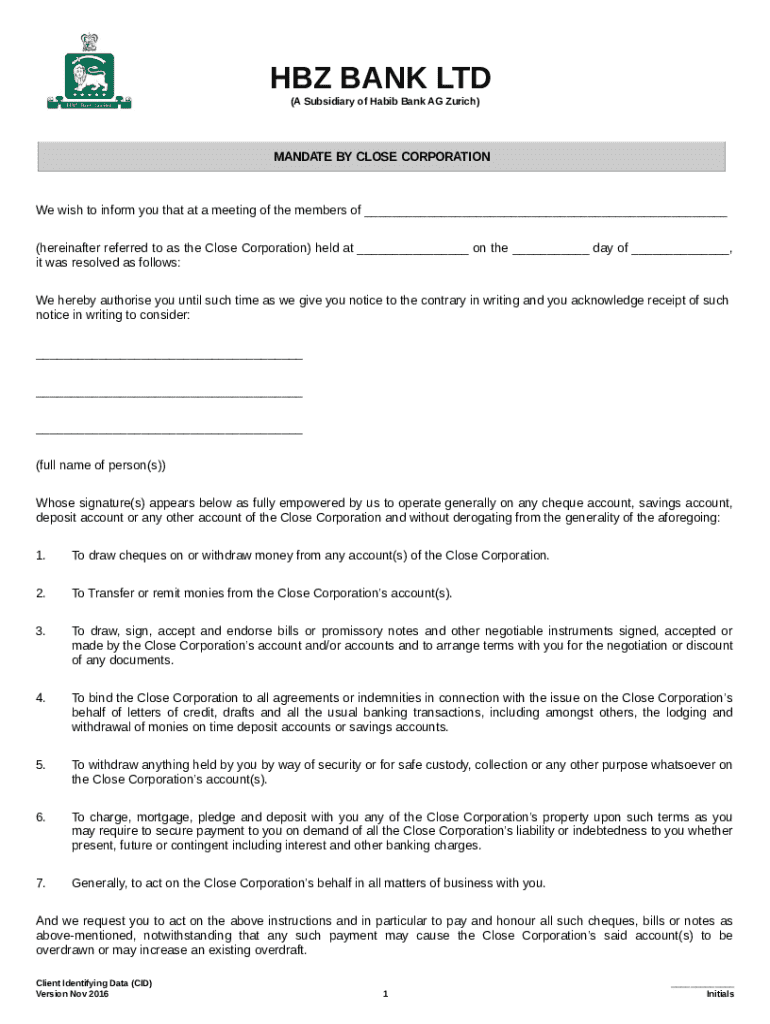

Get the free Mandate by Close Corporation

Get, Create, Make and Sign mandate by close corporation

Editing mandate by close corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mandate by close corporation

How to fill out mandate by close corporation

Who needs mandate by close corporation?

Understanding the Mandate by Close Corporation Form: A Comprehensive Guide

Understanding close corporations and the mandate requirement

Close corporations are unique business structures that offer limited liability to their owners while enabling them to manage their operations with a higher degree of flexibility than typical corporations. Distinct from traditional corporations, close corporations often have a limited number of shareholders, which allows for easier decision-making and operational control.

The mandate by close corporation form is crucial for establishing official governance and operational frameworks. It acts as a declaration of authority granted to specific individuals or groups within the corporation to act on its behalf. This mandate is essential for ensuring that all business activities are conducted in compliance with corporate laws and internal regulations.

Key elements of the mandate by close corporation form

Filling out the mandate by close corporation form requires specific information to ensure legal compliance and proper record-keeping. Essential details include the name of the corporation, registered agent, and shareholder information. Each of these components carries weight in establishing the legitimacy of the mandate and safeguarding the corporation's interests.

Creating an accurate and complete filing is vital. Incorrect or incomplete details can result in delays or even legal challenges. The signature requirements must also be met to validate the form, which often necessitates signatures from key stakeholders within the corporation.

Step-by-step guide to filling out the mandate by close corporation form

Filling out the mandate by close corporation form can be straightforward if approached methodically. Here’s a step-by-step guide to assist individuals and teams in ensuring a proper submission.

Common pitfalls in filing the mandate by close corporation form

Navigating the complexities of the mandate by close corporation form can present challenges. Common pitfalls in the filing process often lead to disruptions, delays, or rejections. Awareness of these pitfalls can save time and resources for corporations.

One frequent error is providing incomplete information, which can invalidated the filing. Another common issue is obtaining incorrect signatures or the absence of required endorsers. These errors can lead to unnecessary delays, as they require resubmission and could incur additional fees.

Legal considerations for close corporations in mandate filings

Legal considerations are crucial for close corporations, especially regarding mandate filings. Each state may have specific regulations governing what information must be disclosed, who can hold a mandate, and how often these mandates must be updated.

Engaging legal counsel can provide immense value, guiding corporations through the nuances of state-specific regulations. Non-compliance can have serious consequences, ranging from financial penalties to the invalidation of corporate actions taken without proper mandate authority.

Interactive tools for simplifying the filings process

In an era where efficiency is paramount, utilizing interactive tools can greatly simplify the mandate filing process for close corporations. Various online platforms and tools can assist in ensuring accuracy, compliance, and ease of submission.

For instance, pre-filled form templates can substantially reduce errors by providing a structured layout that prompts users to enter necessary information. Document comparison tools can verify that all necessary aspects are included in your submission, while eSigning capabilities offer a convenient way to collect signatures quickly and securely.

FAQs about the mandate by close corporation form

Understanding the common questions associated with the mandate by close corporation form can provide additional clarity for individuals and teams involved in the filing process. These FAQs cover essential topics that can impact successful compliance.

Best practices for close corporations and compliance

Incorporating best practices into the mandate filing process can help close corporations maintain compliance and operational efficiency. These practices foster a culture of diligence and attention to detail, minimizing potential issues.

Routine review of corporate compliance frameworks can ensure all mandates and filings are up to date. Implementing robust document management systems will assist teams in tracking necessary filings and deadlines. It’s advisable to foster collaboration among internal teams during the filing process, ensuring that all stakeholders remain informed and engaged.

Frequently asked questions about close corporation mandates

Further inquiries about close corporation mandates can often clarify the nuances surrounding this area of compliance. Understanding these distinctions can be particularly advantageous for new corporations navigating their filing responsibilities.

Technology and support for efficient document management

Leveraging technology can significantly enhance the document management process for close corporations. Various tools, particularly cloud-based solutions like pdfFiller, offer capabilities that streamline filing, editing, and compliance management.

pdfFiller’s cloud-based platform allows users to create, edit, eSign, and manage documents seamlessly from virtually anywhere. Features tailored specifically for close corporations, such as advanced document tracking and template management, are invaluable in ensuring that the mandate by close corporation form is executed efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mandate by close corporation directly from Gmail?

How can I edit mandate by close corporation from Google Drive?

How do I edit mandate by close corporation on an iOS device?

What is mandate by close corporation?

Who is required to file mandate by close corporation?

How to fill out mandate by close corporation?

What is the purpose of mandate by close corporation?

What information must be reported on mandate by close corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.