Comprehensive Guide to Financial Analysis Fact Finder Form

Understanding the financial analysis fact finder form

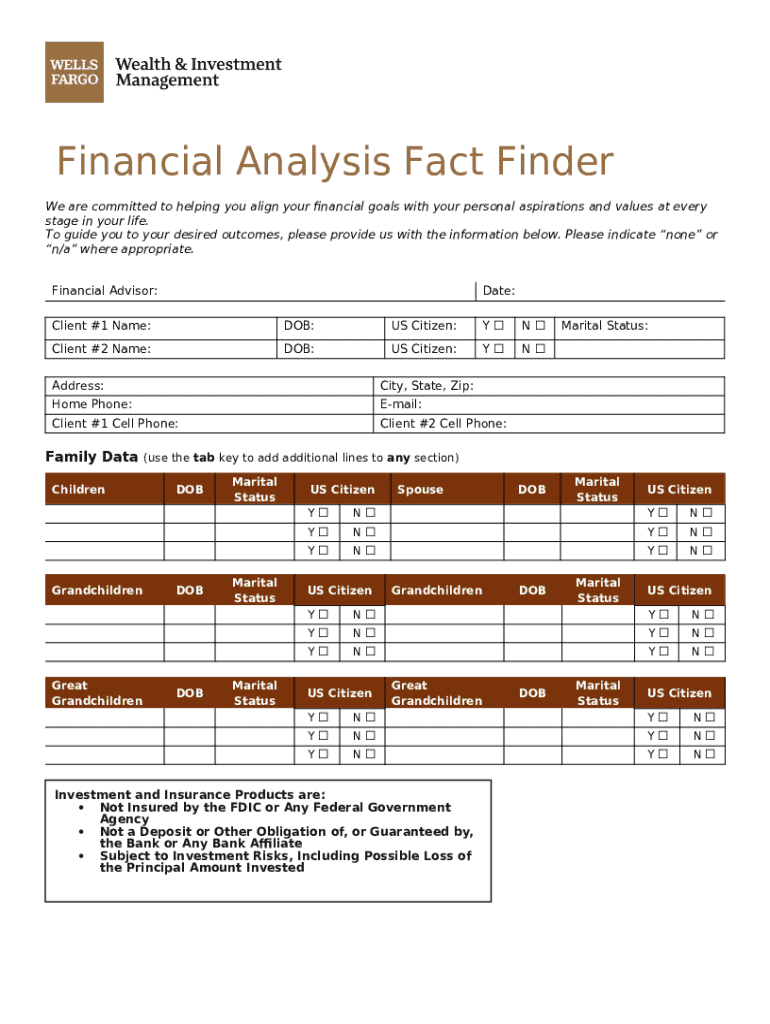

The financial analysis fact finder form is an essential tool in financial planning, serving as the foundation for effective budget management and investment strategies. It collects relevant financial data that allows both individuals and teams to gain insights into their financial standing. Understanding the purpose and structure of this form is crucial for effective financial decision-making.

The primary purpose of the financial analysis fact finder form is to gather detailed financial data that contributes to long-term financial planning. Financial advisors, accountants, and personal finance management experts rely on this form to assess their clients' financial situations comprehensively. Such professionals and the clients they serve benefit greatly as this form provides a structured approach to understanding all aspects of one’s finances.

Individuals looking to organize their financial life.

Financial advisors needing a comprehensive overview of client finances.

Companies aiming for better cash flow management.

Getting started with the financial analysis fact finder form

Accessing the financial analysis fact finder form is straightforward via the pdfFiller platform, which provides a user-friendly interface. Users can navigate directly to the form on the pdfFiller website, where they can leverage the many features to create a customized financial analysis toolkit.

For new users, setting up an account on pdfFiller is quick and easy. Entering your email and creating a password will give you access to a versatile document creation resource that can help streamline your financial documentation processes.

Go to the pdfFiller website and search for the financial analysis fact finder form.

Create an account by providing your email address and setting a password.

Log in to start accessing and editing the form.

Step-by-step guide to filling out the form

Filling out the financial analysis fact finder form requires careful attention to detail. Begin by entering your personal information. This section should include your name, contact details, and demographic information, which helps to personalize your financial planning experience.

Next, move on to documenting your assets. This involves listing all relevant assets, such as real estate, savings accounts, investments, and personal possessions. Evaluating the value of these assets can be done using current market rates or professional appraisals, which ensure a realistic reflection of your economic standing.

Types of assets to include are: real estate, bank accounts, investments, and personal property.

Evaluate asset value through market research or financial advisement.

After documenting assets, it’s important to list your liabilities, which may include loans, credit card debts, and other forms of obligations. Categorizing them helps in understanding your overall financial health.

