Get the free Credit Application Form

Get, Create, Make and Sign credit application form

Editing credit application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application form

How to fill out credit application form

Who needs credit application form?

Credit Application Form: A Comprehensive Guide to Completion and Management

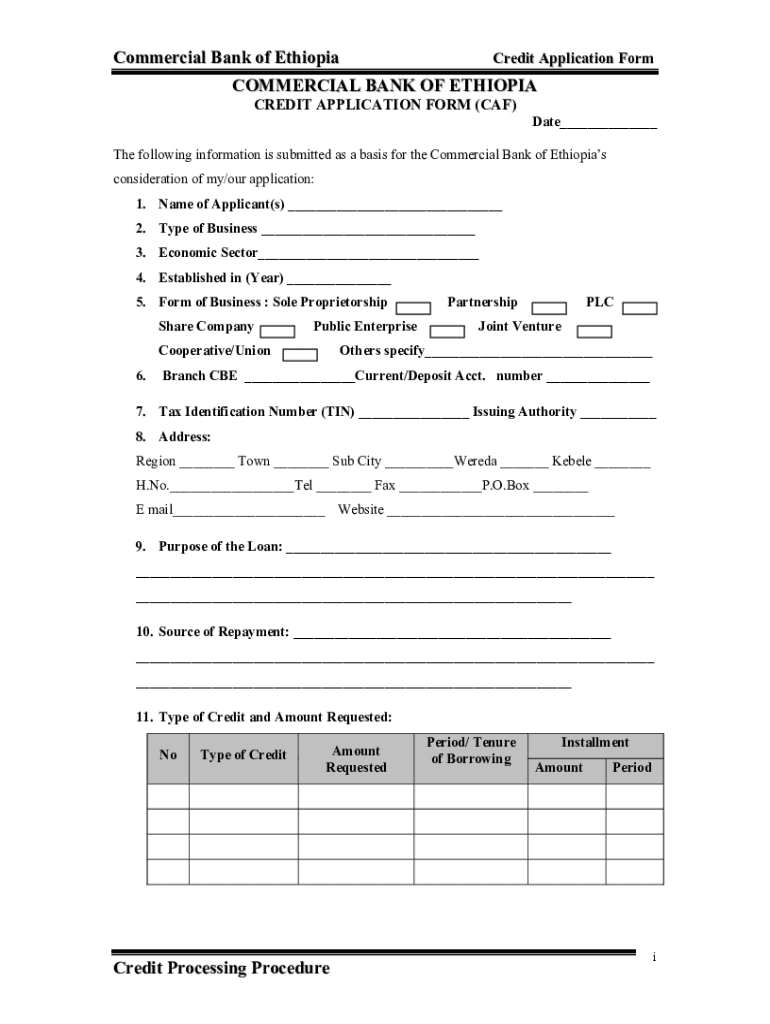

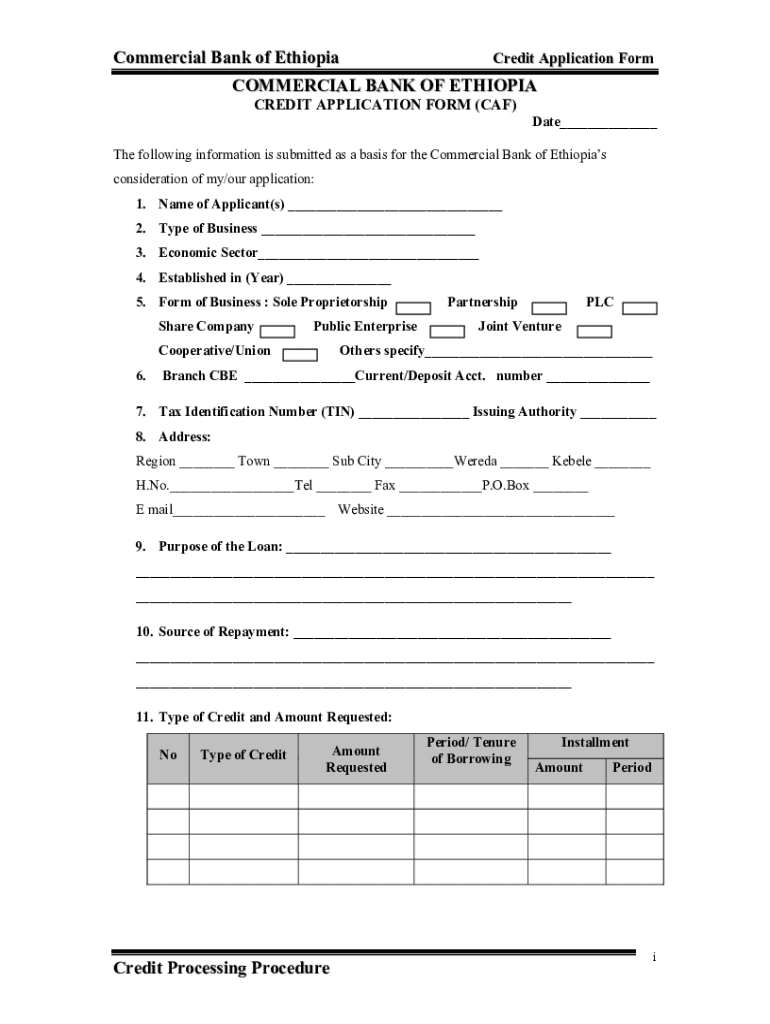

Understanding the credit application form

A credit application form is a crucial document used by lenders to assess an applicant's creditworthiness. Typically, it collects essential personal and financial information from individuals or businesses seeking credit, be it a loan, credit card, or mortgage. This form serves as the foundation for credit decisions, influencing whether the applicant receives funding and under what terms.

