Get the free Claiming Super

Get, Create, Make and Sign claiming super

Editing claiming super online

Uncompromising security for your PDF editing and eSignature needs

Claiming Super Form: A Comprehensive Guide to Superannuation Contributions

Understanding the claiming super form

The claiming super form is a vital document for individuals looking to claim tax deductions on personal contributions made to their superannuation funds. This form allows individuals to notify their super fund of their contributions, enabling them to potentially reduce their taxable income. Understanding how to correctly navigate this process is crucial for anyone aiming to make the most out of their retirement savings.

The importance of the claiming super form in financial management cannot be overstated. It serves not only as a record of contributions but also facilitates an understanding of the tax implications involved. This is particularly significant in Australia, where tax benefits associated with super contributions can positively influence an individual’s financial landscape during retirement.

Typically, the claiming super form is utilized by individuals who have made personal contributions to their superannuation, especially those who are self-employed or working part-time. Whether you're contributing on a regular basis or sporadically, understanding how to fill out the claiming super form correctly can enhance your retirement strategy.

Steps to claim superannuation contributions

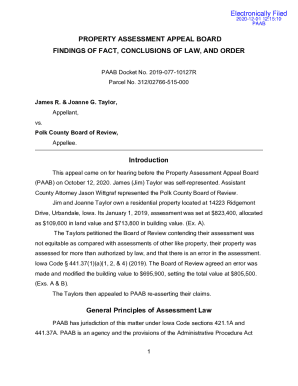

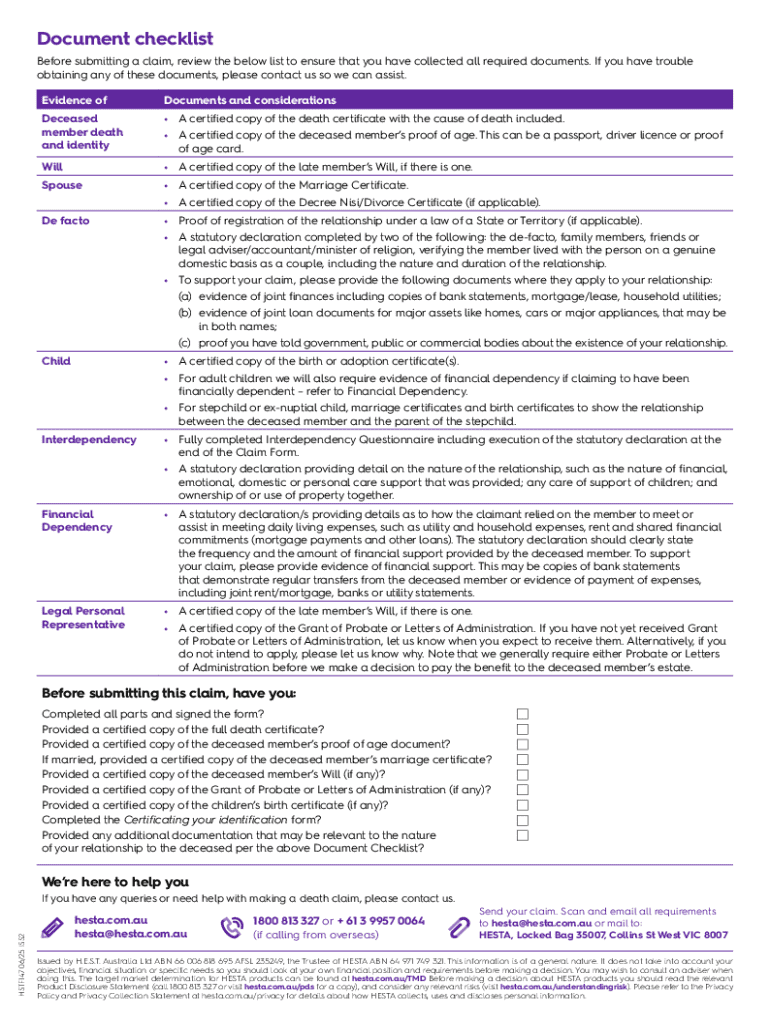

Claiming superannuation contributions requires a systematic approach to ensure eligibility and compliance with ATO guidelines. One of the first steps is identifying your eligibility to make personal contributions and claim deductions.

