Get the free Direct Deposit Request Form

Get, Create, Make and Sign direct deposit request form

How to edit direct deposit request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit request form

How to fill out direct deposit request form

Who needs direct deposit request form?

A Comprehensive Guide to the Direct Deposit Request Form

Understanding direct deposit

Direct deposit is a banking process that involves electronically transferring funds directly into a bank account. This method is widely used for payroll payments, government benefits, and tax refunds, eliminating the need for paper checks.

Transitioning to direct deposit offers numerous advantages that both individuals and organizations can benefit from. Most notably, it ensures faster access to money. Instead of waiting for a check to clear, funds are typically available immediately on payday or the specified payment date.

Moreover, direct deposit enhances security and convenience by minimizing the handling of physical checks, which can be vulnerable to loss or theft. Users can easily verify transactions through online banking, further simplifying financial management.

Eligibility and requirements

To take advantage of direct deposit, various eligibility criteria must be met. Generally, anyone with a bank account can consider using direct deposit for receiving funds. This includes employees receiving salary payments, individuals receiving government benefits, and even taxpayers expecting refunds.

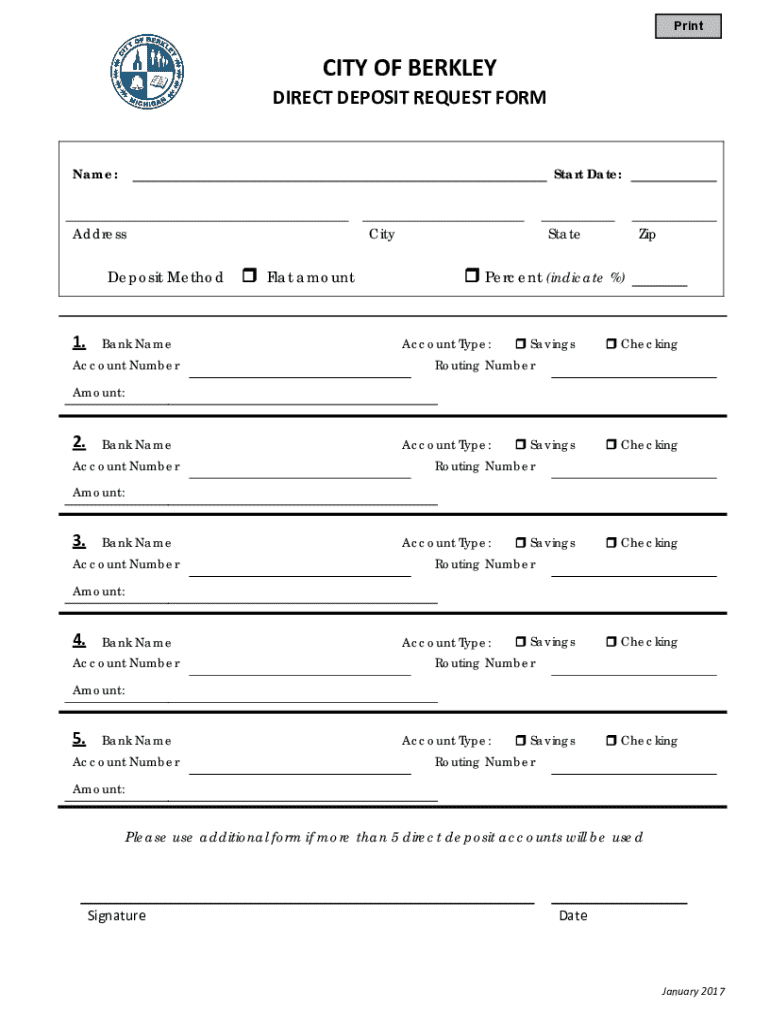

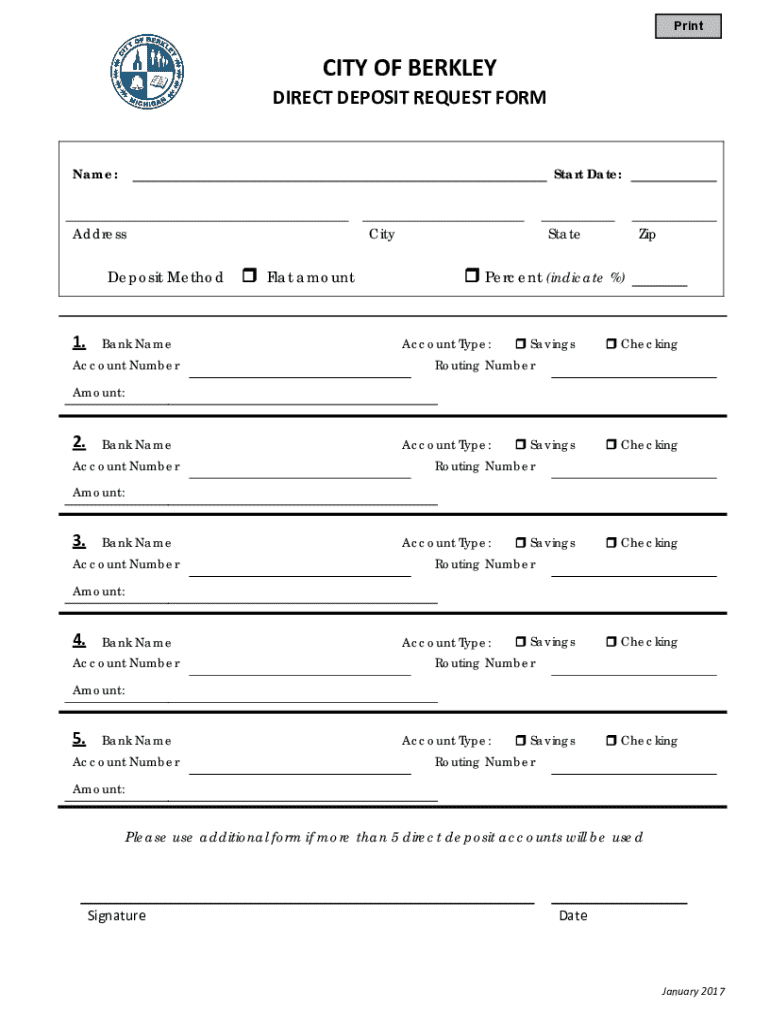

When completing a direct deposit request form, specific information is required to ensure that deposits are routed correctly. This typically includes bank details such as your account number and routing number, alongside personal identification, including your Social Security number and current address.

How to fill out the direct deposit request form

Completing a direct deposit request form is straightforward, but accuracy is crucial to avoid potential delays in payments. Here’s a step-by-step guide to ensure you fill out the form correctly.

Submitting your direct deposit request

After completing the direct deposit request form, the next step involves submission. Organizations and banks may offer various methods for delivering your form, including electronic submission via email and traditional mail.

Whichever method you choose, it’s essential to follow up regarding your submission status. Don’t hesitate to reach out to your employer or bank's HR department to ensure your request is processed smoothly.

