Money-changing and remittance businesses form: A comprehensive guide

Understanding money-changing and remittance businesses

Money-changing and remittance businesses provide essential services for transferring money across borders and converting one currency to another. These services significantly impact global commerce and personal transactions, enabling immigrants and expatriates to send funds back home efficiently. The widespread reliance on these services highlights their importance in fostering economic connectivity and ensuring financial inclusion.

In the context of globalization, money-changing and remittance sectors have become cornerstones for individuals and businesses seeking to navigate currency conversion and international money transfers. Individuals, often in desperate need of reliable and cost-effective transfer options, rely on both traditional establishments and emerging online platforms.

Improved accessibility for unbanked populations.

Promotes remittances as a significant source of income for many developing nations.

Facilitates ease of currency conversion for tourists and travelers.

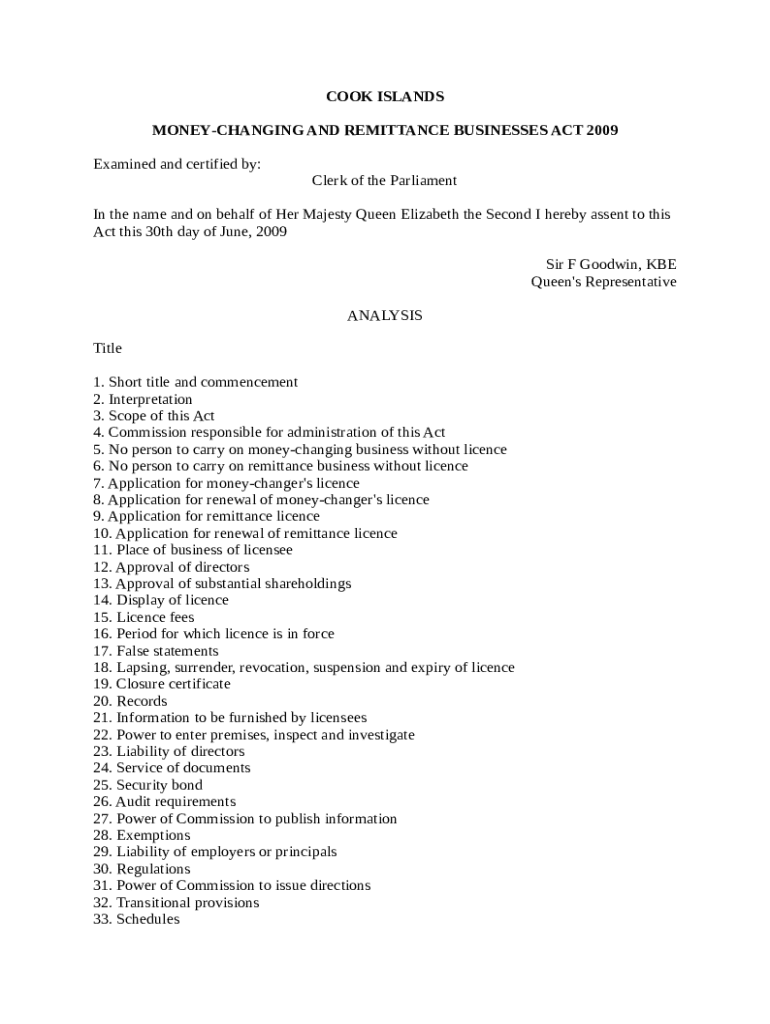

Legal framework governing money-changing and remittance

Establishing a money-changing and remittance business requires navigating a complex legal landscape. Licensing is the first step in legitimizing your operations. Different jurisdictions have varying requirements, often including a detailed application process to ensure all standards are met. Generally, businesses must apply for a Money Services Business (MSB) license, which helps regulatory bodies ensure customer protection and combat financial crime.

Certain documentation is consistently needed, including proof of identity, business plan, and even potential financial audits. Also, businesses must understand the associated fees, which can differ significantly based on local regulations.

Business registration documents.

Identity verification for all principal stakeholders.

Proof of financial integrity and business practices.

The money-changing and remittance business model

Understanding the business model for money-changing and remittance services is critical to successful operation. Revenue primarily comes from two streams: transaction fees charged to customers for services and the margins applied to exchange rates. Transaction fees can vary based on the transfer amount and destination, while exchange rates can be adjusted strategically to maintain profitability.

