Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

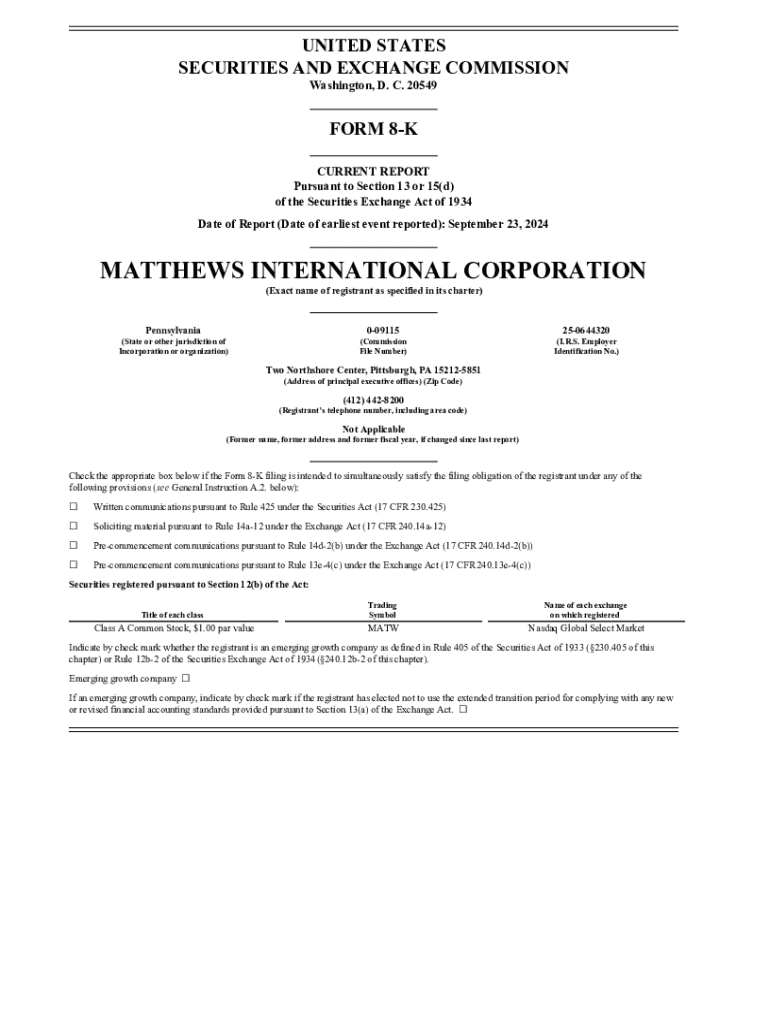

Understanding Form 8-K: Your Comprehensive Guide

Understanding Form 8-K

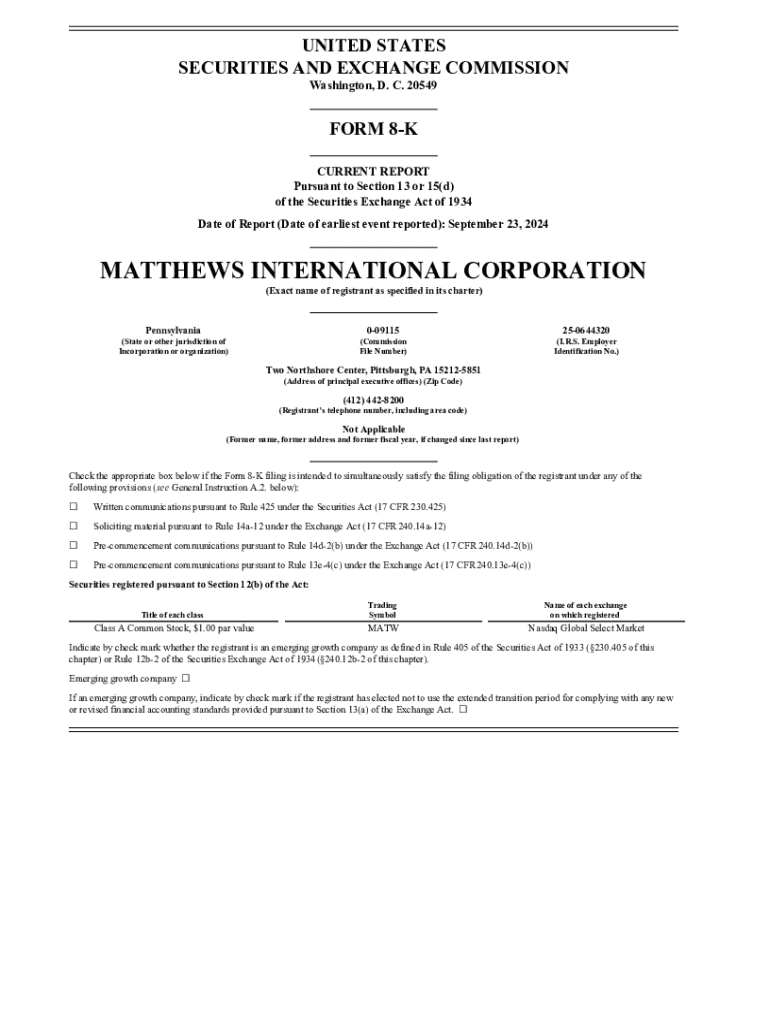

Form 8-K is a critical document in the realm of corporate governance, serving as a key mechanism for companies to disclose significant events to their shareholders and the public. This form ensures that everyone is informed about important changes within the company, thereby facilitating transparency. The primary function of Form 8-K is to announce any material events that could affect investors’ decisions and ultimately the value of the company's securities.

