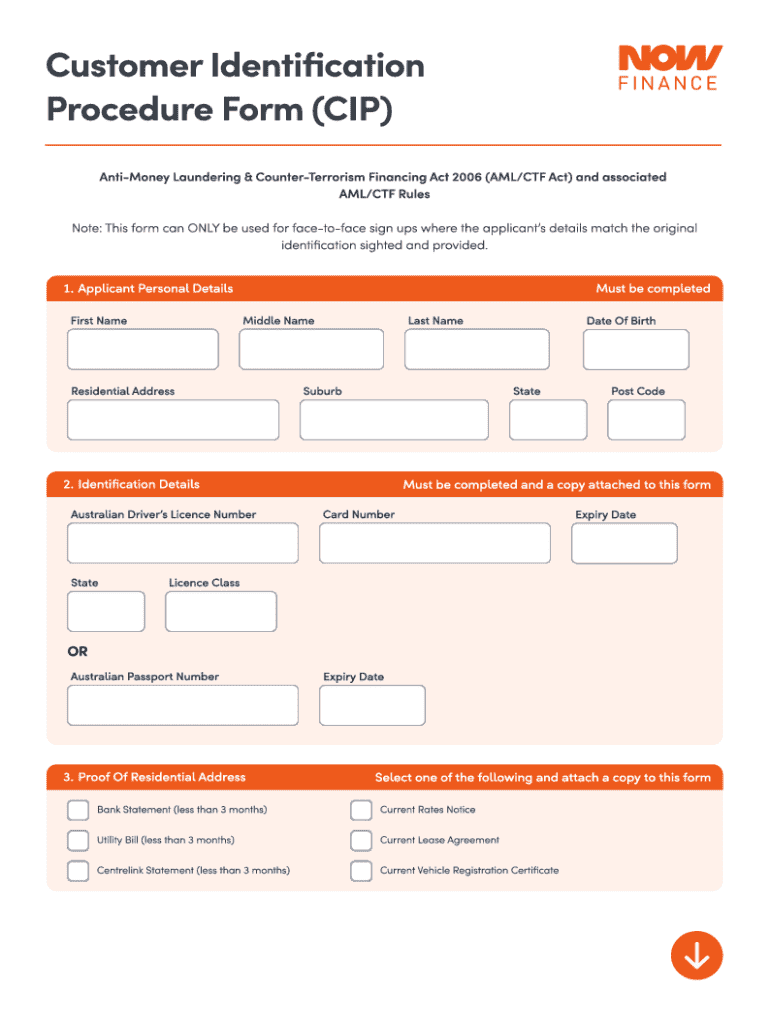

Get the free Customer Identification Procedure Form (cip)

Get, Create, Make and Sign customer identification procedure form

How to edit customer identification procedure form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer identification procedure form

How to fill out customer identification procedure form

Who needs customer identification procedure form?

