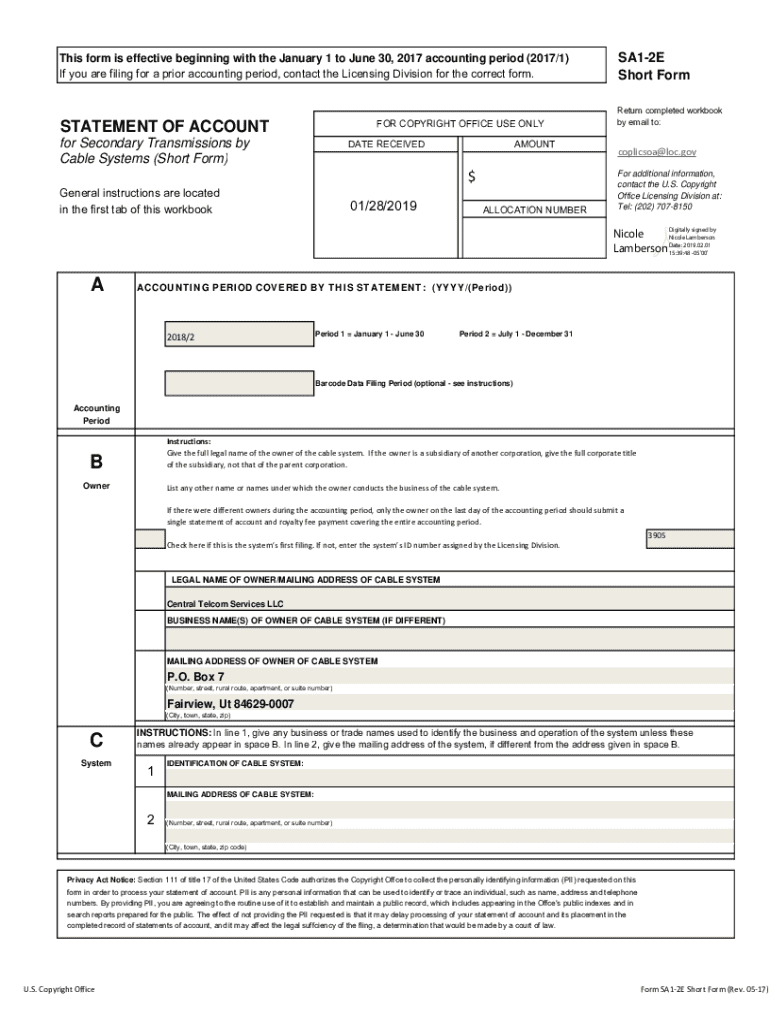

Get the free Form Sa1-2e Short Form

Get, Create, Make and Sign form sa1-2e short form

Editing form sa1-2e short form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form sa1-2e short form

How to fill out form sa1-2e short form

Who needs form sa1-2e short form?

Comprehensive Guide to the Form SA1-2E Short Form

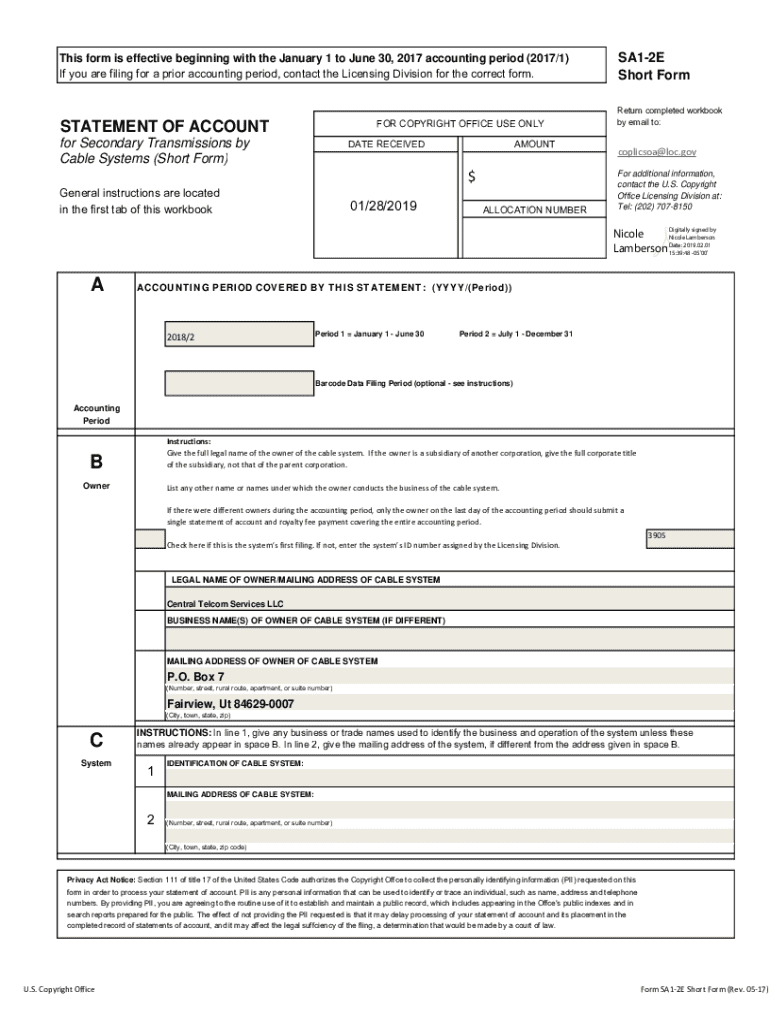

Overview of the form SA1-2E

The SA1-2E short form is a critical document used for various administrative and legal submissions. Its purpose is to streamline the process of collecting necessary information from individuals and teams, often for regulatory or compliance reasons. By utilizing this form, users can ensure that they are providing the required data in a standardized format, which helps both the submitter and the receiving agency.

