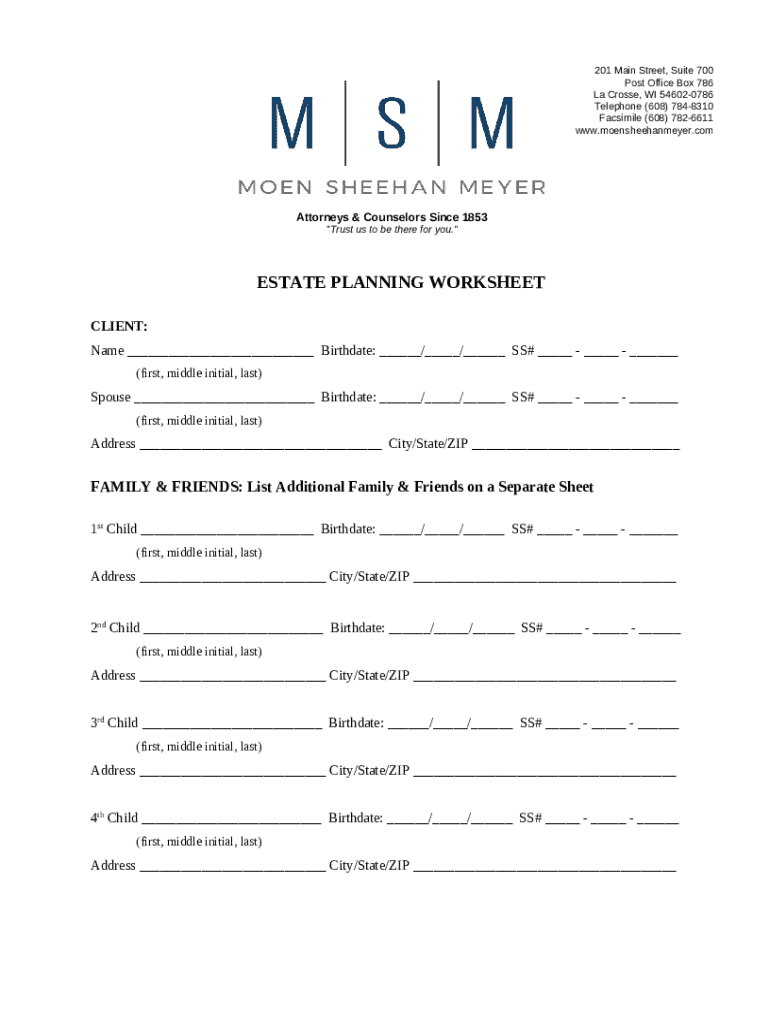

Estate Planning Worksheet Template Form

Overview of estate planning

Estate planning is crucial for ensuring that your wishes regarding your assets and dependents are honored after your passing. It involves the process of organizing how your wealth is distributed, healthcare decisions during incapacity, and the management of your affairs post-mortem. Many individuals underestimate its significance, believing that estate planning is only necessary for the wealthy or for those of advanced age.

The truth is that anyone with assets, dependents, or specific wishes for their healthcare should engage in estate planning. This misconception can lead to complications later, leaving family members with difficult decisions during an emotional time. An estate planning worksheet can serve as an invaluable tool in navigating this sensitive process.

What is an estate planning worksheet?

An estate planning worksheet is a structured document designed to guide you through the estate planning process. It serves as a comprehensive form that gathers essential information regarding your personal life, financial assets, family ties, liabilities, and existing estate documents. The worksheet provides a clear overview that can facilitate conversations with financial and legal advisors.

Using a worksheet simplifies the estate planning process by ensuring that no critical details are overlooked. It can help clarify complex situations, especially when multiple family members are involved, making discussions about inheritance, healthcare decisions, and other important issues much smoother.

Facilitates comprehensive planning by organizing vital information.

Promotes clarity around your wishes and decision-making.

Serves as a conversation starter with professionals and family.

Key components of the estate planning worksheet

An effective estate planning worksheet typically encompasses several key components, each critical to creating a detailed and actionable plan. These components help gather pertinent data that you'll refer to when finalizing your plans.

Personal information

The first section captures your personal details, including your name, address, and contact information. Also, include your date of birth, social security number, and citizenship status. This information is vital for legal documentation and identification.

Family information

Next, you’ll provide details about your immediate family, including your spouse (if applicable) and children. Make sure to document their birth dates and any dependents you might have. Understanding your family structure helps ensure that all members are considered in your planning.

