Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

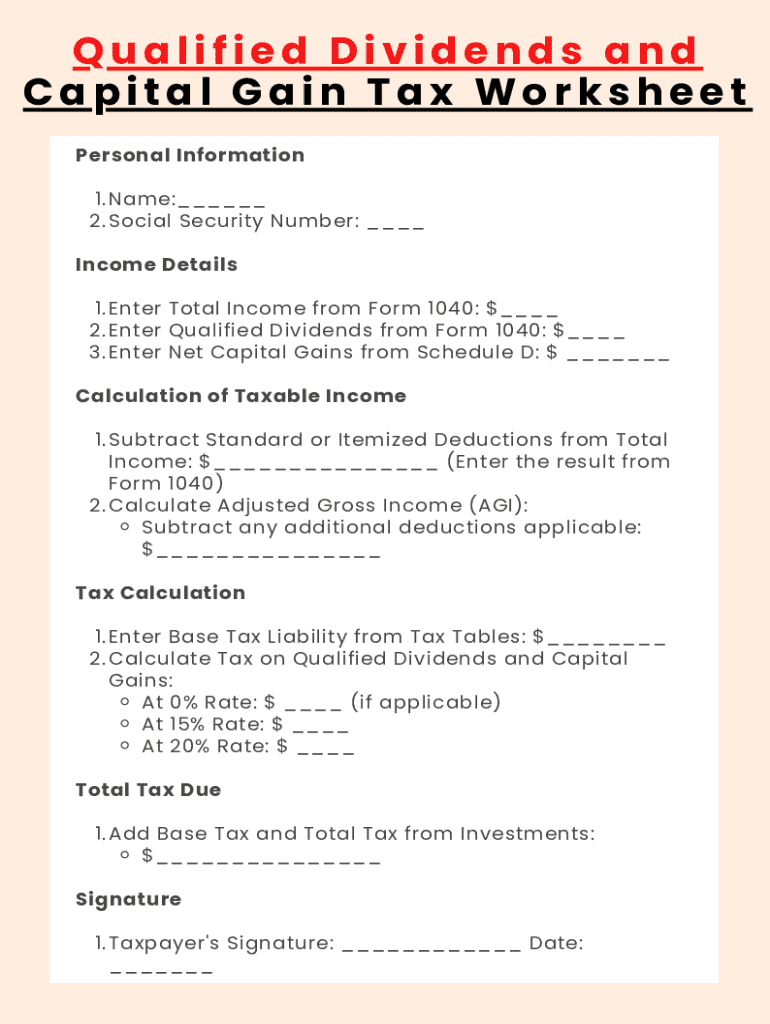

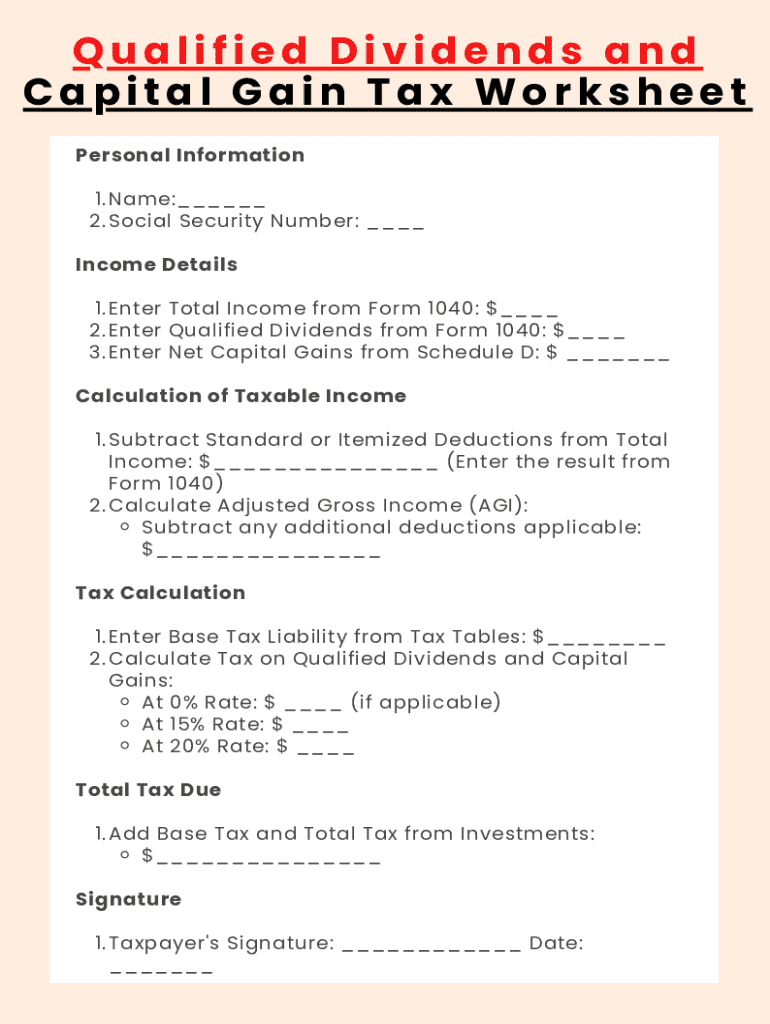

How to fill out qualified dividends and capital

Who needs qualified dividends and capital?

Qualified dividends and capital gains: A comprehensive guide

Understanding qualified dividends and capital gains

Qualified dividends and capital gains are two crucial components of investing that impact your tax obligations significantly. As an investor, grasping the characteristics of these financial phenomena can lead to better tax management strategies and enhanced wealth accumulation.

What are qualified dividends?

Qualified dividends are a specific type of dividend payment from corporations that meet certain criteria, making them eligible for lower tax rates. Generally, these dividends arise from stocks that have been held for a specific term, making them more favorable for tax purposes compared to ordinary dividends.

To be considered qualified, dividends must meet the following criteria: they must be paid by a U.S. corporation or a qualified foreign corporation, and the taxpayer must hold the stock for a minimum period, typically at least 60 days within the 121-day period that starts 60 days before the ex-dividend date.

For example, dividends received from companies like Apple or Microsoft would likely be qualified dividends as long as you meet the holding period. This treatment can significantly reduce your tax liability.

What are capital gains?

Capital gains represent the profit that an investor realizes when they sell an asset for more than its purchase price. This can occur not only with stocks but also with other investments like real estate, bonds, and collectibles. Capital gains are pivotal for investors looking to maximize their investment returns.

There are two primary types of capital gains: short-term and long-term. Short-term capital gains apply to assets held for one year or less and are taxed at ordinary income tax rates, while long-term capital gains are on assets held for more than one year and are generally taxed at lower rates.

Key factors influencing capital gains include the holding period of the asset, the current market conditions, and any associated costs of selling the asset. Understanding these can help investors make informed decisions when trading.

The tax implications of qualified dividends and capital gains

Tax implications are significant when dealing with qualified dividends and capital gains, as these can affect your overall tax return. Knowledge of these implications allows for better financial planning and tax-efficient investment strategies.

How qualified dividends affect your tax return

Qualified dividends are taxed at the long-term capital gains tax rate, which is generally lower than the ordinary income tax rate. This favorable tax treatment means that understanding how to report these dividends accurately can lead to considerable savings on your tax return.

To report qualified dividends, you typically use IRS Form 1040, specifically the qualified dividends line on the form. It's essential to differentiate between qualified and ordinary dividends to ensure you're taxed appropriately, which can be especially relevant for investors relying heavily on dividend income.

This distinction underscores the importance of record-keeping in investments, as maintaining accurate documentation can facilitate a more effective tax return process.

