Credit Card Authorization Template Form: A Comprehensive Guide

Understanding credit card authorization forms

A credit card authorization form is a document that allows a business to charge a customer's credit card for a specified amount. This form typically serves as proof that the customer has authorized the business to charge their card, providing both parties with legal protection. The unique significance of this form is particularly pronounced in the ecommerce sector and subscription services where repeated transactions are commonplace. It helps ensure that businesses have the proper documentation to defend against potential chargebacks while maintaining customer trust.

Legally, businesses using credit card authorization forms must adhere to regulations such as the Payment Card Industry Data Security Standard (PCI DSS). Compliance not only protects customer information but also safeguards the business from legal repercussions arising from fraudulent transactions.

Components of a credit card authorization form

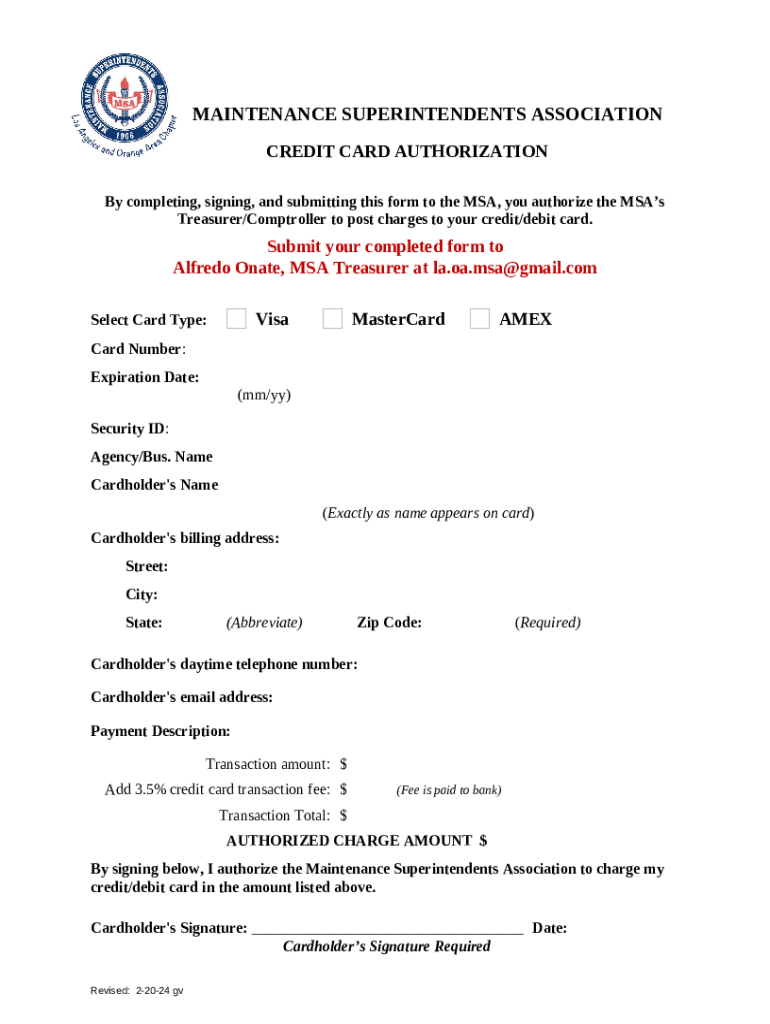

Creating a well-structured credit card authorization form requires careful attention to detail. Some essential elements to include are:

Gathering the customer's name, email address, and phone number facilitates clear communication.

Include the transaction amount and date to ensure clarity on what the customer is paying for.

Specify whether payment will be made via credit card or ACH transfer for versatility.

A signature from the customer is critical to validate their consent.

Optional but recommended sections enhance the form's effectiveness. Fields for the CVV number and expiration date add another layer of security. Including merchant contact information is useful for customers who may have questions, while a terms and conditions section helps set expectations for the transaction.

