Get the free Product Contamination Insurance Application

Get, Create, Make and Sign product contamination insurance application

Editing product contamination insurance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out product contamination insurance application

How to fill out product contamination insurance application

Who needs product contamination insurance application?

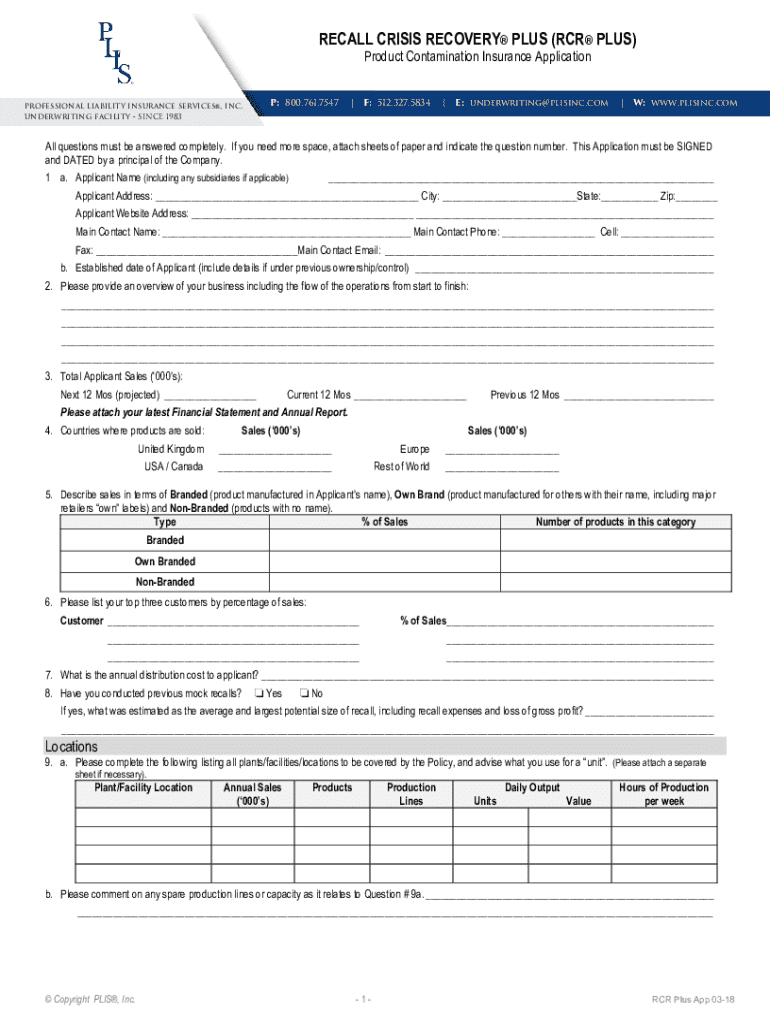

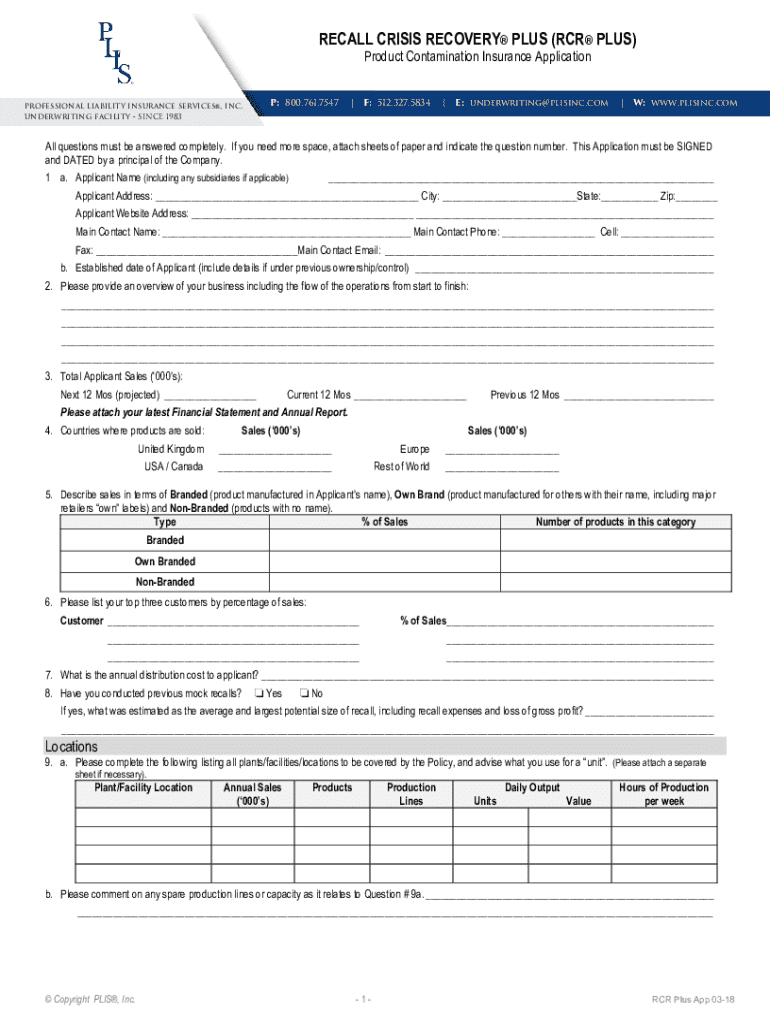

Understanding and Completing the Product Contamination Insurance Application Form

Understanding Product Contamination Insurance

Product contamination insurance protects businesses against the risks associated with contaminated goods that can cause harm to consumers. This type of insurance covers claims arising from illnesses or injuries caused by faulty products, providing a crucial safety net for manufacturers and suppliers.

