towards their missions and community services rather than paying property taxes. However, many individuals and church administrators are often unaware of how to navigate this process effectively.

Filing for exemption is important not only to ensure compliance with local tax regulations, but also to maximize the financial resources available to enhance the church's community impact. Misconceptions abound regarding the nature of these exemptions, with some believing that all properties used by churches are automatically exempt, which is not the case.

Eligibility criteria for church exemption

To qualify for a church exemption claim, organizations must meet specific eligibility criteria. Primarily, the property in question must be used for religious worship or related functions. This can often include any properties already owned by the church or those leased specifically for religious purposes.

When assessing eligibility, it's crucial to not only identify the primary usage of the property, but also to consider the relationships with surrounding properties, such as parking areas that serve the church. New acquisitions that occur after the lien date can also be factored in, provided they meet the given criteria.

Filing requirements

Filing a church exemption claim form necessitates specific documentation to substantiate the request. Essential documents typically include proof of the church's tax-exempt status, which verifies the organization's eligibility for the exemption. Additionally, property title documents must also be submitted, as they confirm ownership or lease agreements.

Understanding filing deadlines is vital to the process. Each jurisdiction may impose different deadlines, often based on the assessment calendar of the local government. Failing to submit a claim within the required time frame could result in penalties, though it's sometimes possible to rectify late submissions with additional documentation.

Navigating the church exemption claim form

Completing the church exemption claim form requires careful attention to detail. If you are not familiar with the form itself, the following steps will guide you through the process, ensuring accuracy in your submission and minimizing the chance of complications.

Initially, gather all required information, including personal details of the church representatives, property specifics, and supporting documents. Next, fill out the personal information fields and provide clear details about the property in question. Once the form is completed, submit the necessary documentation alongside it.

Managing your submission

After submitting your church exemption claim form, tracking the progress of your claim becomes paramount. Most local tax authorities will provide some form of status tracking, whether via an online portal or through direct customer service. It is advisable to regularly check this status to stay informed.

Once submitted, expect a review process that can vary in length depending on local regulations and the nature of your claim. This process sometimes includes requests for additional information or clarification from the tax authority.

Resources for additional support

pdfFiller offers interactive tools that streamline the process of managing your church exemption claim form. The platform provides editing capabilities, eSigning features, and options for collaborating with additional church members, ensuring everyone involved can access and manage request documentation from a single location.

For further assistance, local government resources, including your local Board of Equalization, should be contacted to clarify any unique aspects of your claim. Engaging with the community via social media can help, as many churches share experiences and solutions, further demystifying the claims process for others.

Addressing common questions and concerns

As inquiries arise regarding church exemption claims, it is vital to acknowledge and provide clarity on common questions. Many organizations wonder about the amendment process, particularly how to modify previously submitted claims. The requirements may slightly differ based on local jurisdictions.

Furthermore, non-profit organizations sometimes have unique considerations regarding property utilization and eligibility, which warrants a thorough understanding of the local laws governing exemptions.

Staying informed on church exemption updates

Keeping up-to-date with the changing landscape of church exemptions is crucial for any religious organization to maintain compliance and optimize benefits. Changes in legislation or local tax policies can significantly impact existing exemptions.

Therefore, subscribing to notifications regarding upcoming deadlines and revisions of the church exemption claim form ensures organizations are promptly informed about important changes that could affect their status.

Additional helpful insights

Navigating external tax resources can offer additional support and clarification on church exemption claims. There are numerous organizations and websites that provide updated knowledge, guidance, and tools for tax-exempt entities, including churches.

Moreover, maintaining open communication with local officials and leveraging legal counsel when necessary ensures that your organization is well-informed and compliant with all tax obligations.

Interactive component

To simplify your processing needs, pdfFiller provides downloadable links for the church exemption claim form and related documentation. These resources are integral for ensuring you have the right tools at your disposal to make your claims efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the pdffiller form form on my smartphone?

Can I edit pdffiller form on an iOS device?

How do I complete pdffiller form on an iOS device?

What is church exemption claim form?

Who is required to file church exemption claim form?

How to fill out church exemption claim form?

What is the purpose of church exemption claim form?

What information must be reported on church exemption claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.