Get the free Monthly Retail Motor Fuel Report

Get, Create, Make and Sign monthly retail motor fuel

How to edit monthly retail motor fuel online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly retail motor fuel

How to fill out monthly retail motor fuel

Who needs monthly retail motor fuel?

Monthly retail motor fuel form: How-to guide long-read

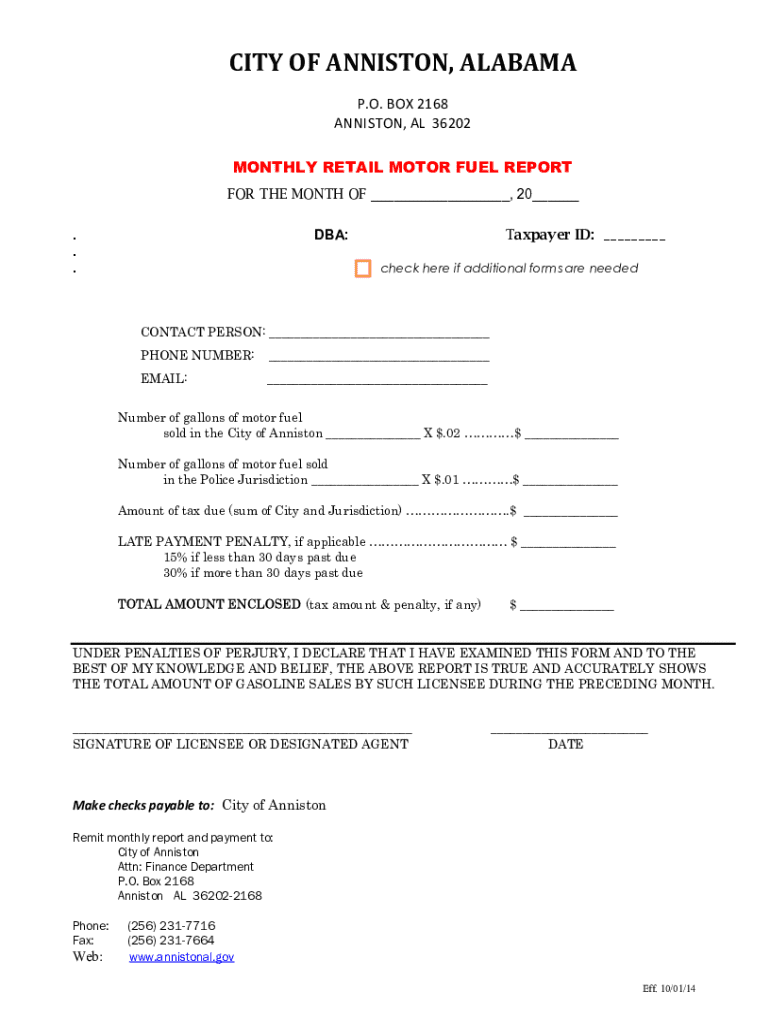

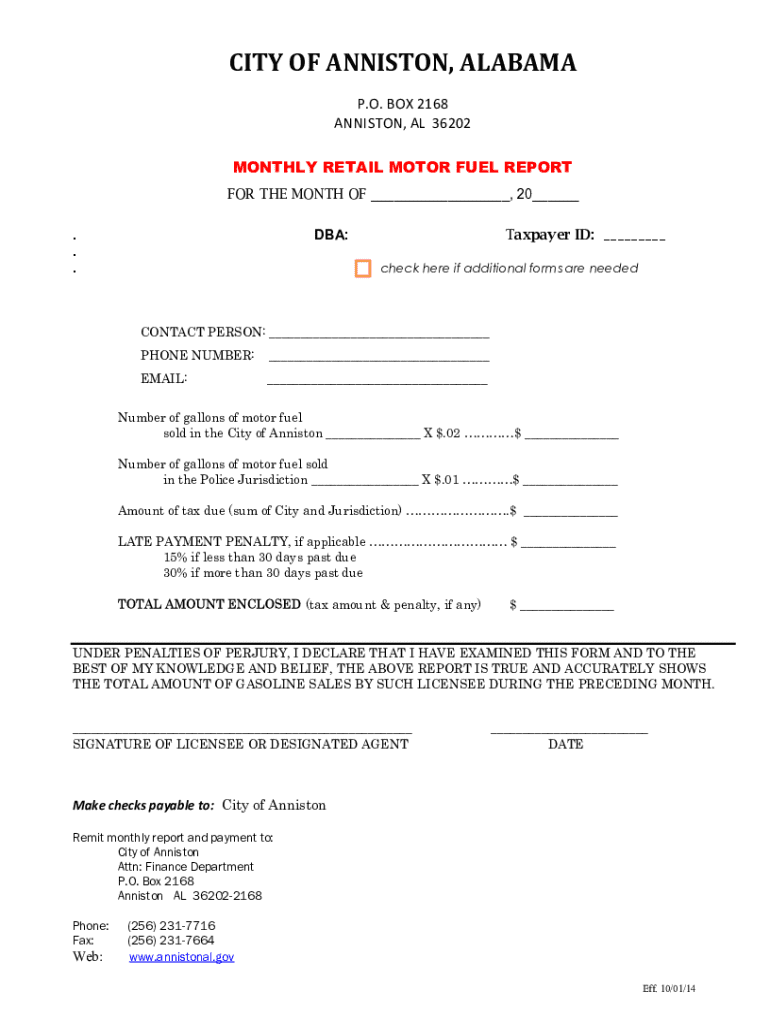

Overview of the monthly retail motor fuel form

The Monthly Retail Motor Fuel Form is a crucial document for fuel retailers, designed to capture essential data relating to fuel sales on a monthly basis. This form plays a vital role in ensuring that fuel taxes are accurately reported and collected, thereby enabling the appropriate funding for infrastructure and public services. By filling out this form, retailers provide transparency in their operations, which is key to maintaining public trust and adhering to regulatory requirements.

