Get the free Arizona Form 140-sbi

Get, Create, Make and Sign arizona form 140-sbi

Editing arizona form 140-sbi online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 140-sbi

How to fill out arizona form 140-sbi

Who needs arizona form 140-sbi?

Understanding Arizona Form 140-SBI: A Comprehensive Guide for Taxpayers

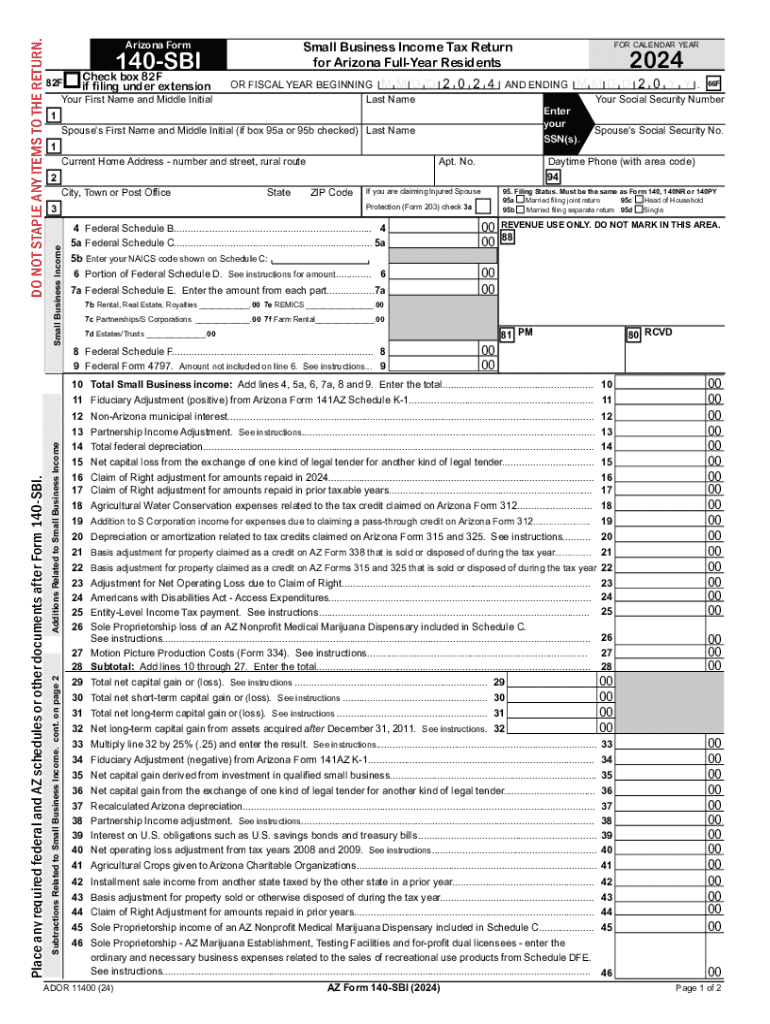

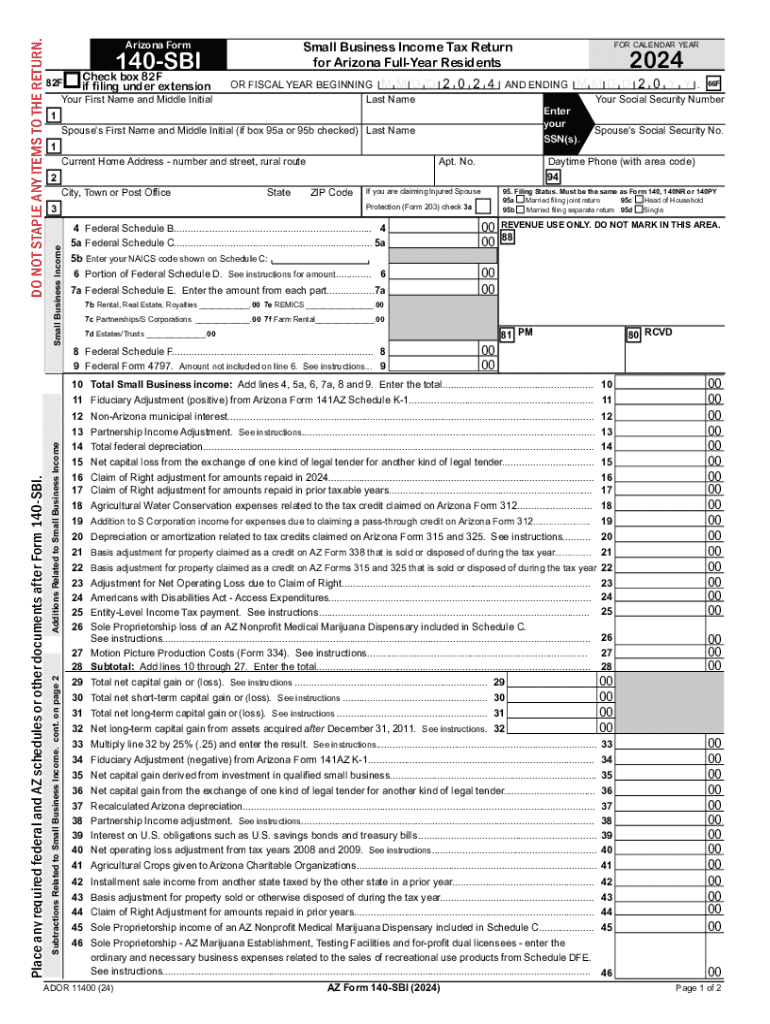

Overview of Arizona Form 140-SBI

Arizona Form 140-SBI, a tax document specifically designed for non-residents and part-year residents of Arizona, serves a critical purpose in enabling taxpayers to report their income accurately. The form is essential for individuals who earn income from sources within Arizona but do not reside in the state throughout the year.

