Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

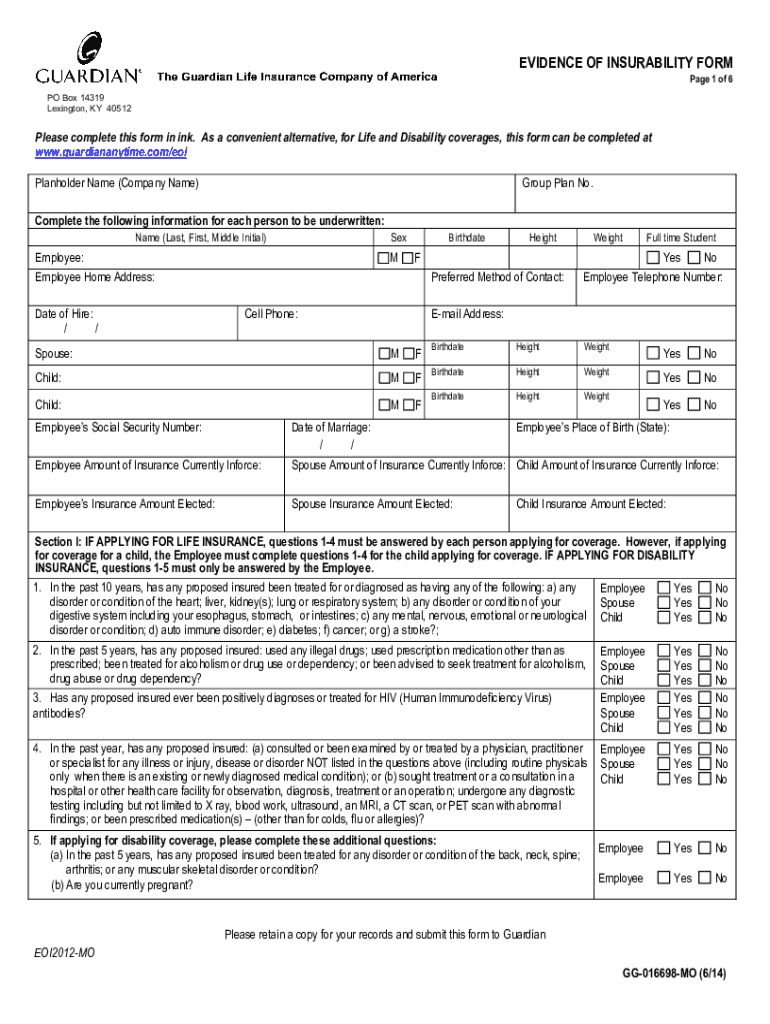

How to fill out evidence of insurability form

Who needs evidence of insurability form?

