Get the free 2023 Florida Profit Corporation Annual Report

Get, Create, Make and Sign 2023 florida profit corporation

How to edit 2023 florida profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 florida profit corporation

How to fill out 2023 florida profit corporation

Who needs 2023 florida profit corporation?

2023 Florida Profit Corporation Form - How-to Guide

Understanding profit corporations in Florida

A profit corporation in Florida is a legal entity formed to conduct business with the primary goal of generating profit for its shareholders. These corporations allow shareholders to limit their personal liability, meaning that personal assets are generally protected from business debts and lawsuits. This structure is particularly appealing for small to medium-sized businesses aiming to attract investors, as it boosts credibility in the market.

Key characteristics of Florida profit corporations include the ability to issue stock, which represents ownership in the company, and the requirement to maintain corporate formalities such as annual meetings and record keeping. Additionally, profit corporations must register with the state and comply with specific filing requirements, encapsulating their status as distinct legal entities separate from their owners.

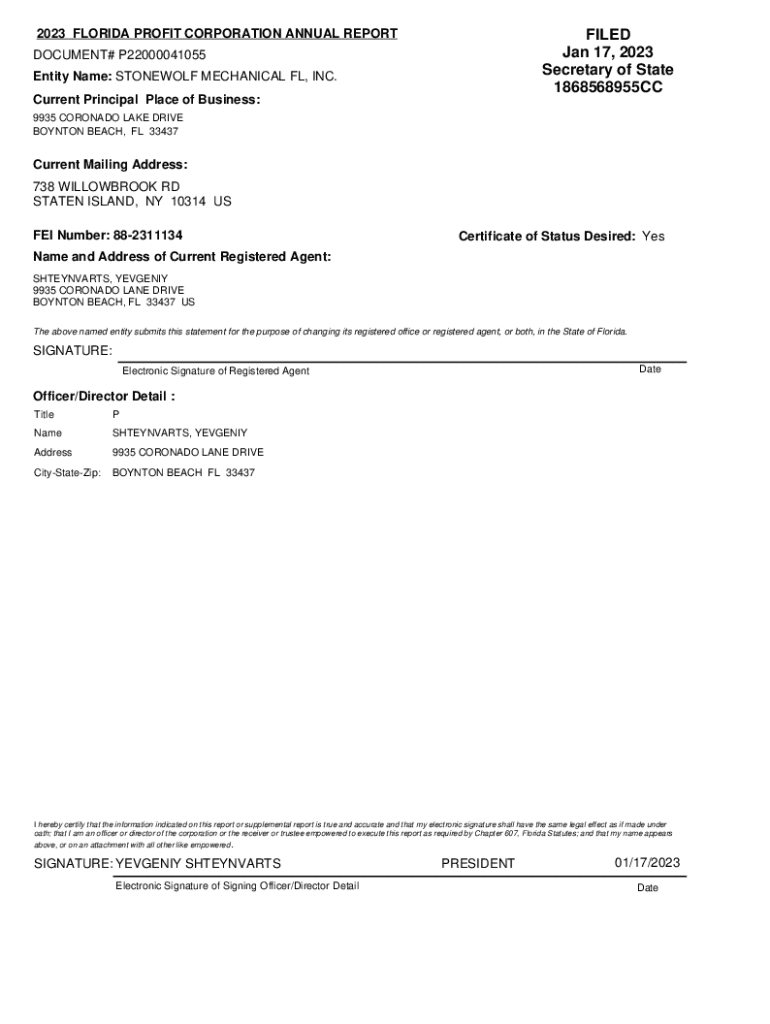

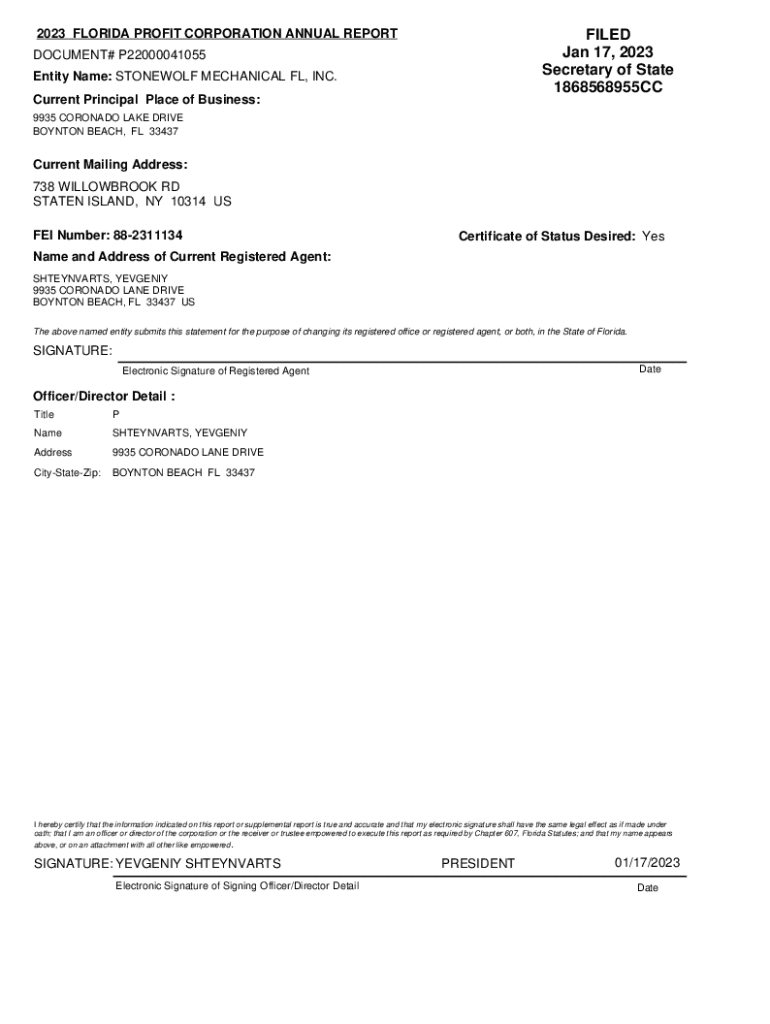

Overview of the 2023 Florida profit corporation form

The 2023 Florida profit corporation form is a crucial document that business owners must complete and file with the Florida Division of Corporations when creating a new corporation. This form includes essential information about the corporation, such as its name, address, registered agent, and initial stock structure, thereby laying the foundation for legal recognition in Florida.

Accurate completion of this form is vital. Missing or incorrect information can lead to processing delays or rejection of the application, which may impede your corporation's ability to operate legally. Interested parties can obtain the latest version of this form from the Division of Corporations' website, where they can also access additional resources and updates.

Key sections of the 2023 Florida profit corporation form

The 2023 Florida profit corporation form comprises several sections that each require specific information to ensure compliance with state regulations. Let's explore these key sections in detail.

Step-by-step guide to filling out the 2023 form

Completing the 2023 Florida profit corporation form can be straightforward if you follow a structured approach. Here’s a step-by-step guide to ensure you fill it out accurately.

Common mistakes to avoid when completing the form

Navigating the 2023 Florida profit corporation form can present challenges, and certain common mistakes can lead to delays or complications. Awareness and understanding of these pitfalls may enhance your filing experience.

Filing the 2023 Florida profit corporation form

After completing the form, the next step is submitting it to the Florida Division of Corporations. You can file the form online or via mail, depending on your preference. Filing fees are currently set at $70 for standard processing, with expedited options available for an additional fee.