Understanding the Customer Identification Procedure Form

Overview of the customer identification procedure form

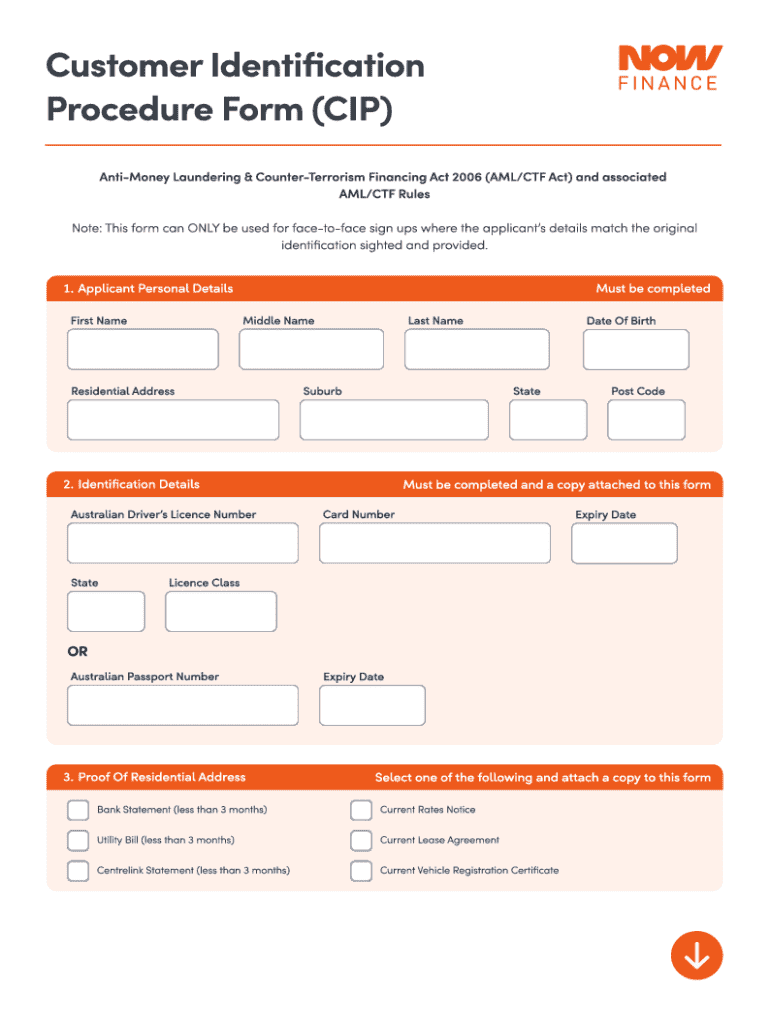

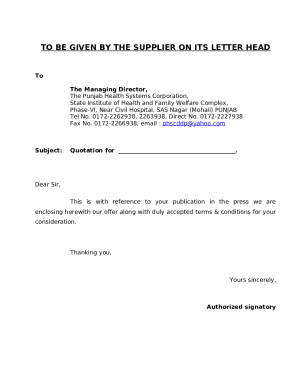

The customer identification procedure form serves as a crucial document in varying financial transactions, designed primarily to verify the identity of customers before services are rendered or accounts are opened. This form plays a key role in safeguarding financial institutions against risks like fraud, money laundering, and terrorist financing by ensuring they have accurate information about their clients.

The importance of compliance with this procedure cannot be overemphasized. Banks and financial services must adhere to stringent guidelines set forth by regulators to protect both their operations and the greater financial system. By utilizing a customer identification procedure form, institutions can minimize risk while fostering trust with their clientele.

Understanding regulatory requirements

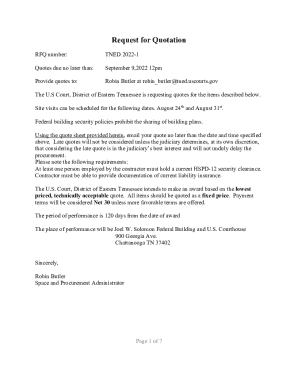

The USA PATRIOT Act significantly reshaped the landscape of customer identification for financial institutions in an effort to bolster national security. This Act requires financial entities to establish a robust customer identification program, which primarily hinges on the completion of the customer identification procedure form. All entities subjected to the act, including banks, credit unions, brokerages, and money service businesses, are mandated to secure identification from customers seeking to open accounts.

In terms of compliance, it is not only the financial institutions that bear the responsibility. Individuals engaging in relevant transactions also need to understand the requirements thoroughly. Failure to comply with the regulations can lead to severe penalties, including substantial fines and potential criminal charges for institutions and individuals alike.

Key components of the customer identification procedure form

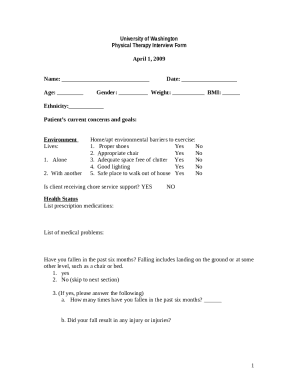

The customer identification procedure form typically requires several key pieces of information to verify a person's identity adequately. Firstly, the individual’s personal identification data is essential; this data typically includes their full name, Social Security number (or equivalent), and perhaps a unique identifying number if they are non-U.S. citizens. Additionally, providing proof of residential address is standard practice to further authenticate a customer's identity.