A Comprehensive Guide to the Evidence of Insurability Form

Understanding the Evidence of Insurability (EOI) Form

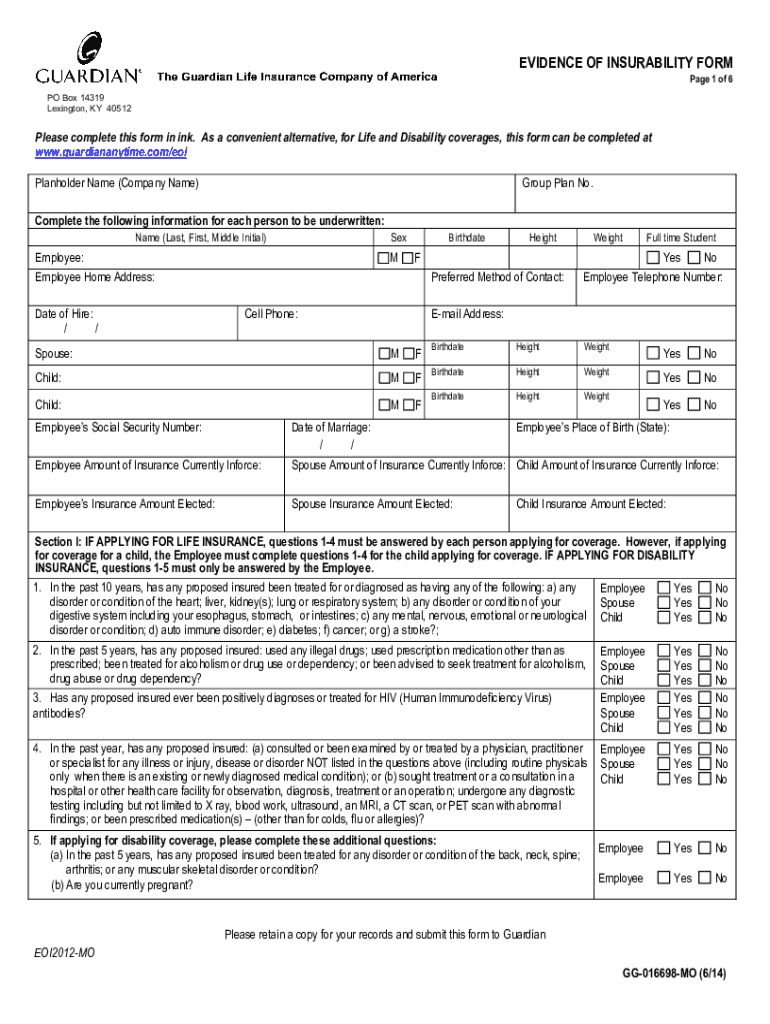

The Evidence of Insurability (EOI) form serves as a critical element in the insurance application process, enabling insurers to assess an individual's health status and risk level before approving coverage. Simply put, the EOI is a document where you provide detailed health-related information, allowing insurers to determine eligibility for life, health, or disability insurance. Without it, applicants may face delays or denials in coverage, making this form essential.

Various individuals are required to complete the EOI form, particularly when applying for insurance coverage through an employer or independently. Employees seeking to enroll in new insurance plans, dependents wishing to obtain coverage, and individuals requesting an increase in their existing policy limits may find themselves needing to provide an EOI. Understanding these requirements is crucial for navigating the insurance landscape.

When to complete an Evidence of Insurability form

The EOI form is typically required under specific circumstances. Key scenarios include enrolling in new insurance plans during employer-sponsored enrollment periods or applying for benefits outside of the standard enrollment window. Additionally, if you wish to request increased coverage on existing policies or add new benefits, submitting an EOI is essential. Knowing when to file this form, along with any corresponding deadlines, helps prevent any lapses in coverage.

Types of insurance that require EOI

The EOI form is required for various types of insurance policies that assess risk based on health and medical status. Life insurance, for instance, typically requires an EOI to verify the applicant's history of health, lifestyle factors, and any pre-existing conditions that may affect coverage approval. Medical insurance and disability insurance also necessitate an EOI to evaluate the applicant's current health needs and to determine appropriate coverage options.

In each case, providing accurate and thorough information on the EOI aids the insurer’s decision-making process. For example, a person interested in increasing their life insurance from $200,000 to $500,000 might be required to fill out an EOI to address any changes in their health status since their last application.

How Evidence of Insurability (EOI) works

Completing an Evidence of Insurability form involves a specific process that ensures accuracy and thoroughness in your submission. Start by gathering necessary information such as your medical history and lifestyle choices. The form typically includes a questionnaire with specific health-related questions that you must answer honestly to avoid any issues later on with your insurance policy.

After filling out the EOI form, double-check for accuracy and completeness before submission. Carefully follow your insurer’s guidelines regarding submission methods, which can vary from online platforms to mail-in forms. Some insurers may request follow-up documentation based on the information you provide, so be prepared to supply additional details or medical records if needed.

Documentation and requirements for EOI

To complete the EOI form successfully, you’ll need to provide several documents and pieces of information. These may include your medical history, specific answers to health-related questions, and, at times, identification documents. Most insurers require you to report pre-existing conditions, surgeries, medications, and lifestyle habits, such as smoking or exercising, that could impact your risk profile.

If your insurer requires additional information during their evaluation, being responsive and organized with your documentation will significantly impact the speed of your application's success. Ensure that you keep track of any communications with your insurance provider and promptly provide the necessary information to facilitate the approval process.

