Get the free Monthly Return of Equity Issuer on Movements in Securities

Get, Create, Make and Sign monthly return of equity

How to edit monthly return of equity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly return of equity

How to fill out monthly return of equity

Who needs monthly return of equity?

Monthly Return of Equity Form: A Comprehensive Guide

Understanding monthly return of equity

Return on Equity (ROE) is a financial performance metric that measures the ability of a company to generate profits from its shareholders' equity. It is calculated by dividing net income by shareholders' equity. Monitoring ROE on a monthly basis is crucial for identifying trends, assessing financial health, and making timely business decisions. Monthly reports play a pivotal role in financial analysis, offering insights into business performance and informing strategic planning.

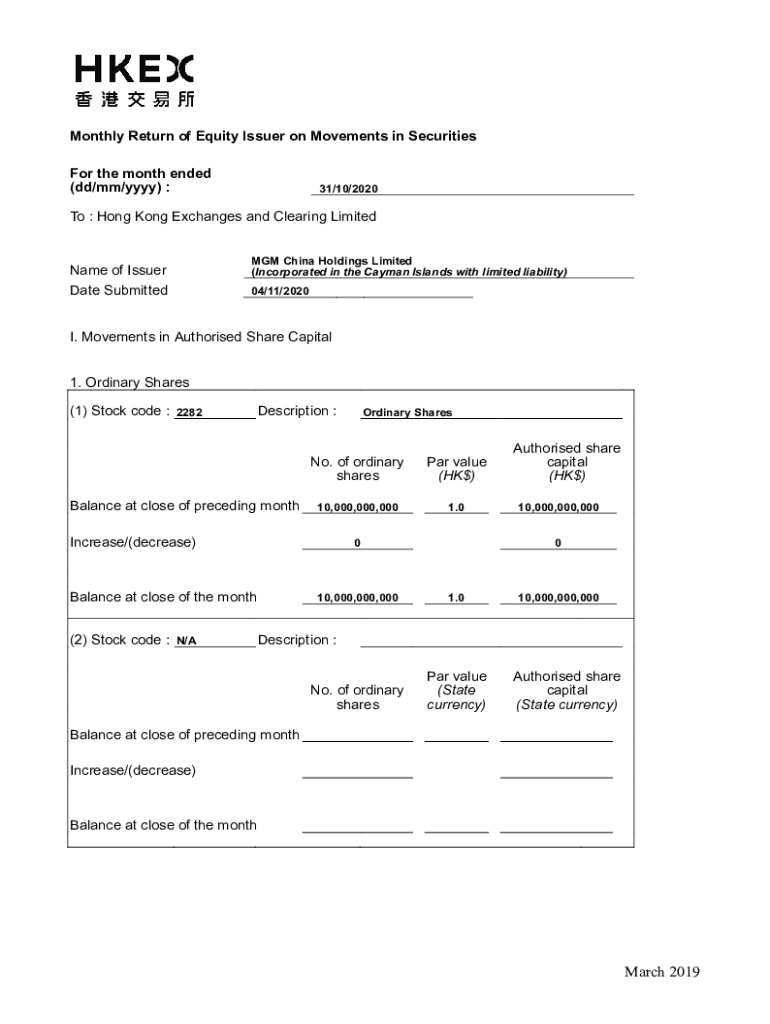

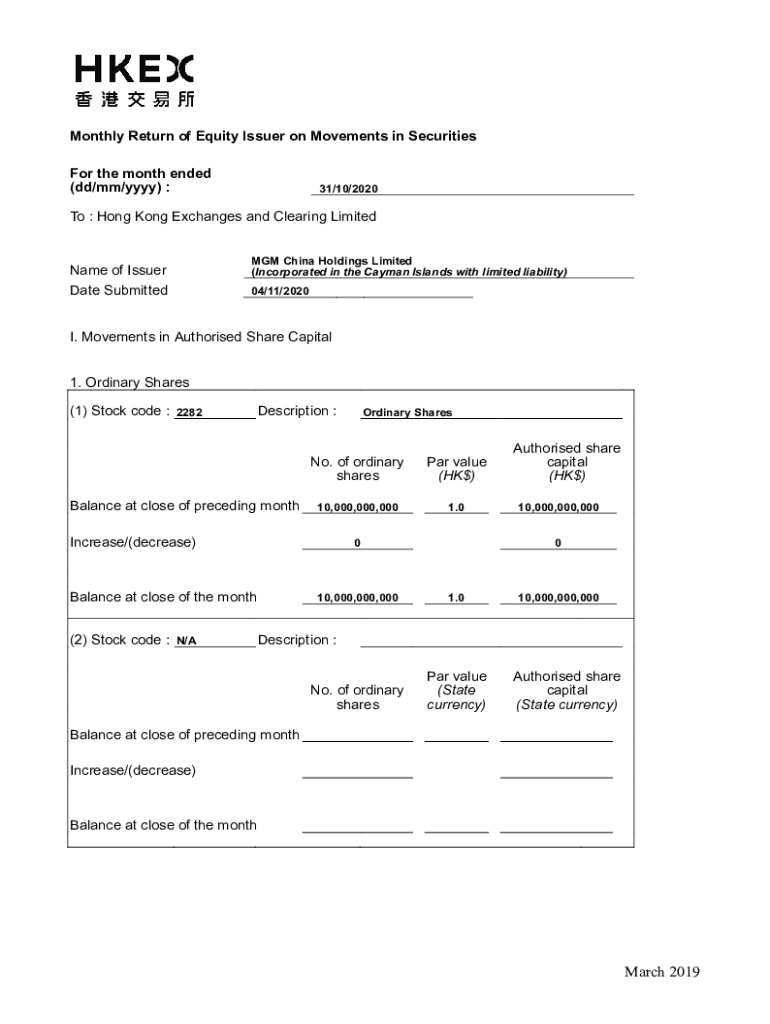

Components of the monthly return of equity form

The Monthly Return of Equity Form consists of several components that facilitate accurate assessments. Understanding key terminology is vital for ensuring precision in reporting. Terms such as 'equity', 'net income', and 'assets' are foundational for accurate calculation.

The structure of the form typically includes sections for recording company identification data, financial metrics, and calculations necessary to derive the ROE. Each field corresponds to specific inputs needed for the monthly calculations, emphasizing clarity and ease of use.

Filling out the monthly return of equity form

Completing the Monthly Return of Equity Form requires attention to detail and a systematic approach. Start by gathering necessary financial data such as income statements and balance sheets before proceeding with the form.

For each section, it is advisable to record figures accurately and verify them against the accounting records. Use examples to illustrate common practices: when filling in net income, ensure it reflects the most recent month’s results and shows a true picture of financial performance.

Calculating monthly return on equity

The formula for calculating ROE is straightforward: (Net Income / Equity) x 100. This percentage indicates how effectively a company is using shareholders' equity to generate net income. A higher ROE suggests efficient management and a profitable company.

Several factors can influence monthly ROE, including seasonal business changes and economic conditions. For example, companies in retail might see variances in ROE during holiday seasons as net income peaks. Understanding these fluctuations can provide valuable context for monthly results.

Analyzing monthly return of equity results

Interpreting your monthly ROE involves understanding what high or low figures signify about your business. A high ROE usually indicates strong financial performance, business efficiency, and potential for growth, while low ROE might suggest the need for operational improvements.

