Get the free Cst-1550

Get, Create, Make and Sign cst-1550

How to edit cst-1550 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cst-1550

How to fill out cst-1550

Who needs cst-1550?

Understanding the CST-1550 Form: A Comprehensive How-to Guide

Overview of the CST-1550 form

The CST-1550 form is a critical document used by businesses to declare specific information related to tax obligations. This form is particularly relevant for organizations operating in regions where compliance with local tax regulations is essential. The primary purpose of the CST-1550 is to document transactions that fall under particular tax categories, ensuring that organizations fulfill their legal requirements.

Utilizing the CST-1550 form is crucial for maintaining transparency and accountability in business practices. It not only aids in compliance with tax authorities but also plays a vital role in a company’s financial recording, making it an indispensable component of business administration.

Key features of the CST-1550 form

The CST-1550 form comes packed with features designed to enhance its effectiveness for users. One of its greatest benefits is the clarity it brings to tax reporting requirements. By systematically organizing tax data into specific sections, the form allows businesses to present information succinctly, making it easier for both employees and tax authorities to interpret.

When it comes to choosing between a digital and paper version, the digital format often provides added advantages. Digital forms offer convenient cloud-based management features, allowing users to edit and store documents securely online, which can greatly streamline tax processes. Additionally, businesses can benefit from real-time updates with online forms, increasing accuracy and reducing errors.

How to access the CST-1550 form on pdfFiller

To access the CST-1550 form on pdfFiller, simply navigate to their website and use the search bar. By entering 'CST-1550', you will be directed to the form-specific landing page. This page will provide you with direct links to fill out or view the form online.

To make navigation easier, pdfFiller allows users to filter by categories or types of documents. Keep an eye on the suggested forms section as this often includes the CST-1550 form. Additionally, familiarize yourself with the layout of pdfFiller, as the intuitive design helps guide users through the process efficiently.

Step-by-step instructions for filling out the CST-1550 form

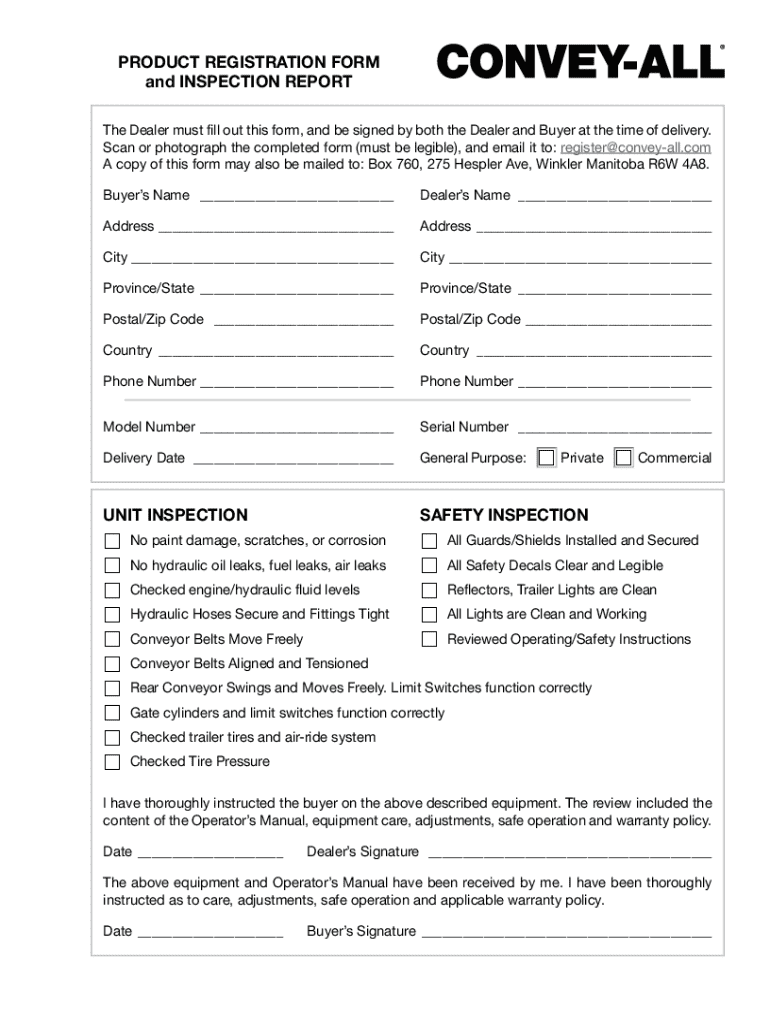

Filling out the CST-1550 form involves various sections, each requiring specific information. First, the Personal Information section captures essential details, such as your name, business name, and contact information. This sets the stage for the rest of the form.

Next is the Tax Information section, where you’ll declare the relevant transactions that are subject to taxation. Ensure you read the instructions carefully to avoid any common mistakes, such as incorrect entry of figures. Finally, the form concludes with a Signature and Acknowledgment section, where you both certify the information provided and acknowledge your responsibilities.

