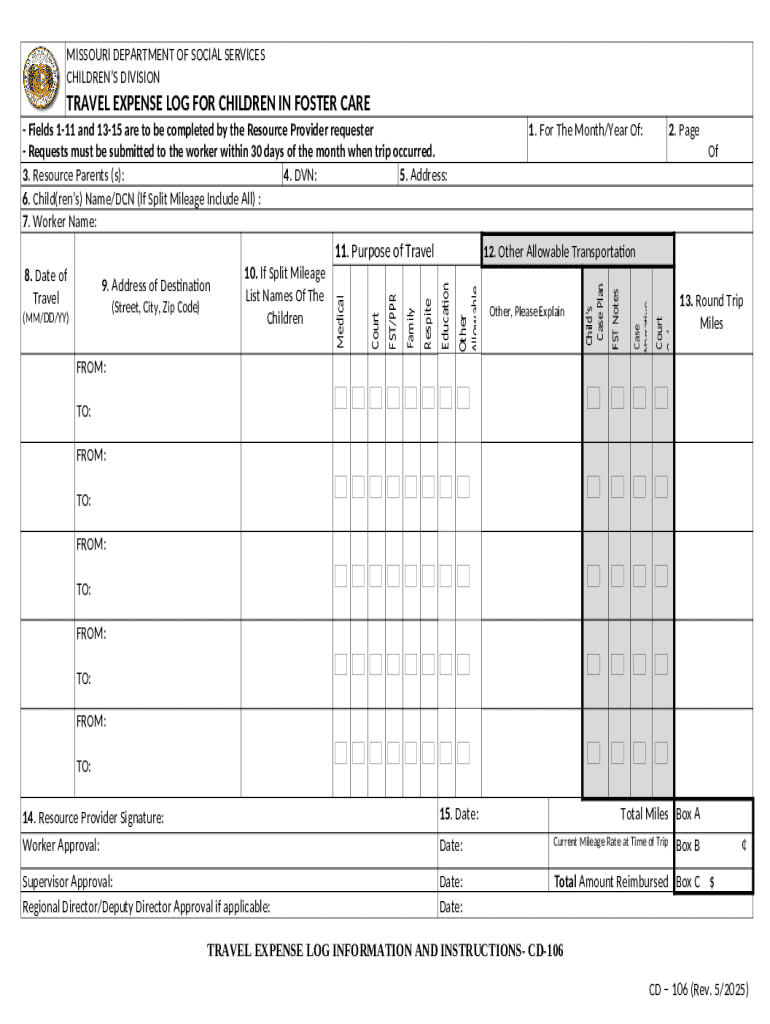

Travel Expense Log for Form

Understanding travel expense logs

A travel expense log is a systematic record of all expenses incurred while traveling for business or personal purposes. It serves as a detailed account of financial transactions relating to travel, allowing individuals and teams to track their spending efficiently. By maintaining a travel expense log, travelers can substantiate their expenses for reimbursements and tax deductions.

The importance of maintaining a travel expense log cannot be understated. It not only ensures accurate tracking of expenditures but also plays a crucial role in financial planning and budgeting. However, tracking travel expenses can be challenging due to various factors, including lost receipts, inconsistent record-keeping, and differing company reimbursement policies.

Increased accuracy in reporting expenses.

Streamlined reimbursement processes.

Better financial oversight and controls.

Key components of a travel expense log

To create an effective travel expense log, certain key components must be documented. These include mandatory information such as the date of travel, purpose of travel, and locations visited. Each log entry should clearly outline these elements to facilitate easy retrieval and understanding of travel history.

In addition to basic trip details, documenting the types of expenses is vital to provide a complete overview of financial commitments. Common categories include transportation costs like airfare and taxis, lodging expenses related to hotels, meal reimbursements, and other travel-related expenditures such as conference fees or parking costs.

Date of travel: Specify the exact date each expense occurred.

Purpose of travel: Include a brief explanation of the trip's goals.