The importance of Form 8-K extends beyond mere compliance; it fosters trust among investors and the public by demonstrating corporate accountability. By promptly communicating relevant changes and occurrences, companies uphold their responsibility to keep stakeholders informed about their operational landscape.

Why Form 8-K is important

The legal and regulatory significance of Form 8-K is undeniable. Governed by the Securities and Exchange Commission (SEC), this form is mandated for periodic disclosures whenever a significant event occurs. SEC regulations stipulate that firms must file Form 8-K within four business days of the triggering event, ensuring timely reporting.

Consequences of failing to file Form 8-K on time can be severe, potentially involving penalties from the SEC and damaging the company’s reputation. Additionally, timely transparency through this form boosts investor trust. When companies proactively share essential information, they position themselves favorably in a competitive market, cultivating a reputation for honesty and openness.

When is Form 8-K required?

Form 8-K is required to be filed under specific circumstances. Certain events trigger the necessity for a filing, and these include:

Filing deadlines are strict, often requiring submission within four business days following the event. This timeline emphasizes the urgency of maintaining communication with investors and reflects the SEC's commitment to transparency.

How to read and interpret Form 8-K

Understanding the structure of Form 8-K is crucial for effective interpretation. Each filing typically includes several sections, such as:

Focusing on key items within a Form 8-K, such as significant financial data and leadership changes, is essential for stakeholders looking to grasp the ramifications of the reported events on their investments.

Filling out Form 8-K

Completing Form 8-K involves several key steps that organizations must follow to ensure accurate and compliant filings. The process begins with preparation, where companies gather necessary information and documentation relevant to the event.

The steps to complete Form 8-K are as follows:

For accuracy and compliance, companies should adhere to best practices such as thorough proofreading, consulting legal experts, and using templates to streamline the drafting process.

Historical context of Form 8-K items

The evolution of Form 8-K has been influenced by changing market dynamics and regulatory requirements. Over time, the SEC has revised the items listed on the form to better capture material events impacting investors. Significant enhancements to the form have made it more comprehensive, aligning with the growing complexities of the corporate landscape.

Notable examples from past filings illustrate the power of Form 8-K in the face of corporate crises. For instance, a prominent case involved a major tech company that disclosed a cybersecurity breach via Form 8-K, providing investors with critical information about potential risks and outcomes.

Industry-specific considerations

Form 8-K filings can vary significantly across different industries. For example, technology firms often file these forms related to patent agreements or mergers and acquisitions, whereas healthcare companies more frequently disclose regulatory compliance issues or product recalls. Understanding these sector-specific trends provides valuable insights into how various industries approach compliance.

Industries that frequently utilize Form 8-K include finance, biotech, and technology. Each has its nuances, influencing the frequency and content of filings, which can serve as a benchmark for investors monitoring company activities.

Frequently asked questions about Form 8-K

Several common queries arise about Form 8-K, including the types of events that typically require reporting. Companies generally report on major incidents affecting operations, leadership changes, legal cases, and financial performance. Effective preparation for contingencies necessitates a clear understanding of these requirements.

Furthermore, stakeholders often ask about the penalties for non-compliance with Form 8-K filing requirements. Companies failing to adhere to the SEC timelines and regulations may face significant fines and potential legal challenges, emphasizing the critical need for diligent reporting.

Resources for Form 8-K filing

Resources such as interactive tools and templates can significantly simplify the Form 8-K filing process. pdfFiller offers seamless solutions for document creation and management, enabling users to easily edit PDFs, e-sign, and collaborate on forms from any location.

To stay updated, companies should monitor ongoing obligations related to Form 8-K through reliable financial news sources and regulatory updates. Best practices include subscribing to industry newsletters and leveraging technology to manage compliance.

Join the conversation

Staying informed about changes to SEC rules and best practices in filing Form 8-K is essential for corporate governance. Engaging with industry experts and peers offers insights into effective compliance strategies and evolving trends.

Consider subscribing to platforms that facilitate discussions and sharing of experiences related to Form 8-K filings. This engagement can enhance understanding and foster valuable networking opportunities, ensuring your organization remains at the forefront of corporate transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8-k to be eSigned by others?

How do I edit form 8-k straight from my smartphone?

How do I complete form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.