Get the free The Student Loan Default Divide: Racial Inequities Play a ...

Get, Create, Make and Sign form student loan default

Editing form student loan default online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form student loan default

How to fill out form student loan default

Who needs form student loan default?

Navigating the Form Student Loan Default Form: A Comprehensive Guide

Understanding student loan default

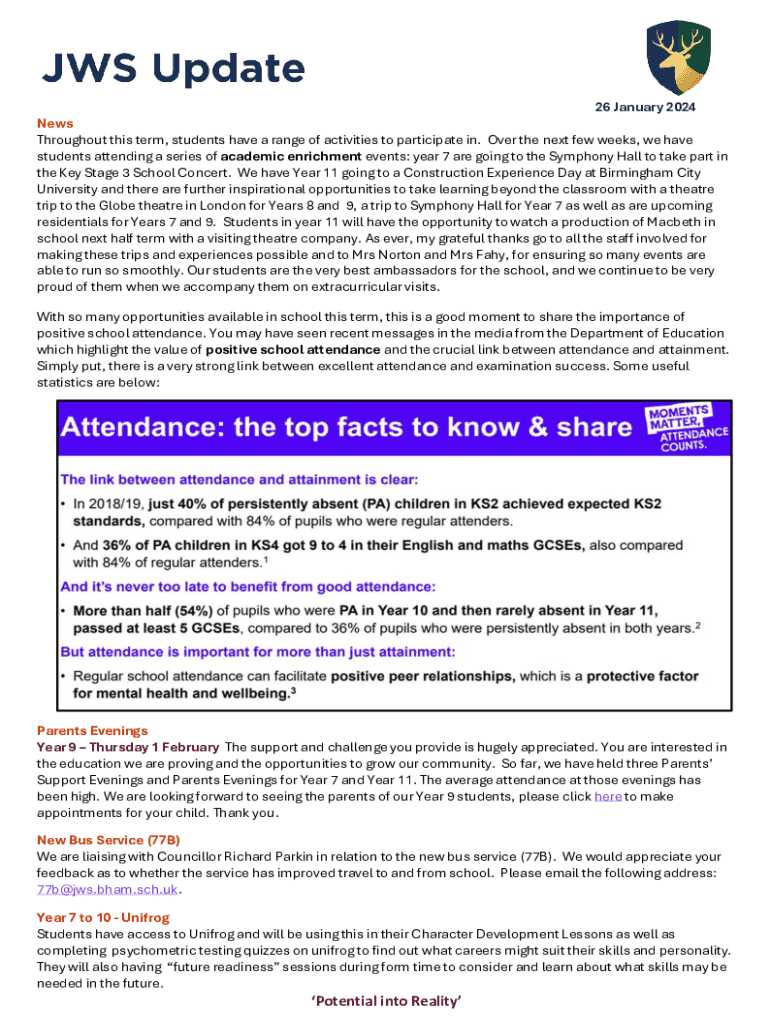

Student loan default occurs when a borrower fails to make required payments on their student loans for an extended period, typically 270 days for federal loans. Defaulting can have serious consequences, affecting not just financial standing but also personal peace of mind.

Common reasons borrowers default include financial hardship, lack of understanding of repayment options, and unexpected life events such as job loss or medical emergencies. When an individual defaults on their loans, the implications are severe, impacting their credit score significantly and leading to aggressive collection practices. This can include wage garnishments and legal actions taken by lenders.

Recognizing the need for a default form

Employing a Student Loan Default Form is crucial when you find yourself in default. This form is a formal approach to either reactivate your loan repayment status or negotiate potential solutions with your loan servicer. It's essential for borrowers to act quickly to mitigate the long-term effects of default.

Addressing default proactively can provide significant benefits, such as restoring eligibility for federal student aid and reopening options for various repayment plans. The form acts as a vital document in negotiating your way out of default and can lead to options like loan rehabilitation or consolidation.

Steps to complete the student loan default form

Completing the Student Loan Default Form requires meticulous attention to detail. Start by gathering your personal information, which includes your name, address, and Social Security Number. You will also need specific loan details such as the type of loans you have and information about your loan servicer.

