Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out property tax bill

Who needs property tax bill?

Your Comprehensive Guide to Property Tax Bill Forms

Understanding property taxes

Property taxes are taxes imposed by local governments on real estate properties, based on the assessed value of the property. These taxes serve as a primary funding source for essential community services such as schools, public safety, infrastructure maintenance, and parks. The tax revenue collected allows local governments to maintain and improve public resources, impacting the quality of life for residents.

The process of tax assessment involves evaluating the value of a property, often conducted annually or biannually by local assessors. They consider various factors including the size of the property, location, market trends, and comparable sales to derive the assessment value. Understanding this process provides insight into the property tax bill you receive.

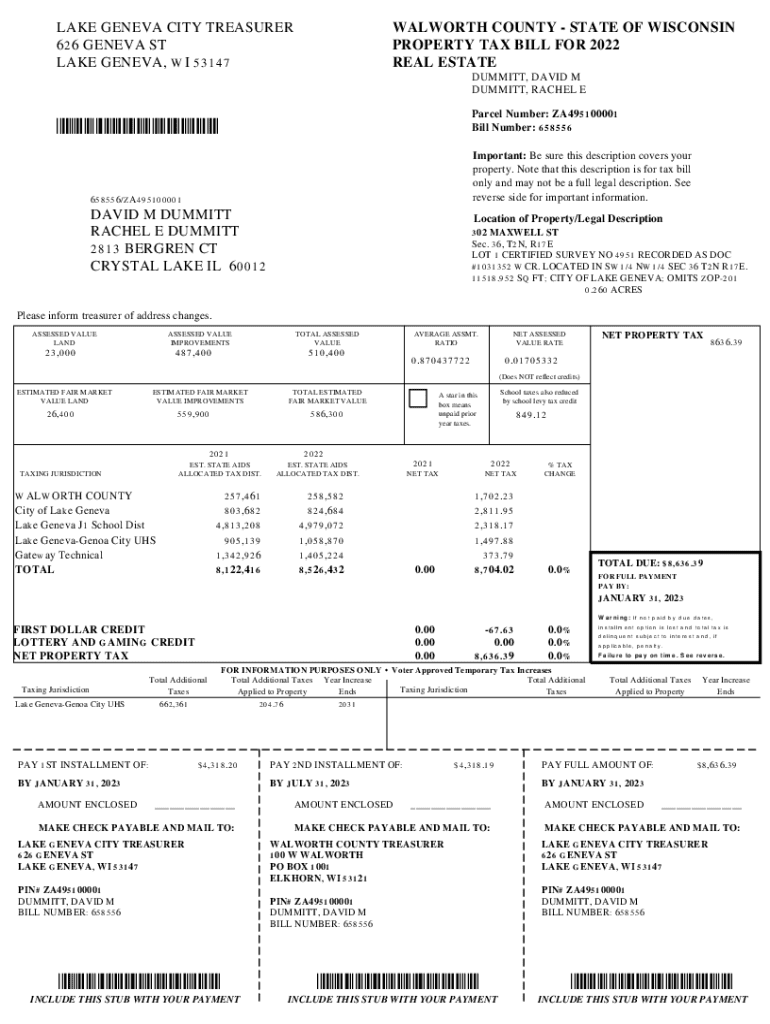

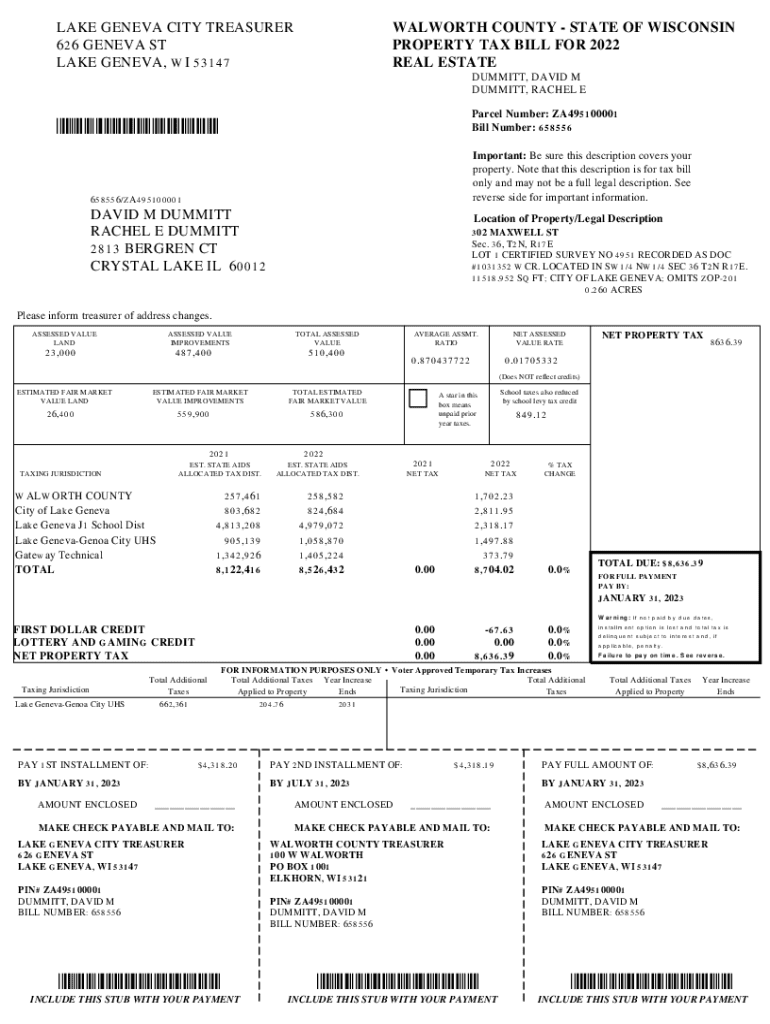

What is a property tax bill?

A property tax bill is an official document that outlines the amount of property tax due for a specific tax period. It includes various essential components that help property owners understand their financial obligations. Key components typically include the assessment value, which reflects the determined market value of the property, and the applicable tax rate consistent with a local jurisdiction's budgetary requirements.

The payment deadlines are also clearly stated on the bill, ensuring property owners are aware of when payments are due to avoid penalties. Additionally, potential exemptions, aimed at offering tax relief to certain qualifying individuals, may also be detailed. Understanding how these bills are calculated helps in budgeting and planning for property expenses.

Accessing your property tax bill