Key stakeholders in the fuel retail sector include state agencies, local governments, fuel wholesalers, and the fuel retailers themselves. Each of these entities has a vested interest in the accurate reporting of fuel sales, as it impacts economic forecasts, tax revenue allocations, and compliance measures. By understanding the significance of this monthly report, retailers can appreciate the essential role they play in the broader economic landscape.

Regulatory context

The filing of the Monthly Retail Motor Fuel Form is governed by several federal and state laws designed to regulate fuel sales and taxation. Each state may have specific requirements that can include filing frequency, data to be reported, and submission deadlines. Non-compliance with these regulations can lead to significant penalties, including fines and potential legal action. Retailers must stay informed about these regulations to avoid costly repercussions.

Getting started with the monthly retail motor fuel form

Before attempting to complete the Monthly Retail Motor Fuel Form, it is essential to determine eligibility. Generally, retailers who sell motor fuel must file this form regularly. However, certain exemptions may apply to small sellers or specific types of sales. Understanding your categorization is key to ensuring compliance.

Gathering all required documentation is the next step. Essential documents may include sales data, inventory records, and tax identification numbers. It is advisable to develop a filing system to keep these documents organized, allowing for smooth form completion each month. Investing time in organizing paperwork will save retailers significant stress during busy filing periods.

Navigating the monthly retail motor fuel form

Familiarizing yourself with the structure of the Monthly Retail Motor Fuel Form is critical for accurate completion. The form is segmented into various sections, each requiring specific information. For example, sections typically include sales data, tax calculations, and a summary of deliveries. Being methodical in reviewing these areas will help prevent errors and ensure all necessary details are captured.

Many retailers benefit from utilizing interactive tools like pdfFiller, which features document editing, electronic signature options, and collaborative tools. Using these tools can streamline the process, allowing users to be more efficient and ensuring compliance at every step.

Step-by-step instructions for completing the monthly retail motor fuel form

When filling out the Monthly Retail Motor Fuel Form, accuracy is paramount. Here are some best practices to keep in mind: double-check figures, ensure that all fields are completed, and cross-verify against your documentation. Common mistakes, such as miscalculations or leaving blanks, can lead to delayed submissions and potential audits.

Using pdfFiller’s platform can simplify your experience with the Monthly Retail Motor Fuel Form. The step-by-step guide below outlines how to navigate the site effectively:

Submitting your completed monthly retail motor fuel form

Once you have completed the Monthly Retail Motor Fuel Form, it’s time for submission. You have several options for submitting your form, including online through the state’s portal or by mailing a physical copy. Different states have specific submission methods, so be sure to review the requirements based on your location.

Meeting submission deadlines is critical. Forms are typically due at the beginning of the following month, with strict penalties in place for late filings. These can include monetary fines or potential audits, which could result in further complications and expenses.

Managing your monthly retail motor fuel form

Once you have submitted the Monthly Retail Motor Fuel Form, it is essential to track your submission. Many state portals allow you to verify the status of your submitted forms. Keeping contact information handy for follow-ups will facilitate this process.

Record-keeping is another essential aspect of managing your submissions. Maintaining copies of the forms you’ve submitted not only helps address discrepancies but also is crucial in the event of an audit. Recommended best practices include storing these forms digitally in a secure location for easy access.

Resources for further support

Numerous resources are available to support retailers in completing the Monthly Retail Motor Fuel Form. Frequently asked questions (FAQs) provide clarity on common issues, such as how to report corrections or handle discrepancies in data.

For personalized assistance, retailers can contact local regulatory agencies or visit online forums where industry peers share insights. Networking and engaging with the community can provide additional, invaluable perspectives on managing the fuel retail landscape.

Best practices for fuel retailers

Maintaining compliance with fuel tax regulations requires constant vigilance. Here are several best practices that can help retailers navigate this complex landscape:

By adopting these strategies, retailers can not only ensure compliance but also enhance overall operational efficiency.

Understanding updates and changes to the form

Regulatory environments are fluid, and it is important for retailers to stay updated on any changes that may affect the Monthly Retail Motor Fuel Form. Changes can range from modifications in reporting requirements to new tax obligations. Staying ahead of these updates helps avoid compliance issues.

Subscribing to newsletters from relevant agencies or setting up alerts on industry news websites can be excellent ways to remain informed about such changes. Engaging with industry associations can also provide valuable insights and resources.

Conclusion

In summary, the Monthly Retail Motor Fuel Form is an essential tool for fuel retailers, enabling accurate reporting and compliance within a stringent regulatory framework. Understanding its importance and navigating its complexities is critical for maintaining operational integrity.

Using pdfFiller for form management empowers retailers to streamline their processes, ensuring accuracy and compliance efficiently. By leveraging these resources, individuals and teams can transform their fuel documentation practices and maintain seamless operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send monthly retail motor fuel for eSignature?

How do I edit monthly retail motor fuel on an Android device?

How do I fill out monthly retail motor fuel on an Android device?

What is monthly retail motor fuel?

Who is required to file monthly retail motor fuel?

How to fill out monthly retail motor fuel?

What is the purpose of monthly retail motor fuel?

What information must be reported on monthly retail motor fuel?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.