Provide detailed income information from various sources, ensuring a comprehensive assessment. This could include salaries, rental income, dividends, and any freelance earnings. Finally, outline your monthly expenses, taking care to account for fixed costs like rent and fluctuating expenses like entertainment.

Common liabilities include: mortgage, student loans, and credit card debt.

Detailed income sources can include salaries, rental income, and bonuses.

Essential expenses categories include: housing, food, transportation, and subscriptions.

Utilizing interactive tools on pdfFiller

pdfFiller excels in offering various interactive tools that enhance the process of filling out the financial analysis fact finder form. One significant feature is the capability to edit the form easily. Users can add custom fields according to their specific financial needs, providing additional necessary information that standard forms might overlook.

Moreover, you can import data from other documents, which helps streamline the process and ensure consistency. This feature is particularly useful when you have various sources of financial documentation.

Easily add custom fields to tailor the form to your needs.

Import necessary data from existing documents to save time and ensure accuracy.

eSigning the fact finder form

Once you have completed the financial analysis fact finder form, applying your electronic signature through pdfFiller is simple. The functionality to eSign directly on the platform enhances the convenience of finalizing documents without the need for printouts.

eSigning not only accelerates the process but also carries legal weight similar to traditional signatures, adding a layer of authenticity and security in the financial context.

Collaborating on the financial analysis fact finder form

In a team setting, sharing the financial analysis fact finder form with team members is straightforward. pdfFiller allows users to grant access for reviews and edits, ensuring all necessary parties can contribute valuable insights. This collaborative aspect facilitates better analysis and decision-making.

Furthermore, pdfFiller offers real-time collaboration tools, which means multiple users can engage with the form at the same time. This ability can lead to richer discussions and quicker resolutions to financial planning challenges.

Grant access to trusted participants for review or edits.

Utilize real-time tools for enhanced collaboration and discussion.

Annotations and comments for clarification

Adding notes to specific sections of the financial analysis fact finder form may help clarify data points or highlight areas that need special attention. pdfFiller offers options to annotate, which can streamline communication among team members.

Facilitating discussions around comments and annotations encourages team involvement in the financial planning process, ensuring that all viewpoints are taken into account. This collaborative effort can lead to more informed recommendations and strategies.

Managing your financial analysis fact finder form

Managing your financial analysis fact finder form on pdfFiller comes with several benefits, particularly in document storage and access. The cloud-based solution ensures that users can retrieve their forms from any location, which is especially advantageous for teams working remotely or from various locations.

In addition to easy access, you can export and print your form in multiple formats, supporting flexibility in how you use the information. Whether it’s for a presentation, filing for legal records, or simply for personal reference, different formats can cater to various needs.

Enjoy cloud-based storage for seamless access anywhere.

Retrieve your document anytime without depending on physical copies.

Export and print in various formats for diverse use-cases.

Advanced insights into financial analysis

Once you’ve collected data using the financial analysis fact finder form, understanding what that information reveals about your financial health is the next crucial step. Analyzing this data can illuminate your strengths and weaknesses, guiding better financial strategies.

After completing the form, consider consulting financial professionals for advice on how to act on the insights gathered. This might involve reassessing investment strategies, improving saving habits, or planning for future financial goals.

Interpret data to unveil financial strengths and weaknesses.

Consult financial professionals for actionable next steps.

Case studies of successful financial planning

Real-world examples underscore the effectiveness of the financial analysis fact finder form in informing decision-making. Users who diligently filled out and analyzed their forms reported clearer pathways toward financial success and stability.

Testimonials highlight how this interactive tool supported users in redefining their financial priorities and making informed choices, confirming its value as a vital component of sound financial planning.

Q&A: Common questions about the financial analysis fact finder form

Many individuals and teams have queries regarding the financial analysis fact finder form. A common question pertains to amending any submission once it has been completed. Fortunately, pdfFiller allows users to easily edit their forms post-submission, facilitating updates whenever necessary.

Additionally, security concerns are paramount. Users can rest assured that pdfFiller employs rigorous privacy policies and data encryption practices, ensuring sensitive financial information remains protected. Lastly, some may wonder about the costs involved in utilizing this service through pdfFiller; generally, while accessing certain features entails fees, many basic functionalities can be employed for free.

Edit your submission easily even after the form is completed.

Benefit from strong data protection measures provided by pdfFiller.

Access many features at no cost while specific services may involve charges.

Contact support for assistance

For additional help, reaching out to pdfFiller support is straightforward. Users can access support through their help center, which features a range of resources, including live chat options for urgent queries about the financial analysis fact finder form.

The FAQ section is particularly helpful for quick troubleshooting, addressing common problems users may encounter while using the financial analysis fact finder form. With dedicated assistance available, users can resolve their issues efficiently.

Access support via the pdfFiller help center for inquiries.

Use the FAQ section for rapid problem-solving.