For businesses and taxpayers, understanding the Form 140-SBI is vital as it ensures compliance with Arizona tax laws, helping to avoid unnecessary penalties and fines. Filing this form correctly not only reflects an individual’s financial responsibilities but also assists in accessing various tax benefits and credits available within the state.

Understanding the 140-SBI form

The Arizona Form 140-SBI consists of several key sections that allow taxpayers to provide detailed information necessary for tax assessment. Each section of the form is tailored to ensure that all relevant income and deductions are accurately summarized.

In the 'Personal Information' section, taxpayers need to provide their name, address, Social Security number, and other identifiers essential for the state to process the return efficiently. It’s important to ensure this information is accurate to avoid delays.

When calculating taxable income, taxpayers should follow distinct steps. Begin by adding all sources of income accrued, including wages, business income, and others. After this, applicable deductions and credits can be applied, which may significantly reduce the taxable amount owed.

However, common mistakes often arise in this section. Taxpayers may overlook necessary documentation or miscalculate income. It’s recommended to double-check each entry and have a peer review your form prior to submission.

Step-by-step instructions for completing Form 140-SBI

The process of filing Arizona Form 140-SBI involves several careful steps to ensure accuracy and compliance. Before beginning, it's vital to prepare by gathering all required documents such as W-2s, 1099 forms, and any additional income records.

Next, having a firm understanding of tax-related terminology will make filling out the form smoother. Familiarize yourself with terms such as 'adjusted gross income' and 'tax credits' to navigate the form effectively.

Options for filing your Arizona Form 140-SBI

When it comes to submitting your Arizona Form 140-SBI, taxpayers have two primary options: electronic filing or paper filing. E-filing is encouraged due to its convenience and speed, especially when using platforms like pdfFiller.

The advantages of e-filing include the ability to receive instant confirmation of submission and reduced processing time. Additionally, using pdfFiller allows users to navigate the e-filing process seamlessly. Here’s a brief overview of the e-filing steps:

For those opting for paper filing, it’s essential to ensure accuracy and completeness before mailing the form. Pay special attention to mailing address information to avoid delays in processing. Confirm that all required documents are attached and sent to the correct Arizona Department of Revenue address to prevent any issues.

Editing and managing your Form 140-SBI

One of the key advantages of using pdfFiller is its user-friendly editing capabilities. Should any errors be identified post-filing, editing your Form 140-SBI is straightforward. The pdfFiller platform allows you to make modifications easily.

If you're part of a team, collaborating on the document is seamless. Team members can review and provide input, ensuring that all details are accurate before finalizing the submission. Additionally, managing previous submissions and amendments can be done directly on the platform, ensuring you have a clear record of what has been filed.

Signing your Arizona Form 140-SBI

Signing your Arizona Form 140-SBI is a critical step in confirming the accuracy of the information provided. The importance of eSignatures lies in their legal validity, making them integral in the digital age.

Adding an eSignature using pdfFiller is simple and efficient. Users just need to follow the on-screen instructions to generate a legally binding signature. Ensuring that you sign your tax documents is essential, as failure to do so can lead to processing delays or even rejection of the form.

FAQs about Arizona Form 140-SBI

Understanding common questions surrounding Arizona Form 140-SBI can ease the filing process. Many taxpayers encounter uncertainties when filing, and addressing these can provide clarity.

For instance, a frequent concern is how to correct an error after submission. Taxpayers can amend their form by filing an amended return. Another common question is regarding missed filing deadlines, which can lead to penalties. However, there may be avenues for appeal or penalty relief in such cases.

Troubleshooting common issues

Errors on the Arizona Form 140-SBI can lead to complications if not addressed. Identifying and resolving these errors early in the filing process is essential to ensure compliance with tax regulations. Common issues include incorrect figures, omitted income sources, or missing signatures.

If you encounter problems or have questions, it’s advisable to contact Arizona Tax Assistance. Additionally, using pdfFiller's support features can provide guidance on navigating through the form errors efficiently.

Additional tools and resources available on pdfFiller

pdfFiller provides an array of interactive form features that enhance user experience for tax document management. The platform allows users to integrate Form 140-SBI with other tax documents, creating a seamless filing experience.

Keeping up with tax regulations is critical. pdfFiller offers continuous updates to its document templates and resources, ensuring that users are informed of any changes that may affect their tax filings.

Using pdfFiller for your comprehensive document solution

pdfFiller acts as a one-stop solution for individual and team document needs. Whether you need to fill out, edit, or manage tax documents like the Arizona Form 140-SBI, pdfFiller makes it simple and accessible.

Access to your documents anytime and anywhere means that you can handle your tax obligations on the go. Users consistently report positive experiences with pdfFiller’s ease of use and robust features, providing them confidence in managing their tax documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the arizona form 140-sbi electronically in Chrome?

Can I create an electronic signature for signing my arizona form 140-sbi in Gmail?

How do I edit arizona form 140-sbi straight from my smartphone?

What is arizona form 140-sbi?

Who is required to file arizona form 140-sbi?

How to fill out arizona form 140-sbi?

What is the purpose of arizona form 140-sbi?

What information must be reported on arizona form 140-sbi?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.