Locations visited: List all cities or towns affected by your travel.

Types of expenses: Note categories such as transportation, lodging, meals, and incidentals.

Who should use a travel expense log?

Both individuals and teams benefit from utilizing a travel expense log. Solo travelers, such as freelancers and contractors, often find it essential for ensuring that they accurately track expenses that can be claimed on their tax returns or reimbursed by clients.

Similarly, teams within corporations, small businesses, and non-profit organizations rely on travel expense logs to maintain clear records of collective travel costs. This documentation facilitates transparency and accountability, particularly when managing budgets across different departments or project teams.

Individuals: Solo travelers, freelancers, and contractors looking to manage personal expenses.

Teams: Corporations, small businesses, and non-profits needing organized reporting for group travel.

Benefits of using a travel expense log

Employing a travel expense log offers substantial benefits. Firstly, it allows for precise tracking of expenses, making it easier to evaluate travel costs against budgets. This accuracy leads to better financial decision-making and aids in the effective management of travel budgets.

Secondly, a well-maintained travel expense log streamlines the reimbursement process. By providing organized and documented expenses, travelers can quickly submit their logs for reimbursement, reducing turnaround times and the potential for disputes. Additionally, these logs enhance budgeting and financial planning by presenting clear insights into spending patterns and future travel forecasts.

Precise tracking of expenses helps maintain budgetary discipline.

Streamlined reimbursement processes results in quicker approvals.

Enhanced budgeting practices foster better decision-making for future travel.

What can be claimed as travel expenses?

When filing a travel expense log, it is crucial to recognize what expenses can be claimed. Eligible expenses typically include transportation costs such as airfare, train fare, car rentals, and taxi fares. Lodging expenses, inclusive of hotel charges, are also claimable, as are meal expenses and incidental costs that arise during travel.

Moreover, travelers should be aware of allowable limits and per diems that are often stipulated by organizations or tax authorities. Understanding these limits helps avoid potential issues with claims being rejected. It's also essential to consider that different travel scenarios may have varying guidelines on what can be claimed, requiring familiarity with company policies.

Transportation costs: Airfare, taxi, rental cars, etc.

Lodging: Hotel expenses incurred during travel.

Meals: Daily allowances or actual expenses for food.

Incidental expenses: Parking fees, tolls, and other minor costs.

What can’t be claimed?

Certain expenses, however, cannot be claimed on travel expense logs. Non-reimbursable costs often include personal expenses such as entertainment, sightseeing, or travel upgrades unless explicitly covered by company policies. Understanding company policies and limitations is fundamental to prevent misunderstandings during the expense claim process.

Additionally, being aware of the potential tax implications of unclaimed expenses is essential. Keeping thorough records and understanding what constitutes a claimable expense can provide a safety net during tax season, as unclaimed items may provide possible deductions in specific scenarios.

Personal expenses: Non-business related costs such as leisure activities.

Luxury travel upgrades: First-class flights or premium accommodation unless otherwise stated.

Fines or penalties: Parking fines or other charges incurred during travel.

How to create a travel expense log

To create a travel expense log, you can follow a straightforward step-by-step guide to ensure nothing is omitted. Begin by selecting the appropriate template, which can be in formats like PDF, Word, or Excel. Each format has its advantages, and selecting one often depends on personal preferences or organizational requirements.

Next, accurately input relevant data for each expense incurred during your travels. It’s vital to be thorough for transparency and easy review. Organize expenses logically, grouping them by category, date, or trip segment for better organization. Efficient recording practices, coupled with a keen eye for detail, will facilitate effective expense management.

Choose a template: Find a travel expense log template that suits your needs.

Input data accurately: Ensure all expense details are correct and comprehensive.

Organize expenses: Group them logically for better understanding and retrieval.

Strengthening expense management with digital solutions

Digital solutions for travel expense logs provide significant advantages, streamlining reporting and documentation processes. One such solution is pdfFiller, which enhances travel expense management through its cloud-based platform. Users can access their documents from anywhere, making it easy to update and maintain records while on the go.