The date of birth is another critical element required on the form to preclude identity theft. Alongside the information, specific documentation might be needed, such as government-issued IDs and proof of address, like utility bills or bank statements, to support the claims made on the form. Lastly, signatures and dates of completion finalize the verification process and confirm the applicant's submission.

Step-by-step guide to completing the customer identification procedure form

Filling out the customer identification procedure form accurately is vital for compliance and can streamline the account setup process. Here’s a straightforward step-by-step guide to assist individuals in completing it effectively.

For best practices, ensure that you double-check each field for accuracy, as common mistakes often lead to delays in processing applications.

Tools for filling out the customer identification procedure form

Utilizing effective tools can make the process of completing and managing the customer identification procedure form seamless. For instance, pdfFiller provides interactive PDF features that allow you to fill out forms effortlessly online. The ability to use digital signatures not only promotes authenticity but also speeds up the submission process, as physical printing is eliminated.

Additionally, pdfFiller offers guides for editing and managing your forms all in one cloud-based platform. This enhances document accessibility for both teams and individuals, as you can retrieve or modify forms from anywhere at any time, ensuring you are never bogged down by paperwork.

Frequently asked questions (FAQ)

It's common for individuals to have queries regarding the necessity and specifics of the customer identification procedure form. Below are some frequently asked questions that can help clarify common doubts.

Common scenarios requiring the customer identification procedure form

The customer identification procedure form becomes essential in several financial situations. For instance, when opening a new bank account, customers must provide this form to establish their identity and comply with regulatory requirements. Similarly, applying for loans—be it personal, mortgage, or auto loans—necessitates this document to assess creditworthiness and manage risk effectively.

Investment procedures, particularly with brokerage firms, similarly require clients to complete this form. This process aids in aligning the investor's profile with the firm's policies and regulatory standards. Other financial service situations such as money transfers, online payment services, and even cryptocurrency exchanges are also instances where submitting the customer identification procedure form is mandatory.

Best practices for managing your customer identification procedure form

Managing your customer identification procedure form effectively is key not just for compliance but for keeping your private information secure. Consider employing document storage solutions that safeguard sensitive data while ensuring accessibility when needed. Various cloud services, including pdfFiller, emphasize safe storage, aiding users in keeping their documents organized.

Furthermore, ensuring privacy and security of your personal information is paramount. Use passwords and encryption where applicable to protect your files from unauthorized access. Regular updates and maintenance of your forms can also enhance their validity and ensure you are using the most current regulations as a guideline for completion.

Customer experiences and testimonials

Customers utilizing pdfFiller have shared positive experiences while navigating the customer identification procedure form. Using the platform made it easier for many to understand complex requirements and significantly reduced processing times. Success stories highlight the efficiency of digital signatures and document management, leading to smoother interactions with financial institutions.

Experts in the field emphasize that leveraging tools like pdfFiller for form management can streamline your administrative tasks. By opting for an integrated approach, teams can collaborate effectively, resulting in fewer errors and faster completion times. It transforms a potentially tedious process into a straightforward, user-friendly experience.

Additional considerations

It's worthwhile to view the customer identification procedure form within the broader context of personal financial management. This form is not just a checklist item but a foundational element in fostering a robust relationship with financial institutions. Proper execution leads to greater ease in accessing various financial products and services in the future.

Additionally, individuals should remain aware of potential regulatory updates that could affect their obligations and processes related to the customer identification procedure form. Being proactive about regulations enables effective compliance in changing environments, thus keeping financial activities secure and structured.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the customer identification procedure form in Chrome?

How can I edit customer identification procedure form on a smartphone?

How do I fill out the customer identification procedure form form on my smartphone?

What is customer identification procedure form?

Who is required to file customer identification procedure form?

How to fill out customer identification procedure form?

What is the purpose of customer identification procedure form?

What information must be reported on customer identification procedure form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.