The importance of credit application forms in financial transactions cannot be overstated. They help lenders minimize risk by allowing them to analyze an applicant’s financial history and current situation. This is not only beneficial for the lender but also assists borrowers in understanding their financial standing and what they can realistically afford.

Key components of a credit application form often include personal identification details, financial information, employment history, and the purpose of the credit request. Gathering accurate and honest information is paramount, as it directly affects the evaluation by the lender.

Types of credit application forms

Credit application forms generally fall into two primary categories: individual and business applications. Individual applications are primarily for personal loans or credit, while business applications cater to companies seeking funding for operational costs or expansion.

Furthermore, applications can also be categorized as secured or unsecured. Secured applications require collateral, such as property or a vehicle, which the lender can claim if the loan is defaulted. Conversely, unsecured applications do not require collateral but may come with higher interest rates due to increased risk for the lender.

How to fill out a credit application form effectively

Filling out a credit application form may seem straightforward, but attention to detail is essential. Begin by gathering necessary information. This includes identification details such as your Social Security Number (SSN), address, and any identification documents. It is also critical to compile financial information, including your income sources, existing debts, and monthly expenses.

Next, take the time to understand the terminology. Familiarizing yourself with key financial definitions such as Annual Percentage Rate (APR), credit limits, and terms relating to your financial situation will help you navigate and fill out the form with confidence.

Being honest and accurate is paramount; misrepresenting your financial status can lead to application denial or more severe consequences. After completing your form, review it carefully for completeness. Use a checklist to ensure everything is filled in, particularly crucial fields like income and existing debts, before submission.

Editing your credit application form

Sometimes, you may need to modify a credit application form that’s been pre-filled. Through pdfFiller, users can access editing tools that allow them to amend any details easily. Simply upload the document, make your changes, and ensure the final product retains the original formatting, which often makes the review process smoother for lenders.

For example, if there’s an error in your financial figures or any personal identification details, using pdfFiller’s intuitive interface will ensure you can make precise adjustments without starting from scratch.

Signing your credit application form

After filling out and editing your credit application form, the next crucial step is signing it. The rise of electronic signatures has streamlined this process significantly, allowing users to eSign their documents easily and securely. Using pdfFiller, the eSigning process is straightforward, requiring minimal effort from the user while ensuring the document remains legally binding.

Electronic signatures hold the same legal validity as traditional handwritten ones, significantly enhancing the efficiency of document submission. This digitized approach is essential in today’s fast-paced financial environment, allowing for quicker turnaround times on credit decisions.

Managing your credit application form after submission

Once your credit application form is submitted, it’s crucial to manage the next steps carefully. Keep track of your application status by following up with the lender after a reasonable period. Many lenders provide a tracking system or contact information for inquiries regarding your application.

Additionally, accessing and saving your documents is vital. Storing your application within pdfFiller allows for easy retrieval when needed and ensures you have a digital copy. Should your application lead to additional actions, such as follow-ups with the lender, having your documentation organized and easily accessible can streamline the process.

Common mistakes to avoid when completing a credit application form

When it comes to completing a credit application form, certain pitfalls can hinder your chance of approval. Incomplete information is a primary mistake; omitting critical details can raise red flags for lenders. Always ensure every requested field is filled in accurately.

Misunderstanding the credit terms can also lead to issues; applicants should clarify any ambiguities before submission. Furthermore, providing inaccurate financial data, whether intentional or unintentional, can result in rejection or future complications. It is essential to double-check all figures and claims before turning in your application.

Tools and resources for enhancing your application experience

Utilizing interactive tools can significantly enhance your credit application experience. pdfFiller provides a range of resources, including collaboration features that cater to both individuals and teams. This is particularly useful for businesses that require multiple team members to input data into the application form.

Additionally, pdfFiller offers various templates that simplify the form-filling process. These templates can assist you in ensuring all necessary information is included and organized correctly, further optimizing your application experience.

Frequently asked questions about credit application forms

As you navigate your credit application form, you may have some common questions. For instance, what to do if your application is denied? Understanding the reasoning behind the denial can help you address any issues in future applications. Lenders often provide specific feedback regarding credit history or financial issues influencing their decision.

Another frequent question is how long the application process usually takes. This varies by lender, but many will provide a timeframe upon submission. Finally, concerns over confidentiality of information are valid; ensure you review the lender’s privacy policy to understand how they will protect your data during the application process.

Conclusion

Understanding how to navigate the credit application form is essential for anyone seeking credit, whether for personal or business use. By thoroughly comprehending the form's structure, being mindful of common mistakes, and utilizing tools like pdfFiller, applicants can enhance their chances of approval and optimize their application experience.

Empower yourself with pdfFiller to handle your documents seamlessly. Its cloud-based platform offers integrated editing, eSigning, and collaboration features tailored for both individuals and teams, making your credit application process as streamlined as possible.

Additional tips for managing your credit records

Keeping your credit records up to date is just as important as the application process itself. Regularly monitoring your credit score and credit reports can reveal areas for improvement, helping boost your overall financial health. Make use of tools that allow you to track changes in your credit score over time.

Strategies for improving your creditworthiness include making payments on time, decreasing outstanding debts, and avoiding opening too many new accounts in a short period. Each of these factors contributes to a healthier credit profile, which will benefit you in future credit applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit application form from Google Drive?

How can I send credit application form to be eSigned by others?

How do I edit credit application form straight from my smartphone?

What is credit application form?

Who is required to file credit application form?

How to fill out credit application form?

What is the purpose of credit application form?

What information must be reported on credit application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.