Property tax bills can often be accessed through local government websites. Most municipalities maintain online portals where residents can look up their property tax information. If you're unsure how to find your property tax bill online, follow these steps: First, visit your local tax assessor's website and navigate to the property search section. Input required details such as your property address or parcel number to retrieve your tax bill.

For those who prefer mobile access, some local governments have dedicated applications that allow users to view tax bill information directly from their smartphones. If you prefer a paper copy, you can contact your local assessor's office and request a mail-in bill.

How to fill out the property tax bill form

Filling out a property tax bill form correctly is crucial for ensuring accurate processing. Begin by gathering required information such as your property address and parcel number. Then, carefully read each field on the form; this usually includes sections for assessment value, exemptions claimed, and taxpayer information.

Common mistakes to avoid when filling out the form include incorrect values, missing signatures, and failing to attach required documentation. Properly completed forms aid in timely processing and ensure you receive appropriate tax benefits. Below, you can find examples of correctly filled forms that may serve as a reference.

Editing and signing your property tax bill form

Using tools like pdfFiller for editing your property tax bill form can streamline the process significantly. With pdfFiller, users can edit PDFs effortlessly by adding text, checking boxes, and making other necessary adjustments. Let's walk through the editing tools available: You can add new text, highlight critical information, or delete erroneous entries directly within the document.

Moreover, pdfFiller allows users to insert digital signatures securely. This feature is especially valuable for co-owners or when legal advisors need to review and approve the document. Collaborating and making necessary adjustments has never been easier.