Moreover, businesses often provide a range of services beyond simple currency exchanges. These services can include international wire transfers, domestic money transfers, payment solutions for businesses, and even digital wallets. Adapting services to consumer preferences is essential for sustained growth and customer loyalty.

Currency exchange at competitive rates.

Cross-border remittance options facilitating easy fund transfers.

Integration of modern payment technologies.

Form overview: Essential documents for starting your business

Starting your money-changing and remittance business entails submitting specific forms to regulatory authorities. The primary document you'll need is the application for Money Services Business (MSB) registration. When your application is being processed, maintaining comprehensive client and transaction records is essential. These records help establish credibility and ensure compliance with legal requirements.

Key forms can vary by location but typically include initial licensing applications, ongoing reporting documents, and customer identification records. Utilizing platforms like pdfFiller can streamline the process by providing interactive tools that aid in the quick completion of necessary forms.

Client identification forms documenting KYC compliance.

Transaction record-keeping forms for regulatory purposes.

Step-by-step guide to completing the money-changing form

Completing the money-changing form involves gathering all necessary business and personal information. Identifying required details is the first step towards ensuring your application is comprehensive and accurate. Information typically required will include business name, address, contact information, and ownership details.

Once you have gathered this information, begin filling out the form. Key sections will include your business's financial history and ownership structure, where transparency and accuracy are paramount. Leveraging pdfFiller's features can further enhance this process with interactive form completion capabilities and real-time updates.

Enter your business information clearly and accurately.

Be transparent about ownership and financial plans.

Use pdfFiller’s editing features for corrections and adjustments.

Managing your money-changing and remittance operations

Efficient operational management is critical for the success of money-changing and remittance services. Employing the right software tools helps track transactions effectively while maintaining a clear overview of financial forecasts. Incorporating modern financial reporting software boosts productivity and enhances decision-making capabilities.

Furthermore, fostering collaboration within teams is vital. Document sharing tools like pdfFiller support team efforts by allowing real-time document editing, commenting, and assessment of client relations. This collaborative environment can lead to streamlined processes and improved customer service.

Utilize transactions tracking software.

Establish regular financial reporting protocols.

Implement team collaboration tools for efficiency.

Risk management in money-changing and remittance services

In the money-changing and remittance business, identifying potential risks is essential in maintaining trust and compliance. Fraudulent transactions and regulatory non-compliance can jeopardize a business's reputation and operational capabilities. Proactive measures to assess risks include implementing strong security protocols and continuous employee training.

Mitigation strategies can encompass the introduction of multi-factor authentication for transactions, regular audits, and creating a culture of compliance through training sessions for employees to stay abreast of new regulations and risks.

Conduct regular security assessments and audits.

Instill a compliance-driven mindset among staff.

Develop and implement comprehensive security protocols.

Ongoing compliance and adaptation

The landscape of money-changing and remittance services is perpetually evolving. Staying updated with regulatory changes is essential for compliance. Engaging with professional networks and subscribing to regulatory updates can be beneficial. Businesses must implement review protocols to adapt to these changes quickly.

Additionally, adapting to market trends is vital for growth. The rise of digital currencies and innovative payment technologies are reshaping customer preferences. Regularly assessing market needs and innovating service offerings ensures businesses remain competitive and relevant.

Stay engaged with relevant regulatory bodies and updates.

Invest in market research for service enhancements.

Embrace technology and digital innovations to improve user experience.

Case studies and real-world examples

Examining success stories within the money-changing industry can provide valuable insights. For instance, a small startup managed to differentiate itself through exceptional customer service, eventually expanding its operations across several countries. Conversely, analyzing lessons from failed ventures reveals the pitfalls of neglecting regulatory compliance or not adapting to market needs.

These real-world examples underline the critical importance of robust planning and implementation in achieving sustainable business operations.

Study successful case examples in various regions.

Learn from missteps of failed money-changing startups.

Identify key factors contributing to success in different markets.

FAQs on money-changing and remittance processes

As potential business owners navigate the complexities of money-changing and remittance processes, numerous questions arise. Common queries often involve clarifying specific regulatory requirements or understanding the customer verification process. Expertise is crucial in ensuring that potential business owners address these queries directly and accurately, paving the way for informed operational strategies.

Tackling frequently asked questions helps demystify aspects of forms, regulations, and operational challenges, providing a smoother entry into the industry.

What documents are essential for licensing?

How can businesses ensure compliance with local and international laws?

What strategies can optimize customer service in money remittance?