Financial overview

A complete breakdown of your assets and liabilities is essential for sound estate planning. In this section, list all forms of real estate, bank accounts, investments, business interests, and personal property. Don’t forget to include your liabilities, such as mortgages, loans, and other debts. This detail will provide a clearer picture of your estate's value.

Insurance policies

Enumerate any insurance policies you have in place, including types like life, health, and disability insurance. Detail the coverage amounts, policy numbers, and designated beneficiaries to ensure accurate execution of your wishes.

Current estate planning documents

Documenting existing wills, trusts, and powers of attorney is vital in assessing your current estate plan. This section should provide a brief overview of any legal documents currently in place, allowing you to identify if updates or revisions are necessary.

Step-by-step guide to filling out the estate planning worksheet

Filling out your estate planning worksheet can initially seem daunting. However, by breaking the process down into manageable steps, you can ensure everything is documented comprehensively.

Gathering personal information

Begin by compiling accurate personal information. Have documents like identification, previous tax returns, and birth certificates ready as reference points. Investing time in accurate record-keeping avoids complications later on.

Assessing your assets and liabilities

Invest effort into valuating your assets—real estate, vehicles, accounts, and more. Make sure to document the most current valuations. Include liabilities to ascertain an accurate net worth, essential in determining the estate distribution.

Understanding your insurance needs

Take a moment to review your current insurance policies. Make notes on coverage levels and identify potential future needs, keeping in mind how these adjustments may impact your overall estate planning.

Documenting existing estate plans

Review current wills and trusts thoroughly. Analyze their relevancy and whether they align with your current life circumstances. This will help you pinpoint what gaps may exist in your current planning and how it can be improved.

Finalizing your worksheet

Once all information is gathered, review the worksheet to ensure that everything necessary is included. It should provide a complete overview, ready for use in legal discussions and planning decisions.

Using the estate planning worksheet template from pdfFiller

pdfFiller offers an excellent estate planning worksheet template that is interactive and user-friendly. With its robust features, you can easily fill out, sign, edit, and manage your worksheet online.

Interactive features

The template is designed to be filled out directly online, allowing you to make real-time edits and updates. This saves physical space and time while providing tools for collaboration should you wish to involve family members or advisors.

Accessing your worksheet from anywhere

Being cloud-based means you can access your completed worksheet from anywhere at any time. You can rest assured that your data is protected with stringent security and privacy measures, making pdfFiller a trustworthy choice for managing your estate documents.

Common questions about estate planning worksheets

As you embark on your estate planning journey, you may have several questions regarding the process and its nuances. Here are some common inquiries.

How often should I update my estate plan? Regularly reviewing your estate plan ensures it reflects your current wishes and circumstances, so it's advisable to revisit it every few years or after significant life events.

What if I have complicated family dynamics? It's crucial to be transparent and perhaps consult a professional if family relationships are intricate, ensuring all parties understand your intentions.

What legal terms should I be aware of? Familiarize yourself with terms like executor, intestacy, and power of attorney, as understanding these can aid in effective estate planning.

Tips for effective estate planning

Navigating the estate planning process can be intricate, but with careful thought and consideration, it becomes manageable. Here are a few tips to enhance your planning experience.

Consult with professionals, including attorneys and financial advisors, to gain insights into the best practices tailored to your situation.

Keep communication lines open with family members regarding your estate plans, which can alleviate confusion and potential disputes later.

Review and modify your plan regularly to adapt to any life changes, such as marriages, births, or financial shifts.

Next steps after completing your worksheet

After you’ve thoroughly completed your estate planning worksheet, it’s time to turn your attention to the logistics of finalizing your plans. The careful organization of your worksheet should flow into actionable next steps.

Utilize professional services to finalize documents, ensuring they comply with legal requirements relevant to your state.

Discuss your estate plan with family members and executors to confirm they understand their roles and your particular wishes.

Store your documents securely, either digitally with pdfFiller or in a safe location, to maintain easy access while ensuring security.

Contact information for assistance

Should you require additional support throughout the estate planning process, pdfFiller offers robust customer service to assist you. From inquiries about the estate planning worksheet template to helping you navigate through filling it out effectively, their team is readily available.

You can reach out to pdfFiller's support through their website for real-time help, ensuring that your estate planning journey is as smooth and informed as possible.