Get the free Perpetual Select Pension Plan

Get, Create, Make and Sign perpetual select pension plan

How to edit perpetual select pension plan online

Uncompromising security for your PDF editing and eSignature needs

Comprehensive Guide to the Perpetual Select Pension Plan Form

Understanding the Perpetual Select Pension Plan

The Perpetual Select Pension Plan is a retirement savings scheme designed to offer individuals flexible investment options and the potential for long-term financial security. This plan allows participants to accumulate savings over time, providing a steady income during their retirement years. It is endorsed by various institutions due to its adaptability in an ever-changing financial landscape.

Enrolling in the Perpetual Select Pension Plan presents numerous benefits. Participants can invest in a variety of funds catering to different risk appetites, including conservative, balanced, and aggressive growth options. Flexibility in contribution amounts empowers members to adjust their savings according to personal circumstances and market conditions, promoting greater financial independence in retirement.

Individuals of various employment backgrounds, whether self-employed, corporate employees, or freelancers, can benefit from this plan. Understanding its structure and benefits can enable better decision-making when it comes to long-term financial planning.

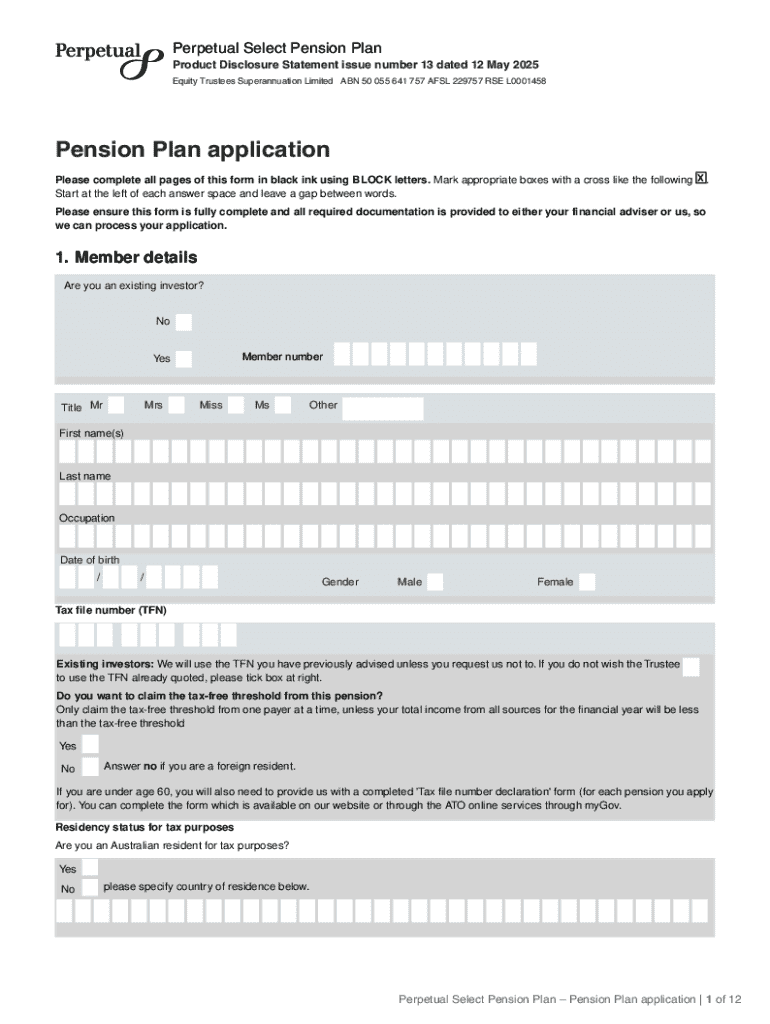

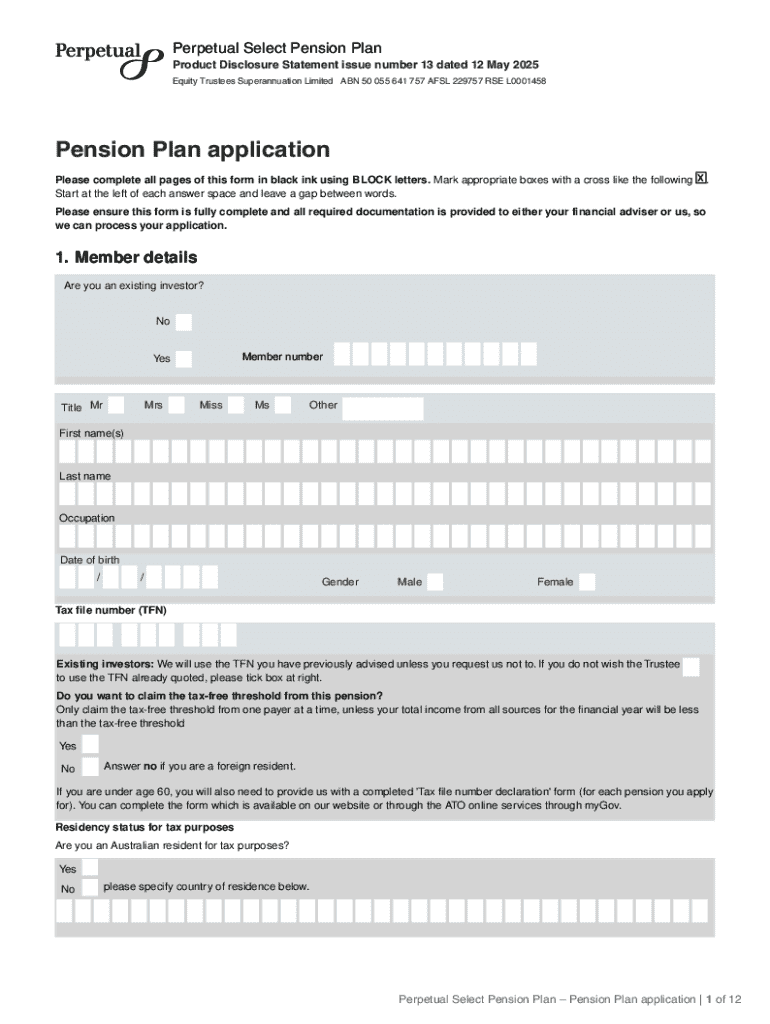

Navigating the Perpetual Select Pension Plan Form

Accessing the Perpetual Select Pension Plan form is straightforward with various resources available online. You can typically find the form on financial institution websites, or specifically through platforms like pdfFiller, ensuring easy access anytime and anywhere.

Familiarizing yourself with the layout of the form is crucial. The key sections include personal information, investment choices, and contribution levels. It is essential to pay attention to the important notes provided alongside the instructions, which often contain specific eligibility criteria and guidelines to prevent common mistakes.

Step-by-step guide to completing the Perpetual Select Pension Plan form

Completing the Perpetual Select Pension Plan form can be simplified by following a systematic approach. Here’s a breakdown of each step:

Editing and managing your Perpetual Select Pension Plan form

Using pdfFiller to edit your Perpetual Select Pension Plan form is a breeze. Should you need to make corrections or modifications, the platform provides easy-to-use tools that guide you through each step. Simply upload your filled-out form, and pdfFiller allows you to make necessary changes directly within the document.

After edits, you can save and share your filled-out form securely through pdfFiller, ensuring that your sensitive information is well-protected. eSigning your form through pdfFiller simplifies the finalization process; you can use their electronic signature feature to sign documents without needing to print or scan.

