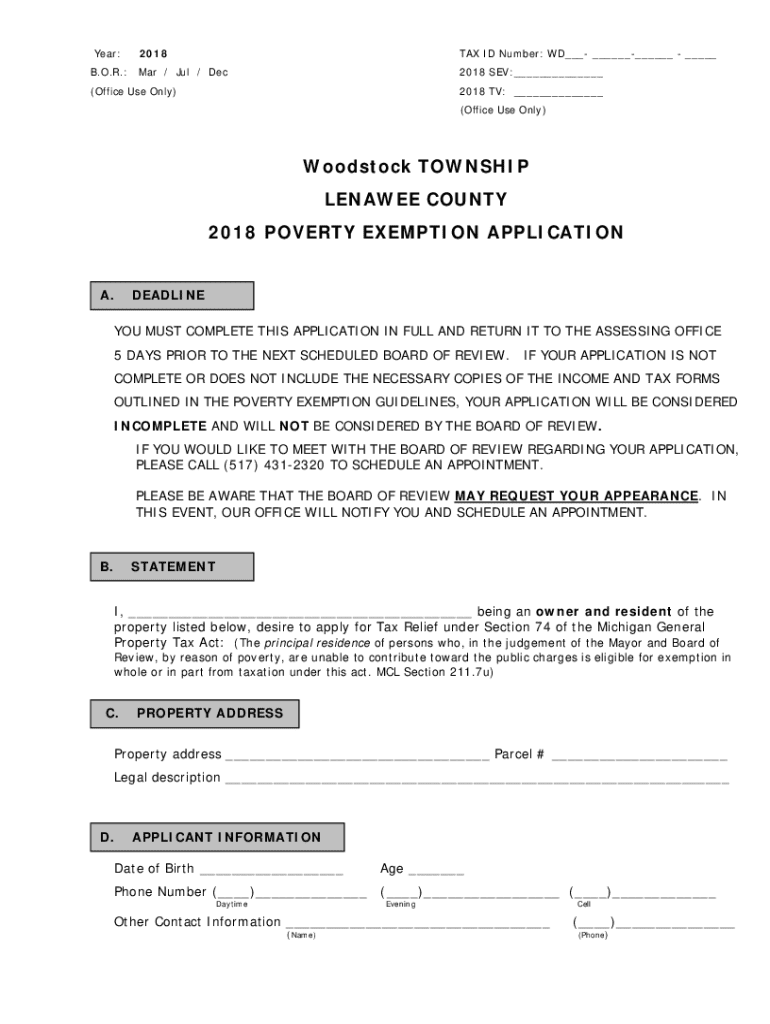

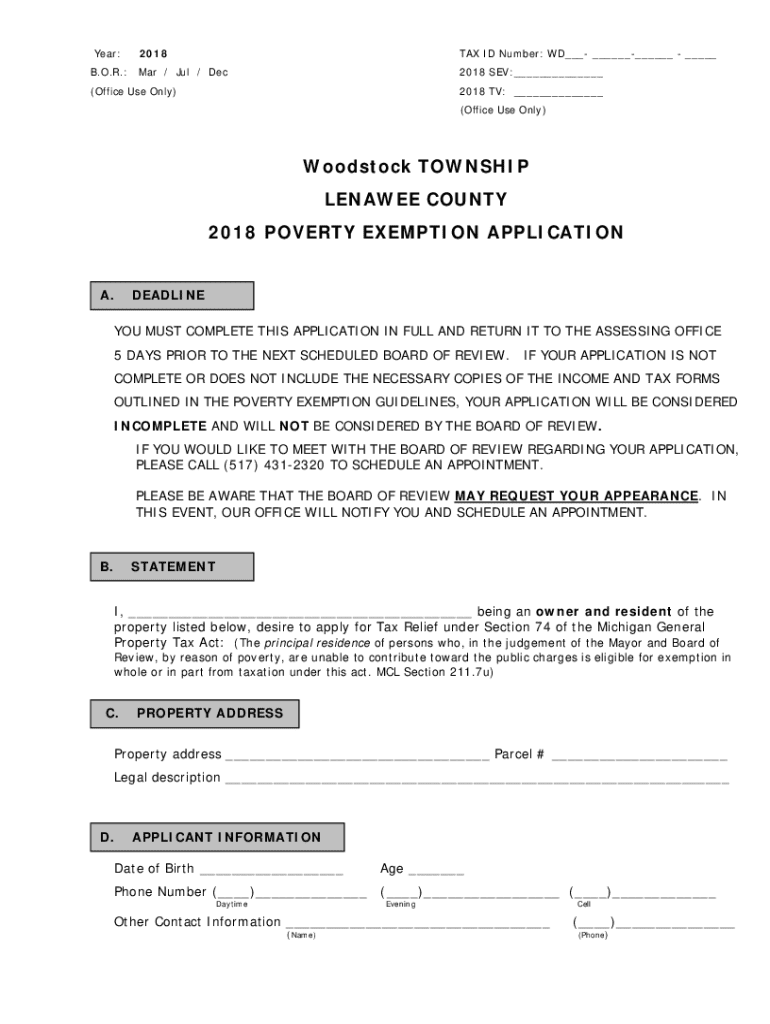

Get the free 2018 Poverty Exemption Application

Get, Create, Make and Sign 2018 poverty exemption application

Editing 2018 poverty exemption application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2018 poverty exemption application

How to fill out 2018 poverty exemption application

Who needs 2018 poverty exemption application?