Typically, processing times for forms submitted online are faster, often within a few business days, whereas mailed forms may take longer. Always check the latest information on processing times to avoid unexpected delays.

Post-filing requirements for profit corporations

Once you've successfully filed your 2023 Florida profit corporation form and received confirmation from the state, certain post-filing responsibilities come into play. One significant requirement is the submission of annual reports. Florida corporations must file these reports annually to maintain their active status and provide updates about changes in personnel and corporate structure.

Compliance with state regulations ensures that your corporation remains in good standing. Additionally, effective document management practices should be adopted to keep track of all legal documents, meeting minutes, and annual reports, safeguarding your corporation’s ongoing compliance.

Utilizing pdfFiller for efficient document management

Managing your 2023 Florida profit corporation form and other business documents can be made significantly easier with tools like pdfFiller. This cloud-based platform allows users to seamlessly edit PDFs, eSign documents, and collaborate with team members in real time. Its user-friendly interface simplifies the often complex process of document management.

Moreover, pdfFiller employs robust security measures, ensuring that your sensitive corporate information is well protected. The platform also integrates well with various online services, making it easy to store and manage your forms over time, thereby enhancing your overall productivity.

FAQs about the 2023 Florida profit corporation form

Navigating the formation of a profit corporation can raise several questions. Below are some frequently asked questions related to the 2023 Florida profit corporation form.

Leveraging pdfFiller beyond the profit corporation form

pdfFiller is not just limited to the profit corporation form; it offers a wide range of additional forms that are essential for business creation and ongoing operations. From tax forms to employment contracts, the platform supports various business documentation needs.

In addition to forms for initial filing, pdfFiller provides features that support document tracking, compliance tracking, and collaboration across all business processes. For users needing assistance, the platform connects them with customer support, ensuring they receive help when navigating complicated documentation requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2023 florida profit corporation directly from Gmail?

How can I modify 2023 florida profit corporation without leaving Google Drive?

Can I sign the 2023 florida profit corporation electronically in Chrome?

What is 2023 florida profit corporation?

Who is required to file 2023 florida profit corporation?

How to fill out 2023 florida profit corporation?

What is the purpose of 2023 florida profit corporation?

What information must be reported on 2023 florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.