Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

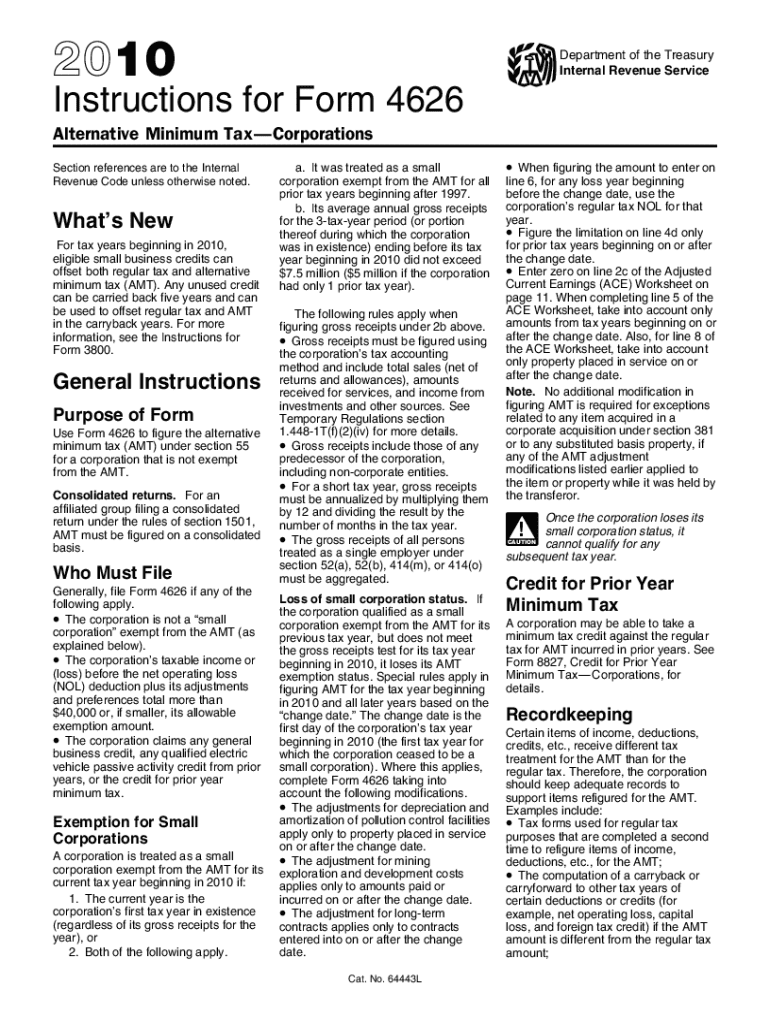

How to fill out form 4626

Who needs form 4626?

Form 4626: A How-to Guide

Understanding IRS Form 4626: What You Need to Know

Form 4626 is a crucial component of the Corporate Alternative Minimum Tax (CAMT) system. This form enables corporations to report their tax obligations under CAMT, a parallel tax system designed to ensure that corporations pay a minimum amount of tax regardless of various deductions and credits claimed on their regular tax returns. Unlike traditional tax forms, Form 4626 is unique in that it emphasizes adjustments that could lead to a minimum tax liability.

Who needs to file Form 4626?

Filing Form 4626 is mandatory for specific corporate taxpayers, primarily those whose taxable income exceeds a defined threshold. Corporations must file this form when their average annual gross receipts equal or exceed $1 million over the previous three years. Moreover, Form 4626 must be filed by corporations that have adjustments leading to an alternative minimum taxable income (AMTI) of at least $40,000.

The Corporate Alternative Minimum Tax (CAMT)

The Corporate Alternative Minimum Tax (CAMT) is an essential aspect of corporate tax regulation that strives to ensure that corporations pay a minimum level of tax, regardless of their income situation. Established in the 1980s, this tax was introduced to close loopholes that allowed profitable corporations to reduce their tax liability to negligible levels through deductions and credits. Over time, adjustments have been made to the CAMT guidelines to adapt to economic changes and public expectations.

CAMT eligibility criteria

To determine eligibility for CAMT, corporations must assess a variety of financial metrics to ensure compliance. To begin, a corporation’s average annual gross receipts over the last three years are considered. If these receipts exceed $1 million, the corporation is likely required to confront the complexities of CAMT. Additionally, the AMTI threshold plays a pivotal role; corporations must have a minimum AMTI of $40,000 to necessitate Form 4626.