Common questions about the Evidence of Insurability form

As applicants navigate the process of completing the Evidence of Insurability form, they often have common questions. A frequently asked question is, 'What happens if my health changes after submitting the EOI?' In such cases, it is crucial to inform your insurer of any significant changes in health status as this can affect your policy approval. Failure to disclose these changes may lead to complications later if you need to file a claim.

Another common concern involves the timeline for EOI submission. What are the consequences of not submitting an EOI on time? Missing the submission deadline may result in denial of coverage or increased premiums, as insurers typically have specific guidelines to abide by. Understanding your insurer’s evaluation process can shed light on what to expect throughout your EOI submission journey.

Scenarios related to Evidence of Insurability

Envisioning various scenarios can provide further insights into the Evidence of Insurability process, particularly concerning late submissions. Applicants submitting their EOI beyond the deadline often face stringent conditions or may not be able to increase their coverage. However, insurers may accommodate late applicants under specific circumstances, allowing for appeals if justified correctly.

Another essential aspect is understanding Non-Evidence Maximum (NEM), which is the maximum coverage amount available without completing an EOI. For instance, if your employer-sponsored policy allows coverage up to $100,000 without EOI, anything above that threshold mandates filling the form. Exploring additional coverage options, particularly for rising families or increasing assets, can clarify the relevance and implications of the EOI on your overall insurance strategy.

Special considerations

Optional coverage selections often influence EOI requirements. If an applicant chooses supplemental or optional coverage, they may need to submit an EOI if the additional benefit exceeds certain limits set by insurance providers. Understanding your chosen coverages ensures clarity in what documentation is needed at each application phase.

Moreover, for individuals unable to provide EOI due to health conditions or challenges in obtaining relevant documentation, it’s essential to seek alternative options. Insurers typically have guidelines in place to assist such applicants, which might include a streamlined approval process based on available medical records or other supporting documentation.

Navigating the EOI process with pdfFiller

pdfFiller offers robust solutions for individuals and teams navigating the Evidence of Insurability form. Utilizing interactive tools, users can fill out, edit, and eSign their documents with ease. This cloud-based platform allows for effective collaboration, enabling users to work together seamlessly, whether in an office setting or from remote locations.

The convenience of managing EOI forms online with pdfFiller not only streamlines the process but also ensures documents are secure and easily accessible. With features designed for document management, individuals can focus on ensuring their insurance needs are met without the hassle of physical paperwork.

Key takeaways about the Evidence of Insurability form

As you consider the Evidence of Insurability form, it's essential to keep in mind its significance in the insurance landscape. Understanding the requirements, timing, and potential scenarios surrounding your EOI will empower you as an applicant. By utilizing tools like pdfFiller to manage your documents, you can ensure a smoother application process, with an emphasis on accuracy and timeliness.

With the right knowledge and preparation, tackling your EOI submission can become a straightforward task. Emphasizing efficient document management will facilitate your insurance journey and optimize your experience with insurers.

Related topics and further reading

To further expand your understanding of insurance documentation and related concepts, consider exploring articles that delve into subjects such as the employer's guide to COBRA notices or the nuances of the ACA and health coverage requirements. Keeping informed about advancements in benefits technology and document management solutions can also enhance your approach to insurance applications.

Conclusion: Get started with your Evidence of Insurability form today

Taking the first steps with your Evidence of Insurability form can significantly impact your insurance experience. By leveraging pdfFiller for a seamless EOI process, you can enjoy the benefits of easy document management, enhanced accuracy, and quick submissions. Embracing digital solutions allows you to navigate the complexities of insurance forms effortlessly, ensuring you as an applicant are equipped and informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pdffiller form online?

Can I edit pdffiller form on an iOS device?

How do I complete pdffiller form on an iOS device?

What is evidence of insurability form?

Who is required to file evidence of insurability form?

How to fill out evidence of insurability form?

What is the purpose of evidence of insurability form?

What information must be reported on evidence of insurability form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.