Get the free Mortgage Assistance Application

Get, Create, Make and Sign mortgage assistance application

Editing mortgage assistance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage assistance application

How to fill out mortgage assistance application

Who needs mortgage assistance application?

Mortgage assistance application form: How-to guide

Understanding mortgage assistance

Mortgage assistance programs are essential resources for homeowners struggling to make their mortgage payments. These programs can offer various types of support, such as grants or loan modifications, to help alleviate the financial burden faced by many families. Understanding your options is the first step toward securing the necessary assistance.

Different forms of mortgage assistance exist, catering to varying needs: grants that do not require repayment, loan modifications that adjust the terms of the existing mortgage, and temporary payment plans. Each program has specific eligibility criteria that applicants must meet, making it crucial to familiarize yourself with the available resources within your community or through federal programs.

Criteria for qualifying for mortgage assistance

Eligibility for mortgage assistance programs often hinges on income levels and demonstrated financial hardship. Typically, income limits are set based on the area’s median income, so applicants must have their financial documents ready to prove their current state. Moreover, each program might require specific documentation to verify your financial status.

Income eligibility requirements can vary widely based on the program and local regulations, but gathering necessary documentation like tax returns, pay stubs, and financial statements is crucial to streamline your application process and avoid unnecessary delays.

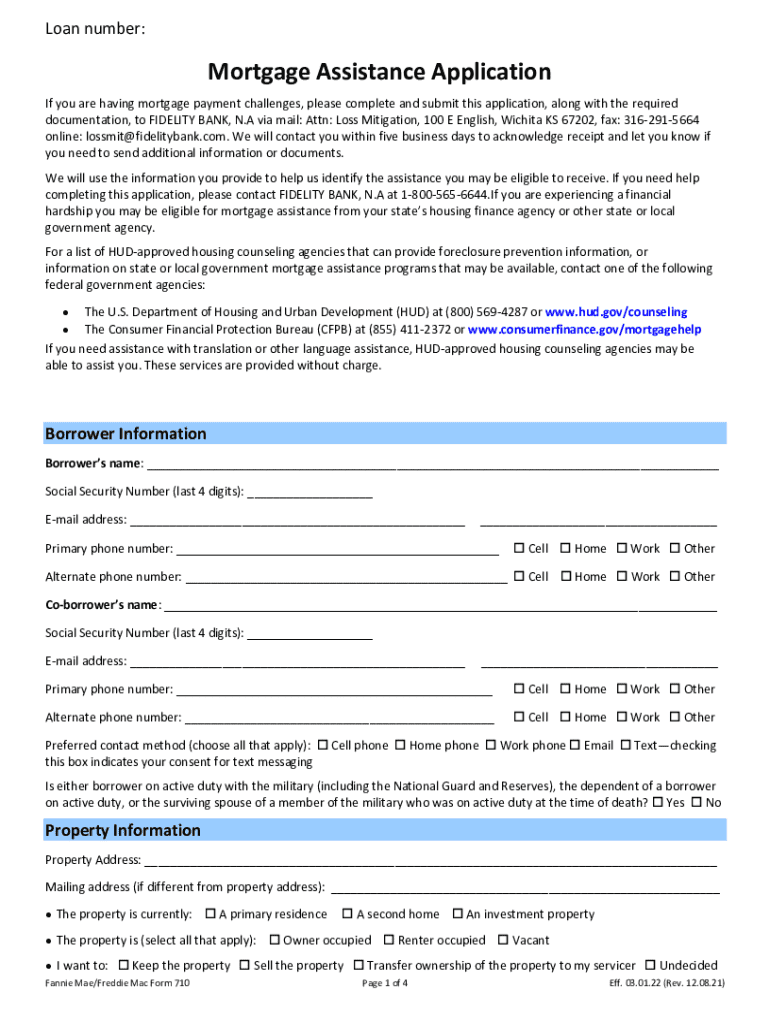

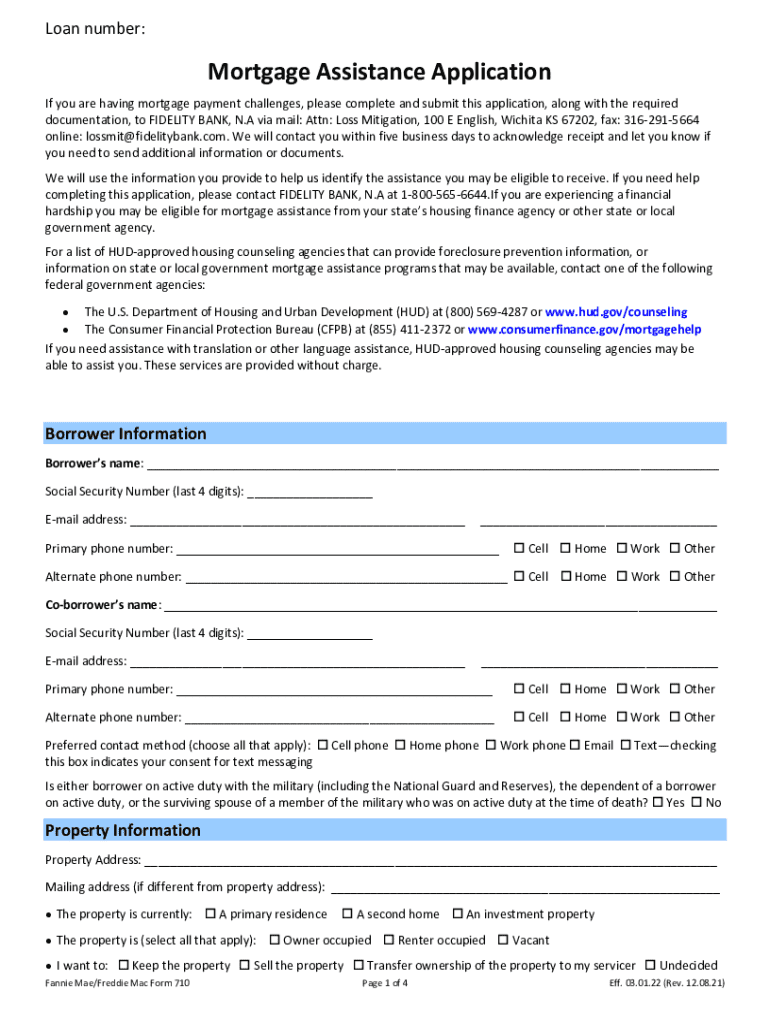

Preparing to complete the mortgage assistance application form