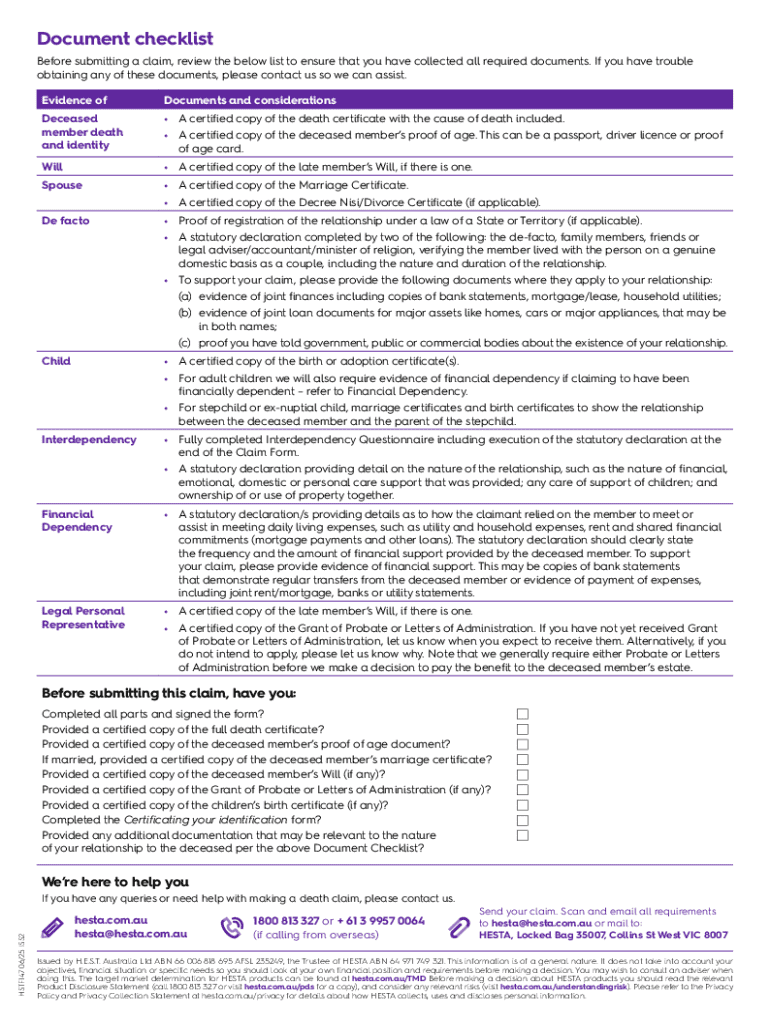

Gather necessary information

Before filling out the claiming super form, gather all necessary information to ensure accuracy and completeness. This includes your Tax File Number (TFN) and identification, which are pivotal for processing your claim.

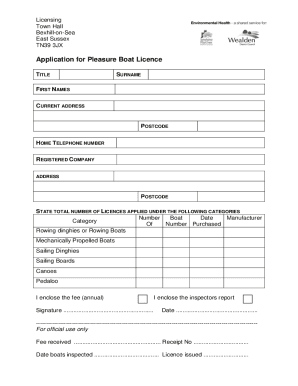

Completing the claiming super form

Filling out the claiming super form accurately is crucial. Start with personal details such as your full name, contact information, and TFN. Ensure these details are current to avoid processing delays.

Avoid common mistakes while completing the form, such as entering incorrect TFN or neglecting to sign the declaration. Each mistake can lead to significant delays in your claim processing.

Submit the claiming super form

Once the claiming super form is completed, the next step involves submitting it to the appropriate entity. Typically, this could be your super fund or the Australian Taxation Office (ATO), depending on individual circumstances.

Updating your super details

It’s vital to keep your superannuation details up to date to avoid complications in receiving funds during retirement. Changes in personal information such as your address or name can affect your super account.

Interpreting your super fund statement

Understanding your super fund statement is essential for tracking the growth of your retirement savings. Your statement typically outlines contributions, any fees incurred, and the overall performance of your designated investments.

FAQs on claiming super

Clarifying frequently asked questions can demystify the claiming super process. One common query relates to what happens if you change jobs before claiming. It’s essential to realize that your new employer’s fund may also accept your contributions.

Tools and resources for claiming super

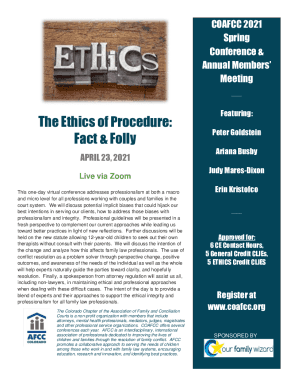

Utilizing effective tools can simplify the claiming process for your super. Platforms like pdfFiller offer interactive tools to aid in form filling and managing contributions effectively.

Considerations for specific situations

Certain circumstances necessitate specialized guidance in claiming super. For instance, if you are a contractor or part-time worker, the eligibility rules can differ significantly from those in full-time employment.

Final thoughts on claiming your super

It's imperative to stay updated on superannuation rules and regulations as changes can significantly influence your retirement planning. Regularly reviewing your contributions can help in adjusting your retirement strategy effectively.

Encouraging users to share their experiences with claiming super can foster a supportive community, while also aiding others in navigating the complexities that often accompany the claiming process. Stay informed, engaged, and proactive regarding your superannuation to secure a more comfortable financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my claiming super directly from Gmail?

How do I edit claiming super online?

How do I edit claiming super in Chrome?

What is claiming super?

Who is required to file claiming super?

How to fill out claiming super?

What is the purpose of claiming super?

What information must be reported on claiming super?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.