Get the free Mgt-7

Get, Create, Make and Sign mgt-7

How to edit mgt-7 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mgt-7

How to fill out mgt-7

Who needs mgt-7?

A Comprehensive Guide to the MGT-7 Form

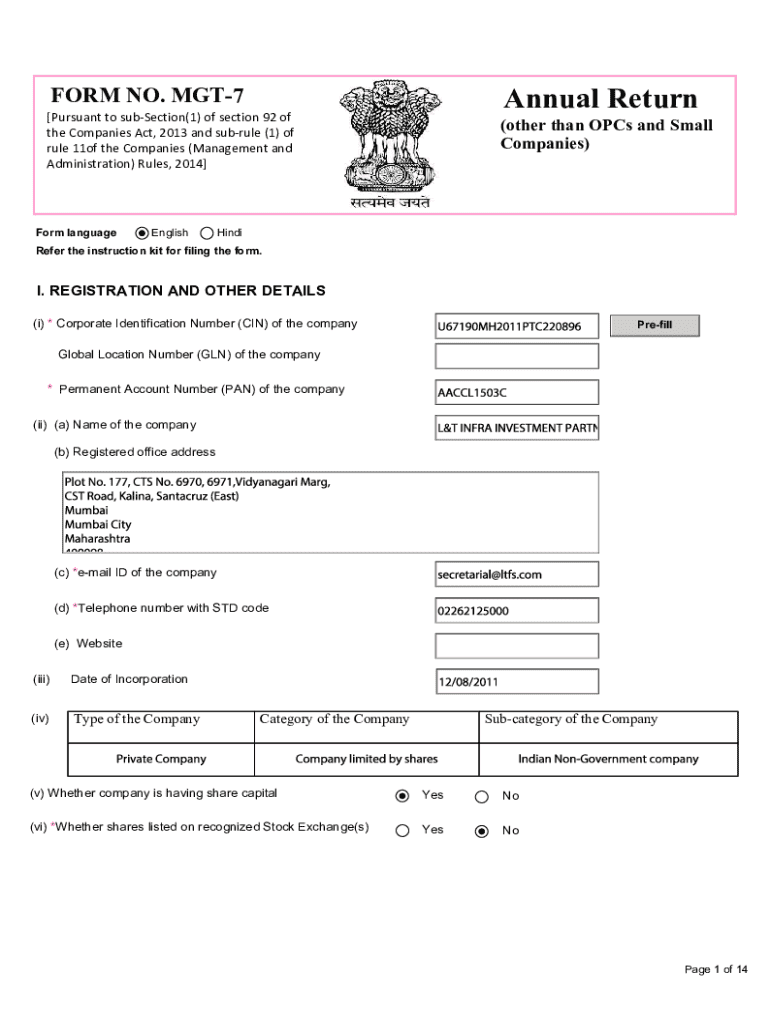

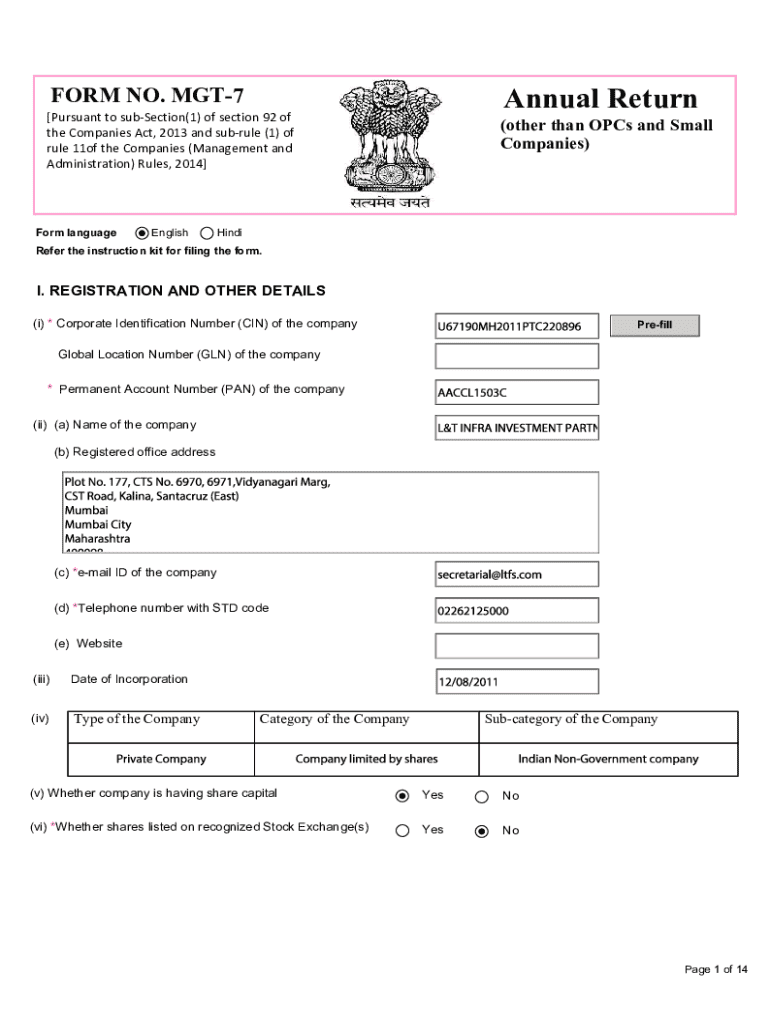

Understanding the MGT-7 form

The MGT-7 form is a crucial document in the realm of corporate governance in India. This form is used for filing the annual return of a company, providing a wealth of information about a firm's structure, its shareholders, and its management. It serves as a comprehensive declaration of a company’s operational information, such as details regarding directors, registered offices, and shareholdings.