Before diving into filling out the mortgage assistance application form, it's essential to collect all necessary documents that demonstrate your financial situation. Begin by gathering proof of income, such as recent pay stubs or tax returns, to showcase your earnings. Accurate bank statements will also provide insight into your financial stability.

Don’t forget to include your current mortgage statement, detailing your loan balance, interest rate, and payment history. Having these documents prepared can significantly reduce the chance of errors and increase your chances of approval. Being meticulous with documentation will help streamline the application process.

Common pitfalls to avoid

One common pitfall applicants face is providing incomplete information on their application. It’s critical to double-check your form before submission, as any missing fields can delay processing or result in denial. Additionally, ensure that all necessary documentation is included to support your claims.

Trusting the process but also taking personal ownership in preparing your application will make a significant difference. Keep a checklist of required documents to track what you’ve completed and ensure nothing is overlooked.

Step-by-step guide to filling out the mortgage assistance application form

Completing the mortgage assistance application form doesn't have to be daunting. Here’s a section-by-section breakdown to help you navigate through it with confidence.

Personal information

Start with accurate personal data, which is foundational for identification. Include your full name, address, and contact information to ensure the program can easily reach you regarding your application status.

Income and employment information

Detail your income sources comprehensively, including wages, benefits, or any side businesses. Be transparent about your financial situation, as this will give reviewers a clearer picture of your needs.

Housing details

In the housing section, provide information on your current mortgage status. List all housing expenses, including property taxes and insurance, to give an accurate depiction of your financial obligations.

