Get the free Nri Declaration Form

Get, Create, Make and Sign nri declaration form

How to edit nri declaration form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nri declaration form

How to fill out nri declaration form

Who needs nri declaration form?

NRI Declaration Form - How-to Guide

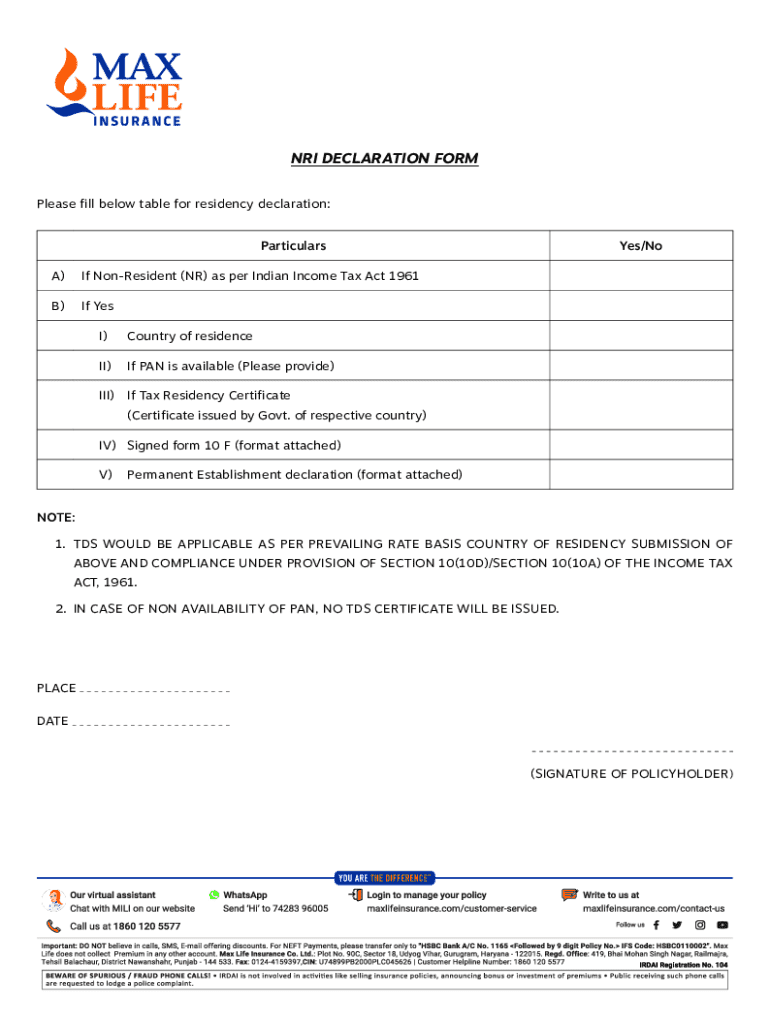

Understanding the NRI declaration form

The NRI declaration form is a crucial document designed to collect essential information from Non-Resident Indians (NRIs). It serves multiple purposes, mainly focusing on tax obligations, banking requirements, and property transactions. By outlining personal and financial details, the form aids Indian authorities and institutions in accurately assessing the tax status and compliance of NRIs, while also ensuring smooth transaction processes.

Understanding the significance of the NRI declaration form is essential for anyone who has settled abroad but remains tied to the financial landscape of India. NRIs might be required to submit this form for various reasons, including opening bank accounts, investing in real estate, transferring funds, or fulfilling taxation requirements. The importance of this form thus extends beyond mere documentation; it establishes a framework of trust and compliance between NRIs and Indian regulatory bodies.

Key features of the NRI declaration form

The NRI declaration form is comprehensive, requiring detailed information that encompasses various aspects of an individual's status. Firstly, personal details such as name, address, and nationality are fundamental for identification. Additionally, financial information is crucial, where individuals must disclose assets, income sources, and bank details. Tax information, including tax residency status and prior tax filings, plays a vital role in determining any financial obligations in India.

Moreover, the form may vary based on the context in which it's used—whether for banking, taxation, or real estate. Each purpose necessitates specific information tailored to meet regulatory requirements. For instance, when dealing with banks, the focus may be on income verification, while property transactions might require more extensive asset disclosure. Engaging with interactive tools for form completion can ease this process, ensuring that users provide accurate information while reducing the risk of errors.

Step-by-step guide to completing the NRI declaration form

Completing the NRI declaration form can seem daunting, but with a structured approach, it becomes manageable. Start by gathering the necessary documents, which often include your passport, PAN card, address proof, and financial statements. These documents are essential as they verify your identity and financial status.