Moreover, pdfFiller offers editable and eSigning capabilities, allowing users to quickly modify logs and submit for reimbursement without the need for printed forms. Its collaboration features facilitate teamwork, as multiple users can access and work on the same document simultaneously, reinforcing data accuracy and efficiency.

Cloud-based access: Easily access your travel expense log from anywhere.

Easy editing capabilities: Modify details without hassle.

Collaborative features: Work together on expense logs in real-time.

Common mistakes when filling out a travel expense log

Filling out a travel expense log can be straightforward, but there are common mistakes that individuals should be aware of to avoid issues. Common errors include failing to keep receipts, miscalculating totals, and not categorizing expenses correctly. These mistakes can lead to discrepancies and delays in the reimbursement process.

Another frequent pitfall is submitting logs that lack clear documentation or are incomplete. To ensure accuracy and promote efficient reporting, it is essential to periodically review the log and its entries, as well as to have a checklist of requirements against which to benchmark completed logs.

Failing to keep receipts: Always retain receipts for claimed expenses.

Miscalculating totals: Double-check calculations to avoid mistakes.

Not categorizing correctly: Ensure expenses are organized categorically.

Sample travel expense log

Having a sample travel expense log can provide a reference point for individuals looking to create their unique logs. A completed log should outline key sections including dates, purposes, locations, types of expenses, and amounts. Each component should be clearly marked and consistency maintained throughout the log entries to instate professionalism and diligence.

For instance, a sample log might include entries detailing a business trip to New York, showcasing expenses such as airfare, hotel costs, and meals. Annotating the log with clear labels ensures that all necessary information can be easily referenced for reimbursement or auditing purposes.

Purpose: Business meeting with client.

Expenses: Airfare - $400, Hotel - $300, Meals - $100.

FAQ section

Understanding how to utilize a travel expense log effectively raises several common questions. One frequently asked question is about the purpose of a travel expense log itself, which is to provide an organized record for tracking and reporting of travel-related expenditures.

Another typical inquiry pertains to how to handle joint expenses on a business trip. Typically, each traveler should keep their logs, noting their share of shared expenses to ensure proper reporting. Tax considerations for travel expenses are also vital; travelers should consult with a tax advisor to clarify eligible claims.

What is the purpose of a travel expense log? To track and document all travel-related costs.

How do I handle joint expenses on a business trip? Maintain individual logs and note shared expenses.

What are the tax considerations for travel expenses? Consult a tax advisor for individual eligibility.

Related templates and tools

Beyond the travel expense log for form, several other relevant documentation tools can help manage expenses and submissions effectively. For example, employee expense reimbursement forms enable businesses to streamline the claims process and provide clear guidelines for submitting expenses.

Additionally, reimbursement forms that incorporate receipts offer a comprehensive view of claimed expenses, ensuring alignment with organizational policies. Furthermore, specific templates designed for unique scenarios can assist in catering to diverse travel-related expenses, enhancing overall processes.

Employee expense reimbursement form: Standard template for reimbursement.

Reimbursement form with receipts: Compiles expenses alongside documentation.

Specialized templates: Catering to particular travel needs or scenarios.

General tips for travel expense reporting

Implementing best practices for travel expense reporting promotes efficient management. Keeping digital records and regular updates to expense logs can mitigate issues related to forgotten costs and documentation. Additionally, using apps or software specifically designed for expense tracking enhances accuracy.

Encouraging team compliance with expense policies is equally important. Organizations should provide clear guidelines and training on how to fill out expense logs correctly, ensuring that everyone understands what can be claimed and what cannot. This consistency fosters a culture of accountability and transparency across teams.

Keep digital records: Utilize cloud storage for easy access.

Use expense tracking apps: Technology can streamline logging efforts.

Provide training on policies: Ensure team members are well-informed.