Financial hardship explanation

This section is critical, as it allows you to articulate the challenges you are facing. Present a clear and honest description of your financial obstacles and how they have impacted your ability to keep up with mortgage payments.

Tips for providing compelling supporting information

When writing a hardship letter, be succinct but informative. Clearly outline the events leading to your financial troubles, as well as any attempts you have made to remedy your situation. Supporting documents, such as layoff notices or medical bills, will provide additional context to your story.

Best practices include organizing your supporting evidence in a logical format that directly correlates with the claims made in your application.

Interactive tools for efficient application management

Leveraging tools such as pdfFiller can significantly enhance your experience when completing and managing the mortgage assistance application form. This cloud-based platform allows for easy editing and customization.

Utilizing pdfFiller's document creation features enables you to fill out the form efficiently. You can create, edit, and store your completed application all in one place without the hassle of printed documents.

eSigning instructions

With pdfFiller, electronically signing your application is straightforward. After completing your form, simply navigate to the eSign feature, follow the prompts to add your digital signature, and save your document. This streamlines the submission process, allowing for quick and efficient documentation.

Collaborating with others

Sharing your application with family members or financial advisors can also be beneficial. Utilize pdfFiller's collaboration features to send your form easily, allowing others to provide feedback or additional documentation as needed.

Submitting your application

Once your mortgage assistance application form is complete, the next step is submission. You have the option of online portals or traditional paper submissions, each with its advantages and disadvantages.

Online submissions are generally faster and allow for instantaneous confirmation of receipt, whereas paper submissions can take longer and may be lost in transit. Choosing the right method depends on your comfort level with technology and the specific requirements of the assistance program.

Tips for following up

After submitting your application, it’s wise to follow up. Contact the assistance program to check on the status of your application. Prepare a concise inquiry that includes your name, application number, and any other identifiers that will help them locate your submission.

Maintaining open communication with assistance programs can demonstrate your commitment and eagerness to resolve your financial situation.

Navigating post-submission processes

After submission, applicants should have realistic expectations regarding processing timelines. It is typical for assistance programs to take several weeks to review and determine the results of applications. Being informed about what to expect can ease anxiety during this waiting period.

There are potential outcomes, including approval, denial, or a request for additional documentation. If your application is denied, it’s essential to understand the reasons and what steps you can take to rectify the situation, such as reapplying or appealing the decision.

Maintaining document organization and management

Organizing your documents post-application submission is just as important as preparation. Keeping records of all correspondence, submitted forms, and documentation can be beneficial for future applications or appeals. It’s recommended to retain these records for a minimum of three years, as this is typically the timeframe for most assistance programs.

Utilizing pdfFiller can significantly aid in managing these documents. Its cloud-based features allow for easy tracking, and storage of application-related documents, ensuring you have access to everything you need at your fingertips.

Additional tips for a smooth application process

Consider seeking professional help when navigating the complexities of mortgage assistance. A financial advisor or housing counselor can provide invaluable insights, ensuring you optimize your application’s chances of approval. They can assist in providing an outside perspective on your financial situation and recommendations for additional resources.

Moreover, staying informed about changes in mortgage assistance programs is essential. Government regulations and local programs can frequently change, so utilizing resources such as community housing organizations or governmental websites can ensure you're not missing out on available opportunities.

Conclusion

Navigating the mortgage assistance application form can seem challenging, but with thorough preparation and understanding of the process, individuals can successfully access the help they need. By utilizing the information and tools provided in this guide, applicants are empowered to complete their forms accurately and effectively.

Remember, you are not alone in this process. Support systems and resources are available to help you overcome financial struggles associated with your mortgage. Approach the application process with confidence, and explore all options for assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete mortgage assistance application online?

How can I edit mortgage assistance application on a smartphone?

How do I fill out mortgage assistance application using my mobile device?

What is mortgage assistance application?

Who is required to file mortgage assistance application?

How to fill out mortgage assistance application?

What is the purpose of mortgage assistance application?

What information must be reported on mortgage assistance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.