Submitting your property tax bill form

After completing the property tax bill form, it's vital to ensure it is submitted in accordance with the guidelines provided by your local government. For online submissions, follow the specific instructions on their website to avoid complications. Alternatively, if you prefer or are required to mail your submission, use the address specified on the form and ensure it is sent with plenty of time before the deadline.

Deadlines can vary significantly depending on your jurisdiction, usually occurring annually. If you happen to miss the deadline, it's essential to understand the procedures for addressing late submissions. Your municipality's tax office can provide guidance on possible solutions.

Managing and tracking your property tax payments

Keeping track of property tax payments is crucial for effective financial management. Setting up payment alerts can help you stay informed about upcoming due dates and avoid late fees. Many local governments offer online portals where you can view your payment history. These portals often provide additional features, including printable statements for tax preparation.

By regularly accessing and managing your property tax records through these local services and utilizing platforms like pdfFiller, you can maintain organized records and ensure compliance with your local tax laws.

Understanding penalties and appeals

Late payments on property taxes can incur penalties that range from a flat fee to a percentage of the overdue amount. It is essential to be aware of these penalties, as they can affect your overall financial standing. If you find yourself penalized unfairly, most jurisdictions allow you to request a penalty cancellation. This process often requires documentation to support your request.

If you disagree with your property's assessed value, you have the right to appeal the assessment. The appeal process typically requires presenting evidence to support your case, such as comparable sales data or proof of property conditions. It's beneficial to understand the common scenarios for appeals, as they provide context in preparing your case.

Additional resources and support

Accessing relevant resources can significantly enhance your understanding of the property tax process. Links to local tax assessors and departments are invaluable for obtaining specific information about local procedures and deadlines. For assistance with pdfFiller, their customer service options, including chat support, can help you navigate the platform efficiently.

Moreover, user guides and tutorials provided by pdfFiller serve as excellent references for learning how to utilize various tools effectively. Lastly, subscribing for tax due date reminders can help you stay ahead in managing your property tax obligations.

Exploring related forms and documents

In addition to the property tax bill form, there are several other relevant forms that you may encounter throughout the taxation process. Exemption applications help property owners claim relief from certain taxes, while payment change forms can be used to modify payment methods or schedules. Variance applications may also be necessary if you dispute specific assessment decisions.

For convenience, local government websites typically house these forms, providing easy access to the necessary documentation for various tax-related needs.

Language assistance

Ensuring accessibility for all property owners, many local governments offer property tax forms in multiple languages. This initiative aims to assist non-English speakers in understanding their tax obligations and rights fully. If you require forms in other languages, check your local assessor's website or resources like pdfFiller, which may offer language assistance.

Additionally, language help resources often include customer support that can accommodate various language preferences, allowing for smoother communication and understanding.

Navigating property tax information by state

Property tax laws can differ significantly from one state to another, impacting how property taxes are assessed and collected. To navigate these laws effectively, it's crucial to familiarize yourself with state-specific regulations and processes. For those looking for detailed information, many state websites provide guides and resources tailored to their residents.

Utilizing resources that break down these variations can help ensure that property owners stay compliant and make informed financial decisions regarding their property taxes.

Current updates and announcements

Staying informed about tax-related changes is crucial for property owners. Local governments regularly release announcements pertaining to tax rates, exemptions, and changes in tax law that can affect your financial obligations. Subscribing to updates from your local tax office or following their social media accounts can help you remain aware of these critical updates.

It’s essential to keep track of local government notices, especially during tax season, as they may introduce new opportunities for exemptions or adjustments that could benefit property owners.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pdffiller form in Chrome?

Can I create an electronic signature for signing my pdffiller form in Gmail?

How do I fill out the pdffiller form form on my smartphone?

What is property tax bill?

Who is required to file property tax bill?

How to fill out property tax bill?

What is the purpose of property tax bill?

What information must be reported on property tax bill?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.