2018 Poverty Exemption Application Form: How to Navigate the Process Effectively

Understanding the 2018 Poverty Exemption

The 2018 Poverty Exemption is a crucial program designed to alleviate financial burdens on low-income individuals, allowing them to qualify for tax exemptions. This exemption can significantly reduce property taxes, thereby making housing more affordable for eligible households. For many, it serves as a lifeline, providing the much-needed financial breathing space they require.

Eligibility criteria for the 2018 application

To qualify for the 2018 Poverty Exemption, applicants must meet specific eligibility criteria that include income limits and asset restrictions. Typically, the income floor is based on local median household earnings, which means it can vary depending on your location. In many regions, a household’s total annual income must remain below 200% of the federal poverty level to qualify.

Additionally, applicants are often subject to asset limits — including savings, property value, and other resources. Understanding these limitations is crucial; applicants should ensure their total countable assets do not exceed the defined threshold. Finally, there may be other qualifying conditions, such as age or disability status, that can affect eligibility.

Preparing to apply for the poverty exemption

Preparing to fill out the 2018 Poverty Exemption application requires careful organization of necessary documents. Begin by gathering all relevant paperwork which will demonstrate your financial situation clearly. Essential documents include W-2s, tax returns, and paycheck stubs to verify income. Additionally, bank statements and any evidence of personal loans or debts can establish your asset base.

Personal identification such as a valid driver's license or Social Security card is also critical. This helps validate your identity during the application process. Alongside gathering documents, being aware of application deadlines is vital. Each state or locality may have its own key submission dates that align with the fiscal year implications. Mark these deadlines on your calendar to ensure timely submission.

Navigating the 2018 poverty exemption application form

Once the paperwork is gathered, the next step is to navigate the 2018 Poverty Exemption Application form itself. The form typically comprises several sections: personal information, income details, asset information, and a declaration. Accurate reporting is vital; each section demands precise information as incorrect details can delay the process or even result in denial of the exemption.

Common mistakes to avoid include leaving sections incomplete. Double-check for accuracy and clarity, especially regarding reported income and assets. Even minor errors can lead to unintended complications, such as additional requests for information or outright denial.

Submitting the 2018 poverty exemption application

Once the application form is completed, it’s essential to know where to submit it. In most cases, applications can be submitted to local government offices or tax assessor offices. Depending on your area, online submission options may also be available, making the process quicker and more convenient.

Understanding the review process is also critical. After submission, expect a review period during which local officials verify your information against the submitted documentation. Typical review timelines can vary significantly; thus, inquiring about the expected timeframe can help manage your expectations.

Post-submission: Managing your application status

After submitting your application, it's essential to monitor its status actively. Most local tax offices provide online resources allowing you to check your application’s progress. If online tracking is not an option, reaching out to local offices by phone or in-person can help you gather updates.

If local officials require additional information, respond promptly. Prepare any supportive documentation requested and understand that there are typically deadlines for these responses. Staying organized and proactive can significantly aid the approval process.

Tips for maximizing your chances of approval

When applying for the 2018 Poverty Exemption, several key factors can influence approval rates. Providing accurate information is paramount, but detailing your financial circumstances may strengthen your case. Consider drafting a personal statement that justifies your need for the exemption, presenting a well-rounded view of your financial situation.

Using pdfFiller to simplify your application process

One of the best ways to manage the 2018 Poverty Exemption application is through pdfFiller. This platform enables users to edit PDFs seamlessly, ensuring all aspects of your application are accurate and polished. You can fill out the form digitally, making adjustments as necessary without the hassle of printing and re-scanning.

pdfFiller's features facilitate electronic signatures, which simplify document submission. This cloud-based service helps in streamlining document management as well, allowing you to store all related documents in one safe location. Considering the collaborative nature of the platform, you can easily share the form with family members or advisors for feedback.

Updates and changes for future exemption applications

While focusing on the 2018 Poverty Exemption, it's wise to keep an eye on potential updates for future applications. Local governments sometimes adjust eligibility criteria based on shifting economic conditions or budgetary constraints. Staying informed about any changes can aid in timely preparations for subsequent applications.

Resources such as local government websites, community forums, or newsletters are valuable for keeping abreast of policy changes. Signing up for notifications related to poverty exemptions ensures that you won’t miss out on crucial updates affecting your applications.

Community resources and support

Navigating the application process can feel overwhelming; however, numerous community resources can offer support. Local organizations and non-profits often provide assistance with completing the 2018 Poverty Exemption application. These groups typically hold workshops, offer one-on-one consultations, and provide helpful materials that simplify the process.

Legal aid services can also assist individuals facing potential challenges in securing their exemption. Community workshops focusing on financial education may not only help with the application process but can also provide a greater understanding of financial literacy as it relates to poverty alleviation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2018 poverty exemption application?

How do I complete 2018 poverty exemption application on an iOS device?

Can I edit 2018 poverty exemption application on an Android device?

What is 2018 poverty exemption application?

Who is required to file 2018 poverty exemption application?

How to fill out 2018 poverty exemption application?

What is the purpose of 2018 poverty exemption application?

What information must be reported on 2018 poverty exemption application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.