Common issues when filling out the Perpetual Select Pension Plan form

Filling out the Perpetual Select Pension Plan form can sometimes be fraught with challenges. Common mistakes include omitting required information, entering incorrect identification numbers, or failing to double-check investment choices. To avoid these pitfalls, take your time and go through your form multiple times before submission.

If you need to amend a submitted form, ensure you follow the specified process laid out by your pension service provider. Typically, contacting support is advisable for guidance to ensure your adjustments are properly recorded.

Additional considerations for your pension plan

As you navigate your Perpetual Select Pension Plan, consider the tax implications of your contributions. Understanding how your contributions affect your tax liabilities can aid in long-term planning. Moreover, regularly keeping track of your pension plan's performance will help you make informed decisions about future contributions or changes in investment direction.

Utilize available resources, such as financial advisory services or tools provided by pdfFiller, to deepen your knowledge about pension plans. This knowledge can be invaluable in making smarter financial decisions over time.

Interactive tools and resources available on pdfFiller

pdfFiller offers a robust suite of document creation tools that make handling the Perpetual Select Pension Plan form easier than ever. Using interactive templates allows users to fill in data quickly, streamline processes, and ensure all necessary fields are features.

The platform emphasizes document security. With encryption and secure sharing options, you can rest assured that your sensitive information remains confidential. These tools greatly enhance user experience when dealing with important financial documents.

FAQs about the Perpetual Select Pension Plan form

The Perpetual Select Pension Plan form can lead to several questions from participants. Here are some frequently asked questions that provide clarity:

Contact support for further assistance

If you have further questions regarding the Perpetual Select Pension Plan form, pdfFiller’s customer support is ready to help. You can reach out via online chat or email, and they typically respond within 24-48 hours.

Additionally, pdfFiller offers a variety of resources, including articles and webinars that dive deeper into pension planning and document management, providing comprehensive knowledge for effective financial planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send perpetual select pension plan for eSignature?

How do I complete perpetual select pension plan online?

How do I fill out perpetual select pension plan on an Android device?

What is perpetual select pension plan?

Who is required to file perpetual select pension plan?

How to fill out perpetual select pension plan?

What is the purpose of perpetual select pension plan?

What information must be reported on perpetual select pension plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.