Accurate submission of the SA1-2E is vital as inaccuracies can lead to delays in processing or denied submissions. This form is often utilized in situations ranging from personal tax submissions to team project approvals, illustrating its importance across various domains.

Key features of the SA1-2E short form

One of the standout features of the SA1-2E short form is its user-friendly design. The layout is crafted to promote easy navigation, which is crucial for users who may not be tech-savvy. With clearly labeled sections and a straightforward flow, individuals can complete the form without unnecessary confusion or errors.

In addition, the form comes equipped with interactive tools that enhance efficiency. These tools assist users in quickly filling out data, reducing the time spent on administrative tasks. Another major advantage is the accessibility of the SA1-2E from anywhere via its cloud-based platform. This means that whether you are at home or in the office, you can complete your form with ease.

Step-by-step guide to filling out the SA1-2E short form

Before you start filling out the SA1-2E short form, preparation is key. Ensure you have all required documentation on hand, as this will facilitate a smoother completion process. Essential items to gather include identification documents, financial statements, and any other relevant records. A checklist of essential information will also be beneficial; this may include personal identification, financial records, and any specific notes from relevant authorities.

The next step involves completing each section of the form. Section 1 focuses on personal information, where it's crucial to input your name and address in the correct format. For accuracy, double-check these details by cross-referencing them with official documents. In Section 2, you'll provide financial information. Ensure you break down your financial disclosures appropriately, being mindful to avoid common errors such as miscalculating figures or omitting critical details. Lastly, Section 3 will require your signature and date; ensure you follow guidelines for electronic signatures and check that the date is accurate as it plays a significant role in processing your submission.

Editing and reviewing your SA1-2E short form

Once the form is filled out, utilizing pdfFiller tools for effective edits can greatly enhance your submission. The platform’s editing features allow for instant corrections, making it easy to rectify any errors right away. Additionally, collaboration tools enable team members to provide input, ensuring that the form is accurate and comprehensive.

Before submitting your SA1-2E short form, thorough review is essential. Take the time to preview the entire document. Look for common checkpoints such as inconsistent formatting, missing signatures, and incorrect financial figures. These are frequent pitfalls that can result in processing delays or issue flags at the receiving end.

Signing the SA1-2E short form

The signing process for the SA1-2E short form has significantly evolved with the advent of electronic signatures. These digital signatures hold legal validity akin to traditional handwritten ones, thus ensuring that your submissions are recognized and accepted without the need for physical copies. Using pdfFiller, signing is made easy and accessible; users can follow straightforward prompts to insert their signatures directly onto the document.

Post-signing verification is equally important. Users should familiarize themselves with methods to confirm their submission, such as checking email confirmations or accessing online submission platforms. After completing your signing process, knowing the right follow-up actions can save time and hassle later.

Managing your document after submission

After submitting your SA1-2E short form, it is crucial to understand the post-submission workflow. Tracking your submission status is a vital step to ensure that it has been received and is being processed. Depending on your submission method, you may also want to keep an eye out for any communication from the receiving agency regarding further actions or clarifications.

Managing document revisions is an important aspect of maintaining records. Utilizing tools available on pdfFiller, such as versions and backups, ensures that you have access to earlier iterations if any issues arise. Lastly, storing and securing your SA1-2E short form in a cloud-based solution not only offers convenience but also enhances data security. pdfFiller prioritizes user data protection through robust security measures.

Frequently asked questions about the SA1-2E short form

Many users have common queries regarding the SA1-2E short form. A frequent concern is about mistakes to avoid while filling out the form. These can range from simple typos to more significant omissions. Taking the time to read through instructions and guidelines can mitigate these risks significantly. Additionally, understanding processing times is essential; this varies significantly by agency, and being aware can help manage expectations effectively.

Should you encounter challenges or need further assistance, pdfFiller offers a range of support resources. From a detailed help center to community forums where users exchange tips, leveraging these resources can enhance your experience and ensure successful submission.

Advanced tips for enhanced form management

To optimize your use of the SA1-2E short form, customizing your approach can make a significant difference. Tailoring the form for different needs, such as team-oriented projects or personal applications, enhances usability and effectiveness. Practical tweaks, like adding custom fields in pdfFiller, can streamline the process further.

In addition, consider integrating the SA1-2E short form with other tools and platforms that your team may already be using. By collaborating with existing document management solutions, you can enhance overall organization and efficiency. Automation can also significantly speed up workflows, taking repetitive tasks off user hands, allowing for more time to focus on critical work.

Real-life examples and case studies

Successful completion stories highlight the versatility of the SA1-2E short form. For example, an individual utilizing the form to submit an accurate personal tax return was able to efficiently manage their finances and receive timely processing feedback. Meanwhile, a case study involving team collaboration showcased how members contributed effectively, ensuring that all required fields were filled out thoroughly and accurately, resulting in successful project approval.

However, not all experiences are seamless. Analyzing frequent user errors reveals that incorrect data entry and lack of documentation often led to rejections. Learning from these challenges provides users with a roadmap for success; strategies such as thorough pre-filling checks and collaborative reviews can significantly enhance the submission process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form sa1-2e short form without leaving Google Drive?

Can I create an eSignature for the form sa1-2e short form in Gmail?

How can I fill out form sa1-2e short form on an iOS device?

What is form sa1-2e short form?

Who is required to file form sa1-2e short form?

How to fill out form sa1-2e short form?

What is the purpose of form sa1-2e short form?

What information must be reported on form sa1-2e short form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.