Editing the CST-1550 form

Once the CST-1550 form is completed on pdfFiller, users have access to a variety of tools for editing. These features allow individuals to make necessary changes in real-time, enhancing accuracy and ensuring that the form is always up to date. Whether correcting minor typos or adjusting larger entries, pdfFiller provides a seamless editing experience.

A significant advantage is the version control feature, which helps track changes and revisions made over time. This not only helps maintain clarity but also ensures that all stakeholders can refer back to previous iterations if necessary, making collaborative efforts simpler and more efficient.

eSigning the CST-1550 form

The eSigning process for the CST-1550 form is not just a convenience; it adds a layer of security and validation. Signing electronically ensures that the submitter's identity is verified while maintaining the integrity of the document. This feature is particularly beneficial for businesses that require swift processing of documents to comply with various deadlines.

To add an eSignature on pdfFiller, follow these steps: access the form, click on the signature line, and choose the option to insert an eSignature. You can draw, type, or upload your signature per your preference, ensuring it meets all legal requirements.

Collaborating on the CST-1550 form

Collaboration on the CST-1550 form is incredibly straightforward with pdfFiller. Users can invite team members to collaborate on the document by sending an invitation directly through the platform. This function is especially useful for larger teams where several individuals may need to contribute to different sections of the form.

Real-time editing capabilities provide immediate feedback and continuity, allowing for dynamic discussions and adjustments. Furthermore, managing permissions ensures that sensitive information remains protected while enabling adequate access for those who need to work on the document.

Managing your CST-1550 form with pdfFiller

Efficiently managing the CST-1550 form within pdfFiller enhances organization and accessibility. Users can categorize different forms and templates within their accounts, making it easy to find specific documents when needed. The search functionality is robust, allowing for quick access to forms without navigating through countless folders.

Another critical aspect is the ability to archive and retrieve previous versions of forms. This means whether you need to reference a prior submission for clarification or manage historical data, everything is securely stored and readily accessible through your pdfFiller account.

FAQs about the CST-1550 form

Users often have questions about the CST-1550 form, particularly regarding its filling out and submission processes. Common inquiries revolve around specific sections of the form, required documentation, and clarity on tax information narratives. Addressing these FAQs can help streamline the experience for all users.

When encountering issues while filling out the CST-1550 form, users should first refer to the guidance provided within pdfFiller. If problems persist, reaching out to customer support can provide tailored assistance quickly.

User testimonials and success stories

The positive feedback surrounding the CST-1550 form on pdfFiller showcases its effectiveness and user satisfaction. Many users have reported significant improvements in productivity attributed to the ease of use and collaborative tools embedded in the form.

Success stories often highlight time saved during tax season and a decrease in errors, which can be particularly costly for businesses. Testimonials reflect an overall enhancement in workflow efficiency—fundamentally reinforcing why utilizing pdfFiller’s tools can benefit any organization.

Additional tools and resources within pdfFiller for document management

Beyond the CST-1550 form, pdfFiller provides a variety of other forms and templates to further enhance document management. These related tools enable seamless transitions between different document types, ensuring that users can adapt to their specific business needs with ease.

Interactive tools for document creation enhance the overall experience, enabling users to design customized forms tailored to organizational requirements. This capability not only optimizes workflow but also provides a professional edge to document handling.

Support and customer service

For any inquiries or challenges related to the CST-1550 form, users can utilize pdfFiller’s robust customer service options. The platform provides comprehensive resources and contact information should you need guided support. Quick response times have been noted, illustrating a commitment to user satisfaction and effective problem resolution.

Resources such as instructional videos, FAQ sections, and user forums are available to assist with any uncertainties regarding the CST-1550 form or general document management on pdfFiller.

Features of the CST-1550 form on pdfFiller

The CST-1550 form on pdfFiller emphasizes convenience, allowing users to work from anywhere. This cloud-based platform means that users can access documents and edit them at their leisure, reducing the barriers associated with traditional document processing.

Moreover, pdfFiller’s unique selling propositions include seamless integration of editing, eSigning, and collaboration—all in one place. This facilitates real-world applications of the CST-1550 form and ensures that businesses can maintain compliance efficiently and effectively.

Additional insights

Understanding the legal implications of the CST-1550 form is essential for individuals and businesses alike. Filling out this form incorrectly could lead to compliance issues, potential fines, or legal scrutiny. Developing an awareness of the regulations surrounding tax obligations ensures that users maintain proper compliance with local laws.

Best practices for maintaining compliance include regularly reviewing updates to regulations, utilizing up-to-date forms, and ensuring that all team members are trained on proper procedures related to the CST-1550 form. This proactive approach contributes to a solid foundation for tax compliance and accountability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cst-1550 in Gmail?

How do I edit cst-1550 in Chrome?

How do I fill out cst-1550 on an Android device?

What is cst-1550?

Who is required to file cst-1550?

How to fill out cst-1550?

What is the purpose of cst-1550?

What information must be reported on cst-1550?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.