Once you have the documents, proceed to fill out the form, ensuring that you provide accurate information in each section. It's crucial to avoid common mistakes such as incorrect PAN numbers or misleading address details. After filling out the form, take the time to review your entries. Double-checking against your supporting documents can prevent potential issues. Finally, submit the form either online or offline, depending on the requirements. Tracking your submission is important, and you can do so through designated websites or by contacting customer support.

Editing and customizing the NRI declaration form

Editing the NRI declaration form to reflect accurate information is paramount, and pdfFiller offers robust editing tools to facilitate this process. Users can easily upload the form into the platform, allowing for all necessary modifications. Interactive features provide options to add, delete, or change information, ensuring the form is accurate before submission.

Once you make the necessary changes, saving and storing the updated document securely is essential. Utilizing cloud storage features offered by pdfFiller enables you to access your edited forms anytime, anywhere, ensuring that your documents remain organized and retrievable when you need them.

eSigning the NRI declaration form

In today’s digital landscape, electronic signatures have emerged as a trusted method for validating documents, including the NRI declaration form. The ease and security of eSigning streamline the process, making it essential for anyone looking to finalize their forms quickly. With pdfFiller, users can eSign documents effortlessly, ensuring compliance with legal standards while enhancing convenience.

To eSign using pdfFiller, simply follow the platform's step-by-step signing process. This usually involves importing the document into the platform, navigating to the signature section, and applying your signature electronically. Security features like encryption and authentication ensure that your signed document is safeguarded from unauthorized access.

Collaborating on the NRI declaration form

Collaboration is a key aspect when filling out the NRI declaration form, especially when multiple parties are involved. pdfFiller provides sharing features that enable users to work together seamlessly. Whether you're co-managing this form with family members, tax advisors, or banks, real-time editing and feedback options enhance communication and ensure everyone is on the same page.

Moreover, utilizing version control and document management features ensures that all changes are tracked and managed effectively. This is especially important in formal documents where accuracy and up-to-date information are crucial. With these tools, stakeholders can annotate the document, leave comments, and receive notifications about changes, making the collaborative process efficient and transparent.

Frequently asked questions (FAQ) about the NRI declaration form

Many people have questions when navigating the NRI declaration form, especially regarding who should fill it out. Generally, any Non-Resident Indian engaged in financial activities in India or dealing with Indian authorities is required to submit this form. If mistakes occur on the form, it is advisable to correct them before submission. In cases of submitted forms with errors, contact the relevant authorities immediately to avoid complications.

Processing of the form can vary based on the purpose; however, timely follow-ups are encouraged. Additionally, updating your information post-submission is possible in many situations, aligning your declarations with any changes in your financial or residency status.

Troubleshooting common issues

Despite the best preparation, issues can arise when handling the NRI declaration form. Common errors could include omission of key information or discrepancies in data. To resolve such issues, utilize pdfFiller’s help resources which provide step-by-step troubleshooting guides. When in doubt, it’s advisable to contact customer support directly for personalized assistance.

Ensuring that you have all necessary documents and information readily available reduces the likelihood of errors. If uncertainty persists, engaging with financial advisors or legal consultants familiar with NRI law could provide additional clarity and guidance, ultimately ensuring a smoother submission process.

Additional tips for NRIs

For NRIs, understanding tax implications related to the NRI declaration form is crucial. Tax consultancy services often offer insights into how various income streams may be taxed, ensuring that NRIs stay compliant with the Indian tax system without incurring penalties. Best practices for managing documentation help maintain order and accessibility—consider adopting digital storage solutions to avoid losing important papers.

Additionally, keeping your financial records organized—including ensuring timely updates to the NRI declaration form—mitigates complications and allows for smoother transitions during financial transactions. Whether it's investing in property or addressing tax filings, a proactive approach towards documentation is key for NRIs to navigate their financial landscape efficiently.

Staying compliant with NRI regulations

Being compliant with NRI regulations involves a comprehensive understanding of the relevant laws governing tax and financial activities. The NRI declaration form is integral to this compliance framework, ensuring that NRIs remain transparent in their dealings. Regular updates to the form and adherence to prescribed guidelines are essential to avoid legal complications.

Resources such as legal advisories, online webinars, or financial consultation services can provide the latest updates on regulatory changes, helping NRIs to remain informed. Engaging with community forums where other NRIs share their experiences can also serve as a valuable resource, offering tips and advice to help navigate unique challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nri declaration form without leaving Google Drive?

How do I edit nri declaration form on an iOS device?

How do I edit nri declaration form on an Android device?

What is nri declaration form?

Who is required to file nri declaration form?

How to fill out nri declaration form?

What is the purpose of nri declaration form?

What information must be reported on nri declaration form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.