To effectively analyze ROE, it is vital to compare results across different periods. Tracking the trends rather than isolated figures provides a clearer picture of financial health and operational performance.

Use cases for the monthly return of equity form

The Monthly Return of Equity Form serves various purposes across different roles in finance. For individual investors, tracking ROE monthly aids in making informed investment choices. Observing how a company's ROE changes over time can signal strong or weak performance.

For business owners and managers, monitoring ROE closely can illuminate areas for improvement and inform strategic planning. Setting financial goals in alignment with ROE allows businesses to drive performance more effectively. Financial analysts and advisors can leverage this form in advising clients and guiding investment decisions.

Interactive tools and resources available on pdfFiller

pdfFiller offers several tools that streamline the process of completing the Monthly Return of Equity Form. With online editing features, users can customize their forms easily, adjusting fields to suit their specific reporting needs.

The eSignature capabilities allow for quick digital signing and efficient sharing, reducing the need for physical paperwork. Additionally, pdfFiller's collaborative tools enable team members to work together seamlessly, enhancing productivity and clarity.

Common pitfalls and considerations

While ROE is a valuable metric, it has its limitations. Overreliance on ROE alone can be misleading, as it does not account for factors like debt levels or market conditions. It's essential to contextualize ROE within a broader financial framework to gain a true understanding of company performance.

Alongside this metric, consider integrating additional financial indicators to paint a complete picture of your business's health. Analyze cash flow, debt ratios, and return on assets to provide a well-rounded view of company performance.

Frequently asked questions (FAQs)

Questions about the Monthly Return of Equity Form often arise. Common inquiries include how to maintain accuracy in calculations, how to ensure compliance with financial reporting standards, and the best practices to enhance the integrity of data gathered for reporting.

It's also important to clarify uncertainties regarding how often to update the form and whether external auditors should verify reported data. Ensuring clarity on these topics can significantly boost the utility and reliability of the Monthly Return of Equity Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete monthly return of equity online?

How do I make edits in monthly return of equity without leaving Chrome?

Can I create an electronic signature for signing my monthly return of equity in Gmail?

What is monthly return of equity?

Who is required to file monthly return of equity?

How to fill out monthly return of equity?

What is the purpose of monthly return of equity?

What information must be reported on monthly return of equity?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.