The form itself usually comprises several sections. It typically begins with your borrower information, followed by detailed loan information. An explanation of your circumstances leading to the default and your current financial situation should also be included.

Lastly, ensure that every section of the form is verified for accuracy. Keeping a checklist can aid in confirming that all necessary information is included, as completeness is critical to avoid delays in processing your appeal.

Submitting the student loan default form

When you’re ready to submit the Student Loan Default Form, you typically have two main options: online submission or mailing a physical copy. Most lenders now offer secure online portals where you can upload your documents directly, making the process easier and faster.

Regardless of the method you choose, it’s vital to track your submission. Keep copies of all documents submitted, and ensure you monitor any correspondence from your loan servicer. Following up shortly after submission can help clarify your status and show your commitment to resolving the issue.

What happens after submission?

Once your Student Loan Default Form is submitted, the review process begins. Generally, you should expect to receive a response within four to six weeks, but this can vary depending on the volume of applications being handled by your servicer.

The outcomes from your form submission can lead to several options. Many borrowers find they qualify for loan rehabilitation, which may involve making a series of on-time payments to bring their loan out of default. Another option could be loan consolidation, but it’s crucial to understand the implications of each choice.

Resolving issues related to default

Contacting your loan servicer should be a priority after submitting your form. Clear communication can help alleviate any uncertainties or miscommunications regarding your default status. Prepare a list of questions in advance to ensure you cover everything.

In addition to direct communication, explore the various programs available for rehabilitation and consolidation. For example, income-driven repayment plans can help reduce your monthly payment to an affordable level based on your income, while the Public Service Loan Forgiveness program may offer forgiveness opportunities to qualifying borrowers.

Preventing future defaults

Once you’re out of default, implementing best practices to manage your student loan payments is crucial. Set up reminders, automate payments, or even schedule alerts to help keep your payments on track. Maintaining good communication with your loan servicer can also assist you in understanding your options proactively.

Incorporating budgeting tools can further aid in managing finances effectively. Many resources are available for borrowers, from expense tracking apps to financial counseling services that can help provide structure to your financial obligations. Staying informed about your loan terms and any changes in student loan policies will also empower you to make informed decisions.

Frequently asked questions (FAQ) about student loan default form

As you navigate the complexities of student loan defaults, here are some common questions you may face:

Tools for managing student loans effectively

pdfFiller provides digital tools that make managing and editing your Student Loan Default Form more accessible. From creating new forms to securely editing existing ones, the platform simplifies the document management process. Users can enjoy the convenience of cloud-based access, allowing them to handle their student loan forms from virtually anywhere.

Testimonials from users illustrate how effective pdfFiller can be in resolving student loan issues, showcasing stories of individuals who turned their financial distress into empowerment through organized documentation and efficient submissions.

Communicating with key stakeholders

Establishing clear lines of communication can make a significant difference in handling student loans. Reach out to your educational institution for advice and support; they often have resources and personnel to assist students facing default.

Awareness of your rights as a borrower is another vital area. Various organizations specialize in assisting borrowers, providing programs that help navigate the complexities of student loans. Engaging with these bodies can offer additional leverage in discussions with your loan servicer.

Final tips and resources

Continuous education on student loan management is essential for all borrowers. Numerous resources are available, including nonprofit organizations and financial advisors, who can assist in devising practical repayment strategies.

Utilizing pdfFiller not only for the Student Loan Default Form but for all future document management needs is advisable. Keeping documents organized helps streamline access to important information, ensuring you remain informed and prepared.

Engaging with pdfFiller community

By engaging with the pdfFiller community, you can discover new tips and share experiences with fellow users. Connecting with user forums can provide valuable insights into strategies that have worked for others, turning overwhelming situations into manageable ones.

Consider sharing your success stories and strategies within the pdfFiller user community. Such interactions not only enrich your knowledge but also contribute to a supportive space for navigating student loan challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form student loan default to be eSigned by others?

How do I make edits in form student loan default without leaving Chrome?

How can I fill out form student loan default on an iOS device?

What is form student loan default?

Who is required to file form student loan default?

How to fill out form student loan default?

What is the purpose of form student loan default?

What information must be reported on form student loan default?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.