The capital gains tax worksheet: An essential tool

The capital gains tax worksheet is a valuable resource for taxpayers who wish to calculate their capital gains or losses accurately. This worksheet helps streamline the reporting process, ensuring that every financial transaction is accounted for in a detailed manner.

To complete the capital gains tax worksheet, follow these steps:

Common mistakes to avoid include overlooking sales transaction fees and failing to account for adjustments that may affect your cost basis. Keeping an eye on these details can save you from costly errors down the line.

Tax strategies for managing qualified dividends and capital gains

Effective management of qualified dividends and capital gains involves strategic planning. Investors must leverage multiple strategies to optimize their tax situation while maximizing returns.

When you have a gain: Potential strategies

If you find yourself in a position of capital gains, consider implementing the following strategies to either mitigate taxes or maximize charitable contributions:

When you have a loss: Options to consider

Experiencing capital losses can feel disheartening, but there are options for managing these effectively. Reporting capital losses can provide substantial benefits in terms of offsetting capital gains, potentially reducing your overall tax burden.

In situations where losses are higher than gains, you can leverage this by carrying over excess losses into future tax years, effectively providing a cushion for future gains.

Lessons learned from real-life scenarios

Analyzing actual case studies offers valuable lessons in navigating the complexities of qualified dividends and capital gains. These scenarios reflect the practical applications of strategies discussed earlier.

Case studies on qualified dividends

For instance, a retiree relying on dividend income needs to prioritize investments in stocks that yield qualified dividends, ensuring efficient tax treatment while providing steady income.

Conversely, a young investor building a portfolio may benefit from prioritizing growth stocks over dividend-yielding stocks, knowing they can capitalize on lower long-term capital gains rates later on.

Case studies on capital gains

Selling a primary residence presents an excellent case for navigating capital gains exclusions. For homeowners, if the property has been occupied as a primary residence for at least two of the last five years, they may exclude up to $250,000 of capital gains from taxation.

Meanwhile, investors facing large gains during market fluctuations must be strategic, ensuring they maximize their returns while effectively managing their tax implications. Realizing profits in a down market could trigger unnecessary taxes without corresponding benefits.

Expert tips for keeping track of your investments

Document management plays a vital role in ensuring optimal tax reporting concerning qualified dividends and capital gains. Using reliable tools can streamline the process, minimize errors, and facilitate agility in responding to changing tax laws.

Best practices for document management

One of the best practices involves using tools such as pdfFiller to track, edit, and store important tax documents. Adopting cloud-based solutions enhances accessibility and collaboration, allowing you to retrieve documents whenever necessary.

Tools for monitoring qualified dividends and capital gains

With countless apps and software available, choosing the right tools can make monitoring your investments much easier. Look for platforms that automatically track dividend payments, alert you about potential capital gains tax events, and provide insights into market behavior.

Navigating changes in tax laws

Tax laws surrounding qualified dividends and capital gains frequently change, making it essential for investors to stay informed. Understanding these developments can help you adapt your investment strategies accordingly and ensure compliance.

Keeping up with updates on qualified dividends and capital gains tax regulations

Regularly consult resources like IRS publications, tax professionals, and online tax law newsletters to stay educated regarding changes. These resources often provide insights, trends, and educational webinars to help deepen your understanding.

Anticipating future tax developments

The landscape of tax regulations is constantly evolving, and expected future developments regarding dividend taxation and capital gains could significantly impact investor behavior. Keeping an eye on proposals and discussions surrounding tax reforms allows for proactive financial planning.

Emerging trends suggest potential adjustments to dividend tax rates, which could influence investment strategies significantly. Insights from financial experts hint at a more structured approach moving forward, with the potential for increased scrutiny on high earners.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pdffiller form for eSignature?

How can I get pdffiller form?

How do I make edits in pdffiller form without leaving Chrome?

What is qualified dividends and capital?

Who is required to file qualified dividends and capital?

How to fill out qualified dividends and capital?

What is the purpose of qualified dividends and capital?

What information must be reported on qualified dividends and capital?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.