The CAMT calculation process

Understanding the CAMT calculation process is essential for accurately completing Form 4626. The formula involves several key components including the standard taxable income, adjustments for specific deductions, and credits that minimize the corporation's tax burden. The first step is determining the total income and then making the necessary adjustments to arrive at the AMTI. Following this, the corporation applies the prevailing CAMT rate to ascertain the minimum tax due.

Common pitfalls in CAMT calculations

Many corporations encounter difficulties while navigating the complexities of CAMT calculations. Common pitfalls include misunderstanding the adjustments required or misstating income. Not accounting for all applicable deductions or credits can also lead to inaccuracies. Best practices suggest maintaining comprehensive tax data workflows and revisiting prior tax filings to confirm eligibility for any deductions taken.

Navigating the form: A step-by-step process for filing Form 4626

Before diving into filling out Form 4626, thorough preparation is essential to avoid common filing mistakes. Begin by gathering all necessary documentation, including financial statements, previous tax filings, and any necessary supporting documentation that might impact CAMT obligations. Keep in mind that the deadline for filing may vary depending on corporate tax filing dates, usually coinciding with the tax return due date.

Detailed instructions for completing each section of Form 4626

Filling out Form 4626 requires attention to detail in each section of the form. Key areas include the header information where corporations must accurately list their names, identification numbers, and applicable taxable year. The income section should reflect all sources of revenue with appropriate adjustments noted, while the tax calculation portion requires careful navigation of line items detailing deductions.

Error-checking your completed form

Once Form 4626 is filled out, a comprehensive review is vital to ensure accuracy. Establish a detailed checklist that outlines required fields, line items calculated, and any attachments needed for submission. This process is directly tied to compliance, as errors can lead to rejection, subsequent penalties, or an IRS audit if discrepancies occur.

Tools and resources for managing Form 4626

Navigating the complexities of Form 4626 is simplified through interactive tools designed to enhance efficiency and accuracy in filing. Various online calculators and tax preparation software can assist in determining corporate tax obligations accurately. pdfFiller serves as an indispensable resource to streamline the process of managing Form 4626 by offering features that enable form filling, editing, and collaboration all in one accessible platform.

After filing: What happens next?

Once Form 4626 is submitted, companies should understand the internal IRS review process. Typically, corporations can expect to receive notifications regarding their submissions within a few weeks. Should inquiries arise based on any discrepancies, more information may be requested, or adjustments may be suggested. Keeping track of submissions can help remedy any issues quickly.

Managing payments and potential refunds

Navigating payments following the filing of Form 4626 requires attention to the available options for settling tax dues. Corporations can manage payment methods through electronic transfers, checks, or installment agreements if necessary. It's also important to be informed about procedures for claiming refunds in case of overpayment or adjustments resulting from the filing, assisting corporations in managing cash flows effectively.

Common questions about Form 4626

Many inquiries arise surrounding Form 4626 and the associated CAMT system. People often wonder about the fundamental differences between CAMT and traditional corporate tax, potential exemptions, and the repercussions of inaccuracies in filings. Clarifying these common misconceptions can significantly benefit decision-makers within corporations, empowering them to make informed tax-related choices.

Using pdfFiller for your document management needs

pdfFiller is a cloud-based document solution that presents a powerful array of features designed to enhance how users manage, fill, and share forms like Form 4626. With an intuitive interface and robust features, pdfFiller allows seamless collaboration among teams, making it easy to keep track of document revisions and updates. Stored documents can be accessed from anywhere, enabling flexible teamwork for corporations.

Getting started with pdfFiller for Form 4626

To harness the full potential of pdfFiller for Form 4626, users can initiate a straightforward onboarding process. Embracing features developed specifically for tax form management can be transformative, as users gain access to templates, guidelines, and collaboration tools that significantly streamline the filing process. New users can easily navigate through the platform's tutorials to maximize efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pdffiller form to be eSigned by others?

Can I create an eSignature for the pdffiller form in Gmail?

How do I complete pdffiller form on an Android device?

What is form 4626?

Who is required to file form 4626?

How to fill out form 4626?

What is the purpose of form 4626?

What information must be reported on form 4626?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.