The importance of having product contamination insurance cannot be overstated. It safeguards against not only potential legal actions and liability claims but also the significant financial losses that can accompany product recalls and reputation damage. Companies without this coverage risk their financial stability and long-term viability.

The application process for product contamination insurance

The application process for product contamination insurance can seem daunting, but understanding the steps involved can simplify it immensely. Typically, insurers require comprehensive details about your business, the products you manufacture or distribute, and the risks associated with potential contamination.

Essential information required on the application form includes business information details that provide context about your company, product specifics to assess contamination risks, and financial information demonstrating your business's stability. Accurately completing this form is vital; it not only influences your coverage but also how insurers will assess your risks.

Step-by-step guide to filling out the application form

The first section of the product contamination insurance application form requires basic company information. You will need to provide your company name, address, contact details, and the structure of your business, whether it is a sole proprietorship, partnership, or corporation.

Moving on to product information, it is crucial to clearly describe the products your business makes or sells. Include specifics about the production and distribution processes, as these details enumerate potential contamination risks associated with them. Furthermore, the risk assessment section should outline identifying potential contamination risks, safety measures currently in place, and any previous claims history that may impact your new application.

Editing and finalizing your application

Once the application form is filled out, it's essential to review and ensure it accurately reflects all necessary details. Utilizing pdfFiller's interactive tools can streamline the document editing process. You can upload your application form and make real-time edits and corrections to ensure no critical information is missing.

Before finalizing your application, it’s wise to have a checklist for a thorough review. Double-check all sections for completeness and verify that your contact information is current to avoid delays in processing.

E-signing and submission of the application

In today's digital landscape, e-signatures have become essential for the application process, providing a quick and secure way to sign documents. pdfFiller offers a straightforward approach to e-sign your application. This can be achieved by following simple steps within the platform, ensuring that your signature is legally recognized.

After signing your application, submitting it through pdfFiller is easy. You'll receive a confirmation of submission, which can typically take a few days for your application to be reviewed, so understanding the timeline can help with your business planning.

Managing your product contamination insurance

Once your application is submitted, it's crucial to keep track of its status. Regular follow-ups can ensure that you remain informed, especially if insurers require additional documentation or clarification. Whether you need to store your insurance documents securely or need easy accessibility, pdfFiller offers features that make managing your documents a breeze.

The benefits of using pdfFiller extend beyond submission. You can access your files from any device, simplifying the process of renewing and modifying your policy. Furthermore, reaching out to your insurance provider for follow-up inquiries can be easily managed through features available in the pdfFiller tool.

Exploring additional resources and support

Accessing reliable resources can aid your understanding of product contamination insurance. Platforms like pdfFiller provide various document templates that can facilitate the entire application process. Additionally, a knowledge base for FAQs specifically about product contamination insurance can guide you through common questions and concerns.

Furthermore, connecting with experts in the field can offer personalized support, helping you navigate nuances in your application or specific issues related to your business’s products.

Understanding coverage and policy details

When obtaining product contamination insurance, it’s crucial to familiarize yourself with the coverage options available. Policies may vary, offering different limits, inclusions, and exclusions. Understanding these details is essential for ensuring your business has adequate protection against contamination-related claims.

Factors influencing your premium costs include your product types, the scale of your business, and your overall claims history. A company that has implemented rigorous safety standards and has a clean claims record may benefit from lower premiums compared to those with a history of claims.

Highlighting success stories

Examining case studies of businesses that effectively managed product contamination claims reveals valuable lessons. One notable instance involved a food manufacturer who rapidly addressed a contamination issue by recalling affected products and implementing comprehensive safety measures, resulting in minimal long-term impact on their brand.

Such stories underline the importance of having robust insurance coverage coupled with proactive safety practices, ensuring that a business can navigate challenges related to product contamination while preserving its reputation.

Industry trends and regulatory changes

The landscape of product contamination is constantly evolving, influenced by emerging trends and regulatory changes. Understanding these developments is essential for staying compliant and ensuring the effectiveness of your insurance coverage. Keeping abreast of new safety standards is crucial for manufacturers and suppliers alike.

For instance, as regulations tighten around food safety and product recalls, businesses must prepare themselves to navigate these complexities, ensuring that their insurance policies adequately protect against potential fallout from compliance failures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete product contamination insurance application online?

How do I edit product contamination insurance application online?

Can I sign the product contamination insurance application electronically in Chrome?

What is product contamination insurance application?

Who is required to file product contamination insurance application?

How to fill out product contamination insurance application?

What is the purpose of product contamination insurance application?

What information must be reported on product contamination insurance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.