Filing the MGT-7 form is vital for corporate compliance as it ensures transparency and accountability within the corporate structure. It not only helps in maintaining proper records but also provides regulatory authorities and stakeholders with necessary insights about the company, enabling them to make informed decisions.

Who should file the MGT-7 form?

MGT-7 is primarily filed by companies registered under the Companies Act, 2013, particularly those categorized as public and private limited entities. All types of companies that have shareholders, regardless of their size, are required to submit this annual return.

Key roles within the organization involved in filing include the company secretary, who usually manages compliance matters, and directors who provide essential information. It is essential for all directors and stakeholders to collaborate in gathering accurate data to ensure a smooth filing process.

Consequences of non-filing

Failing to submit the MGT-7 form can lead to serious legal ramifications for companies. Non-compliance can result in penalties imposed by regulatory bodies, specifically the Registrar of Companies (RoC). These can include fines and legal actions against the directors and the company.

In addition to legal consequences, late submissions incur financial penalties, adding unnecessary costs to the company's operations. Timely filing not only avoids these penalties but also enhances the company's credibility in the eyes of investors and stakeholders.

Preparing to file the MGT-7 form

Preparation is key to a successful MGT-7 filing. To ensure accuracy and compliance, gather the following recommended documents: company details such as the name and registration number, director and shareholder information, including their addresses and shares held. Having this information readily available will streamline the filing process.

It is also advisable to set up a pdfFiller account, which provides seamless document management capabilities. pdfFiller offers robust tools for editing and filing documents easily, ensuring that you have all your resources in one accessible location.

Step-by-step instructions for filing the MGT-7 form

Filing the MGT-7 form starts with downloading it from the MCA Portal. Begin by navigating to the official Ministry of Corporate Affairs website and locate the forms section. Download the MGT-7 template to your device.

When completing the form, pay attention to each section to ensure accuracy. This includes entering personal details of directors and shareholders accurately, as errors can lead to complications. Use pdfFiller’s tools to save your progress as you work through the form, allowing you to review and finalize at your convenience.

E-filing the MGT-7 form

E-filing through pdfFiller comes with several benefits, including ease of use and faster processing times. Once you have completed the MGT-7 form, take advantage of pdfFiller's features to review your entries. Check for errors or inconsistencies before moving onto the next steps.

You can utilize pdfFiller’s electronic signature functionality to sign the form digitally. This not only expedites the submission process but also ensures that your documents are secure. After signing, follow the final submission procedures outlined by the MCA Portal to complete the filing.

Costs and fees associated with MGT-7 filing

Filing the MGT-7 form is not completely devoid of costs. Companies need to be aware of the official filing fees, which are dependent on the company’s paid-up capital. For instance, smaller companies may incur lower fees compared to larger public entities.

Late filings carry additional charges that increase with time, highlighting the importance of timely submissions. Additionally, pdfFiller supports various payment methods, making it convenient for you to manage the costs associated with your filing.

Supporting attachments and documentation

Alongside the MGT-7 form, certain attachments are required to complete the submission process. These may include copies of shareholder resolutions and details of the company’s registered office. Ensuring all attachments are in order contributes to a successful filing.

When using pdfFiller, follow the guidelines provided to attach documents to your MGT-7 form seamlessly. This platform allows users to upload supporting documents effortlessly, preserving the integrity and accuracy of your filing.

Important deadlines and due dates

Understanding deadlines is crucial for compliance regarding the MGT-7 submission. The form must be filed within 60 days from the end of the financial year, making it essential for companies to keep track of these critical timelines.

Missing these deadlines can lead to severe consequences, including late fees and challenges in maintaining good standing with regulatory authorities. Setting reminders and using tools such as pdfFiller can help ensure compliance.

Frequently asked questions (FAQs) about the MGT-7 form

Here are some common inquiries about the MGT-7 form and e-filing process:

These FAQs address some of the most pressing concerns users might have and can assist in navigating the complexities of the filing process successfully.

Engage with the community

Joining the community of users can broaden your understanding of the MGT-7 filing process. Sharing personal testimonials and success stories regarding the use of pdfFiller for MGT-7 filing can enrich the learning experience.

We invite everyone to share their experiences and ask any lingering questions in the comments section below. Collaboration and shared advice can provide valuable insights for both new and experienced filers.

Updates and changes to MGT-7 filing requirements

Staying informed about legislative changes affecting the MGT-7 form is crucial for compliance. Recent updates, if any, could alter filing requirements and deadlines, demonstrating the need for companies to remain vigilant.

pdfFiller is committed to keeping its users up-to-date with the latest requirements surrounding the MGT-7 form. Regular updates enhance users' ability to achieve compliance efficiently and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in mgt-7?

How do I make edits in mgt-7 without leaving Chrome?

How do I fill out mgt-7 using my mobile device?

What is mgt-7?

Who is required to file mgt-7?

How to fill out mgt-7?

What is the purpose of mgt-7?

What information must be reported on mgt-7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.