Tracking your direct deposit application

Once your direct deposit request has been submitted, monitoring its progress is crucial. Many employers have systems in place to track submitted forms, providing updates on processing times.

Typical processing times can vary but expect it to take anywhere from a few days to a couple of weeks. In case of a delay, act swiftly to contact your employer or bank to resolve common issues, ensuring your payments are issued on time.

FAQs on direct deposit

As direct deposit has become an increasingly popular method for receiving payments, several common questions arise regarding its process. Knowing the answers can facilitate a smoother transition.

For instance, you may wonder what happens if you change banks. Generally, it involves filling out a new direct deposit request form with your new bank details. On the other hand, if you forget to submit your form, it’s advisable to do so as soon as possible to avoid payment interruptions.

Enhancing your document management experience

Utilizing a platform like pdfFiller can significantly enhance your experience with document management. Whether it’s for filling out a direct deposit request form or any other type of document, pdfFiller offers tools that make the process simple and efficient.

With pdfFiller, users can easily edit and customize forms before sharing them for collaboration. The cloud-based nature of the platform means that documents are accessible from anywhere, at any time, simplifying the process of managing sensitive information.

Conclusion and next steps

Direct deposit streamlines how you receive payments, offering security, convenience, and faster access to your funds. By taking the time to complete a direct deposit request form accurately, you ensure a smooth transition into this payment method.

Consider utilizing the powerful tools provided by pdfFiller for a hassle-free experience. From drafting to submitting your direct deposit request form, pdfFiller empowers users to manage their documents seamlessly in the cloud.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the direct deposit request form electronically in Chrome?

How can I edit direct deposit request form on a smartphone?

How can I fill out direct deposit request form on an iOS device?

What is direct deposit request form?

Who is required to file direct deposit request form?

How to fill out direct deposit request form?

What is the purpose of direct deposit request form?

What information must be reported on direct deposit request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.