Benefits of using credit card authorization forms

Implementing credit card authorization forms brings multiple advantages to both businesses and customers. Firstly, it significantly reduces the risk of chargebacks. By having a signed authorization, merchants can easily defend against claims of unauthorized transactions. Additionally, these forms enhance payment security by ensuring that sensitive customer information is handled properly through compliant storage measures.

Furthermore, these forms streamline the transaction process. Customers appreciate knowing their payment has been authorized in advance, while businesses can process payments efficiently without needing to repeatedly request approval. This not only saves time but also fosters trust between the customer and the business.

When and why to use a credit card authorization form

Several scenarios warrant the use of a credit card authorization form. Recurring payments, such as those from subscription services or membership fees, benefit significantly from pre-authorized payment agreements. This not only facilitates continuous service but also minimizes disruptions in billing.

Another instance is when payment holds are necessary for services like hotels or car rentals. These businesses often need to verify funds before finalizing transactions to ensure they will be able to collect their dues upon completion of service.

For sellers, adopting best practices such as ensuring clarity in terms and conditions, maintaining thorough documentation, and acting promptly on customer queries can enhance the overall efficacy of credit card authorization forms.

Step-by-step guide: How to create your credit card authorization template

Creating a credit card authorization template can be straightforward if followed systematically. Here’s how:

Compile all required details, including customer name, contact information, and payment specifics.

Utilize a clean layout that highlights essential sections to ensure clarity for users.

Clearly state your adherence to privacy regulations and data protection policies to build customer trust.

Conduct quality checks and user testing to ensure that the form functions seamlessly across different platforms.

Using pdfFiller to create and manage your form

pdfFiller offers a range of tools that simplify the creation and management of your credit card authorization form. With easy customization options, users can tailor templates to fit their brand and specific needs. The eSigning capabilities allow for instant validation of authorizations, eliminating delays in the payment process.

Moreover, pdfFiller’s cloud storage and management tools enable users to access their forms from anywhere while ensuring all documents remain secure. The drag-and-drop functionality enhances user experience, making form creation more intuitive, while the templates library provides a variety of ready-made options that can cater to different business scenarios.

FAQs about credit card authorization forms

Several common questions arise when discussing credit card authorization forms, helping clarify their use and management:

It's advisable to retain signed authorization forms for at least 6-12 months to safeguard against any future disputes.

In such cases, reference the signed authorization as proof of consent to help resolve the matter swiftly.

While not legally mandated, including a CVV field enhances security and is highly recommended.

Exploring related resources and tools

In addition to standard credit card authorization forms, other templates can be beneficial in various contexts. Examples include:

Useful for one-time transactions outside of a subscription model.

Ideal for organizations requiring payment from multiple participants.

Specifically designed for events where attendees may need to secure their spot with a payment.

Incorporating these additional tools into your workflow can enhance your payment processing capabilities and ensure a smooth experience for your customers.

Customer stories: Success with credit card authorization forms

Many businesses report significant improvements in their transaction processes after implementing credit card authorization forms through pdfFiller. For instance, one user noted that waiting times for payments drastically reduced, allowing them to focus more on serving their customers rather than managing payments.

Case studies highlight the effectiveness of well-designed authorization forms in minimizing fraud and enhancing customer trust. Users have found that transparent processes not only encourage repeat business but also foster loyal customer relationships.

Stay updated: Best practices and trends in payment authorization

Remaining informed about best practices in payment authorization can lead to improved business strategies. Subscribing to pdfFiller's newsletter ensures you receive the latest insights directly related to your payment processing methods.

The landscape of credit card authorization is continuously evolving, influenced by trends such as enhanced security protocols and integrating new payment technologies. Staying ahead of these trends can help your business maintain a competitive edge in customer service and efficiency.

Get started today!

Utilizing pdfFiller can revolutionize how you create and manage credit card authorization forms. With a plethora of resources available, you can ensure a seamless transition towards more efficient business practices.

With comprehensive customer support, pdfFiller is dedicated to assisting you every step of the way, helping to streamline your document management and payment authorization process.